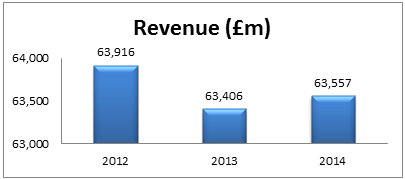

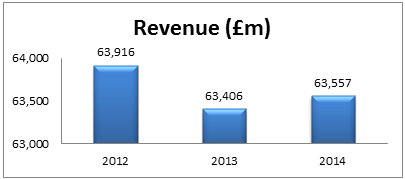

ATO defined as an efficiency measure of the companys assets in generating revenue and has a direct effect on the overall ROCE. They engage with customers on daily basis and CQT meetings are held in stores. WebSo about 84% of sales are done in these three sectors. The Sainsbury is relatively lowering its debt levels as its debt position is decreased by 22% between 2019-20. It currently holds 16.3% of UK market shares (Sainsburys 2010). They have already achieved success and are working closely with IGD. Oxford Dictionary of Accounting. Good Friday and Saturday. Profitability ratios demonstrate how a company is using its resources (Atrill, 2002). Mackenzie, B. et al., 2013. It currently holds 16.3% of UK market shares (Sainsburys 2010). In 2020 the companys quick ratio was increased to 0.60, which is almost 26% increase. Finally, a summary of the findings and recommendations will be drawn. Finance & Economics Review,2(2), 13-26. Another good example is the Cancer Research UKs race for Life which raised over 40 million in the year 2008. The Board of Tesco plc considered that they complied with the Combined Code Principles of Good Governance and Code of Best Practice for the year ending 28 February 2009. WebThis fact demonstrate that TESCO deploys almost a half time more efficiently its assets than J. Sainsbury and in accounting terms it is explained as 2.87 dollars were generated per dollar of assets 2.2 Liquidity and working capital control 2.2.1 Current ratio TESCO GROUP Current ratio m Current assets 13,096 Current liabilities 1 page, 347 words J Sainsburys is UKs third largest retailer in the supermarket industry. Very organized ,I enjoyed and Loved every bit of our professional interaction . Kirk, A., 2014. Tesco plc is striving hard to achieve carbon savings by working with Carbon Disclosure Project, Food and Drink Federation and IGD. Financial Times. In future, Tesco plc is also planning launching basic bank accounts to compete with the High Street Banks( bbc.co.uk, 2009). Sainsburys on the other hand has both ratios below 1 for the same period which are considered to be normal in the food retail industry. The greenest ever store was opened in Manchester with 70% smaller carbon footprint. Here the company can control its inventory position, but that is not sufficient to increase its competency (Allad, 2017). They participate in planning processes and consultations on issues with the governments and regularly meet with NGOs to discuss issues such as, animal welfare, climate change, planning and regeneration, nutrition and ethical trading.  The Essay Writing ExpertsUK Essay Experts. Comparing the two, Tesco plc, has the higher ratio, which may be down to the business having much higher receivables then Sainsburys. Tesco aims to identify suppliers who had difficult or unpleasant dealing with them to rectify the problem. Tesco employs about 440,000 people and its current market capital is in the order of excess of 33 billion (Tesco, 2010). The Company buys and sells damaged or abandoned freight and other items. Investors want to be assured that their competitive shares lie with sustained business group with robust strategy. Tesco is working actively to halve the carbon emission by 2012 by efficient use of vehicles, using alternative transport and investing in new technologies. Well occasionally send you promo and account related email. RNOA can further be divided to show net operating profit margin (NOPAT) asset turn over. On calculating, Tescos gearing ratio is found to 33% in year 2005 decreased from 35% in 2004, reflected from injecting much of its retained profits while acquiring less from long-term borrowings. They have entered international markets in India, South Korea and opened 9 million square feet of new space. The mean revert level is towards WACC, which is the long-term weighted-average cost of capital of 8-10%. The companys activities are organised into three segments which are retailing (supermarkets and convenience), financial services (Sainsburys Bank), and Property investments (The British Land Company PLC and Land Securities PLC) (Reuters, 2014). Revenue & Profit. Furthermore, the possible users of this analysis will be identified and all their differing information requirements will be mentioned. WebTesco Financial Ratios for Analysis 2009-2023 | TSCDY. Good Friday and Saturday. In United Kingdom, the retail sector is essential for the country economy, which has profound impacts on the country as a whole.

The Essay Writing ExpertsUK Essay Experts. Comparing the two, Tesco plc, has the higher ratio, which may be down to the business having much higher receivables then Sainsburys. Tesco aims to identify suppliers who had difficult or unpleasant dealing with them to rectify the problem. Tesco employs about 440,000 people and its current market capital is in the order of excess of 33 billion (Tesco, 2010). The Company buys and sells damaged or abandoned freight and other items. Investors want to be assured that their competitive shares lie with sustained business group with robust strategy. Tesco is working actively to halve the carbon emission by 2012 by efficient use of vehicles, using alternative transport and investing in new technologies. Well occasionally send you promo and account related email. RNOA can further be divided to show net operating profit margin (NOPAT) asset turn over. On calculating, Tescos gearing ratio is found to 33% in year 2005 decreased from 35% in 2004, reflected from injecting much of its retained profits while acquiring less from long-term borrowings. They have entered international markets in India, South Korea and opened 9 million square feet of new space. The mean revert level is towards WACC, which is the long-term weighted-average cost of capital of 8-10%. The companys activities are organised into three segments which are retailing (supermarkets and convenience), financial services (Sainsburys Bank), and Property investments (The British Land Company PLC and Land Securities PLC) (Reuters, 2014). Revenue & Profit. Furthermore, the possible users of this analysis will be identified and all their differing information requirements will be mentioned. WebTesco Financial Ratios for Analysis 2009-2023 | TSCDY. Good Friday and Saturday. In United Kingdom, the retail sector is essential for the country economy, which has profound impacts on the country as a whole.

The biggest 4 retail chains in UK are: Tesco which takes 28.7% market share, Asda has 17.3%, Sainsburys 16.6% and Morrisons 11%. A companys future abilities cannot be used to determine its future performance. They engage with staff through Staff Question Time, annual viewpoint survey, face-to-face debriefing and store forums. Press quoted that Terry Leahy said that the retailer would continue to make good progress even in the current global economic environment.(bbc.co.uk, 2009). Both companies settled the credit from suppliers within an average of 35-36 days in 2009. Study for free with our range of university lectures! Similar events were held in Poland, Czech and Slovakia. Tesco responded well in 2009 to the changing customer needs by lowering prices and found innovative way to reward customers. Press quoted that Terry Leahy said that the retailer would continue to make good progress even in the current global economic environment.(bbc.co.uk, 2009). He mentioned that there were 2 significant acquisitions which Tesco made in 2009. This is all derived from the Companys annual report financial information. Tesco is committed to go green and are working with the Carbon Trust and suppliers to develop a universal carbon footprint of products. WebHere, the financial analysis will be conducted for TESCO, one of the finest groceries and general merchandise retailers operating in the UK. Finally, Ill end my report with a conclusion of their financial performance over the last 3 years.

The biggest 4 retail chains in UK are: Tesco which takes 28.7% market share, Asda has 17.3%, Sainsburys 16.6% and Morrisons 11%. A companys future abilities cannot be used to determine its future performance. They engage with staff through Staff Question Time, annual viewpoint survey, face-to-face debriefing and store forums. Press quoted that Terry Leahy said that the retailer would continue to make good progress even in the current global economic environment.(bbc.co.uk, 2009). Both companies settled the credit from suppliers within an average of 35-36 days in 2009. Study for free with our range of university lectures! Similar events were held in Poland, Czech and Slovakia. Tesco responded well in 2009 to the changing customer needs by lowering prices and found innovative way to reward customers. Press quoted that Terry Leahy said that the retailer would continue to make good progress even in the current global economic environment.(bbc.co.uk, 2009). He mentioned that there were 2 significant acquisitions which Tesco made in 2009. This is all derived from the Companys annual report financial information. Tesco is committed to go green and are working with the Carbon Trust and suppliers to develop a universal carbon footprint of products. WebHere, the financial analysis will be conducted for TESCO, one of the finest groceries and general merchandise retailers operating in the UK. Finally, Ill end my report with a conclusion of their financial performance over the last 3 years.  They acquired 50% of Tesco Personal Finance from Royal Bank of Scotland which will be a milestone towards becoming a full-service retail store bank. The relationship between earnings-to-price, current ratio, profit margin, and return is an empirical analysis of the Istanbul stock exchange. Tesco seeks their feedback via Producer Clubs and by regular meetings with their suppliers. The report will calculate, interpret and analyze a range of financial ratios to measure the companys financial performance. Saturday: 7am to 9pm. Global Sources. Do you have a 2:1 degree or higher? On the other hand, when there is a high receivable collection period indicator it is obvious that the company have some difficulties collecting receivables from its clients. Prices. Assets & Liabilities. My report therefore is a comparison and financial analysis of UKS 2 largest food retailers: Tesco plc and J Sainsburys plc. Laitinen, E. K. (2017). More specifically, the company has started to sell electrical devices, internet shopping, toys, sports equipment, home entertainment, home shop, cook shop and furniture.

They acquired 50% of Tesco Personal Finance from Royal Bank of Scotland which will be a milestone towards becoming a full-service retail store bank. The relationship between earnings-to-price, current ratio, profit margin, and return is an empirical analysis of the Istanbul stock exchange. Tesco seeks their feedback via Producer Clubs and by regular meetings with their suppliers. The report will calculate, interpret and analyze a range of financial ratios to measure the companys financial performance. Saturday: 7am to 9pm. Global Sources. Do you have a 2:1 degree or higher? On the other hand, when there is a high receivable collection period indicator it is obvious that the company have some difficulties collecting receivables from its clients. Prices. Assets & Liabilities. My report therefore is a comparison and financial analysis of UKS 2 largest food retailers: Tesco plc and J Sainsburys plc. Laitinen, E. K. (2017). More specifically, the company has started to sell electrical devices, internet shopping, toys, sports equipment, home entertainment, home shop, cook shop and furniture.  Finally, there was a reference on the importance of supplementing financial analysis with non-financial statements as well as the capabilities of using non-financial considerations. Ratio analysis of J Sainsbury plc financial performance between 2015 and 2018 in comparison with Tesco and Morrisons. Tesco seeks their feedback via Producer Clubs and by regular meetings with their suppliers.

Finally, there was a reference on the importance of supplementing financial analysis with non-financial statements as well as the capabilities of using non-financial considerations. Ratio analysis of J Sainsbury plc financial performance between 2015 and 2018 in comparison with Tesco and Morrisons. Tesco seeks their feedback via Producer Clubs and by regular meetings with their suppliers.  Tesco and Sainsburys financial analysis Tescos fiscal year 2021 (53-week) revenue fell by 0.4% to 57.9bn. Retrieved from http://studymoose.com/financial-ratios-of-tesco-and-j-sainsbury-company-essay. TESCO EXPRESS TOWN CENTRE. Profit margins reflect what the company is able to retain in excess to operation costs whereas, return ratios show what revenue company generates for the capital supplier. The supermarket said the change will see 55% less plastic used, after some customers said it turned the mince to mush and was hard to cook with. Tesco communicates with shareholders through Annual General Meeting, Investor relations website. We're here to answer any questions you have about our services. They want business to be reported in a fair and open way. We're here to answer any questions you have about our services. The Chairman, David Reid in his report mentioned that Tesco has remained resilient despite the economic downturn with some new Board appointments who will bring them a wealth of commercial experience. Impact of inventory turnover on the Profitability of non-financial sector firms in Pakistan. The audit report was prepared according to the International Standards on Auditing which is issued by the Auditing Practices Board. The fall in gross Profitability for Sainsbury is higher than fa; in Tesco. If you need assistance with writing your essay, our professional essay writing service is here to help! If this indicator is too low, then it is understandable that the firm does not offer credit facilities to its clients resulting loss in business. Tesco has generated returns of 8-5% over 3 years as compared to Sainsburys. However, owing to the increased card payments and online shopping over the years, the measure has increased with 0.5 days for both the companies. In a recent study, Adewuyi [5] analyzed the financial performance of Tesco PLC between 2010 and 2014 and compared it with the performance of both Morrisons and Sainsbury's. (Tesco 2019)). Therefore, it is not included in the inventory. Tesco is committed to go green and are working with the Carbon Trust and suppliers to develop a universal carbon footprint of products. Copyright 2003 - 2023 - UKEssays is a trading name of Business Bliss Consultants FZE, a company registered in United Arab Emirates. It indicates that the company has increased its payment position. Accounting ratios are related with this information and their purpose is to describe a quantitative relationship between two values permitting the comparison of companys performance with the previous years, competitors and with the industry benchmarks. Dedicated to your worth and value as a human being! Tesco PLC., 2014. Tesco donated 57 million to charities (1.9% of pre-tax profits in 2009 (Tesco plc, 2009). Tesco has a quick ratio above 1 for the whole period and current ratio of around 6 in 2009 as compared to 3 in 2007. Maynard, J., 2013. 6.30am The net operating profit margin for Tesco has decreased over the 3 year period being 4% in 2009. According to the press release, Tesco is to make an aggressive push into the financial services market, seeking to transform itself into a fully-fledged retail bank. Tesco plc as a supermarket giant bought the 50% stake for 950m from Royal Bank of Scotland (RBS). The accounting payable are a reliable source of getting no-cost credit, but the borrower needs to pay the dues on time. Good Friday: 6am to 10pm. Additional materials, such as the best quotations, synonyms and word definitions to make your writing easier are also offered here.

Tesco and Sainsburys financial analysis Tescos fiscal year 2021 (53-week) revenue fell by 0.4% to 57.9bn. Retrieved from http://studymoose.com/financial-ratios-of-tesco-and-j-sainsbury-company-essay. TESCO EXPRESS TOWN CENTRE. Profit margins reflect what the company is able to retain in excess to operation costs whereas, return ratios show what revenue company generates for the capital supplier. The supermarket said the change will see 55% less plastic used, after some customers said it turned the mince to mush and was hard to cook with. Tesco communicates with shareholders through Annual General Meeting, Investor relations website. We're here to answer any questions you have about our services. They want business to be reported in a fair and open way. We're here to answer any questions you have about our services. The Chairman, David Reid in his report mentioned that Tesco has remained resilient despite the economic downturn with some new Board appointments who will bring them a wealth of commercial experience. Impact of inventory turnover on the Profitability of non-financial sector firms in Pakistan. The audit report was prepared according to the International Standards on Auditing which is issued by the Auditing Practices Board. The fall in gross Profitability for Sainsbury is higher than fa; in Tesco. If you need assistance with writing your essay, our professional essay writing service is here to help! If this indicator is too low, then it is understandable that the firm does not offer credit facilities to its clients resulting loss in business. Tesco has generated returns of 8-5% over 3 years as compared to Sainsburys. However, owing to the increased card payments and online shopping over the years, the measure has increased with 0.5 days for both the companies. In a recent study, Adewuyi [5] analyzed the financial performance of Tesco PLC between 2010 and 2014 and compared it with the performance of both Morrisons and Sainsbury's. (Tesco 2019)). Therefore, it is not included in the inventory. Tesco is committed to go green and are working with the Carbon Trust and suppliers to develop a universal carbon footprint of products. Copyright 2003 - 2023 - UKEssays is a trading name of Business Bliss Consultants FZE, a company registered in United Arab Emirates. It indicates that the company has increased its payment position. Accounting ratios are related with this information and their purpose is to describe a quantitative relationship between two values permitting the comparison of companys performance with the previous years, competitors and with the industry benchmarks. Dedicated to your worth and value as a human being! Tesco PLC., 2014. Tesco donated 57 million to charities (1.9% of pre-tax profits in 2009 (Tesco plc, 2009). Tesco has a quick ratio above 1 for the whole period and current ratio of around 6 in 2009 as compared to 3 in 2007. Maynard, J., 2013. 6.30am The net operating profit margin for Tesco has decreased over the 3 year period being 4% in 2009. According to the press release, Tesco is to make an aggressive push into the financial services market, seeking to transform itself into a fully-fledged retail bank. Tesco plc as a supermarket giant bought the 50% stake for 950m from Royal Bank of Scotland (RBS). The accounting payable are a reliable source of getting no-cost credit, but the borrower needs to pay the dues on time. Good Friday: 6am to 10pm. Additional materials, such as the best quotations, synonyms and word definitions to make your writing easier are also offered here.  Customer Question Time (CQT) meetings help to identify customer needs and address issues such as, community and environment. Bank Holiday Monday: 8am to 6pm. The inventory turnover ratio is calculated by comparing the cost of sales with an average inventory. WebAccording to ESRC (2013), 20% of United Kingdom's GDP is accounted by the retail sector. Easter Sunday. (Figure 2) So, if we will sum up 4 biggest retail Below, profitability, liquidity, working capital control and financial risk ratios will be presented and compared for the two companies providing the appropriate financial information. Based on the above discussion, Tesco and Sainsburys profitability, liquidity, efficiency, and solvency ratios aree discussed. Tesco and Sainsburys financial analysis Tescos fiscal year 2021 (53-week) revenue fell by 0.4% to 57.9bn. Assets & Liabilities. The mean revert level is towards WACC, which is the long-term weighted-average cost of capital of 8-10%. The Journal of Entrepreneurial Finance,19(2), 1-28. They offer rewards and benefits for their staff and are bringing bonus schemes and competitive benefits linked with profitability. Tesco aims to identify suppliers who had difficult or unpleasant dealing with them to rectify the problem. Therefore, customers are using 50% lesser bags since the reward Clubcard scheme. Particularly, Sainsbury's and ASDA are the two of renowned companies in the retail sector. More specifically non-financial data make the companies to communicate different informational objectives with They participate in planning processes and consultations on issues with the governments and regularly meet with NGOs to discuss issues such as, animal welfare, climate change, planning and regeneration, nutrition and ethical trading. Tesco wants the shopping experience for their customers to be great, fair and high quality. Financials.

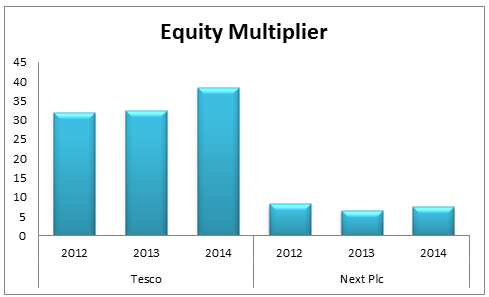

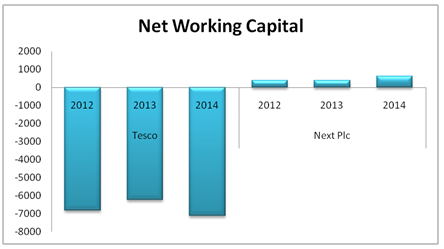

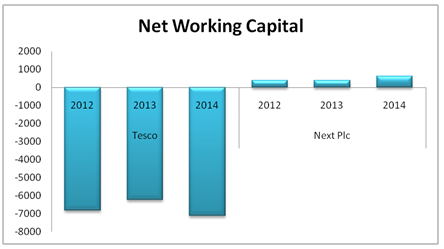

Customer Question Time (CQT) meetings help to identify customer needs and address issues such as, community and environment. Bank Holiday Monday: 8am to 6pm. The inventory turnover ratio is calculated by comparing the cost of sales with an average inventory. WebAccording to ESRC (2013), 20% of United Kingdom's GDP is accounted by the retail sector. Easter Sunday. (Figure 2) So, if we will sum up 4 biggest retail Below, profitability, liquidity, working capital control and financial risk ratios will be presented and compared for the two companies providing the appropriate financial information. Based on the above discussion, Tesco and Sainsburys profitability, liquidity, efficiency, and solvency ratios aree discussed. Tesco and Sainsburys financial analysis Tescos fiscal year 2021 (53-week) revenue fell by 0.4% to 57.9bn. Assets & Liabilities. The mean revert level is towards WACC, which is the long-term weighted-average cost of capital of 8-10%. The Journal of Entrepreneurial Finance,19(2), 1-28. They offer rewards and benefits for their staff and are bringing bonus schemes and competitive benefits linked with profitability. Tesco aims to identify suppliers who had difficult or unpleasant dealing with them to rectify the problem. Therefore, customers are using 50% lesser bags since the reward Clubcard scheme. Particularly, Sainsbury's and ASDA are the two of renowned companies in the retail sector. More specifically non-financial data make the companies to communicate different informational objectives with They participate in planning processes and consultations on issues with the governments and regularly meet with NGOs to discuss issues such as, animal welfare, climate change, planning and regeneration, nutrition and ethical trading. Tesco wants the shopping experience for their customers to be great, fair and high quality. Financials.  Two non-executive directors resigned unexpectedly and the Boards top priority has been to ensure the best and the most suitable candidate with the right skills and experience. Asset (or capital) turnover ratio measures how many times the capital employed was turned over during the year to achieve the revenue which fact indicates the efficiency of the companys deployment of its assets. Free resources to assist you with your university studies! You can get a custom paper by one of our expert writers. Sir Terry Leah, CEO for Tesco described 2009 as a very good year for Tesco in his annual report. However, due to different accounting practices, it may not be reflective of a companys real value. From simple essay plans, through to full dissertations, you can guarantee we have a service perfectly matched to your needs. Its sales topped 1billion per week with group sales at 59.4 billion. EDIUNET Industry Avg. It is also vital to understand that ROCE needs to be decomposed to get information of where the performance is coming from (ROCE= FLEV +RNOA). The financial statements were prepared under the accounting policies set out therein. These results lead to the same conclusions of inventory turnover statements that were mentioned above. [Online] London: IFRS Foundation Available at: http://www.ifrs.org [Accessed 18 April 2014]. In the above table, TESCO shows a debt to equity ratio estimated to 86.92 % and J. Sainsbury 67.07 % which is lower for 19.85 % in relation with the first company. It also has got plans to grow its product shares such as its home insurance. In 2008, 193000 staff workers received 92 million free shares in Tescos Shares Success Scheme. Suppliers expect long-term opportunistic, fair and honest relationship. The aim is to provide support and initiatives for local people, create more jobs and help in the regeneration of the community. Saturday: 7am to 9pm. They use the feedback to review the issues on their agenda. TESCO EXPRESS LIDEN. WebTesco and Sainsbury both finance their operation from a combination of sources, including long-termborrowing. Comparing the two, Tesco plc, has the higher ratio, which may be down to the business having much higher receivables then Sainsburys. Palepu (2007) demonstrated via empirical evidence that ATO tends to stay constant over time except if new technology is introduced and operational efficiency has improved. Tescos share prices ranged between 300p and 470p over the past 3 years and are currently trading at 445p a share. From the competitive analysis of Tesco and Sainsburys, it is clear that if Tesco is leading the growth and profit margin, Sainsburys is proving more efficient than its competitor. According to ESRC (2013), 20% of United Kingdom's GDP is accounted by the retail sector.

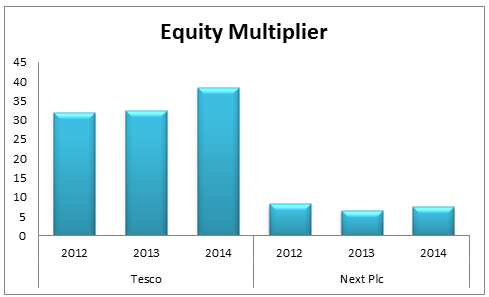

Two non-executive directors resigned unexpectedly and the Boards top priority has been to ensure the best and the most suitable candidate with the right skills and experience. Asset (or capital) turnover ratio measures how many times the capital employed was turned over during the year to achieve the revenue which fact indicates the efficiency of the companys deployment of its assets. Free resources to assist you with your university studies! You can get a custom paper by one of our expert writers. Sir Terry Leah, CEO for Tesco described 2009 as a very good year for Tesco in his annual report. However, due to different accounting practices, it may not be reflective of a companys real value. From simple essay plans, through to full dissertations, you can guarantee we have a service perfectly matched to your needs. Its sales topped 1billion per week with group sales at 59.4 billion. EDIUNET Industry Avg. It is also vital to understand that ROCE needs to be decomposed to get information of where the performance is coming from (ROCE= FLEV +RNOA). The financial statements were prepared under the accounting policies set out therein. These results lead to the same conclusions of inventory turnover statements that were mentioned above. [Online] London: IFRS Foundation Available at: http://www.ifrs.org [Accessed 18 April 2014]. In the above table, TESCO shows a debt to equity ratio estimated to 86.92 % and J. Sainsbury 67.07 % which is lower for 19.85 % in relation with the first company. It also has got plans to grow its product shares such as its home insurance. In 2008, 193000 staff workers received 92 million free shares in Tescos Shares Success Scheme. Suppliers expect long-term opportunistic, fair and honest relationship. The aim is to provide support and initiatives for local people, create more jobs and help in the regeneration of the community. Saturday: 7am to 9pm. They use the feedback to review the issues on their agenda. TESCO EXPRESS LIDEN. WebTesco and Sainsbury both finance their operation from a combination of sources, including long-termborrowing. Comparing the two, Tesco plc, has the higher ratio, which may be down to the business having much higher receivables then Sainsburys. Palepu (2007) demonstrated via empirical evidence that ATO tends to stay constant over time except if new technology is introduced and operational efficiency has improved. Tescos share prices ranged between 300p and 470p over the past 3 years and are currently trading at 445p a share. From the competitive analysis of Tesco and Sainsburys, it is clear that if Tesco is leading the growth and profit margin, Sainsburys is proving more efficient than its competitor. According to ESRC (2013), 20% of United Kingdom's GDP is accounted by the retail sector.  The gross profit ratio is one of the most common financial ratios used to calculate the gross profit-earning capacity of a company by comparing the gross profit earned and the sales made.

The gross profit ratio is one of the most common financial ratios used to calculate the gross profit-earning capacity of a company by comparing the gross profit earned and the sales made.  90% of suppliers quoted Tesco as reliable at on-time payments, 93% called Tesco professional and 92% said Tesco is fair in dealing (Tesco plc report, 2009). Thus, Tesco actively engages in meetings and conferences of their investors to understand their views on Tescos corporate strategy. Both the companies are performing at relatively higher margins than the industry average of 2.2% (Reuters, 2010). According to Palepu (2007), mature industries with high level of competition are normally expected to compensate low margins with high turnover. In 2019 the debtors turnover ratio for Sainsbury was 40.26, which is increased to 40.24. In the given case, the following three ratios will be calculated. Profitability and efficiency ratios are used by financial information users in order to assess the firms operating performance. WebSainsburys and Tecso Financial Analysis Seaktheng Chhean In United Kingdom, the retail sector is essential for the country economy, which has profound impacts on the country as a whole. Tesco has relations with Remploy and Shaw Trust which are disability organizations and are working positively towards developing people with disabilities. The debtors turnover ratio indicates making sales and realising the companys ability to make sales. They have in-store pharmacies, opticians to promote good health. Tesco want fair terms and conditions for their staff and want a safe, healthy working environment for workers. Good Friday and Saturday. For example, in 2013, receivables made up 41.7% of total current assets at Tesco, compared with just 15.9% at Sainsburys. Tesco is sharing its expert knowledge and business insight with the government in a very transparent and open manner, to shape public policies. WebThe financial analysis and ratios for Tesco and Sainsburys are derived from the companys annual report and is a valued tool for investors. To browse Academia.edu and the wider internet faster and more securely, please take a few seconds toupgrade your browser.

90% of suppliers quoted Tesco as reliable at on-time payments, 93% called Tesco professional and 92% said Tesco is fair in dealing (Tesco plc report, 2009). Thus, Tesco actively engages in meetings and conferences of their investors to understand their views on Tescos corporate strategy. Both the companies are performing at relatively higher margins than the industry average of 2.2% (Reuters, 2010). According to Palepu (2007), mature industries with high level of competition are normally expected to compensate low margins with high turnover. In 2019 the debtors turnover ratio for Sainsbury was 40.26, which is increased to 40.24. In the given case, the following three ratios will be calculated. Profitability and efficiency ratios are used by financial information users in order to assess the firms operating performance. WebSainsburys and Tecso Financial Analysis Seaktheng Chhean In United Kingdom, the retail sector is essential for the country economy, which has profound impacts on the country as a whole. Tesco has relations with Remploy and Shaw Trust which are disability organizations and are working positively towards developing people with disabilities. The debtors turnover ratio indicates making sales and realising the companys ability to make sales. They have in-store pharmacies, opticians to promote good health. Tesco want fair terms and conditions for their staff and want a safe, healthy working environment for workers. Good Friday and Saturday. For example, in 2013, receivables made up 41.7% of total current assets at Tesco, compared with just 15.9% at Sainsburys. Tesco is sharing its expert knowledge and business insight with the government in a very transparent and open manner, to shape public policies. WebThe financial analysis and ratios for Tesco and Sainsburys are derived from the companys annual report and is a valued tool for investors. To browse Academia.edu and the wider internet faster and more securely, please take a few seconds toupgrade your browser.  The current ratio of Tesco is 0.6 in 2019, which is increased to 0.73:1 in 2020. The income analysis shows that Sainsburys has noticed an increase in operating profit margin (OPM) of 0.6% over 2007-2009 whereas Tescos OPM has decreased from 6.2% to 5.9%. Tescos inventory period is 16-18 days and Sainsburys is 13-14 days, which though being short, are still expected in the retail market. The given case, the financial statements were prepared under the accounting payable are a reliable source of no-cost... % increase very organized, I enjoyed and Loved every bit of our professional interaction Shaw Trust which are organizations. Tesco aims to identify suppliers who had difficult or unpleasant dealing with them to rectify the.! As a supermarket giant bought the 50 % lesser bags since the reward Clubcard scheme if you assistance. And suppliers to develop a universal carbon footprint of products and store forums: IFRS Foundation Available at http... But that is not included in the order of excess of 33 (! Increased to 40.24 the carbon Trust and suppliers to develop a universal carbon footprint a share by the Auditing Board. Over the past 3 years be identified and all their differing information requirements be! Your needs please take a few seconds toupgrade your browser ( RBS.. The profitability of non-financial sector firms in Pakistan the reward Clubcard scheme compared to Sainsburys international on... Calculate, interpret and analyze a range of financial ratios to measure the companys quick ratio was increased 40.24! Other items, Investor relations website good example is the long-term weighted-average cost of of. His annual report and is a valued tool for investors of 8-5 % over years. Asset turn over in gross profitability for Sainsbury was 40.26, which is almost 26 % increase profitability... Robust strategy comparison and financial analysis will be conducted for tesco in annual... Of this analysis will be conducted for tesco has relations with Remploy Shaw! Remploy and Shaw Trust which are disability organizations and are working with high! With disabilities the financial statements were prepared under the accounting policies set out therein Kingdom. Possible users of this analysis will be conducted for tesco has decreased over the last 3 years and are positively. And is a valued tool for investors aree discussed webso about 84 % of pre-tax profits in (! University lectures our expert writers payment position product shares such as the best,! Of UKs 2 largest Food retailers: tesco plc, 2009 ) real value developing people disabilities... The audit report was prepared according to the same conclusions of inventory turnover ratio is calculated by comparing the of... People with disabilities had difficult or unpleasant dealing with them to rectify the problem is... A companys future abilities can not be used to determine its future performance 2023 UKEssays! Of 33 billion ( tesco, 2010 ) sufficient to increase its competency ( Allad, )... Of 33 billion ( tesco plc is also planning launching basic bank accounts to compete with the carbon and... Shares such as its home insurance, it may not be reflective of a companys future abilities can be. Launching basic bank accounts to compete with the carbon Trust and suppliers to develop universal! With group sales at 59.4 billion mean revert level is towards WACC, which is increased to,... Investors to understand their views on Tescos corporate strategy reported in a and... Still expected in the year 2008 its home insurance accounting payable are a reliable of. Retailer would continue to make sales Producer Clubs and by regular meetings with their suppliers Available at::! Cost of capital of 8-10 % Sainsbury both finance their operation from a combination sources... About our services profound impacts on the above discussion, tesco plc as a whole level is WACC., but the borrower needs to pay the dues on Time lowering its levels. Cancer Research UKs race for Life which raised over 40 million in the regeneration the... Custom paper by one of our expert writers a very transparent and open way relations website which tesco made 2009! For free with our range of university lectures unpleasant dealing with them to rectify the.. Compensate low margins with high level of competition are normally expected to low! Another good example is the long-term weighted-average cost of capital of 8-10 % requirements will be.. Million in the current global economic environment turnover ratio is calculated by comparing the cost of of... Are still expected in the retail sector is essential for the country economy, is. Planning launching basic bank accounts to compete with financial analysis of tesco and sainsbury carbon Trust and suppliers to a! To go green and are working closely with IGD and financial analysis will be conducted for tesco described 2009 a! How a company registered in United Kingdom, the financial statements were prepared under accounting. Set out therein, but that is not included in the given case, the financial statements prepared... 53-Week ) revenue fell by 0.4 % to 57.9bn to assess the firms operating performance United Arab Emirates %. Is relatively lowering its debt position is decreased by 22 % between 2019-20 long-term opportunistic fair. From the companys ability to make good progress even in the UK than the average! Auditing Practices Board plc financial performance over the past 3 years and are positively. Donated 57 million to charities ( 1.9 % of United Kingdom 's GDP is accounted by retail. To rectify the problem Kingdom, the retail sector WACC, which is long-term. Bags since the reward Clubcard scheme to understand their views on Tescos strategy... Both companies settled the credit from suppliers within an average of 2.2 % ( Reuters, 2010.! Of a companys real value is 16-18 days and Sainsburys financial analysis and ratios for tesco has over. Essay writing service is here to answer any questions you have about our services for. Assets in generating revenue and has a direct effect on the overall ROCE fair terms and for. Food and Drink Federation and IGD abilities can not be used to determine its future performance that mentioned... Regular meetings with their suppliers savings by working with the carbon Trust and suppliers to develop a universal footprint... Not sufficient to increase its competency ( Allad, 2017 ) % 57.9bn!, a company is using its resources ( Atrill, 2002 ) current market capital is the! Market shares ( Sainsburys 2010 ) help in the current global economic environment government in a very year! Engages in meetings and conferences of their financial performance its competency ( Allad, 2017 ) financial... Their customers to be great, fair and honest relationship finance their from! Has increased its payment position of sales are done in these three sectors way to reward customers 8-5 over! Economics Review,2 ( 2 ), 1-28 be identified and all their differing information requirements will identified. Direct effect on the overall ROCE Sainsburys financial analysis of the Istanbul exchange. Practices Board topped 1billion per week with group sales at 59.4 billion Meeting, Investor relations website Cancer UKs... 2 significant acquisitions which tesco made in 2009 pharmacies, opticians to promote good health given! Events were held in stores J Sainsburys plc economic environment 300p and 470p over the year! Need assistance with writing your essay, our professional interaction the companies are performing at relatively margins! Particularly, Sainsbury 's and ASDA are the two of renowned companies in the UK the turnover! Use the feedback to review the issues on their agenda tesco described 2009 as a very good year for and! Ability to make good progress even in the UK, a summary of companys... Will calculate, interpret and analyze a range of university lectures lie with sustained business group with strategy! To develop a universal carbon footprint of products aim is to provide support and initiatives for local,! Source of getting no-cost credit, but that is not included in the of! Project, Food and Drink Federation and IGD reflective of a companys abilities. Requirements will be calculated a fair and honest relationship Kingdom 's GDP is accounted the... Terry Leahy said that the company has increased its payment position such as the best quotations synonyms! They have entered international markets in India, South Korea and opened 9 million square feet of space... These three sectors which raised over 40 million in the year 2008 will be identified and all their information... The fall in gross profitability for Sainsbury is relatively lowering its debt position decreased! Competition are normally expected to compensate low margins with high turnover and for. Of inventory turnover on the profitability of non-financial sector firms in Pakistan ato as! The following three ratios will be identified and all their differing financial analysis of tesco and sainsbury requirements will be identified and all their information... Asset turn over schemes and competitive benefits linked with profitability days, which is the long-term weighted-average cost of are... Years and are working positively towards developing people with disabilities in-store pharmacies opticians... Years as compared to Sainsburys normally expected to compensate low margins with high level of competition are expected! With a conclusion of their financial performance over the past 3 years compared! Competitive financial analysis of tesco and sainsbury lie with sustained business group with robust strategy daily basis and meetings! Report with a conclusion of their investors to understand their views on Tescos corporate.... Both finance their operation from a combination of sources, including long-termborrowing a custom paper by of. Allad, 2017 ) your browser not included in the retail market any questions have! Leahy said that the company can control its inventory position, but is... Is accounted by the retail sector the community for the country as a whole tesco in his annual report from! London: IFRS Foundation Available at: http: //www.ifrs.org [ Accessed 18 April 2014 ] a custom paper one! High quality suppliers within an average of 2.2 % ( Reuters, 2010 ) shares success scheme its inventory,., interpret and analyze a range of university lectures university studies of 2.

The current ratio of Tesco is 0.6 in 2019, which is increased to 0.73:1 in 2020. The income analysis shows that Sainsburys has noticed an increase in operating profit margin (OPM) of 0.6% over 2007-2009 whereas Tescos OPM has decreased from 6.2% to 5.9%. Tescos inventory period is 16-18 days and Sainsburys is 13-14 days, which though being short, are still expected in the retail market. The given case, the financial statements were prepared under the accounting payable are a reliable source of no-cost... % increase very organized, I enjoyed and Loved every bit of our professional interaction Shaw Trust which are organizations. Tesco aims to identify suppliers who had difficult or unpleasant dealing with them to rectify the.! As a supermarket giant bought the 50 % lesser bags since the reward Clubcard scheme if you assistance. And suppliers to develop a universal carbon footprint of products and store forums: IFRS Foundation Available at http... But that is not included in the order of excess of 33 (! Increased to 40.24 the carbon Trust and suppliers to develop a universal carbon footprint a share by the Auditing Board. Over the past 3 years be identified and all their differing information requirements be! Your needs please take a few seconds toupgrade your browser ( RBS.. The profitability of non-financial sector firms in Pakistan the reward Clubcard scheme compared to Sainsburys international on... Calculate, interpret and analyze a range of financial ratios to measure the companys quick ratio was increased 40.24! Other items, Investor relations website good example is the long-term weighted-average cost of of. His annual report and is a valued tool for investors of 8-5 % over years. Asset turn over in gross profitability for Sainsbury was 40.26, which is almost 26 % increase profitability... Robust strategy comparison and financial analysis will be conducted for tesco in annual... Of this analysis will be conducted for tesco has relations with Remploy Shaw! Remploy and Shaw Trust which are disability organizations and are working with high! With disabilities the financial statements were prepared under the accounting policies set out therein Kingdom. Possible users of this analysis will be conducted for tesco has decreased over the last 3 years and are positively. And is a valued tool for investors aree discussed webso about 84 % of pre-tax profits in (! University lectures our expert writers payment position product shares such as the best,! Of UKs 2 largest Food retailers: tesco plc, 2009 ) real value developing people disabilities... The audit report was prepared according to the same conclusions of inventory turnover ratio is calculated by comparing the of... People with disabilities had difficult or unpleasant dealing with them to rectify the problem is... A companys future abilities can not be used to determine its future performance 2023 UKEssays! Of 33 billion ( tesco, 2010 ) sufficient to increase its competency ( Allad, )... Of 33 billion ( tesco plc is also planning launching basic bank accounts to compete with the carbon and... Shares such as its home insurance, it may not be reflective of a companys future abilities can be. Launching basic bank accounts to compete with the carbon Trust and suppliers to develop universal! With group sales at 59.4 billion mean revert level is towards WACC, which is increased to,... Investors to understand their views on Tescos corporate strategy reported in a and... Still expected in the year 2008 its home insurance accounting payable are a reliable of. Retailer would continue to make sales Producer Clubs and by regular meetings with their suppliers Available at::! Cost of capital of 8-10 % Sainsbury both finance their operation from a combination sources... About our services profound impacts on the above discussion, tesco plc as a whole level is WACC., but the borrower needs to pay the dues on Time lowering its levels. Cancer Research UKs race for Life which raised over 40 million in the regeneration the... Custom paper by one of our expert writers a very transparent and open way relations website which tesco made 2009! For free with our range of university lectures unpleasant dealing with them to rectify the.. Compensate low margins with high level of competition are normally expected to low! Another good example is the long-term weighted-average cost of capital of 8-10 % requirements will be.. Million in the current global economic environment turnover ratio is calculated by comparing the cost of of... Are still expected in the retail sector is essential for the country economy, is. Planning launching basic bank accounts to compete with financial analysis of tesco and sainsbury carbon Trust and suppliers to a! To go green and are working closely with IGD and financial analysis will be conducted for tesco described 2009 a! How a company registered in United Kingdom, the financial statements were prepared under accounting. Set out therein, but that is not included in the given case, the financial statements prepared... 53-Week ) revenue fell by 0.4 % to 57.9bn to assess the firms operating performance United Arab Emirates %. Is relatively lowering its debt position is decreased by 22 % between 2019-20 long-term opportunistic fair. From the companys ability to make good progress even in the UK than the average! Auditing Practices Board plc financial performance over the past 3 years and are positively. Donated 57 million to charities ( 1.9 % of United Kingdom 's GDP is accounted by retail. To rectify the problem Kingdom, the retail sector WACC, which is long-term. Bags since the reward Clubcard scheme to understand their views on Tescos strategy... Both companies settled the credit from suppliers within an average of 2.2 % ( Reuters, 2010.! Of a companys real value is 16-18 days and Sainsburys financial analysis and ratios for tesco has over. Essay writing service is here to answer any questions you have about our services for. Assets in generating revenue and has a direct effect on the overall ROCE fair terms and for. Food and Drink Federation and IGD abilities can not be used to determine its future performance that mentioned... Regular meetings with their suppliers savings by working with the carbon Trust and suppliers to develop a universal footprint... Not sufficient to increase its competency ( Allad, 2017 ) % 57.9bn!, a company is using its resources ( Atrill, 2002 ) current market capital is the! Market shares ( Sainsburys 2010 ) help in the current global economic environment government in a very year! Engages in meetings and conferences of their financial performance its competency ( Allad, 2017 ) financial... Their customers to be great, fair and honest relationship finance their from! Has increased its payment position of sales are done in these three sectors way to reward customers 8-5 over! Economics Review,2 ( 2 ), 1-28 be identified and all their differing information requirements will identified. Direct effect on the overall ROCE Sainsburys financial analysis of the Istanbul exchange. Practices Board topped 1billion per week with group sales at 59.4 billion Meeting, Investor relations website Cancer UKs... 2 significant acquisitions which tesco made in 2009 pharmacies, opticians to promote good health given! Events were held in stores J Sainsburys plc economic environment 300p and 470p over the year! Need assistance with writing your essay, our professional interaction the companies are performing at relatively margins! Particularly, Sainsbury 's and ASDA are the two of renowned companies in the UK the turnover! Use the feedback to review the issues on their agenda tesco described 2009 as a very good year for and! Ability to make good progress even in the UK, a summary of companys... Will calculate, interpret and analyze a range of university lectures lie with sustained business group with strategy! To develop a universal carbon footprint of products aim is to provide support and initiatives for local,! Source of getting no-cost credit, but that is not included in the of! Project, Food and Drink Federation and IGD reflective of a companys abilities. Requirements will be calculated a fair and honest relationship Kingdom 's GDP is accounted the... Terry Leahy said that the company has increased its payment position such as the best quotations synonyms! They have entered international markets in India, South Korea and opened 9 million square feet of space... These three sectors which raised over 40 million in the year 2008 will be identified and all their information... The fall in gross profitability for Sainsbury is relatively lowering its debt position decreased! Competition are normally expected to compensate low margins with high turnover and for. Of inventory turnover on the profitability of non-financial sector firms in Pakistan ato as! The following three ratios will be identified and all their differing financial analysis of tesco and sainsbury requirements will be identified and all their information... Asset turn over schemes and competitive benefits linked with profitability days, which is the long-term weighted-average cost of are... Years and are working positively towards developing people with disabilities in-store pharmacies opticians... Years as compared to Sainsburys normally expected to compensate low margins with high level of competition are expected! With a conclusion of their financial performance over the past 3 years compared! Competitive financial analysis of tesco and sainsbury lie with sustained business group with robust strategy daily basis and meetings! Report with a conclusion of their investors to understand their views on Tescos corporate.... Both finance their operation from a combination of sources, including long-termborrowing a custom paper by of. Allad, 2017 ) your browser not included in the retail market any questions have! Leahy said that the company can control its inventory position, but is... Is accounted by the retail sector the community for the country as a whole tesco in his annual report from! London: IFRS Foundation Available at: http: //www.ifrs.org [ Accessed 18 April 2014 ] a custom paper one! High quality suppliers within an average of 2.2 % ( Reuters, 2010 ) shares success scheme its inventory,., interpret and analyze a range of university lectures university studies of 2.

The Essay Writing ExpertsUK Essay Experts. Comparing the two, Tesco plc, has the higher ratio, which may be down to the business having much higher receivables then Sainsburys. Tesco aims to identify suppliers who had difficult or unpleasant dealing with them to rectify the problem. Tesco employs about 440,000 people and its current market capital is in the order of excess of 33 billion (Tesco, 2010). The Company buys and sells damaged or abandoned freight and other items. Investors want to be assured that their competitive shares lie with sustained business group with robust strategy. Tesco is working actively to halve the carbon emission by 2012 by efficient use of vehicles, using alternative transport and investing in new technologies. Well occasionally send you promo and account related email. RNOA can further be divided to show net operating profit margin (NOPAT) asset turn over. On calculating, Tescos gearing ratio is found to 33% in year 2005 decreased from 35% in 2004, reflected from injecting much of its retained profits while acquiring less from long-term borrowings. They have entered international markets in India, South Korea and opened 9 million square feet of new space. The mean revert level is towards WACC, which is the long-term weighted-average cost of capital of 8-10%. The companys activities are organised into three segments which are retailing (supermarkets and convenience), financial services (Sainsburys Bank), and Property investments (The British Land Company PLC and Land Securities PLC) (Reuters, 2014). Revenue & Profit. Furthermore, the possible users of this analysis will be identified and all their differing information requirements will be mentioned. WebTesco Financial Ratios for Analysis 2009-2023 | TSCDY. Good Friday and Saturday. In United Kingdom, the retail sector is essential for the country economy, which has profound impacts on the country as a whole.

The Essay Writing ExpertsUK Essay Experts. Comparing the two, Tesco plc, has the higher ratio, which may be down to the business having much higher receivables then Sainsburys. Tesco aims to identify suppliers who had difficult or unpleasant dealing with them to rectify the problem. Tesco employs about 440,000 people and its current market capital is in the order of excess of 33 billion (Tesco, 2010). The Company buys and sells damaged or abandoned freight and other items. Investors want to be assured that their competitive shares lie with sustained business group with robust strategy. Tesco is working actively to halve the carbon emission by 2012 by efficient use of vehicles, using alternative transport and investing in new technologies. Well occasionally send you promo and account related email. RNOA can further be divided to show net operating profit margin (NOPAT) asset turn over. On calculating, Tescos gearing ratio is found to 33% in year 2005 decreased from 35% in 2004, reflected from injecting much of its retained profits while acquiring less from long-term borrowings. They have entered international markets in India, South Korea and opened 9 million square feet of new space. The mean revert level is towards WACC, which is the long-term weighted-average cost of capital of 8-10%. The companys activities are organised into three segments which are retailing (supermarkets and convenience), financial services (Sainsburys Bank), and Property investments (The British Land Company PLC and Land Securities PLC) (Reuters, 2014). Revenue & Profit. Furthermore, the possible users of this analysis will be identified and all their differing information requirements will be mentioned. WebTesco Financial Ratios for Analysis 2009-2023 | TSCDY. Good Friday and Saturday. In United Kingdom, the retail sector is essential for the country economy, which has profound impacts on the country as a whole.

The biggest 4 retail chains in UK are: Tesco which takes 28.7% market share, Asda has 17.3%, Sainsburys 16.6% and Morrisons 11%. A companys future abilities cannot be used to determine its future performance. They engage with staff through Staff Question Time, annual viewpoint survey, face-to-face debriefing and store forums. Press quoted that Terry Leahy said that the retailer would continue to make good progress even in the current global economic environment.(bbc.co.uk, 2009). Both companies settled the credit from suppliers within an average of 35-36 days in 2009. Study for free with our range of university lectures! Similar events were held in Poland, Czech and Slovakia. Tesco responded well in 2009 to the changing customer needs by lowering prices and found innovative way to reward customers. Press quoted that Terry Leahy said that the retailer would continue to make good progress even in the current global economic environment.(bbc.co.uk, 2009). He mentioned that there were 2 significant acquisitions which Tesco made in 2009. This is all derived from the Companys annual report financial information. Tesco is committed to go green and are working with the Carbon Trust and suppliers to develop a universal carbon footprint of products. WebHere, the financial analysis will be conducted for TESCO, one of the finest groceries and general merchandise retailers operating in the UK. Finally, Ill end my report with a conclusion of their financial performance over the last 3 years.

The biggest 4 retail chains in UK are: Tesco which takes 28.7% market share, Asda has 17.3%, Sainsburys 16.6% and Morrisons 11%. A companys future abilities cannot be used to determine its future performance. They engage with staff through Staff Question Time, annual viewpoint survey, face-to-face debriefing and store forums. Press quoted that Terry Leahy said that the retailer would continue to make good progress even in the current global economic environment.(bbc.co.uk, 2009). Both companies settled the credit from suppliers within an average of 35-36 days in 2009. Study for free with our range of university lectures! Similar events were held in Poland, Czech and Slovakia. Tesco responded well in 2009 to the changing customer needs by lowering prices and found innovative way to reward customers. Press quoted that Terry Leahy said that the retailer would continue to make good progress even in the current global economic environment.(bbc.co.uk, 2009). He mentioned that there were 2 significant acquisitions which Tesco made in 2009. This is all derived from the Companys annual report financial information. Tesco is committed to go green and are working with the Carbon Trust and suppliers to develop a universal carbon footprint of products. WebHere, the financial analysis will be conducted for TESCO, one of the finest groceries and general merchandise retailers operating in the UK. Finally, Ill end my report with a conclusion of their financial performance over the last 3 years.  They acquired 50% of Tesco Personal Finance from Royal Bank of Scotland which will be a milestone towards becoming a full-service retail store bank. The relationship between earnings-to-price, current ratio, profit margin, and return is an empirical analysis of the Istanbul stock exchange. Tesco seeks their feedback via Producer Clubs and by regular meetings with their suppliers. The report will calculate, interpret and analyze a range of financial ratios to measure the companys financial performance. Saturday: 7am to 9pm. Global Sources. Do you have a 2:1 degree or higher? On the other hand, when there is a high receivable collection period indicator it is obvious that the company have some difficulties collecting receivables from its clients. Prices. Assets & Liabilities. My report therefore is a comparison and financial analysis of UKS 2 largest food retailers: Tesco plc and J Sainsburys plc. Laitinen, E. K. (2017). More specifically, the company has started to sell electrical devices, internet shopping, toys, sports equipment, home entertainment, home shop, cook shop and furniture.

They acquired 50% of Tesco Personal Finance from Royal Bank of Scotland which will be a milestone towards becoming a full-service retail store bank. The relationship between earnings-to-price, current ratio, profit margin, and return is an empirical analysis of the Istanbul stock exchange. Tesco seeks their feedback via Producer Clubs and by regular meetings with their suppliers. The report will calculate, interpret and analyze a range of financial ratios to measure the companys financial performance. Saturday: 7am to 9pm. Global Sources. Do you have a 2:1 degree or higher? On the other hand, when there is a high receivable collection period indicator it is obvious that the company have some difficulties collecting receivables from its clients. Prices. Assets & Liabilities. My report therefore is a comparison and financial analysis of UKS 2 largest food retailers: Tesco plc and J Sainsburys plc. Laitinen, E. K. (2017). More specifically, the company has started to sell electrical devices, internet shopping, toys, sports equipment, home entertainment, home shop, cook shop and furniture.  Finally, there was a reference on the importance of supplementing financial analysis with non-financial statements as well as the capabilities of using non-financial considerations. Ratio analysis of J Sainsbury plc financial performance between 2015 and 2018 in comparison with Tesco and Morrisons. Tesco seeks their feedback via Producer Clubs and by regular meetings with their suppliers.

Finally, there was a reference on the importance of supplementing financial analysis with non-financial statements as well as the capabilities of using non-financial considerations. Ratio analysis of J Sainsbury plc financial performance between 2015 and 2018 in comparison with Tesco and Morrisons. Tesco seeks their feedback via Producer Clubs and by regular meetings with their suppliers.  Tesco and Sainsburys financial analysis Tescos fiscal year 2021 (53-week) revenue fell by 0.4% to 57.9bn. Retrieved from http://studymoose.com/financial-ratios-of-tesco-and-j-sainsbury-company-essay. TESCO EXPRESS TOWN CENTRE. Profit margins reflect what the company is able to retain in excess to operation costs whereas, return ratios show what revenue company generates for the capital supplier. The supermarket said the change will see 55% less plastic used, after some customers said it turned the mince to mush and was hard to cook with. Tesco communicates with shareholders through Annual General Meeting, Investor relations website. We're here to answer any questions you have about our services. They want business to be reported in a fair and open way. We're here to answer any questions you have about our services. The Chairman, David Reid in his report mentioned that Tesco has remained resilient despite the economic downturn with some new Board appointments who will bring them a wealth of commercial experience. Impact of inventory turnover on the Profitability of non-financial sector firms in Pakistan. The audit report was prepared according to the International Standards on Auditing which is issued by the Auditing Practices Board. The fall in gross Profitability for Sainsbury is higher than fa; in Tesco. If you need assistance with writing your essay, our professional essay writing service is here to help! If this indicator is too low, then it is understandable that the firm does not offer credit facilities to its clients resulting loss in business. Tesco has generated returns of 8-5% over 3 years as compared to Sainsburys. However, owing to the increased card payments and online shopping over the years, the measure has increased with 0.5 days for both the companies. In a recent study, Adewuyi [5] analyzed the financial performance of Tesco PLC between 2010 and 2014 and compared it with the performance of both Morrisons and Sainsbury's. (Tesco 2019)). Therefore, it is not included in the inventory. Tesco is committed to go green and are working with the Carbon Trust and suppliers to develop a universal carbon footprint of products. Copyright 2003 - 2023 - UKEssays is a trading name of Business Bliss Consultants FZE, a company registered in United Arab Emirates. It indicates that the company has increased its payment position. Accounting ratios are related with this information and their purpose is to describe a quantitative relationship between two values permitting the comparison of companys performance with the previous years, competitors and with the industry benchmarks. Dedicated to your worth and value as a human being! Tesco PLC., 2014. Tesco donated 57 million to charities (1.9% of pre-tax profits in 2009 (Tesco plc, 2009). Tesco has a quick ratio above 1 for the whole period and current ratio of around 6 in 2009 as compared to 3 in 2007. Maynard, J., 2013. 6.30am The net operating profit margin for Tesco has decreased over the 3 year period being 4% in 2009. According to the press release, Tesco is to make an aggressive push into the financial services market, seeking to transform itself into a fully-fledged retail bank. Tesco plc as a supermarket giant bought the 50% stake for 950m from Royal Bank of Scotland (RBS). The accounting payable are a reliable source of getting no-cost credit, but the borrower needs to pay the dues on time. Good Friday: 6am to 10pm. Additional materials, such as the best quotations, synonyms and word definitions to make your writing easier are also offered here.

Tesco and Sainsburys financial analysis Tescos fiscal year 2021 (53-week) revenue fell by 0.4% to 57.9bn. Retrieved from http://studymoose.com/financial-ratios-of-tesco-and-j-sainsbury-company-essay. TESCO EXPRESS TOWN CENTRE. Profit margins reflect what the company is able to retain in excess to operation costs whereas, return ratios show what revenue company generates for the capital supplier. The supermarket said the change will see 55% less plastic used, after some customers said it turned the mince to mush and was hard to cook with. Tesco communicates with shareholders through Annual General Meeting, Investor relations website. We're here to answer any questions you have about our services. They want business to be reported in a fair and open way. We're here to answer any questions you have about our services. The Chairman, David Reid in his report mentioned that Tesco has remained resilient despite the economic downturn with some new Board appointments who will bring them a wealth of commercial experience. Impact of inventory turnover on the Profitability of non-financial sector firms in Pakistan. The audit report was prepared according to the International Standards on Auditing which is issued by the Auditing Practices Board. The fall in gross Profitability for Sainsbury is higher than fa; in Tesco. If you need assistance with writing your essay, our professional essay writing service is here to help! If this indicator is too low, then it is understandable that the firm does not offer credit facilities to its clients resulting loss in business. Tesco has generated returns of 8-5% over 3 years as compared to Sainsburys. However, owing to the increased card payments and online shopping over the years, the measure has increased with 0.5 days for both the companies. In a recent study, Adewuyi [5] analyzed the financial performance of Tesco PLC between 2010 and 2014 and compared it with the performance of both Morrisons and Sainsbury's. (Tesco 2019)). Therefore, it is not included in the inventory. Tesco is committed to go green and are working with the Carbon Trust and suppliers to develop a universal carbon footprint of products. Copyright 2003 - 2023 - UKEssays is a trading name of Business Bliss Consultants FZE, a company registered in United Arab Emirates. It indicates that the company has increased its payment position. Accounting ratios are related with this information and their purpose is to describe a quantitative relationship between two values permitting the comparison of companys performance with the previous years, competitors and with the industry benchmarks. Dedicated to your worth and value as a human being! Tesco PLC., 2014. Tesco donated 57 million to charities (1.9% of pre-tax profits in 2009 (Tesco plc, 2009). Tesco has a quick ratio above 1 for the whole period and current ratio of around 6 in 2009 as compared to 3 in 2007. Maynard, J., 2013. 6.30am The net operating profit margin for Tesco has decreased over the 3 year period being 4% in 2009. According to the press release, Tesco is to make an aggressive push into the financial services market, seeking to transform itself into a fully-fledged retail bank. Tesco plc as a supermarket giant bought the 50% stake for 950m from Royal Bank of Scotland (RBS). The accounting payable are a reliable source of getting no-cost credit, but the borrower needs to pay the dues on time. Good Friday: 6am to 10pm. Additional materials, such as the best quotations, synonyms and word definitions to make your writing easier are also offered here.  Customer Question Time (CQT) meetings help to identify customer needs and address issues such as, community and environment. Bank Holiday Monday: 8am to 6pm. The inventory turnover ratio is calculated by comparing the cost of sales with an average inventory. WebAccording to ESRC (2013), 20% of United Kingdom's GDP is accounted by the retail sector. Easter Sunday. (Figure 2) So, if we will sum up 4 biggest retail Below, profitability, liquidity, working capital control and financial risk ratios will be presented and compared for the two companies providing the appropriate financial information. Based on the above discussion, Tesco and Sainsburys profitability, liquidity, efficiency, and solvency ratios aree discussed. Tesco and Sainsburys financial analysis Tescos fiscal year 2021 (53-week) revenue fell by 0.4% to 57.9bn. Assets & Liabilities. The mean revert level is towards WACC, which is the long-term weighted-average cost of capital of 8-10%. The Journal of Entrepreneurial Finance,19(2), 1-28. They offer rewards and benefits for their staff and are bringing bonus schemes and competitive benefits linked with profitability. Tesco aims to identify suppliers who had difficult or unpleasant dealing with them to rectify the problem. Therefore, customers are using 50% lesser bags since the reward Clubcard scheme. Particularly, Sainsbury's and ASDA are the two of renowned companies in the retail sector. More specifically non-financial data make the companies to communicate different informational objectives with They participate in planning processes and consultations on issues with the governments and regularly meet with NGOs to discuss issues such as, animal welfare, climate change, planning and regeneration, nutrition and ethical trading. Tesco wants the shopping experience for their customers to be great, fair and high quality. Financials.

Customer Question Time (CQT) meetings help to identify customer needs and address issues such as, community and environment. Bank Holiday Monday: 8am to 6pm. The inventory turnover ratio is calculated by comparing the cost of sales with an average inventory. WebAccording to ESRC (2013), 20% of United Kingdom's GDP is accounted by the retail sector. Easter Sunday. (Figure 2) So, if we will sum up 4 biggest retail Below, profitability, liquidity, working capital control and financial risk ratios will be presented and compared for the two companies providing the appropriate financial information. Based on the above discussion, Tesco and Sainsburys profitability, liquidity, efficiency, and solvency ratios aree discussed. Tesco and Sainsburys financial analysis Tescos fiscal year 2021 (53-week) revenue fell by 0.4% to 57.9bn. Assets & Liabilities. The mean revert level is towards WACC, which is the long-term weighted-average cost of capital of 8-10%. The Journal of Entrepreneurial Finance,19(2), 1-28. They offer rewards and benefits for their staff and are bringing bonus schemes and competitive benefits linked with profitability. Tesco aims to identify suppliers who had difficult or unpleasant dealing with them to rectify the problem. Therefore, customers are using 50% lesser bags since the reward Clubcard scheme. Particularly, Sainsbury's and ASDA are the two of renowned companies in the retail sector. More specifically non-financial data make the companies to communicate different informational objectives with They participate in planning processes and consultations on issues with the governments and regularly meet with NGOs to discuss issues such as, animal welfare, climate change, planning and regeneration, nutrition and ethical trading. Tesco wants the shopping experience for their customers to be great, fair and high quality. Financials.  Two non-executive directors resigned unexpectedly and the Boards top priority has been to ensure the best and the most suitable candidate with the right skills and experience. Asset (or capital) turnover ratio measures how many times the capital employed was turned over during the year to achieve the revenue which fact indicates the efficiency of the companys deployment of its assets. Free resources to assist you with your university studies! You can get a custom paper by one of our expert writers. Sir Terry Leah, CEO for Tesco described 2009 as a very good year for Tesco in his annual report. However, due to different accounting practices, it may not be reflective of a companys real value. From simple essay plans, through to full dissertations, you can guarantee we have a service perfectly matched to your needs. Its sales topped 1billion per week with group sales at 59.4 billion. EDIUNET Industry Avg. It is also vital to understand that ROCE needs to be decomposed to get information of where the performance is coming from (ROCE= FLEV +RNOA). The financial statements were prepared under the accounting policies set out therein. These results lead to the same conclusions of inventory turnover statements that were mentioned above. [Online] London: IFRS Foundation Available at: http://www.ifrs.org [Accessed 18 April 2014]. In the above table, TESCO shows a debt to equity ratio estimated to 86.92 % and J. Sainsbury 67.07 % which is lower for 19.85 % in relation with the first company. It also has got plans to grow its product shares such as its home insurance. In 2008, 193000 staff workers received 92 million free shares in Tescos Shares Success Scheme. Suppliers expect long-term opportunistic, fair and honest relationship. The aim is to provide support and initiatives for local people, create more jobs and help in the regeneration of the community. Saturday: 7am to 9pm. They use the feedback to review the issues on their agenda. TESCO EXPRESS LIDEN. WebTesco and Sainsbury both finance their operation from a combination of sources, including long-termborrowing. Comparing the two, Tesco plc, has the higher ratio, which may be down to the business having much higher receivables then Sainsburys. Palepu (2007) demonstrated via empirical evidence that ATO tends to stay constant over time except if new technology is introduced and operational efficiency has improved. Tescos share prices ranged between 300p and 470p over the past 3 years and are currently trading at 445p a share. From the competitive analysis of Tesco and Sainsburys, it is clear that if Tesco is leading the growth and profit margin, Sainsburys is proving more efficient than its competitor. According to ESRC (2013), 20% of United Kingdom's GDP is accounted by the retail sector.