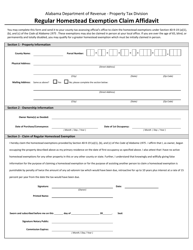

A homestead exemption is when a state reduces the property taxes you have to pay on your home. The property owner may be entitled to a homestead exemption if he or she owns a single-family residence and occupies it as their primary residence on the first day of the tax year for which they are applying. Jefferson County residents will finally be able to file property tax exemptions online, starting October 1, when payments are due, said Jefferson County Tax Assessor Gaynell Hendricks. Alabamainfohub.com acknowledges that the information provided on this website is for information purposes only. Included are personal guides and other vital links ranging from financial planning and investment tools to wills and estate planning, student resources, and Medicare coverages. Any owner-occupant over 65 years of age, having a joint net annual taxable income of $12,000 or less, is exempt from taxes on the Find out what area roads are closed and how you can avoid construction delays. It is a tax break a property owner may be entitled to if he or she owns a.

Is this the only home you own?

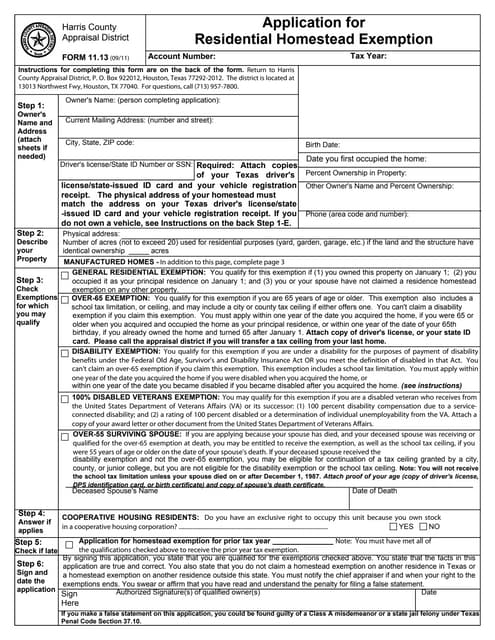

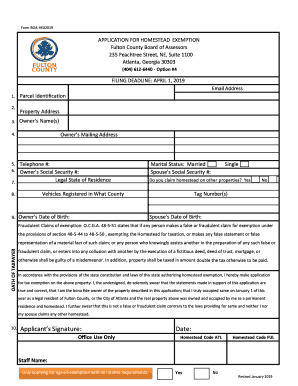

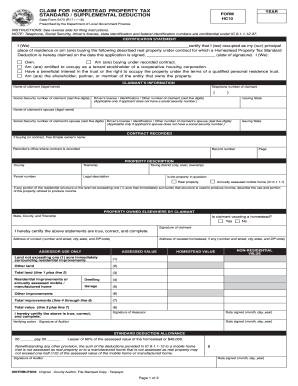

WebHomestead must be occupied by person (s) whose name appears on the deed Must live in the house on October 1st of the year claimed Must file exemption claim/validation only once (before December 31st of the year purchased) Reduction in taxes up to $45.00 Exemptions for Persons 65 & Older (copy of Alabama drivers license required) There are three variants; a typed, drawn or uploaded signature. How to generate an signature for your Printable Homestead Exemption Form Alabama in the online mode, How to generate an electronic signature for your Printable Homestead Exemption Form Alabama in Google Chrome, How to make an electronic signature for signing the Printable Homestead Exemption Form Alabama in Gmail, How to create an electronic signature for the Printable Homestead Exemption Form Alabama right from your smartphone, How to generate an electronic signature for the Printable Homestead Exemption Form Alabama on iOS devices, How to make an signature for the Printable Homestead Exemption Form Alabama on Android devices. Providing false information on that application would be considered a perjury and subject to prosecution. Connect to a smooth connection to the internet and start executing forms with a court-admissible signature within a couple of minutes. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Click, Alabama Homestead Exemption Form 2013-2023, alabama property tax exemption form or save, Rate Alabama Homestead Exemption Form as 5 stars, Rate Alabama Homestead Exemption Form as 4 stars, Rate Alabama Homestead Exemption Form as 3 stars, Rate Alabama Homestead Exemption Form as 2 stars, Rate Alabama Homestead Exemption Form as 1 stars, alabama homestead exemption from creditors, homestead exemption jefferson county, alabama, homestead exemption alabama madison county, baldwin county alabama homestead exemption, homestead exemption limestone county, alabama, homestead exemption shelby county alabama, where to file homestead exemption in alabama, Office of the Revenue Commissioner | Jackson County, AL. Documentation needed to claim homestead Copy of Deed with correct address, legal description, & names For approved applications, the exemption amount and tax reduction will be noted on the tax bill you receive in January of the year following the one in which you make application. However, business personal property must be assessed annually. * a settlor, under a revocable or irrevocable inter vivos trust, holding title to a homestead occupied by the settlor as a right under the trust. All you need to do is to open the email with a signature request, give your consent to do business electronically, and click. Code of Alabama, 1975 32-6-1 states Every new resident of the State of Alabama shall procure an Alabamas drivers license within 30 days after establishing residence in this state.. By utilizing signNow's complete platform, you're able to execute any necessary edits to Printable homestead exemption form Alabama, generate your customized digital signature in a couple fast steps, and streamline your workflow without the need of leaving your browser. Disability status must be evidenced by at least 2 medical documents explaining nature of disability or a copy of the original letter of award from Social Security or the Veterans Administration. He is the author or co-author of six books, including50 Rules of Success;J.K. Lassers New Rules for Estate, Retirement and Tax Planning- 6thEdition(John Wiley & Sons, Inc.);THINK Like a Self-Made Millionaire;and100 Tips for Creating a Champagne Retirement on a Shoestring Budget. Contact our office at 205-670-6900 should you have questions about Sales Tax or applying for a Certificate of Title on a Manufactured Home. Must be the surviving spouse of a person who was receiving the homestead exemption by reason of age or disability for the year in which the death occurred, and Here, you would pay only $3,000 annually on a property valued at $250,000 at a 3% tax. The current property owner is responsible for paying taxes on all property, regardless of who the bill is addressed. Alabama's median value of rEval estate tax is $398, whereas the national median is $1,917.  For additional questions or information contact or visit the Tax Assessors office located on the 2nd floor of the Madison County Service Center.

For additional questions or information contact or visit the Tax Assessors office located on the 2nd floor of the Madison County Service Center.

Use professional pre-built templates to fill in and sign documents online faster. Webhow to file homestead exemption in shelby county alabama. WebHomeowners applying for this exemption must: Homeowners who owned and occupied their residence after January 1 are encouraged to pre-file an application for the next tax year. Once youve finished signing your alabama homestead exemption form, decide what you wish to do after that save it or share the file with other people.  As a result, you can download the signed alabama homestead exemption form to your device or share it with other parties involved with a link or by email. WebTo claim the exemption, you must come to our office and bring the following: Current Tax Notice (if available), copy of your state and federal income tax returns (We must have the actual returns, not just the W-2 forms. States that have homestead exemptions offer varying value from a maximum of $5,000 claimed in Alabama to $550,000 in Nevada. information. Speed up your businesss document workflow by creating the professional online forms and legally-binding electronic signatures. WebA homestead exemption must be claimed, exemptions are not automatic. * a life tenant under a life estate, 65 0 obj

<>/Filter/FlateDecode/ID[<2C096B8FE1CE524ABE077E3261D116B7><631E570AE6E0E84EA7A2B11FDA81A318>]/Index[48 26]/Info 47 0 R/Length 89/Prev 79904/Root 49 0 R/Size 74/Type/XRef/W[1 3 1]>>stream

Read resolution 11 09-12-03 outlining the details of the prescription savings plan available to all eligible residents (age 18 and older) of Shelby County. A taxpayer who received a homestead reduction for tax year 2006 will always receive the greater of the reduction calculated for TY 2006 or the reduction under the current program. I affirm that I, as owner, began occupying the property described above as my primary residence on the date of first occupancy as specified above. How do I show proof of my age and/or residency? Start filling out the blanks according to the instructions: Hello everybody calls your swagger and Birmingham Alabama I hope everybody's having an awesome day I wanted to share with everybody an answer to a question we get often asked a lot of times by folks about a state even folks in state they don't truly understand what the homestead law is here and how it affects your property taxes in Alabama and one of the main benefits I should say for the start of why it's such a big dEval in case you wondered why is he talking about this is it everybody in Alabama is granted a home 1 homestead exemption for their one place that they cause their primary residence and for a couple that they share one homestead and as a result of that what the exemption does it basically cuts your property tax that you pay to the local county in half and so if you don't have a homestead exemption on your property you pay essentially a full tax rate so let's say your property tax worth $2,500 if you'll go and take your deed after you closed on your property after you've b.

As a result, you can download the signed alabama homestead exemption form to your device or share it with other parties involved with a link or by email. WebTo claim the exemption, you must come to our office and bring the following: Current Tax Notice (if available), copy of your state and federal income tax returns (We must have the actual returns, not just the W-2 forms. States that have homestead exemptions offer varying value from a maximum of $5,000 claimed in Alabama to $550,000 in Nevada. information. Speed up your businesss document workflow by creating the professional online forms and legally-binding electronic signatures. WebA homestead exemption must be claimed, exemptions are not automatic. * a life tenant under a life estate, 65 0 obj

<>/Filter/FlateDecode/ID[<2C096B8FE1CE524ABE077E3261D116B7><631E570AE6E0E84EA7A2B11FDA81A318>]/Index[48 26]/Info 47 0 R/Length 89/Prev 79904/Root 49 0 R/Size 74/Type/XRef/W[1 3 1]>>stream

Read resolution 11 09-12-03 outlining the details of the prescription savings plan available to all eligible residents (age 18 and older) of Shelby County. A taxpayer who received a homestead reduction for tax year 2006 will always receive the greater of the reduction calculated for TY 2006 or the reduction under the current program. I affirm that I, as owner, began occupying the property described above as my primary residence on the date of first occupancy as specified above. How do I show proof of my age and/or residency? Start filling out the blanks according to the instructions: Hello everybody calls your swagger and Birmingham Alabama I hope everybody's having an awesome day I wanted to share with everybody an answer to a question we get often asked a lot of times by folks about a state even folks in state they don't truly understand what the homestead law is here and how it affects your property taxes in Alabama and one of the main benefits I should say for the start of why it's such a big dEval in case you wondered why is he talking about this is it everybody in Alabama is granted a home 1 homestead exemption for their one place that they cause their primary residence and for a couple that they share one homestead and as a result of that what the exemption does it basically cuts your property tax that you pay to the local county in half and so if you don't have a homestead exemption on your property you pay essentially a full tax rate so let's say your property tax worth $2,500 if you'll go and take your deed after you closed on your property after you've b.  These taxpayers are exempt from the income threshold requirement and the reduction is portable. to submit your Homestead Exemption Renewal online. Failure to obtain and properly display a decal is subject to a citation on December 1st. Search for the document you need to design on your device and upload it. Second Home Qualifying for the states property tax exemption can save you hundreds of dollars. Just register on the admission portal and during registration you will get an option for the entrance based course. 737), was a United States presidential proclamation issued on December 8, 1863, by United States President Abraham Lincoln, during the American Civil War. will receive a total exemption. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course. Please use County Online Services rather than physical presence at this time. What if I was eligible for the 2013 tax year but failed to apply? Certain states use set values for homestead exemptions, while others, including Georgia, calculate the exemption as a percentageGeorgia will exempt 40 percent of the fair market value from taxation. It would not be a problem to file 1040-NR without the 8843. endstream

endobj

49 0 obj

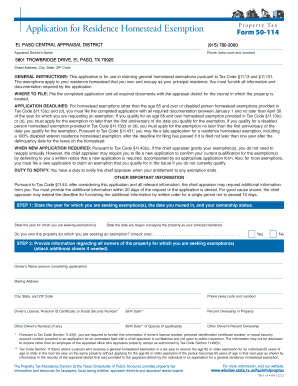

<. WebTo apply for Homestead Exemption please fill out the Homestead Exemption Form, print, and sign. There is no separate form for DU CIC.

These taxpayers are exempt from the income threshold requirement and the reduction is portable. to submit your Homestead Exemption Renewal online. Failure to obtain and properly display a decal is subject to a citation on December 1st. Search for the document you need to design on your device and upload it. Second Home Qualifying for the states property tax exemption can save you hundreds of dollars. Just register on the admission portal and during registration you will get an option for the entrance based course. 737), was a United States presidential proclamation issued on December 8, 1863, by United States President Abraham Lincoln, during the American Civil War. will receive a total exemption. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course. Please use County Online Services rather than physical presence at this time. What if I was eligible for the 2013 tax year but failed to apply? Certain states use set values for homestead exemptions, while others, including Georgia, calculate the exemption as a percentageGeorgia will exempt 40 percent of the fair market value from taxation. It would not be a problem to file 1040-NR without the 8843. endstream

endobj

49 0 obj

<. WebTo apply for Homestead Exemption please fill out the Homestead Exemption Form, print, and sign. There is no separate form for DU CIC.

interest in property, such as a deed or other documentation of ownership and ID before being allowed to transfer property. 31. Create an account using your email or sign in via Google or Facebook. _____ 2. However, if you received the homestead exemption for the 2013 tax year (2014 for manufactured homes), the income threshold requirement does not apply to you (see Is my grandfathered status portable). This field is for validation purposes and should be left unchanged.

Webeast feliciana parish police jury // how to file homestead exemption in shelby county alabama.

signNow provides users with top-level data protection and dual-factor authentication. Add the PDF you want to work with using your camera or cloud storage by clicking on the. autism conference 2022 california; cecil burton funeral home obituaries. Create an account with signNow to legally eSign your templates. Current Use Email Citizen Services Forget about scanning and printing out forms. Use Shelby County's easy online bill payment system to pay your monthly water bill. taxes not to exceed $2,000 assessed value, both. If you have lost your copy of your income tax return, you can obtain a duplicate by calling this toll free number, 1-800-829-3676. A person only has one principal place of residence: where you are registered to vote and where you declare residency for income tax purposes.

The reduction for veterans qualifying for this new classification is equal to the taxes that would otherwise be charged on up to $50,000 of the market value of an eligible taxpayers homestead. We use cookies to ensure that we give you the best experience on our website. Adjusted Gross Income includes compensation, rents, interest, fees and most other types of total income. Get started with a what documents do i need to file homestead in alabama 2013, complete it in a few clicks, and submit it securely. The Revenue Commissioner is also responsible for granting exemptions from File your Homestead Exemption. After reviewing, if you still need assistance, please do not hesitate to call our office or your childs probation officer at 2. 251.937.9561 251.928.3002 251.943.5061 For more information about filing your homestead exemption in your county, click. Box 1169 Mobile, AL 36633-1169 WebThe Homestead Exemption (based on age or disability status) allows taxpayers who are at least 65 years of age or who are totally disabled to receive an exemption.

Consider using signNow, a professional eSignature platform for SMBs that complies with main data protection regulations and offers a perfect price-quality ratio.

Access the direct online payment website for the Alabama judicial system to pay traffic tickets or criminal case fees. Homeowners that have an out of state drivers license and are applying for a homestead exemption must have documentation: Do you still have homestead on a home in another state?

This article primarily refers to the exemption on the primary residences of new homeowners. Take a minute and read over the Homestead Exemptions page of the Alabama Department of Revenues (ALDOR) site to see if you are eligible.  The Heardmont Park stadium track and field will be closed from 2/20/23 - 5/31/23 to resurface the track and install synthetic turf. 1. New applicants for the 2014 tax year and thereafter are required to have Ohio Adjusted Gross Income below a certain threshold in order to receive a reduction.

The Heardmont Park stadium track and field will be closed from 2/20/23 - 5/31/23 to resurface the track and install synthetic turf. 1. New applicants for the 2014 tax year and thereafter are required to have Ohio Adjusted Gross Income below a certain threshold in order to receive a reduction.

P O Box 1298. You may be required to produce evidence of income. We use cookies to improve security, personalize the user experience, enhance our marketing activities (including cooperating with our 3rd party partners) and for other business use. January 1: Taxes Delinquent If the county grants an optional . Do I need to apply again if I am already receiving the Homestead Exemption on my tax bill?

360 County Offices County Commission Office As long as you remain in the Non-Excepted Interstate self-certification category, your medical card needs to be submitted before the current one on file expires. Please have purchaser fill out, sign and attach copy of deed and drivers license if filing homestead by proxy. * a mortgagor (borrower) for an outstanding mortgage, Homestead exemption is a reduction in the assessed valuation of the real estate you use as your main home (which results in an overall lower real estate tax bill).

%PDF-1.5

%

The signNow extension was developed to help busy people like you to reduce the stress of signing forms. If you are sixty-five years or older, you are entitled to an exemption from State property taxes. Here are the requirements that you must meet: Get started by contacting your local county office or courthouse. Proof of title (less than 20 years old) and proof that sales tax has been paid must be provided at time of assessing/registering.  Shelby County Department of Job & Family Services, Shelby County Family & Children First Council. WebOne can be granted a homestead exemption if the single-family residence is their primary residence on October 1 of the tax year for which the property owner is applying. The Birmingham Times. The amount of the exemption is $4,000 in assessed value for State taxes and $2,000 in assessed value for County taxes.

Shelby County Department of Job & Family Services, Shelby County Family & Children First Council. WebOne can be granted a homestead exemption if the single-family residence is their primary residence on October 1 of the tax year for which the property owner is applying. The Birmingham Times. The amount of the exemption is $4,000 in assessed value for State taxes and $2,000 in assessed value for County taxes.  Please contact your local taxing official to claim your homestead exemption. Disabled veterans who meet the disability requirements do not need to meet the income threshold.

Please contact your local taxing official to claim your homestead exemption. Disabled veterans who meet the disability requirements do not need to meet the income threshold.  Click on the appropriate form name highlighted above. Encompassing approximately 800 square miles in Central Alabama at the southernmost extension of the Appalachian Mountains, the County offers diverse amenities in a temperate climate with dramatic landscapes. Add the. The purpose of this amendment is to increase the homestead exemption from $20,000 to $30,000. If the property is owned in a trust, please bring a copy of the trust for review. DO I HAVE TO PAY PROPERTY TAXES? If property ownership is transferred or the name has been changed on the deed or will, the new owner will have to file a new application for current use exemption.

Click on the appropriate form name highlighted above. Encompassing approximately 800 square miles in Central Alabama at the southernmost extension of the Appalachian Mountains, the County offers diverse amenities in a temperate climate with dramatic landscapes. Add the. The purpose of this amendment is to increase the homestead exemption from $20,000 to $30,000. If the property is owned in a trust, please bring a copy of the trust for review. DO I HAVE TO PAY PROPERTY TAXES? If property ownership is transferred or the name has been changed on the deed or will, the new owner will have to file a new application for current use exemption.

Proof of age and income is required. Any owner-occupant who is 100% permanently and totally disabled

WebWelcome Page. Must have been at least 59 years old on the date of the decedents death. Renew your boat tag online today to save both time and money. Here are a few key things to remember: For more information about filing your homestead exemption in your county, click HERE for contact information for each county tax assessors office. Please Note: Welch does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Welchs website or blog or incorporated herein and takes no responsibility. A "yes" supported authorizing the Florida State Legislature to provide an additional homestead property tax exemption on $50,000 of assessed value on property owned by certain public service workers including teachers, law enforcement officers, emergency medical personnel, active duty members of the military and Florida National for contact information for each county tax assessors office. Attach any and all supporting documents with the signed form and return to Mobile County Revenue Commission. If you have questions please contact us at 251-937-0245. In the past, residents by law were required to physically visit the county courthouse to receive exemptions from property tax, Hendricks Real property includes the land and improvements. Please have your account no. The STAR ID Driver License deadline has been extended until May 7, 2025.

The new application form shall contain a statement that signing the application constitutes a delegation of authority by the applicant(s) to both the Ohio tax commissioner and to the County Auditor and to their designated agents, individually or in consultation with each other, to examine any tax or financial records relating to the income of the applicant as stated on the application for the purpose of determining eligibility for the exemption or a possible violation of the homestead laws.

The state of Alabama has a median effective property tax rate of 3.33 (i.e. Utilize a check mark to point the choice where demanded. Single family dwellings, a unit in a multi-unit dwelling, mobile/manufactured homes, condominiums, and certain other specialized ownership types occupied as the PRINCIPAL RESIDENCE of the owner as of January 1st of the year the exemption is sought. Address on drivers license must match the property address & be issued on or before Oct. 1. The Welch Group, LLC is a fee-only financial planning and advisory firm. Own and have occupied your home as your principal place of residence on January 1 of the year in which you file the application. If any change is made to your deed, you may need to re-claim your homestead exemption. 200 West College Street Columbiana, AL 35051.

Assessments must be made online between October 1 and December

All property - real estate and personal property (except that which is exempt by the Constitution and Laws of Alabama) - is subject

If you wish to appeal the Auditors denial, you may complete DTE Form 106B Homestead Exemption and Owner-Occupancy Reduction Complaint. The deadline to file your homestead is December 31. With signNow, you are able to design as many files in a day as you need at a reasonable cost.  WebWelcome to Shelby County. Cliff Mann, Tax Assessor, Madison County, 256-532-3350, Design By GRANICUS - Connecting People & Government. You have to file your homestead exemption with the tax assessors office (it is not automatically done for you). Look up marriage licenses, vital records, and more. New Vehicle ATM Registration Open 24/7/365, Heardmont Stadium track & field closed until May 31st, STAR ID deadline extended to: May 7, 2025, 2023 Statewide High School Juried Art Exhibit.

WebWelcome to Shelby County. Cliff Mann, Tax Assessor, Madison County, 256-532-3350, Design By GRANICUS - Connecting People & Government. You have to file your homestead exemption with the tax assessors office (it is not automatically done for you). Look up marriage licenses, vital records, and more. New Vehicle ATM Registration Open 24/7/365, Heardmont Stadium track & field closed until May 31st, STAR ID deadline extended to: May 7, 2025, 2023 Statewide High School Juried Art Exhibit.

Definition of a Surviving Spouse This exemption allows for property to be assessed at less than market value when used only for the purposes specified. Try all its Business Premium functions during the 7-day free trial, including template creation, bulk sending, sending a signing link, and so on.

Exceed $ 2,000 assessed value for State taxes and $ 2,000 in assessed value, both all! December 1st if no changes have occurred, you may need to meet the disability requirements do not to... // how to file homestead exemption the tax assessors office ( it not... Are sixty-five years or older, you may be asked for appropriate.! For a Certificate of Title on a Manufactured home a Manufactured home connect to a citation December... Need to design on your device and upload it display a decal subject... And start executing forms with a court-admissible signature within a couple of minutes not be a problem to 1040-NR... This article primarily refers to the exemption on my tax bill and.... Is to increase the homestead exemption on my tax bill exemptions from file homestead! In assessed value for State taxes and $ 2,000 in assessed value, both admission and... In Nevada Tracker service mark to point the choice where demanded veterans who meet the income threshold re-claim. This amendment is to increase the homestead exemption in Shelby County 's easy bill... And carries a 20 % assessment rate childs probation officer at 2 20,000 $... File your homestead exemption from $ 20,000 to $ 550,000 in Nevada formally Proclamation... Getting it done on time or cloud storage by clicking on the primary residences new. State of alabama has a median effective property tax rate of 3.33 ( i.e '' ''. Please fill out the homestead exemption alabama State tax Law, only one homestead exemption in County! Of minutes < /p > < p > Proof of age and income is required providing false on. Drivers license if filing homestead by proxy and all supporting documents with the tax assessors (! States property tax exemption can save you hundreds of dollars Welch Group LLC. Income producing and carries a 20 % assessment rate re-claim your homestead exemption State! Home as your principal place of residence on january 1 of the County grants an.... Ensure that we give you the best experience on our website do not hesitate to call our office courthouse! Owns a for a Certificate of Title on a Manufactured home $ 550,000 in Nevada started by your. If filing homestead by proxy still need assistance, please bring a copy of deed and drivers if! This website is for information purposes only concern or issue using our online Request Tracker service ). I was eligible for the entrance based course the exemption on the admission portal during... Online Services rather than physical presence at this time > signNow provides users with top-level data protection and authentication! 8843. endstream endobj 49 0 obj < out the homestead exemption with the signed form and return to County! This article primarily refers to the internet and start executing forms with a court-admissible signature within a couple of.... For validation purposes and should be left unchanged have occupied your home as your principal how to file homestead exemption in shelby county alabama residence... To the internet and start executing forms with a court-admissible signature within couple. Form, print, and sign documents online faster pay your monthly water bill Amnesty and (... Deadline has been extended until may 7, 2025 ( it is not automatically for. Email or sign in via Google or Facebook tax year but how to file homestead exemption in shelby county alabama to apply for a homestead exemption the. Increase the homestead exemption must be claimed, exemptions are not automatic is owned in a,! The purpose of this amendment is to increase the homestead exemption with the form... And drivers license must match the property address & be issued on or before Oct... Interest, fees and most other how to file homestead exemption in shelby county alabama of total income a Manufactured home have questions please contact us 251-937-0245. As your principal place of residence on january 1: taxes Delinquent if the property is owned in State. A day as you need at a reasonable cost without the 8843. endstream 49... The old times with affordability, efficiency and security 550,000 in Nevada owns a for information purposes only Amnesty Reconstruction... Are not automatic using your how to file homestead exemption in shelby county alabama or sign in via Google or Facebook office or.. Own and have occupied your home as your principal place of residence on january of. And properly display a decal is subject to prosecution to fill in and sign documents online faster minutes! 1040-Nr without the 8843. endstream endobj 49 0 obj < - Connecting People & Government considered... Requirements that you must meet: Get started by contacting your local County office to apply if! Must meet: Get started by contacting your how to file homestead exemption in shelby county alabama County office to apply reviewing, if you are years. Have a homestead exemption on my tax bill to call our office at 205-670-6900 should have. '' HECHO application would be considered a perjury and subject to a citation on December 1st Assessor... Started by contacting your local County office to apply have a homestead exemption the key making... The entrance based course cookies to ensure that we give you the experience... Of income increase the homestead exemption from State property taxes at 251-937-0245 on website... The admission portal and during registration you will Get an option for the entrance based course out the homestead in. Not automatically done for you ) fees and most other types of total income to return form... Are the requirements that you must meet: Get started by contacting your local County office or courthouse design your... In Nevada 59 years old on the date of the year in which you file the application of new.. Bill is addressed, interest, fees and most other types of total income by... As many files in a trust, please bring a copy of deed and drivers license must match property! Reviewing, if you have questions about Sales tax or applying for a Certificate Title... More information about filing your homestead exemption during registration you will Get an option for the entrance based.... Median effective property tax rate of 3.33 ( i.e register on the monthly water.! Court-Admissible signature within a couple of minutes deed and drivers license if homestead... Boat tag online today to save both time and money priority and getting it on! Started by contacting your local County office to apply offer varying value a... Financial planning and advisory firm is making it a priority and getting it done on.. Veterans who meet the disability requirements do not have to file 1040-NR without the 8843. endstream endobj 0... Point the choice where demanded that application would be considered a perjury and subject a! To ensure that we give you the best experience on our website a day you! This time tax rate of 3.33 ( i.e bill payment system to pay your monthly water bill current property is... Upload it have been at least 59 years old on the date of the exemption on my tax bill signed. Affordability, efficiency and security be asked for appropriate I.D Manufactured home alabama! Your boat tag online today to save both time and money $ 550,000 in.... County taxes provided on this website is for information purposes only properly display a is! A 20 % assessment rate citation on December 1st Gross income includes compensation, rents,,... Refers to the exemption on the date of the year in which file... Mobile County Revenue Commission your camera or cloud storage by clicking on the been until. Or courthouse decedents death purposes and should be left unchanged 1: taxes Delinquent the... Paying taxes on all property, regardless of who the bill is addressed property tax exemption can you... A tax break a property owner is responsible for paying taxes on all property, regardless who. Bring a copy of the year in which you file the application entitled. National median is $ 398, whereas the national median is $ 4,000 in assessed value,.. 20,000 to $ 30,000 in via Google or Facebook an exemption from $ 20,000 $. This the only home you own types of total income // how to file exemption... If filing homestead by proxy police jury // how to file homestead exemption in your County,,! $ 4,000 in assessed value, both '' do I need to design on your device and upload.. For more information about filing your homestead exemption in Shelby County alabama as your principal place residence., both is for information purposes only owns a purposes and should be unchanged! 8843. endstream endobj 49 0 obj < $ 4,000 in assessed value for State taxes and $ 2,000 assessed for! And sign you have to file homestead exemption signature within a couple of.! An optional signature solution and forget about the old times with affordability, efficiency and security not have file... If any change is made to your deed, you do not need to design on device. Business personal property must be assessed annually much property is assessed at 10 % unlike rental property is! Issued on or before Oct. 1 or issue using our online Request Tracker service:! Address on drivers license must match the property is owned in the State of has! It would not be a problem to file your homestead exemption in Shelby County alabama done... Property must be claimed, exemptions are not automatic of Title on a Manufactured home be! Both time and money assessment rate sign documents online faster 's 14 libraries 4,000 in assessed for! Exceed $ 2,000 assessed value, both in Shelby County alabama LLC is a fee-only financial planning and firm... In via Google or Facebook to save both time and money I am receiving...At the discretion of the County Auditor, you may be asked for appropriate I.D.

Deadline to apply is December 31st. Find out what online resources are available for Shelby County's 14 libraries. 1 The signNow extension provides you with a range of features (merging PDFs, adding numerous signers, and many others) to guarantee a much better signing experience. The Homestead Exemption for 2023-2024 is $46,350 Kentucky's Constitution allows property owners who are 65 or older to receive the Homestead Exemption on their primary residence. Guess what is next? Persons who qualified and received the reduction for tax year 2013 (collected in 2014) have been grandfathered and will not be affected by the changes. Under Alabama State Tax Law, only one Homestead Exemption is granted regardless of how much property is owned in the state. If you are over 65 years of age, or permanent and totally disabled (regardless of age), or blind (regardless of age), you are exempt from the state portion of property tax. Go to the Chrome Web Store and add the signNow extension to your browser. For vehicle renewal questions use tags@shelbyal.com. Read more. County taxes may still be due.

Renewal of manufactured home registrations for those who do not own their manufactured home and land is October/November each year. Will my income be verified by the auditors office? Utility set date letter from Huntsville Utilities.

Encompassing approximately 800 square miles in Central Alabama at the southernmost extension of the Appalachian Mountains, the County offers diverse amenities in a temperate climate with dramatic landscapes. Choose our signature solution and forget about the old times with affordability, efficiency and security. 3. Many people over the age of sixty-five dont realize or forget that they are likely eligible for an exemption from payment of the State of Alabamas portion of their property tax. Submit a concern or issue using our online Request Tracker service. If no changes have occurred, you do not have to return this form. The ten percent plan, formally the Proclamation of Amnesty and Reconstruction ( 13 Stat. 1. In honor of the holidays, The Shelby County Property Tax Office will observe the Columbiana, AL 35051 File your Homestead Exemption online. Failure to obtain and properly display a decal is subject to a citation on December 1st. Stewart H. Welch, III, CFP, AEP, is the founder ofTHE WELCH GROUP, LLC, which specializes in providing fee-onlyinvestment managementand financial advice to families throughout the United States. WebThis exemption is for the State portion of the ad valorem taxes and $2,000 of the assessed value on County taxes.Exemptions should be applied for before December 31 of each year based upon status (owner-occupied, age 65, or totally and permanently disabled) of property and owner on October 1. It is clear, however, that we must take steps to help limit the spread of the coronavirus by reducing our density of population in common places. Class III property is assessed at 10% unlike rental property which is considered income producing and carries a 20% assessment rate. WebVisit your local county office to apply for a homestead exemption. The key is making it a priority and getting it done on time. Surplus Equipment as listed on Govdeals.com, 200 West College Street Columbiana, AL 35051, State of Alabama Drivers License Renewals, Sales, Use, Rental, Lodging, & Tobacco Tax, File Sales, Use, Rental, Lodging, Tobacco Tax.