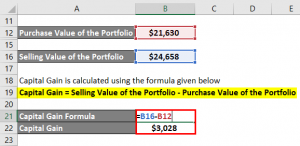

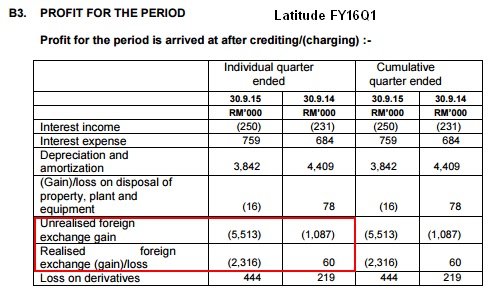

A capital gains tax is a levy on the profit that an investor makes from the sale of an investment such as stock shares.

Search anything about Math Formula in this website. To find gain, all we need to do is: Subtract the previous value from the latter one. "Percentage Increase Calculator. The first row should have a description of what is in the cell below (date, shares, etc.). Add new columns to calculate current value, Gain and Loss: = SUMIFS(Transactions[Quantity], Transactions[Symbol], "="& NOLs Carry-Back = $250k + $250k = $500k

NOLs Carry-Back = $250k + $250k = $500k

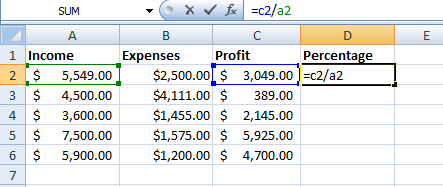

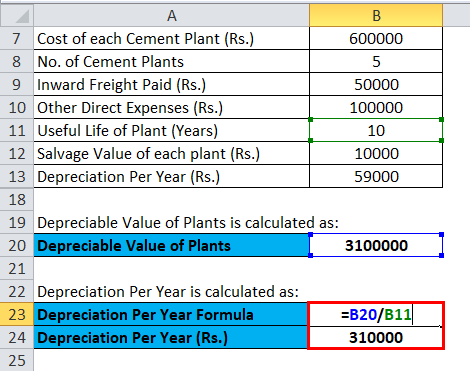

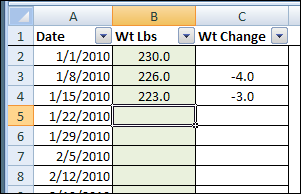

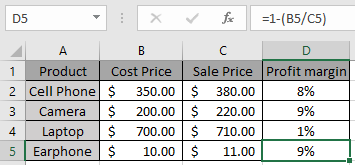

The asterisk (*) means multiply. Download the Excel file: Gain-Loss Ratio template, Present Value of Growth Opportunities (PVGO), was introduced by Bernardo and Ledoit (2000). It's worksheet is just a matter of some simple spreadsheets and basic math. Please keep in mind this calculates total weight loss including muscle. Henceforth, follow the above-described methods.  Suppose they sell those shares for $1700 or $17 each two months later, which means their profit for the trade is $700. WebHow to calculate percent gain/loss in excel - Determining Percentage Gain or Loss Take the selling price and subtract the initial purchase price. Solve Now. The difference between these two figures, $180,000, is the loss to lease. First, click on cell E5 and type the following formula. This guide will break down the ROI formula, outline several examples of how to calculate it, and provide an ROI formula investment calculator to download. ROI = (1,000,000 500,000) / (500,000) = 1 or 100%.

Suppose they sell those shares for $1700 or $17 each two months later, which means their profit for the trade is $700. WebHow to calculate percent gain/loss in excel - Determining Percentage Gain or Loss Take the selling price and subtract the initial purchase price. Solve Now. The difference between these two figures, $180,000, is the loss to lease. First, click on cell E5 and type the following formula. This guide will break down the ROI formula, outline several examples of how to calculate it, and provide an ROI formula investment calculator to download. ROI = (1,000,000 500,000) / (500,000) = 1 or 100%.

"Stocks (Options, Splits, Traders) 1. Regular = ($15.20 $12.50) / $12.50 = 21.6%, Annualized = [($15.20 / $12.50) ^ (1 / ((Aug 24 Jan 1)/365) )] -1 = 35.5%. It is most commonly measured as net income divided by the original capital cost of the investment. These amounts show how many you will receive or lose if you realize all available stocks right now. b) with transactions (if you have a fixed quantity, you can add them without an additional calculation). Using Spreadsheets - Calculating Your Daily Returns. As you will see, we have a lot of helpful information to share. I wanted to know how I can calculate the average gain and average loss for data that is inputted into one column? So, if you really want to be accurate, you need to do a bit of math. Learn the different ways to calculate Return on Investment. Gains occur whenever the current price of the asset is higher than the price at which it was originally purchased.

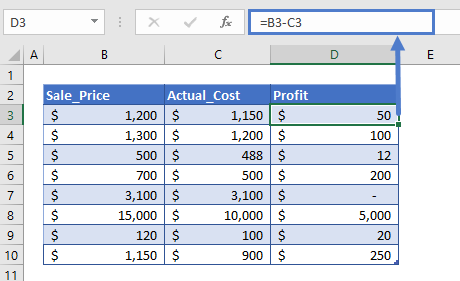

Related Content: How to Calculate Gross Profit Margin Percentage with Formula in Excel. WebThe formula for net income is as follows:-. To implement the ratio in practice, we make use of the first-order Lower Partial Moment. Gains and losses are unrealized if the value changes but you hold onto the stock within your portfolio. Label cell A1 "Original Value," cell A2 "Final Value" and cell A3 "Percent Change."

To do so, subtract theoriginal purchase pricefrom thecurrent priceand divide the difference by the purchase priceof the stock.

Our users love us. How-To Geek is where you turn when you want experts to explain technology. 4. An investor needs to look at the true ROI, which accounts for all possible costs incurred when each investment increases in value. The data set contains Product, Cost Price, and Selling Price. WebThe calculation would be as follows- Realized Gain Formula = Sale Price of the shares Purchase price of the shares = $1,500 $1,000 = $500 The realized gain is $500 since you sold the shares. So if you purchased a share of Amazon (AMZN) stock on Sept. 3, 2013, at $288.80 and held it until May 11, 2020, you'd experienced a gain, as the stock closed at $2,409.78. Done. The distribution of market shares or stocks of the investment portfolio often is illustrated The most detailed measure of return is known as the Internal Rate of Return (IRR). /B1*100 and Excel will display the gain or loss expressed as a percentage. Using MIN Function to Calculate Weight Loss or Gain in Excel, 3. I earn a small commission if you buy any products using my affiliate links to Amazon. But what if you didn't tell your broker to sell specific shares? When calculating your profit or loss, make sure you look at the percentage return as opposed to the dollar value. Total gain of $20.71. To create pie charts like ones above, do the following: a) with stock ticker symbols and prices (see How to view current stocks prices and other quotes in Excel). Enter your name and email in the form below and download the free template now!

Calculating your profit or loss on your stock holdings is a fairly straightforward procedure.

All information is provided on an "as-is" basis for informational purposes only, and is not intended for actual trading purposes or market advice.

Select the data range to create a pie chart. Which indicates a loss. Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Finally, our result will look like the following image.

What is the regular and annualized return on investment? how do you calculate time with distance and speed From this Gain/Loss cell, we can see that you made a profit of $150 on this investment.

So, if you really want to be accurate, you need to do a bit of math. Let's say you invested in Company XYZ stock, buying 100 shares on Jan. 3, 2021, for a total of $1,200 ($12 per share). WebIf one of your health and fitness goals is specifically to lose weight, Excel offers plenty of templates to help you track and visualize your progress. After completing, our result will look like this. Within the finance and banking industry, no one size fits all. Total shareholder return factors in capital gains and dividends to measure the returns an investor earns from a stock.

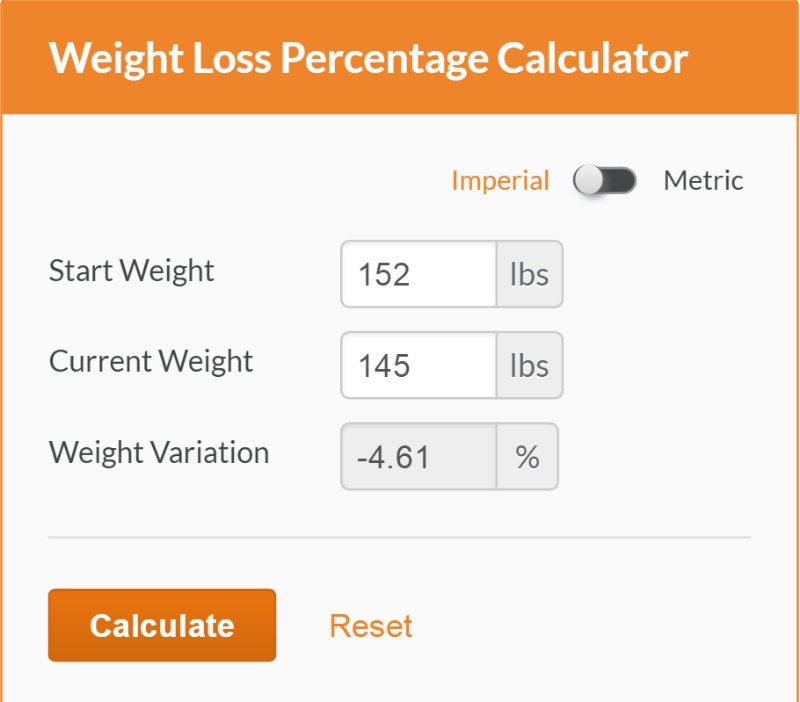

For now, hide those rows. Now, press ENTER key. If you start a new business, create a new product, or change a business model, break-even analysis lets you find out at what stage your company, product, or service will become profitable. Outside of the workplace, my hobbies and interests include watching movies, tv series, and meeting new people. If you want to calculate the profit on a stock, you'll need the total amount of money you used to purchase your stock and the total value of your shares at the current price.  Thus, you can calculate the weight gain or loss in Excel and try to keep using them.

Thus, you can calculate the weight gain or loss in Excel and try to keep using them.

Building confidence in your accounting skills is easy with CFI courses! 2 of 3) How should you sort your data to calculate the profit and loss? "Gain & Loss Percentage Calculator. This leaves you with 50 shares left. You can download the practice workbook from here. A positive result means you have a capital gain while a negative result means you have a loss. The investment in Cory's Tequila Company was made at $10 per share and sold at $17 per share. The calculator uses the examples explained above and is designed so that you can easily input your own numbers and see what the output is under different scenarios. Webhow to calculate gain or loss in excel +38 068 403 30 29. how to calculate gain or loss in excel. Coinbase Cost basis analysis in Excel. Get Certified for Financial Modeling (FMVA).

Return on investment (ROI) is a financial ratio used to calculate the benefit an investor will receive in relation to their investment cost. ", CalculatorSoup. To learn more, launch CFIs Free Finance Courses! Examine sources of between-study heterogeneity, e.g. Math Study. Subtracting the following weight and then dividing it by the initial weight results in a Weight Loss or Gain. Calculating the Revenue Drop Percentage For a consecutive two-year period subtract the later years revenue from the earlier years revenue. I am trying to calculate the sales growth or loss as a percentage. Now, select the range from F5 to F9. [ This allows you to enter the formula to calculate your percentage change. For example, suppose the investor also bought 1,000 shares in Rob's Sake Distillers at $10 apiece (for a total investment of $10,000) and later sold those shares at $10.70 each for a total of$10,700.

This allows you to enter the formula to calculate your percentage change. For example, suppose the investor also bought 1,000 shares in Rob's Sake Distillers at $10 apiece (for a total investment of $10,000) and later sold those shares at $10.70 each for a total of$10,700.

You can offset capital gains by calculating your losses. We first bought 100 shares in January, then we bought another 100 shares in February. WebYou can calculate capital gains or losses by putting your investment info into a worksheet such as in Excel or Google Sheets.

In this method, we will see, how we can use IF function along with profit and loss percentage formula.  Any losses beyond that can be rolled forward to offset gains in future tax years. Thus,

Any losses beyond that can be rolled forward to offset gains in future tax years. Thus,

WebCost basis calculator excel - Coinbase Cost Basis Excel Template. Now, click on cell F5 and type the following formula. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); ExcelDemy is a place where you can learn Excel, and get solutions to your Excel & Excel VBA-related problems, Data Analysis with Excel, etc. Because a return can mean different things to different people, the ROI formula is easy to use, as there is not a strict definition of return. Through this step, you arrive at the loss or gain on your desired investment. From that box, we will select Fill in the header tab and select the color we prefer then click OK then again click OK in the New Formatting Rule dialogue box. Return on investment is a universally understood concept so its almost guaranteed that if you use the metric in conversation, then people will know what youre talking about. We can also use the OFFSET function to do the work similar to method 4 by assigning row and column numbers in Excel to get the latest weight value to subtract. This ratio is commonly used to evaluate hedge fund managers. Step 1.

While the ratio is often very useful, there are also some limitations to the ROI formula that are important to know. Thus, all we need to do is calculate the 1st Higher Partial Moment and the 1st Lower Partial Moment. 2. Our result is as follows. Remember that this is just the dollar value and not the percentage change. Similarly, negative returns are the returns that do not exceed the threshold. Currently, I am working as a technical content writer at ExcelDemy. "Topic No. There are many websites that calculate gains or losses or you can set up a spreadsheet on Microsoft Excel to do it for you. Copyright 2023 Stock-Trak All Rights Reserved. Key Features: Supports 7 of the biggest marketplaces: Binance, Kraken, Bittrex, Poloniex, Bitstamp, and others. Nous et nos partenaires utilisons les donnes pour Publicits et contenu personnaliss, mesure de performance des publicits et du contenu, donnes daudience et dveloppement de produit. You can offset capital gains with capital losses, which can provide another nice tax break, although certain rules apply. Secondly, put the following formula in the blank cell. 3. After that, click on the Format option and another dialogue box will pop up. Timothy has helped provide CEOs and CFOs with deep-dive analytics, providing beautiful stories behind the numbers, graphs, and financial models. Here, we are calculating the amount of profit or loss by subtracting the Cost Price from the Selling Price. You can use excel if you are comfortable with it. Enroll now for FREE to start advancing your career! Download CFIs free ROI Formula Calculator in Excel to perform your own analysis.

3. Use the Sort tool to sort first by Ticker, next by Date (oldest to newest). Your broker charged you a commission of $25.

Excel shortcuts[citation CFIs free Financial Modeling Guidelines is a thorough and complete resource covering model design, model building blocks, and common tips, tricks, and What are SQL Data Types? For DWTI and SPY, we havent ever closed our positions (selling a stock you bought, or covering a stock you short), so we cannot calculate a profit or loss.

Join 425,000 subscribers and get a daily digest of news, geek trivia, and our feature articles. Otherwise, their basis would be the basis of those shares that you acquired first (more on that below). For instance, column A lists the monthly expenses from cell A2 to cell A11.

Chris Gallant, CFA, is a senior manager of interest rate risk for ATB Financial with 10 years of experience in the financial markets. So we have the purchase price plus the commission for both lots of shares ($1,225 for January and $1,250 for February).

That lot number then has a date and a cost associated with it. So when you buy shares, you would fill in the first five columns with information.

When you purchase through our links we may earn a commission.

Follow the ExcelDemy website for more articles like this.

We discussed the Gain-Loss ratio, which is the ratio of the expected return of positive returns divided by the expected return of negative returns. To implement the ratio in practice, we make use of the first-order, The GLR divides the first-order higher partial moment of an investments returns by the first-order lower partial moment of the portfolio returns. To continue learning and advancing your career, these additional CFI resources on rates of return will be helpful: Learn accounting fundamentals and how to read financial statements with CFIs free online accounting classes. Home Sale Exclusion From Capital Gains Tax, Selling Gifted Real Estate Can Have Capital Gains Tax Consequences, Investing With Long-Term Equity Anticipation Securities (LEAPS), Publication 550 (2020), Investment Income and Expenses, Make one worksheet for each stock, bond, or other investment you have, Order the purchases in chronological order from first to last, Keep all the sales transactions on the right side, Use formulas to calculate gains or losses using the data in the other cells if you use spreadsheet software. 3 of 3) How can you calculate the profit and loss per trade if you buy and sell different amounts at different times? After a year, the But there are a number of tools that investors have available to them in order to help them tabulate their returns. After that, a new dialogue box will pop up like this. ", Internal Revenue Service. ROI calculations are simple and help an investor decide whether to take or skip an investment opportunity. Structured Query Language (known as SQL) is a programming language used to interact with a database. Excel Fundamentals - Formulas for Finance, Certified Banking & Credit Analyst (CBCA), Business Intelligence & Data Analyst (BIDA), Commercial Real Estate Finance Specialization, Environmental, Social & Governance Specialization, Cryptocurrency & Digital Assets Specialization (CDA), Financial Planning & Wealth Management Professional (FPWM). =(C5 - LOOKUP(1,1/(C5:C10<>""),C5:C10))/C5, Read More: Weight Loss Spreadsheet in Stones and Pounds (2 Useful Examples). =IF (B3

Cases 1 and 2 provide students with Excel templates and ask them to perform calculations in specified cells. WebThe formula to calculate the loss percentage is: Loss % = Loss/Cost Price The Math of Gains and Losses Percentage gain and loss When an investment changes value, the dollar amount needed to return to its initial (starting) value is the same as

You bought another 100 shares on Feb. 3, 2021, for a total of $1,225 ($12.25 per share).

Loan Calculator Example.

Webhow to calculate gain or loss in excel +38 068 403 30 29. how to calculate gain or loss in excel. Now you have your profit or loss for this trade. First, click on cell E5 and type the following formula. To format the result as a percentage, click the Percent Style button in the Number section on the Home tab. Investopedia requires writers to use primary sources to support their work.

Using the drag handle lower-right corner of the cell drag across the row to enter the formula in the three columns for the second third and. I graduated with a bachelor's degree in engineering from BUET. Download the free Excel template now to advance your finance knowledge! In January 2022, you sold off 150 shares. Add a column for gain or loss. but do not offer the ability to change the appearance of the charts. Read More: How to Use Formula for Tracking Weight Loss in Excel (2 Examples).

googletag.enableServices();

These courses will give the confidence you need to perform world-class financial analyst work. Is it possible to have numbers added to the same cell and have excel continue to calculate the addition for me in that same cellex. the. The question is, Which shares did you sell? Youll learn a lot in just a couple of minutes!  But obviously, a return of 25% in 5 days is much better than 5 years! The calculator covers four different ROI formula methods: net income, capital gain, total return, andannualized return. ROI Formula:

But obviously, a return of 25% in 5 days is much better than 5 years! The calculator covers four different ROI formula methods: net income, capital gain, total return, andannualized return. ROI Formula:

Alan Murray has worked as an Excel trainer and consultant for twenty years. We can use the following general mathematics formula to determine percent profit or loss: In this method, we will use the mathematical formula subtraction to simply get the result of profit or loss and then use percentage formatting from the Number Format ribbon. Heres how you do it! Please leave them in the comments area if you have any questions or feedback. We have received your answers, click "Submit" below to get your score! All other formulas show average weight gain or loss for a month or a few months of volume data.  The higher the ratio, the greater the benefit earned. If you type only a Thanks and look forward to hearing from you.

The higher the ratio, the greater the benefit earned. If you type only a Thanks and look forward to hearing from you.

Put simply, $200- $100- $10 = $90.

Check out our favorite weight

To understand easily, well use a sample dataset as an example in Excel. To do this, we need to add our total amounts for both purchases and There are many benefits to using the return on investmentratio that every analyst should be aware of. Take Screenshot by Tapping Back of iPhone, Pair Two Sets of AirPods With the Same iPhone, Download Files Using Safari on Your iPhone, Turn Your Computer Into a DLNA Media Server, Add a Website to Your Phone's Home Screen, Control All Your Smart Home Devices in One App. Main site navigation. how do you convert mgkg to mgl , How To Calculate Percent Gainloss In Excel Complete Guide, how to calculate percent gainloss in excel.

Isnt it.

To calculate your profit or loss, subtract the current price from the. using subgroup analysis or meta-regression. More formally, the formula based on partial moments that we use in practice to estimate GLR looks as follows: where we set tau equal to zero. Add a column for gain or loss.  WebNo matter if you're losing, gaining, or maintaining weight, it's important to track your caloric intake. Initially, use the following formula in the blank cell. Set up your spreadsheet. Make sure you factor them in when you're considering selling any stocks. Your capital gains tax rate depends on several factors, including your income and filing status. After that, simply drag it down using right click button in the mouse to AutoFill rest of the series. You may have a capital gain or loss when you sell a capital asset, such as real estate, stocks, or bonds. WebYou can calculate capital gains or losses by putting your investment info into a worksheet such as in Excel or Google Sheets. Net Income = Revenue Cost of goods sold Operating expense Gain and losses Other revenue expense +/- Income/loss from the operations of a discounted component +/- Gain/loss from disposal of a discounted component.

WebNo matter if you're losing, gaining, or maintaining weight, it's important to track your caloric intake. Initially, use the following formula in the blank cell. Set up your spreadsheet. Make sure you factor them in when you're considering selling any stocks. Your capital gains tax rate depends on several factors, including your income and filing status. After that, simply drag it down using right click button in the mouse to AutoFill rest of the series. You may have a capital gain or loss when you sell a capital asset, such as real estate, stocks, or bonds. WebYou can calculate capital gains or losses by putting your investment info into a worksheet such as in Excel or Google Sheets. Net Income = Revenue Cost of goods sold Operating expense Gain and losses Other revenue expense +/- Income/loss from the operations of a discounted component +/- Gain/loss from disposal of a discounted component.

Calculate unrealized gain/loss The unrealized gain/loss transactions are created differently between General ledger revaluation and the AR and AP revaluation process. As mentioned above, one of the drawbacks of the traditional return on investment metric is that it doesnt take into account time periods.

Yahoo!

You made no other investment purchases or sales. WebEnter the formula B2-B1B1100 and Excel will display the gain or loss expressed as a percentage. Other alternatives to ROI include Return on Equity (ROE) and Return on Assets (ROA). As, the following image shows. All Rights Reserved. We want to calculate the basis of 50 shares from the January purchase.

Then subtract the $612.50 from the sell price of $2,100: Then subtract the cost basis for the 100 February shares from $1,487.50: Your gain is $237.50 before paying the commission ($212.50 after you account for the $25 commission on the sell) if you sold these specific shares. IRS. The most important reason you would want to use excel to track your stock portfolio is trying to calculate your profit and loss from each trade.

WebTo calculate percent gain, make sure you strictly follow every step: 1. Stocks can be risky investments but you can determine your portfolio's gains and losses.

If you want to calculate the percent gain or loss on your desired investment, then investors must need to determine the original price. In the example, when you enter the formula, Excel displays. Assume that the transaction costs are zero and have nil property tax. Label cell A1 "Original Value," cell A2 "Final Value" and cell A3 "Percent Change.".

This means that I need to first calculate the total cost of the shares I sold, then I can use that to determine my profit. Finally, our result is ready and it looks like the following image.

This means that I need to first calculate the total cost of the shares I sold, then I can use that to determine my profit. Finally, our result is ready and it looks like the following image.

But how do you calculate gains and losses? Preparing and using a worksheet to calculate your gains and losses can help you identify them at tax time and use them to your best advantage.

Then for any sales use a first in first out basis. For example, if the original value equals 71 and the final value equals 80, you would enter 71 in B1 and 80 in B2. Related Content: How to Calculate Net Profit Margin Percentage in Excel.