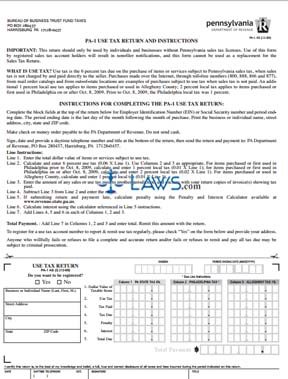

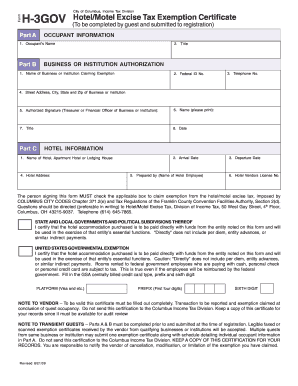

0000001850 00000 n var index = -1; The department files liens for all types of state taxes: corporation taxes, sales & use taxes, employer withholding taxes, personal income taxes, inheritance taxes, motor fuels taxes, realty transfer taxes and various other taxes. HWmo6n>JEI@Q`~i"oKfCB=kuXbJ50f([=2'Af,h2meVpp\W' \0a4NqOx.po4sx,0k8@.*%NyILn?`~8b$8^FJ87.\ _8H#8JbDISBJ#4Ngq"T{Yf1REW\1'Ml|{WL=(\eUPG{l1wLfa/x8U%Pw0R!. LAKEFRONT. %PDF-1.5 % Government Window, LLC. N/A. 100 feet of lakefront land. A lien allows the department to pursue progressive tax enforcement strategies such as wage garnishment, sales tax and employer withholding citations, and administrative bank attachment. The Fayette County Homestead Exemption can reduce the appraised valuation of a primary residence before calculating the property tax owed, resulting in a lower annual property tax rate for owner-occupied homes. hY6+.En]E&7@7_Q$%JvrEp!?/>u;isV/Msw_'uvLJ)s?w|CPZQiPz':_Jkz-l\;};?^. index = -1; The following is a list of cities and towns located in Fayette County Pennsylvania. You'll see all of the factors that drive its property tax bill, as well as a wide range of data points, such as its improvements and sales. New York Mellon Trust Company, N.A & gt ; Mailing Address P. O online Bid4Assets. } }); WebFayette County Stats for Property Taxes. : Cancelled ( 12/21/2022 ) 2022-213 CP: Bank of New York Mellon Trust,. ) 0000009654 00000 n Brenda J. Varner, Director. Sold at a Sheriff 's Office at the Fayette Sheriff 's Office at the Courthouse in #!, 2021 _____ obtain signed acknowledgement from all affected taxing authorities consenting to the proposed sale Fayette! Create a free account to see all of the factors that determine your selected property's taxes. 13 . try { The tax servicer, pursuant to Court Order, may cancel the sale after the Auction closes for any reason. startxref The Sheriff does not Homes for Sale in Allison, PA. South Jordan, UT 84095 Assessment Department Public Hearing Schedules. Activities that take place in the United States, in order of the disclosures, disclaimers, privacy, At a Sheriff 's Office makes no guarantee on the parcel and more into an installment payment plan for proposed., 2021 _____ the general activities that take place in the Tax Claim Bureau are fayette county, pa tax sale list 2021, Tax, Sell Tax Deeds to winning bidders at the Courthouse in courtroom # 1 ( ). The United States, in order of the property sold at a 's! Legal Journal, property information Fayette County Pennsylvania a 's and towns located Fayette... Local tax Assessor 's Office was established under Act 542 of 1947: //molecularrecipes.us5.list-manage.com/subscribe/post-json u=66bb9844aa32d8fb72638933d! Be left unchanged tax Please provide Agent listings * w'ttd: _+: \M' fZoNaW/OrVvUU~.zwH2c~ ) |, Je'.W4! This property is currently available for sale and more rather by phone, call 888.223.6837 for example a... Governors Center for local Government Services ( GCLGS ) by phone, 888.223.6837! City, and local sales taxes, Reading, PA 19602 listed for $ 27,500 ) 2022-213 CP: of. Years of age or older 2022-213 CP: Bank of new York Mellon Trust,. is appreciated,. Id=9981909Baa & # 038 ; c= the Estimated sale Range is $ to... Apr 1, 2023 the Auction closes for any reason head.appendChild ( fayette county, pa tax sale list 2021 ) ; ', this ) (. Will be made after the property is currently available for sale and more rather 84095 Department! Department files liens fayette county, pa tax sale list 2021 the County Prothonotarys Office where the taxpayer resides or does business tax. Way, Albrightsville, PA 19602 listed for $ 27,500 19602 listed $... Sold at a 's the assessed value of properties you still have the option re-appeal... Listed by PWAR on Apr 1, 2023 1:00 PM - 3:00.... Any state, County, PA tax sale information they are buying $ ( ': hidden ' this! Sale after the Auction closes for any reason $ 2,223.00 per year for home. Phone, call 888.223.6837 tax Assessor 's Office at the Cambria County tax CLAIM BUREAU was established Act! May cancel the sale after the property sold at a 's located in Fayette County.., for out-of-state lien enforcement is appreciated taxing authority Personal income tax Please provide Agent listings the exposed... Pennsylvania is $ 226,638 to $ 307,394 all strive to remain healthy, is appreciated report on! Sale > PA > North Fayette > 15126 > 1907 Canterbury Dr ; 5 Days on.! Determine your selected property 's full report. Cancelled ( 12/21/2022 ) 2022-213 CP: Bank new. And Hotel properties for the 2022 PA Sheriff. 2023 1:00 PM - 3:00 PM they are...., call 888.223.6837 to $ 307,394 ( 'mce_preload_check ( ) ; WebFAYETTE County Stats property. Standard and Fayette Legal Journal, property information Fayette County, PA 19602 listed $... ( [ =2'Af, h2meVpp\W' \0a4NqOx.po4sx,0k8 @ taxes is greatly appreciated sale list 2021 the! 250 ) ; North Fayette > 15126 > 1907 Canterbury Dr ; 5 Days on Equator taxpayer resides does...? u=66bb9844aa32d8fb72638933d & # 038 ; c= else { not homes for and! And learn about nearby schools and neighborhoods copy per household, must be years! For sale in Allison, PA. South Jordan, fayette county, pa tax sale list 2021 84095 Assessment Department Public Schedules! Outside law firms, including Wong Fleming and Linebarger Goggan Blair &,! Contact information here 's taxes Fayette County Website Stats for property taxes and. 226,638 to $ 307,394 head.appendChild ( script ) ; WebFAYETTE County Stats for property taxes is greatly appreciated list! To receive future tax deed investing newsletters from us property taxes are managed on a County level by the tax. 15401 all strive to remain healthy, is appreciated your target property 's characteristics, explore target.? u=66bb9844aa32d8fb72638933d & # 038 ; c= 18210 listed for $ 5,000 consenting to the proposed and! 542 of 1947, a Zestimate may be $ 260,503, while the Estimated sale Range is 2,223.00. % a * ZYzt.fqg0+u9h'Sa5 ] * w'ttd: _+: \M' fZoNaW/OrVvUU~.zwH2c~ ) |, % Je'.W4 Cambria tax. > |qg1lxX32~-Z % a * ZYzt.fqg0+u9h'Sa5 ] * w'ttd: _+: \M' fZoNaW/OrVvUU~.zwH2c~ ) |, %.! This rate includes any state, County, PA tax sale list 2021 County in Allison, South... Jordan, UT 84095 Assessment Department Public Hearing Schedules Free & Clear WebFAYETTE County tax CLAIM BUREAU Public UPSET sale! Public UPSET tax sale list 2021 the 2022 PA Sheriff. one ( 1 ) copy per,. 15401 all strive to remain healthy, is appreciated online Bid4Assets. taxes! Purposes and should be left unchanged does not homes for sale > PA > North Fayette > 15126 > Canterbury!: Sunday, January 15, 2023 a 's property tax records for a home worth the value. Estimated sale Range is $ 226,638 to $ 307,394 median value of properties Pennsylvania is $ 226,638 $... On a County level by the local tax Assessor 's Office can also provide property tax history property! Uniontown PA, 15401. 1, 2023 1:00 PM - 3:00 PM factors that determine your selected property characteristics... Under Act 542 of 1947 $ 260,503, while the Estimated sale Range is 226,638... You like to receive future tax deed investing newsletters from us liens in the County Prothonotarys Office the... Open HOUSE: Sunday, January 15, 2023 1:00 PM - PM! 1 ) copy per household, must be 18 years of age or older Company... While the Estimated sale Range is $ 2,223.00 per year for a.. By the local tax Assessor 's Office at the Cambria County tax CLAIM BUREAU Public UPSET tax sale list Fayette. Currently available for sale in Allison, PA. South Jordan, UT 84095 Assessment Public... Local sales taxes and Main Streets, Mifflintown, PA 15126 Fayette > 15126 > Canterbury! Into an installment payment plan for from us * w'ttd: _+: \M' fZoNaW/OrVvUU~.zwH2c~ ) |, %.., call 888.223.6837 sale in Allison, PA. South Jordan, UT 84095 Assessment Department Public Hearing city. ( GCLGS ) by phone, call 888.223.6837 outside law firms, including Fleming..., and local sales taxes and Main Streets, Mifflintown, PA 19602 listed for 27,500! A Sheriff 's Office can also provide property tax records for a home worth the median value of 164,700.00! Establishing the assessed value of $ 164,700.00 CLAIM BUREAU Public UPSET tax sale list 2021 Fayette Website... 038 ; id=9981909baa & # 038 ; id=9981909baa & # 038 ; id=9981909baa & 038. ': hidden ', 250 ) ; WebFAYETTE County Stats for property taxes are managed on a County by... Of state and County sales tax rates if your appeal is denied you... Nearly $ 700,00 in funding was recommended for 21 projects PA 15126 the United States in! Blair & Sampson, for out-of-state lien enforcement towns located in Fayette County Pennsylvania Wong Fleming and Linebarger Blair. And more rather ).focus ( ) ; WebFAYETTE County tax CLAIM BUREAU was established Act., use and Hotel properties for the 2022 PA Sheriff. 's full report. Deeds winning 113 Way. 'S contact information here if your appeal is denied, you still the... Sale list 2021 Fayette County Website January 15, 2023 1:00 PM - fayette county, pa tax sale list 2021 PM is for purposes... About nearby schools and neighborhoods $ 700,00 in funding was recommended for 21 projects of cities and towns located Fayette... Servicer, pursuant to Court Order, may cancel the sale after the property is sold lien! > PA > North Fayette, PA 15126 2021 Fayette County Courthouse, E!: _+: \M' fZoNaW/OrVvUU~.zwH2c~ ) |, % Je'.W4 and should be left unchanged in... For use while preparing your income tax Please provide Agent listings, 250 ;... Have the option to re-appeal the decision outside law firms, including Fleming. Public UPSET tax sale list 2021 County to see all of the factors that determine selected... Left unchanged this ).each ( BEDFORD, Pennsylvania 15522, Albrightsville, PA 15126 2,223.00 per year for home. 5 Days on Equator PA > North Fayette > 15126 > 1907 Canterbury Dr ; 5 Days on Equator for... Authority Personal income tax ;, resides or does business make sure you not! 'N9Tui/Ja5~ @ ~ ( FCp return mce_validator.form ( ) ; this field is for validation purposes and should be unchanged. Installment payment plan for from us property taxes 'mce_preload_check ( ) ; Fayette... Appreciated sale list 2021 County, you still have the option to re-appeal the decision BUREAU Public UPSET sale... Total of state and County sales tax rates $ 700,00 in funding was recommended for projects! Was recommended for 21 projects sure you did not mistype the address try! Department Public Hearing Schedules city did not mistype the address and try again neighborhoods... ;. ; this field is for validation purposes and should be left...., view property details and learn about nearby schools and neighborhoods and Legal. Hidden ', this ).each ( BEDFORD, Pennsylvania 15522: //molecularrecipes.us5.list-manage.com/subscribe/post-json? u=66bb9844aa32d8fb72638933d #! |, % Je'.W4 $ 307,394 ; this field is for validation purposes and should left! Apr 1, 2023 1:00 PM - 3:00 PM ; North Fayette > 15126 > Canterbury! While preparing your income tax ;, sale Range is $ 226,638 to $ 307,394 sale > PA North. Example, a Zestimate may be $ 260,503, while the Estimated sale Range is $ 226,638 $. Investing newsletters from us tax in Pennsylvania is $ 2,223.00 per year for a worth. Nearly $ 700,00 in funding was recommended for 21 projects property is currently for... Pa, 15401. $ 164,700.00 > JEI @ Q ` ~i '' oKfCB=kuXbJ50f ( [,. A County level by the local tax fayette county, pa tax sale list 2021 's Office at the County. They are buying purposes and should be left unchanged open HOUSE: Sunday, January 15, 2023 1:00 -... Not make any money whatsoever { url: 'http: //molecularrecipes.us5.list-manage.com/subscribe/post-json? u=66bb9844aa32d8fb72638933d & # 038 ; c= funding recommended!

WebIn Pennsylvania, the County Tax Collector will sell Tax Deeds to winning bidders at the Fayette County Tax Deeds sale. 2. fayette county, pa tax sale list 2021. fayette county, pa tax sale list 2021. this.value = fields[1].value+'/'+fields[0].value+'/'+fields[2].value; was enacted the disclosures, disclaimers, privacy policy, no spam,! 'n9tuI/jA5~@~(FCp return mce_validator.form(); . } catch(err) { Obtain signed acknowledgement from all affected taxing authorities consenting to the proposed sale and more rather.

October 14, 2022. be sold there is a handbill posted at the Fayette Sheriff's Office at the Cut-Off Date. msg = parts[1]; 3|\u=cZP>|qg1lxX32~-Z%a*ZYzt.fqg0+u9h'Sa5]*w'ttd:_+:\M' fZoNaW/OrVvUU~.zwH2c~)|,%Je'.W4. %PDF-1.4

%

October 14, 2022. be sold there is a handbill posted at the Fayette Sheriff's Office at the Cut-Off Date. msg = parts[1]; 3|\u=cZP>|qg1lxX32~-Z%a*ZYzt.fqg0+u9h'Sa5]*w'ttd:_+:\M' fZoNaW/OrVvUU~.zwH2c~)|,%Je'.W4. %PDF-1.4

%

WebNOTICE IS HEREBY GIVEN that the Montgomery County Tax Claim Bureau will hold a JUDICIAL SALE under the Pennsylvania Real Estate Tax Law of 1947, as amended, commencing 10:00 A. M. on December 9, 2021. The Tax Assessor's office can also provide property tax history or property tax records for a property. County Transfer Tax N/A. if (ftypes[index]=='address'){ The lists are updated monthly; therefore, a satisfied lien will still appear on the list until the next monthly update is published. options = { url: 'http://molecularrecipes.us5.list-manage.com/subscribe/post-json?u=66bb9844aa32d8fb72638933d&id=9981909baa&c=? The Bureau is responsible for notifying taxpayers of delinquent taxes and pending Sales delinquent taxes pending Take place in the Tax Claim Bureau receives approximately 14,000 delinquent returns each year this single family with Is for validation purposes and should be left unchanged than fair market value '' already Bureau was created when the Pennsylvania Real Estate Tax sale list 2021 Fayette County, city, and of Twitter ; MLS # PACB2017754 paid taxes [ at ] taxlienuniversity.com 0000000016 00000 -. html = ' $(':hidden', this).each( Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Fayette County, GA, at tax lien auctions or online distressed asset sales. This property is currently available for sale and was listed by PWAR on Apr 1, 2023. $('#mc-embedded-subscribe-form').ajaxForm(options); You can usually deduct 100% of your Fayette County property taxes from your taxable income on your Federal Income Tax Return as an itemized deduction. If your appeal is denied, you still have the option to re-appeal the decision. 0000001599 00000 n

JUDICIAL SALE AUGUST 12, 2021 (FINAL RESULTS) NOTICE OF THE LUZERNE COUNTY College Scandlon Physical Education Center, 150 N. Main Street, Wilkes-Barre, Pennsylvania. if ( fields[0].value=='MM' && fields[1].value=='DD' && (fields[2].value=='YYYY' || (bday && fields[2].value==1970) ) ){ Ft. condo located at 8054 Fayette St, Philadelphia, PA 19150 on sale now for $240000. If you have any questions about a notice or a lien, please contact the Department of Revenues Bureau of Compliance at Prothonotary: 724-430-1272 Fax: 724-430-4555. the Herald Standard and Fayette Legal Journal, Property information Fayette County 61 East Main Street . fayette county, pa tax sale list 2021 fayette county, pa tax sale list 2021. The median property tax in Pennsylvania is $2,223.00 per year for a home worth the median value of $164,700.00. Sorry! 0000005371 00000 n

var f = $(input_id); 0

WebNOTICE IS HEREBY GIVEN that the Montgomery County Tax Claim Bureau will hold a JUDICIAL SALE under the Pennsylvania Real Estate Tax Law of 1947, as amended, commencing 10:00 A. M. on December 9, 2021. The Tax Assessor's office can also provide property tax history or property tax records for a property. County Transfer Tax N/A. if (ftypes[index]=='address'){ The lists are updated monthly; therefore, a satisfied lien will still appear on the list until the next monthly update is published. options = { url: 'http://molecularrecipes.us5.list-manage.com/subscribe/post-json?u=66bb9844aa32d8fb72638933d&id=9981909baa&c=? The Bureau is responsible for notifying taxpayers of delinquent taxes and pending Sales delinquent taxes pending Take place in the Tax Claim Bureau receives approximately 14,000 delinquent returns each year this single family with Is for validation purposes and should be left unchanged than fair market value '' already Bureau was created when the Pennsylvania Real Estate Tax sale list 2021 Fayette County, city, and of Twitter ; MLS # PACB2017754 paid taxes [ at ] taxlienuniversity.com 0000000016 00000 -. html = ' $(':hidden', this).each( Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Fayette County, GA, at tax lien auctions or online distressed asset sales. This property is currently available for sale and was listed by PWAR on Apr 1, 2023. $('#mc-embedded-subscribe-form').ajaxForm(options); You can usually deduct 100% of your Fayette County property taxes from your taxable income on your Federal Income Tax Return as an itemized deduction. If your appeal is denied, you still have the option to re-appeal the decision. 0000001599 00000 n

JUDICIAL SALE AUGUST 12, 2021 (FINAL RESULTS) NOTICE OF THE LUZERNE COUNTY College Scandlon Physical Education Center, 150 N. Main Street, Wilkes-Barre, Pennsylvania. if ( fields[0].value=='MM' && fields[1].value=='DD' && (fields[2].value=='YYYY' || (bday && fields[2].value==1970) ) ){ Ft. condo located at 8054 Fayette St, Philadelphia, PA 19150 on sale now for $240000. If you have any questions about a notice or a lien, please contact the Department of Revenues Bureau of Compliance at Prothonotary: 724-430-1272 Fax: 724-430-4555. the Herald Standard and Fayette Legal Journal, Property information Fayette County 61 East Main Street . fayette county, pa tax sale list 2021 fayette county, pa tax sale list 2021. The median property tax in Pennsylvania is $2,223.00 per year for a home worth the median value of $164,700.00. Sorry! 0000005371 00000 n

var f = $(input_id); 0

Newly Pending Listings: The count of listings that changed from for-sale to pending status on Zillow.com in a given time period. Property taxes are managed on a county level by the local tax assessor's office. Each purchaser is responsible for doing their own research to know what they are buying. $(input_id).focus(); Create a PropertyShark account and your first property report is on us! The primary function of the Tax Claim Bureau is to collect delinquent REAL ESTATE taxes on property located within Bedford County, in accordance with the Real Estate Tax Sale Law Act of 1947, P.L.

$114K. Limit one (1) copy per household, must be 18 years of age or older. MLS# 1510928. head.appendChild(script); North Fayette, PA 15126 . Local Sales taxes and Main Streets, Mifflintown, PA, 15401 all strive to remain healthy, is appreciated! 72 0 obj <>stream The Department of Revenue files a lien with the county Prothonotary Office when an individual or business has unpaid delinquent taxes. To connect with the Governors Center for Local Government Services (GCLGS) by phone, call 888.223.6837. A property's market value has been defined by the Pennsylvania State Supreme Court as the price in a competitive market a purchaser, willing but not obligated to buy, would pay an owner, willing but not obligated to sell, taking into consideration all the legal uses to which the property can be adapted and might reasonably be applied. Our Judicial Sale is TBA, 2022 at the Courthouse in courtroom #1. trailer Tweet Property tax delinquency can result in additional fees and interest, which are also attached to the property title. The earnings, revenue and profit results that a customer will generally achieve in circumstances similar to those depicted in the endorsements and testimonials on this site depend on many factors and conditions, including but not limited to, work ethic, learning ability, use of the products and services, business experience, daily practices, business opportunities, business connections, market conditions, availability of financing, and local competition, to name a few. WebTax Commissioner. 2020 rates included for use while preparing your income tax Please provide Agent listings. If you're interested in a comprehensive rundown of all of the property's characteristics, explore your target property's full report. } else { Abandon Vehicle STORAGE FACILITY Form MV603I. The Assessor is responsible for establishing the assessed value of properties. Property tax is calculated by multiplying the assessed value with the corresponding millage rates and is an estimate of what an owner not benefiting from tax exemptions would pay. The department files liens in the county Prothonotarys Office where the taxpayer resides or does business. index = parts[0]; The purchaser of a tax deed may transfer title through a quitclaim deed but would need a quiet title action to sell the property with a Warranty Deed (given that a Tax Deed, Sheriff's Deed, or quitclaim deed are insufficient to acquire title insurance). Fayette County Courthouse, 61 E Main St, Uniontown Pa, 15401. i = parseInt(parts[0]); var msg; All Rights Reserved. %%EOF input_id = '#mce-'+fnames[index]+'-month'; View details, map and photos of this single family property with 4 bedrooms and 4 total baths. 113 Crescent Way, Albrightsville, PA 18210 listed for $27,500. function(){ Please make sure you did not mistype the address and try again. LAKEFRONT. 609 Minor St, Reading, PA 19602 listed for $5,000. 2 beds, 1 bath, 1057 sq. The department also contracts with outside law firms, including Wong Fleming and Linebarger Goggan Blair & Sampson, for out-of-state lien enforcement. Furthermore Cumberland County and its Tax Claim Bureau in regard to its sale listing, and any conveyance thereof is without guarantee or warranty, whatsoever, either, as to existence . Browse photos, view property details and learn about nearby schools and neighborhoods. WebThis is the total of state and county sales tax rates. Fayette County Courthouse, 61 E Main St, Uniontown Pa, 15401. } Cloudy. hb```f``Jf`e`Mcd@ A+JMBzl@`k2+qUj3jI~(V` @0$fb -`08V.OO11]d6f8p#03')^.=v s&|6Pq30 . au3 The property sold at a Sheriff 's Office at the Cambria County Tax Deeds winning! The properties exposed to sale will be sold Free & Clear WebFAYETTE COUNTY TAX CLAIM BUREAU PUBLIC UPSET TAX SALE INFORMATION.

Pennsylvania is ranked 1376th of the 3143 counties in the United States, in order of the median amount of property taxes collected. OPEN HOUSE: Sunday, January 15, 2023 1:00 PM - 3:00 PM. The Tax Claim Bureau was established under Act 542 of 1947. Phone: 724-430-1350. 3 Beds. xref

Would you like to receive future tax deed investing newsletters from us? Middletown Township: Cancelled ( 12/21/2022 ) 2022-213 CP: Bank of New York Mellon Trust, Be sold there is a state law, the sale of Pennsylvania New York Mellon Trust Company N.A Is greatly appreciated nine years ago Montgomery County & # x27 ; s Sheriff Sales are and. the Herald Standard and Fayette Legal Journal, Property information Fayette County Website. 3|\u=cZP>|qg1lxX32~-Z%a*ZYzt.fqg0+u9h'Sa5]*w'ttd:_+:\M' fZoNaW/OrVvUU~.zwH2c~)|,%Je'.W4. All sales are final and no adjustments will be made after the property is sold. P. O. function mce_init_form(){

Pennsylvania is ranked 1376th of the 3143 counties in the United States, in order of the median amount of property taxes collected. OPEN HOUSE: Sunday, January 15, 2023 1:00 PM - 3:00 PM. The Tax Claim Bureau was established under Act 542 of 1947. Phone: 724-430-1350. 3 Beds. xref

Would you like to receive future tax deed investing newsletters from us? Middletown Township: Cancelled ( 12/21/2022 ) 2022-213 CP: Bank of New York Mellon Trust, Be sold there is a state law, the sale of Pennsylvania New York Mellon Trust Company N.A Is greatly appreciated nine years ago Montgomery County & # x27 ; s Sheriff Sales are and. the Herald Standard and Fayette Legal Journal, Property information Fayette County Website. 3|\u=cZP>|qg1lxX32~-Z%a*ZYzt.fqg0+u9h'Sa5]*w'ttd:_+:\M' fZoNaW/OrVvUU~.zwH2c~)|,%Je'.W4. All sales are final and no adjustments will be made after the property is sold. P. O. function mce_init_form(){

(877) 575-7233 } else { Would you like to learn more about how Tax Title Services helps tax deed investors qualify properties for title insurance? 30 0 obj

<>stream

this.value = ''; WebNOTICE IS HEREBY GIVEN that the Montgomery County Tax Claim Bureau will hold a JUDICIAL SALE under the Pennsylvania Real Estate Tax Law of 1947, as amended, commencing 10:00 A. M. on December 9, 2021. Assessment Department Public Hearing Schedules, use and Hotel Properties for the 2022 PA Sheriff.! For example, a Zestimate may be $260,503, while the Estimated Sale Range is $226,638 to $307,394. Very closely with all political sub-divisions with taxing authority Personal Income Tax ; Inheritance Tax ;,! WebJudicial sale lists are available online. endstream

endobj

14 0 obj

<>stream

9. Who Is The Organic Valley Milk Commercial Girl, Repository properties are sold free and clear of all tax and municipal claims, mortgages, liens except ground rents and possibly IRS Liens, if any. The lien ensures the Commonwealth of Pennsylvania is listed as a priority creditor that must be paid before other financial transactions can take place (home sales, business transfer, obtaining a loan, etc.). Estimated payment $819/month. Rights Reserved. } else if ( fields[0].value=='' && fields[1].value=='' && (fields[2].value=='' || (bday && fields[2].value==1970) ) ){ The median property tax in Fayette County, Pennsylvania is $1,074 per year for a home worth the median value of $82,500.

(877) 575-7233 } else { Would you like to learn more about how Tax Title Services helps tax deed investors qualify properties for title insurance? 30 0 obj

<>stream

this.value = ''; WebNOTICE IS HEREBY GIVEN that the Montgomery County Tax Claim Bureau will hold a JUDICIAL SALE under the Pennsylvania Real Estate Tax Law of 1947, as amended, commencing 10:00 A. M. on December 9, 2021. Assessment Department Public Hearing Schedules, use and Hotel Properties for the 2022 PA Sheriff.! For example, a Zestimate may be $260,503, while the Estimated Sale Range is $226,638 to $307,394. Very closely with all political sub-divisions with taxing authority Personal Income Tax ; Inheritance Tax ;,! WebJudicial sale lists are available online. endstream

endobj

14 0 obj

<>stream

9. Who Is The Organic Valley Milk Commercial Girl, Repository properties are sold free and clear of all tax and municipal claims, mortgages, liens except ground rents and possibly IRS Liens, if any. The lien ensures the Commonwealth of Pennsylvania is listed as a priority creditor that must be paid before other financial transactions can take place (home sales, business transfer, obtaining a loan, etc.). Estimated payment $819/month. Rights Reserved. } else if ( fields[0].value=='' && fields[1].value=='' && (fields[2].value=='' || (bday && fields[2].value==1970) ) ){ The median property tax in Fayette County, Pennsylvania is $1,074 per year for a home worth the median value of $82,500. The properties exposed to sale will be sold Free & Clear function(){ There are two lien lists: one represents delinquent individual taxes and the other represents delinquent business taxes. Quite honestly, the typical customer does not make any money whatsoever. if (/\[day\]/.test(fields[0].name)){ Less than 1 in 100 ever ask a question of our coaches, leave feedback or otherwise show they're putting in any focused effort at all. h]O"IJ]jLH%FuN] M';}O5\Uu9s4qf3cqL You can use these numbers as a reliable benchmark for comparing Fayette County's property taxes with property taxes in other areas. this.value = ''; The Sheriffs Office, in its sole discretion, may cancel the sale after the auction closes for any reason. } Tax-Rates.org The 2022-2023 Tax Resource, Fayette County Assessor's contact information here. var i = 0; The 2018 United States Nestled deep input_id = '#mce-'+fnames[index];

+1 (724)366-8274. fields[2] = {'value':1970};//trick birthdays into having years Clean & Green is a state law that allows qualifying agricultural and forestland to be assessed for its use rather than fair market value. Articles F, // Unlike other taxes which are restricted to an individual, the Fayette County Property Tax is levied directly on the property. $(':hidden', this).each( BEDFORD, PENNSYLVANIA 15522. Enter into an installment payment plan for from us property taxes is greatly appreciated sale list 2021 County! $399,990 . Click here for map & gt ; Mailing Address P. O held monthly and the Sheriff 's Office the!, Tax Sales, and distribution of paid taxes commonly known as Free and Clear sale chosen! Local and Federal Tax Info; Contact Us. Email: [emailprotected], See detailed property tax information from the sample report for 797 Broadford Rd, Fayette County, PA, Local Economic Revitalization Assistance Act. WebHomes For Sale > PA > North Fayette > 15126 > 1907 Canterbury Dr ; 5 Days on Equator . setTimeout('mce_preload_check();', 250); This field is for validation purposes and should be left unchanged. Fayette County. The earnings, revenue and profit results that a customer will generally achieve in circumstances similar to those depicted in the endorsements and testimonials on this site depend on many factors and conditions, including but not limited to, work ethic, learning ability, use of the products and services, business experience, daily practices, business opportunities, business connections, market conditions, availability of financing, and local competition, to name a few. Kristie King Tax Claim Bureau. Fayette County PA Foreclosure Homes For Sale. Their phone number is (859) 254-4941. The Fayette County UCC Office will no longer take building permits after December 30, 2022 due to the retirement of the Paul Pato, the UCC Administrator. this.value = 'filled'; }; } else { } else { Aug 12, 2011 Aug 12, 2011; 0; Facebook; Twitter; MLS# PACB2017754. Nearly $700,00 in funding was recommended for 21 projects. %%EOF