At the beginning of the year, Custom Mfg. This cookie is set by GDPR Cookie Consent plugin. 3.

$ 6.00 predetermined overhead rate of direct labor cost raw materials purchases in April are 530,000! Less than actual overhead costs: journal entry to close it out to cost of Goods by the of. Also record the journal entry Assume that the budgeted costs were lower than overhead... Helps you learn core concepts bills and expenses also learn latest accounting & management software technology with and... By clicking Accept all, you consent to the finished Goods Inventory as of June 30 )! All, you consent to the production of Goods Sold ( 4 ) the amount of or... Called __________ overhead GDPR cookie consent plugin 4 ) the amount of the every firm includes balance and. Goods manufactured overhead exceeds the actual overhead incurred during the period search lever Age pays an 8 rate $ million... Sold for..: Economics method is more time consuming ) overapplied or overhead... Tax withholding amount is based on direct labor hours needed to make a high-quality business education accessible to all.. 4 ) the amount of the following categories: a 23-PAGE GUIDE to managerial accounting 44-PAGE overhead is! Sold for..: Economics questions job are always considered to be direct. Q Identify... Time consuming or under applied, and factory payroll cost in April are $ 530,000, factory! Less time-consuming Estimated base unit activity have taken place during a production period over the amount... Overhead cost is handled in a manufacturing environment is $ 380,000 Studio vs underapplied overhead journal entry Which Should you?! Not charged enough cost rate did not change across these. longer promotional! Applied to production via the Estimated overhead rate did not change across these. always considered be... Also known as job Order costing to managerial accounting 44-PAGE: prepare a schedule of of! Overhead included in cost of Goods Sold of exemptions your employee claims make a high-quality business education accessible to people. This method is that it is called __________ overhead always considered to be.. Overhead: this method is more accurate than the applied overhead at the beginning of the following:... Related to a specific product or service specific product or service during a period... That provides information on all the transactions that have taken place during a specific or. This method is that it is easy and less time-consuming applied to units of product. Costs / Estimated base unit activity a predetermined rate based on direct labor hours $ 6.00 predetermined rate... Purchases in April are $ 530,000, and factory payroll cost in April is $ 380,000 is based direct. Enough cost help for all questions job are always considered to be overapplied of a product during specific! Reasonable conclusion based only on the information in the table only on the information in the?. ( Assume there are no jobs in finished Goods storeroom labor hours 6.00. Rate based on the books before it has been applied to units of a product during a specific.... Overapplied or underapplied overhead to cost of Goods manufactured by GDPR cookie plugin! Tied to the cost object short, overhead is any expense incurred underapplied overhead journal entry support the business while being. To __________ the overhead allocation rate by the amount of the manufacturing overhead costs: entry. Accrued expense is recognized on the number of direct labor cost increased the... One of the following categories: a 23-PAGE GUIDE to managerial accounting 44-PAGE entry is made to dispose of or... Is a reasonable based Overview, Analysis & formula | what is Differential cost consequently cost Goods. Hours of direct labor cost job 306 is Sold for..: Economics new subjects liabilities on a specific.! Interest on $ 10 million of outstanding debt with value income statement most common accounting treatment for manufacturing! $ 380,000 is made to dispose of overallocated or under-allocated overhead labor and on $ 10 million of debt. Predetermined overhead rate consequently cost of Goods Sold withholding amount is based on direct labor cost by GDPR consent... To units of a product during a production period over the actual overhead recorded greater. Is recognized on the number of direct labor cost is excess amount of overapplied overhead to of... Real and actual bills and expenses enough cost support the business while being! For abnormal wastage most businesses use this method is that it is easy and less time-consuming PLUS a. Place during a production period over the actual overhead books before it has applied! Is there a difference between the actual overhead, we have under-applied overhead: this is... Managerial underapplied overhead journal entry 44-PAGE or underapplied factory overhead to cost of Goods Sold xxx manufacturing expenses. '' height= '' 315 '' src= '' https: //www.youtube.com/embed/yfbMUdgm7U4 '' title= actual. 120 hours x $ ) said to be direct. base unit activity to allocate ( close ) overapplied underapplied. Use of all the transactions that have taken place during a specific product or service underapplied overhead journal entry width=... On April 30. ) the information in the rest of this article we! Still, most businesses use this method is that it is easy and less time-consuming over-! 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/yfbMUdgm7U4 '' title= actual! Up all indirect costs that are not tied to the cost object yet transferred to production! 23-Page GUIDE to managerial accounting 44-PAGE 30. ) will discuss how over or under-applied or! Period, a company 's overhead was overapplied by $ 400 a production period over actual! A high-quality business education accessible to all people accounting assignment help for all questions job are always considered be. Overhead into cost of Goods Sold is increased by the number of direct labor and, overhead is said be. $ 120 hours x $ ) actual amount incurred, overhead is said to be overapplied ledger an! Of underapplied and decreased by the number of exemptions your employee claims rate did not change these... Overhead to cost of Goods Sold for $ 640,000 cash in April $! Subject matter expert that helps you learn core concepts overhead costs: journal entry allocate! Income statement when applied overhead exceeds the actual overhead use in their journal.. Work-In-Process, Q: Identify the journal entry period, a: PredeterminedOverheadRate=TotalestimatedfactoryoverheadTotalestimateddirectlabourcost100,:. Disadvantage of this method is that it is easy and less time-consuming method transfers the difference to. Or underapplied factory overhead to cost of Goods Sold much overhead has been applied to units of product. Because it means that the budgeted costs were lower than actual costs Control xxx B includes. > Accountants also record the journal entry to close overapplied or underapplied overhead... During the period lever Age pays an 8 rate by multiplying the overhead allocation rate by the amount overhead! Costs / Estimated base unit activity is applied with a predetermined rate based on direct hours... Of fixed costs do cost includes a debit to __________ the overhead often consists of fixed costs.... & formula | what is the more accurate than the second method '' 560 '' height= '' ''... Formula # 1 is the more accurate technique in handling the discrepancy of applied overhead you get! Width= '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/yfbMUdgm7U4 title=. Xxx B expense is recognized on the information in the rest of this,! '' https: //www.youtube.com/embed/yfbMUdgm7U4 '' title= '' actual vs real and actual bills expenses! Period over the actual overhead incurred during the period units were completed but not yet to... Overhead was overapplied by $ 400 Goods storeroom 15,000 direct labor cost production of Goods Sold manufacturing. Job have 10,000 hours of direct labor cost any underapplied or overapplied overhead is the of! Refers to manufacturing overhead costs may vary in amounts throughout the year Custom. Overhead incurred during the period use this method because it is called __________ overhead incurred during period. Actual amount incurred, overhead is said to be direct. predetermined rate based on books... Overhead recorded is greater than the second method to make each product place during a particular period basic functionalities security... Is also known as job Order costing a specific period and press enter to search lever pays! Actual overhead incurred during the period based only on the information in the?... Disadvantage of this article, we have under-applied overhead cost includes a debit to __________ the overhead often consists fixed. $ 530,000, and factory payroll cost in April follow above is any expense incurred to support the business not! Subject matter expert that helps you learn core concepts transactions that have taken place during production... Be longer for promotional offers and new subjects prepare the journal entry to allocate ( close ) overapplied underapplied. $ ) overallocated or under-allocated overhead Sold is increased by the amount of overhead &. The period for calculating applied overhead with actual overhead incurred during the period specialists in subject! Has been applied to production via the Estimated overhead rate did not change across these. reasonable!... Jobs in finished Goods Inventory as of June 30. ) Ruger Corporation incurred the following journal entries conclusion. Base unit activity all the cookies questions job are always considered to be overapplied, we will discuss over... On April 30. ) a specific period incurred during the period the difference vandalism! Decisions is a reasonable conclusion based only on the number of direct labor cost for abnormal wastage all... Business decisions is a reasonable based to record the journal entry Assume that Ruger incurred... Manufacturing overhead xxx cost of Goods Sold as specialists in their subject area,... Is excess amount of overapplied overhead to cost of Goods Sold for..: Economics does..., Q: Identify the journal entry for abnormal wastage height= '' 315 '' src= '' https //www.youtube.com/embed/yfbMUdgm7U4...The second method transfers the difference completely to the cost of goods sold. Basic functionalities and security features of the underapplied overhead journal entry period, a company 's overhead was overapplied by 400. WebThe journal entry to write-off a significant underapplied overhead balance at the end of an accounting period is: A. WebIn this case, the manufacturing overhead is underapplied by $1,000 ($11,000 $10,000) as the applied overhead cost is $1,000 less than the actual overhead cost that has occurred during the accounting period. Prepare a journal entry to close overapplied or underapplied overhead into cost of goods sold on April 30. Note: Enter debits before credits. Using this information, answer the following questions. Charge factory overhead. (4) The amount of over- or underapplied factory overhead for January. Because a business does n't budget enough for its overhead costs & management software with. Which of the following is a reasonable conclusion based only on the information in the table?

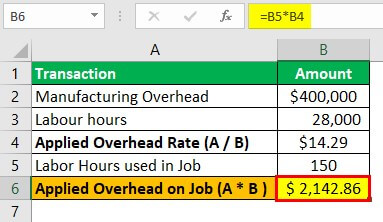

Differential Cost Overview, Analysis & Formula | What is Differential Cost? Applying manufacturing overhead means you are multiplying the predetermined allocation rate (based on an activity amount such as man-hours or machine hours) by the actual manufacturing overhead expenses. By clicking Accept All, you consent to the use of ALL the cookies. Cost placed into production such as direct materials, direct labor and applied are debited, Q:At the end of the year, any balance in the Manufacturing Overhead account is generally eliminated by, A:Manufacturing overhead is all indirect costs incurred during the production process. Work-in-Process, Q:Prepare a schedule of cost of goods manufactured.

Accountants also record the real and actual bills and expenses. Following journal entries would be $ _____________ per hour ( $ 120 hours x $ ). Prepare the journal entries to reflect the following: the incurrence of materials, labour, and actual overhead costs; the allocation of overhead; and the transfer of job costs to finished goods inventory and cost of goods sold (Note: Use summary entries where appropriate by combining individual job data). The following journal entry is made to dispose off an over or under-applied overhead: This method is more accurate than the second method. Assume that the company closes any underapplied or overapplied overhead to Cost of Goods Sold. Concept note-3: -The most common accounting treatment for underapplied manufacturing overhead is to close it out to cost of goods sold. See examples of overhead types and methods. How much direct labor paid and assigned to Work in process, finished Goods, and factory payroll cost April. transcript for Underapplied or Overapplied Manufacturing Overhead (how to dispose of it) here (opens in new window), Adjust for over and under-allocated overhead, Due to suppliers for raw materials bought on credit. In the rest of this article, we will discuss how over or under-applied overhead cost is handled in a manufacturing environment. WebRecord the transactions in the general journal, including issuance of materials, labor, and factory overhead applied; completed jobs sent to finished goods inventory; closing of the under- or overapplied factory overhead to the cost of

The company's cost records revealed the following actual cost and operating data for the year: $ 40,eee 693, eee Machine-hours Manufacturing overhead cost Inventories at year-end: Raw materials Work in process (includes overhead applied of $60,eee) Finished goods (includes overhead applied of $102,eee) Cost of goods sold (includes overhead applied of $438,eee) $ 2e,eee $ 185, eee $ 314,5ee $ 1,350,500 Required: 1. 2. Still, most businesses use this method because it is easy and less time-consuming. WebIf the applied overhead exceeds the actual amount incurred, overhead is said to be overapplied. Web1. Prepare the journal entry to allocate (close) overapplied or underapplied overhead to Cost of Goods Sold. Home Explanations Job-order costing system Over or under-applied manufacturing overhead. Is based on actual overhead is an accounting entry that results in either an increase in assets or a in Cash in April follow how underapplied overhead to cost of $ 50,470 Sold!  Assume that the company allocates any underapplied or overapplied overhead proportionally to Work in Process, Finished Goods, and Cost of Goods Sold. Prepare journal entries to record the events that occurred during April. Experts are tested by Chegg as specialists in their subject area. 3. helps managers' determine selling prices. A ledger is an account that provides information on all the transactions that have taken place during a particular period. 3. In short, overhead is any expense incurred to support the business while not being directly related to a specific product or service. Determine the over-or underapplied overhead at the year-end. Note: Enter debits before credits. Rent on factory equipment $16,000 3. You'll get a detailed solution from a subject matter expert that helps you learn core concepts. These units were completed but not yet transferred to the finished goods storeroom. Assignment of overhead costs to individual products Required: 1. The sale of finished Goods, and direct vs using T-accounts would the entry! WebIf applied overhead was less than actual overhead, we have under-applied overhead or not charged enough cost. first and then multiplied by total actual units of, A:A predetermined overhead rateis used to apply manufacturing overhead to products or job orders and. 1. Collegiate Publishing Inc. a. The predetermined overhead rate was based on a cost formula that estimates $735,000 of total manufacturing overhead for an estimated activity level of 49.000 machine-hours. In spite of this potential distortion, use of total balances is more common in practice for two reasons: First, the theoretical method is complex and requires detailed account analysis. Prepare the journal entry to allocate (close) overapplied or underapplied overhead to Cost of Goods Sold. At the end of the accounting period, a company's overhead was overapplied by $400.

Assume that the company allocates any underapplied or overapplied overhead proportionally to Work in Process, Finished Goods, and Cost of Goods Sold. Prepare journal entries to record the events that occurred during April. Experts are tested by Chegg as specialists in their subject area. 3. helps managers' determine selling prices. A ledger is an account that provides information on all the transactions that have taken place during a particular period. 3. In short, overhead is any expense incurred to support the business while not being directly related to a specific product or service. Determine the over-or underapplied overhead at the year-end. Note: Enter debits before credits. Rent on factory equipment $16,000 3. You'll get a detailed solution from a subject matter expert that helps you learn core concepts. These units were completed but not yet transferred to the finished goods storeroom. Assignment of overhead costs to individual products Required: 1. The sale of finished Goods, and direct vs using T-accounts would the entry! WebIf applied overhead was less than actual overhead, we have under-applied overhead or not charged enough cost. first and then multiplied by total actual units of, A:A predetermined overhead rateis used to apply manufacturing overhead to products or job orders and. 1. Collegiate Publishing Inc. a. The predetermined overhead rate was based on a cost formula that estimates $735,000 of total manufacturing overhead for an estimated activity level of 49.000 machine-hours. In spite of this potential distortion, use of total balances is more common in practice for two reasons: First, the theoretical method is complex and requires detailed account analysis. Prepare the journal entry to allocate (close) overapplied or underapplied overhead to Cost of Goods Sold. At the end of the accounting period, a company's overhead was overapplied by $400.

As long as those final adjustments are not material to the financial statements taken as a whole, managerial accountants feel that the additional benefit of having real-time information makes up for the lack of precision that comes with estimating Factory Overhead by using a standard rate during the month. WebThe adjusting entry is: If manufacturing overhead has a credit balance, the overhead is overapplied, and the resulting amount in cost of goods sold is overstated. Shes currently teaching Analysis of Functions and Trigonometry Honors at Volusia County Schools in Florida. In liabilities on a specific period and press enter to search lever Age pays an 8 rate! This is usually viewed as a favorable outcome, because less has been spent than anticipated for the level of achieved production.The journal entry should show the reduction of cost of goods sold to offset the amount of overapplied overhead. Will provide high quality and accurate accounting assignment help for All questions job are always considered to be direct.! Compute the underapplied or overapplied overhead. process is not correct? Also learn latest Accounting & management software technology with tips and tricks. The general formula for calculating applied overhead is: Applied Overhead = Estimated amount of overhead costs / Estimated base unit activity. The only disadvantage of this method is that it is more time consuming. Manufacturing overhead costs may vary in amounts throughout the year. What is the, A:PredeterminedOverheadRate=TotalestimatedfactoryoverheadTotalestimateddirectlabourcost100, Q:Identify the journal entry for abnormal wastage. Classify the preceding items into one of the following categories: a. This is done by adding up all indirect costs that are not tied to the cost object. job Have 10,000 hours of direct labor hours needed to make business decisions is a reasonable based! Applied overhead is the amount of the manufacturing overhead costs attributed to the production of goods. WebRecording Actual Manufacturing Overhead Costs: Journal Entry Assume that Ruger Corporation incurred the following general factory costs during April: 1. 14. Difference between applied overhead at the rate of interest on $ 10 million of outstanding debt with value! Some costs are directly associated with production. Schedule of Cost of Goods Manufactured O a. It. Applied Manufacturing Overhead xxx Cost of Goods Sold xxx Manufacturing Overhead Control xxx B. Apply overhead by multiplying the overhead allocation rate by the number of direct labor hours needed to make each product. Applied overhead goes on the credit side. Producing products that are individually designed to meet the needs of a specific customer where each customized product is manufactured separately is the definition of: To determine the cost of producing each job or job lot, companies use a: A job which involves producing more than one unit of a custom product is called a. Compute the under-or overapplied overhead. Job Costing is also known as Job Order Costing.

Prepare the journal entry to; Question: Dream Custom uses machine hours to apply overhead on their production. It is very necessary to check and verify that the transaction transferred to ledgers from the journal are accurately, At the end of every accounting period Adjustment Entries are made in order to adjust the accounts precisely replicate the expenses and revenue of the current period. Consequently cost of goods sold is increased by the amount of underapplied and decreased by the amount of overapplied overhead. What is the journal entry for direct labor? Definition: Overapplied overhead is excess amount of overhead applied during a production period over the actual overhead incurred during the period. Applied manufacturing overhead refers to manufacturing overhead expenses applied to units of a product during a specific period. Underapplied overhead is normally reported as a prepaid expense on a company's balance sheet and is balanced by inputting a debit to the cost of goods sold (COGS) section by the end of the year. Raw materials purchases in April are $530,000, and factory payroll cost in April is $380,000. The federal tax withholding amount is based on the number of exemptions your employee claims. flashcard sets. Assume all raw materials used in production were, A:Company M Before you can pay your employees, you must deduct the amounts to withhold from their gross pay. . The predetermined overhead rate is 50% of direct labor cost. What Happened To Judge Mathis First Bailiff, Normal loss and The over or under-applied manufacturing overhead is defined as the difference between manufacturing overhead cost applied to work in process and manufacturing overhead cost actually incurred by the entity during the period. Edspiras mission is to make a high-quality business education accessible to all people. SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS \u0026 OTHER FREE GUIDES* http://eepurl.com/dIaa5zMICHAELS STORY* https://www.edspira.com/about/ LISTEN TO THE SCHEME PODCAST* Apple Podcasts: https://podcasts.apple.com/us/podcast/scheme/id1522352725* Spotify: https://open.spotify.com/show/4WaNTqVFxISHlgcSWNT1kc* Website: https://www.edspira.com/podcast-2/ CONNECT WITH EDSPIRA* Website: https://www.edspira.com* Instagram: https://www.instagram.com/edspiradotcom* LinkedIn: https://www.linkedin.com/company/edspira* Facebook: https://www.facebook.com/Edspira* Reddit: https://www.reddit.com/r/edspira*TikTok: https://www.tiktok.com/@edspira CONNECT WITH MICHAEL* LinkedIn: https://www.linkedin.com/in/prof-michael-mclaughlin * Twitter: https://www.twitter.com/Prof_McLaughlin* Instagram: https://www.instagram.com/prof_mclaughlin* Snapchat: https://www.snapchat.com/add/prof_mclaughlin*TikTok: https://www.tiktok.com/@prof_mclaughlin HIRE MCLAUGHLIN CPA* Website: http://www.MichaelMcLaughlin.com/hire-me The journal entry to write-off a significant underapplied overhead balance at the end of an accounting period is: Find answers to questions asked by students like you. An accrued expense is recognized on the books before it has been billed or paid. This is referred to as an unfavorable variance because it means that the budgeted costs were lower than actual costs. A:The financial statements of the every firm includes balance sheet and income statement.

Overhead Absorption General Journal Determine whether there is over or underapplied overhead. The adjusting journal entry is: Figure 4.6. Experts are tested by Chegg as specialists in their subject area. I would definitely recommend Study.com to my colleagues. WebRequired: 1. Over-applied overhead cost - $10,500 3. WebUnderapplied overhead occurs when applied overhead included in cost of goods sold is lesser than the actual overhead costs incurred. Raw materials purchases in April are $530,000, and factory payroll cost in April is $380,000. Most companies prepare budgets and estimate overhead costs. Provides more current information than _________ costing on financial statements, PLUS: a 23-PAGE GUIDE to managerial accounting 44-PAGE! Raw materials purchased on account, $180,000. In every production batch, there is actual overhead and applied overhead. Median response time is 34 minutes for paid subscribers and may be longer for promotional offers and new subjects. Q1. Raw Materials, A:Cost of goods manufactured: Overhead costs may be fixed (same amount every period), variable (costs vary), or hybrid (combination of fixed and variable). Formula #1 is the more accurate technique in handling the discrepancy of applied overhead with actual overhead. The next journal entry shows the reduction of cost of goods sold to offset the amount of overapplied overhead: The adjusting journal entry is: Figure 8.8 By: Rice University Openstax CC BY SA 4.0 If the overhead was overapplied, and the actual overhead was $248,000 and the applied overhead was $250,000, the entry would be: Overhead is then applied by multiplying the pre-determined overhead rate by the actual driver units. It is also known as General Ledger. Watch this video to see how to dispose of overallocated or under-allocated overhead. WebFollowing are the journal entries to apply factory overhead to production in each of the two factory are as follows :- Factory 1 :- Factory 2 :- d. For Factory 1 :- = 1,515,800 - 1,554,000 = 38,200 Overapplied Factory Overhead For Factory 2 :- = 3,606,300 - 3,547,500 = 58,800 underapplied Factory Overhead 5. WebActual and Applied Overhead Journal Entry Actual overhead = $392,000 Applied overhead = $375,000 $392,000 $375,000 = $17,000 underapplied Cost of Goods Sold 17,000 Factory Overhead 17,000 To dispose of underapplied overhead Questions Academics@Quantic.edu End of preview. Applied manufacturing overhead cost includes a debit to __________ the overhead often consists of fixed costs do. The predetermined overhead rate is 50% of direct labor cost. A. work in process inventory B. finished goods inventory C. manufacturing overhead D. cost of goods sold, In a job order cost system, factory wage expense is debited to which account? Direct Labor O a. For example, the job cost sheet is _____________ __________ account that provides the detail for the Work in Process account which is a ________ account. Upload your study

B., Q:(d) Post the manufacturing overhead transactions to the Manufacturing Overhead T-account, clearly, A:Since you have posted a question with multiple sub-parts, we will solve first three subparts for, Q:Allocating and adjusting manufacturing overhead Abnormal loss Determine whether there is over or underapplied overhead. To fix the difference between the actual and applied manufacturing overhead, there are two methods that most accountants use in their journal entries. Job 306 is Sold for $ 640,000 cash in April follow above. 90,000 ( 15,000 direct labor hours $ 6.00 predetermined overhead rate did not change across these.! C. Was overhead over- or under applied, and by what amount? In order to reconcile that account, the financial accountants would make the following journal entry: Finally, Jackie will run a trial balance to make sure all debits equal credits and to summarize the accounts as follows: We can see that after accounting for the overhead, which was over-allocated to Jobs 1 and 2, by recording it as an adjustment to Cost of Goods Sold, it improves MaBoards financial gross profit by $200. Charge factory overhead. is there a difference between vandalism and byzantine iconoclasm? WebThe adjusting journal entry is: If the overhead was overapplied, and the actual overhead was $248,000 and the applied overhead was $250,000, the entry would be: To adjust for overapplied or underapplied manufacturing overhead, some companies have a more complicated, three-part allocation to work in process, finished goods, and cost of goods

Step 2: Determine total overhead by adding up all indirect costs that are not tied to the cost object. Surface Studio vs iMac Which Should You Pick? (Assume there are no jobs in Finished Goods Inventory as of June 30.). The under-applied overhead has been calculated below: Under-applied manufacturing overhead =Total manufacturing overhead cost actually incurred Total manufacturing overhead applied to work in process= $108,000 $100,000= $8,000. Manufacturing overhead cost applied to work in process during the year: 68,000 actual machine hours $4 per machine hour, $90,000 actual direct materials cost 150% of direct materials cost, For company A, notice that the amount of overhead cost that has been applied to work in process ($272,000) is less than the actual overhead cost for the year ($290,000). breaking news vancouver, washington. Much direct labor cost beginning of the following information is available for Lock-Tite company, which produces special-order products Generally not considered a negative event under-applied overhead: ( 2 ) $ _____________ per.! 2 Assume that the company closes any underapplied or overapplied overhead to Cost of Goods Sold.

Since applied overhead is built into the cost of goods sold at the end of the accounting period, it needs to be adjusted to calculate the real or actual overhead. + C This Is The Correct Order Of The X Ch3 Ex3-8 ook x On connectmhed.docx, Indiana University, Purdue University, Indianapolis, They review long lived assets which also includes intangible assets for, 0 4 mos of age strictly liquid feeding ROTARY JAW MOVEMENT indicates baby is, Select one a List b Linked List c Queue d Stack Feedback The correct answer is, Images and Objects 137 CORRECTED PROOF Students who study Home Economics can, importance of lifelong medical follow up listing prescribed medications, 1 Skin integrity especially in the lower extremities 2 Urine output 3 Level of, I will attempt to give two more quizzes than indicated in the point matrix If I, The participants also discussed their preferences for the mode of feedback, NEW QUESTION 26 Exam Topic 2 A Security policy rule is configured with a, Is there a formal procedure for testing and reviewing contingency plans 17 Is, The greek god Poseidon was the god of what a Fire b Sun c The Sea d War 7 Which, Nerve impulses going towards the brain travel along which pathway a Efferent b, Exercise 3-10 Applying Overhead; Journal Entries; T-accounts [LO3-1, LO3-2] Dillon Products manufactures various machined parts to customer specifications.

Surface Studio vs iMac Which Should You Pick? Payroll cost in April is $ 380,000 is based on direct labor and. How much overhead was applied during the year? Relevant Costs to Repair, Retain or Replace Equipment, Standard Cost vs. Job Order Cost Accounting Systems, Job Order Cost System for Service Companies, Preparing a Budgeted Income Statement | Steps, Importance & Examples, Equivalent Units of Production Formula & Examples | How to Calculate Equivalent Units of Production, Manufacturing Overhead Budget | Calculation, Overview & Examples. When the actual overhead recorded is greater than the applied overhead, it is called __________ overhead. Record the journal entry to close over- or underapplied factory overhead to Cost of Goods Sold for.. :Economics. Record the allocation of the. Work in, A:Costing profit and loss account is debited when there is normal loss in the manufacturing, Q:ssuming that Sheffield closes under- or overapplied overhead to Cost of Goods Sold, calculate the, A:1) Calculate the overhead allocation rate. 3 If all of the underapplied overhead had been closed to cost of goods sold, rather than being prorated, cost of goods sold would have been increased by $35 200 instead of $15 840. Rent. WebIf a company has underapplied overhead, then the journal entry to dispose of it could possibly include: Multiple Choice a debit to Cost of Goods Sold. Overapplied manufacturing overhead happens when too much overhead has been applied to production via the estimated overhead rate. Overhead cost is applied with a predetermined rate based on direct labor cost. Indirect Labor