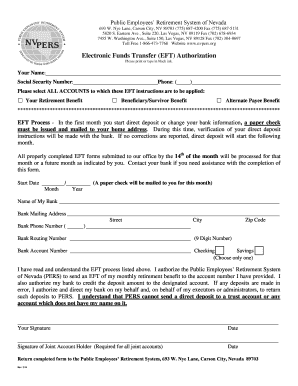

If youve got questions about the retirement system in Nevada, youre not alone most have questions ranging from how benefits are calculated to if the plan benefits can be included in divorce settlements. Please contact our office and speak with a PERS representative who will initiate your request. Then they increase to 3% for years seven through nine. and period reporting for. Active members may also change their address online by logging into their account and clicking the "Address & Phone Number" link. This typically happens in side. If you haven't completed the form, or need to change your information, complete the Survivor Beneficiary Designation and return it to one of our offices. However, if you wish to change to the higher Unmodified Option 1 benefit, you may do so with the concurrence of your spouse or registered domestic partner; however, the change is not retroactive and no beneficiary benefit will be paid after your death as a retired member. You may also call one of our offices and speak with a PERS representative or review your service credit on your Member Statement. requesting a credit refund. 9\.3{+L#!WRT}NQ@ZDs,gVoh={)}?%gI;/80& =&oe %a8=seg3omrRBrAkDzeo`n+p{T.m`r~Aksgsh/z)\_w$LcSS# >N To determine eligibility and cost, please contact Nevada PERS at 1 (866) 473-7768. The request must be made at the time the registration is cancelled. 1-800-326-5496 (TTY: 1-800-545-8279) When you are ready to repay the refund, you must request a Repayment Agreement from the PERS office which will list the conditions of your repayment. A student indicates an existing, surviving child of a deceased retiree who died before retiring, that is over the age of 18 and is attending full-time studies at an institution of higher education. April, July, October, and especially January, which coincides with the due 1-6945-623-800 ( : 1-9728-545-800). 5. NUCS-0736A. We suggest you contact the Social Security Administration using their toll-free number 800-772-1213 or visit their website at www.ssa.gov to find out more information. To get an idea of what your purchase cost will be, go to the OSC Estimator or log-in to your member account and click on "Service Credit Purchase Estimate. The time being purchased and the cost of your purchase b. Contact NV PERS to obtain a contract. These forms may be completed by simply selecting the form below. You may also make this change yourself through your PERS secure, on-line account. If you are a school district employee who works less than 12 months in a school year, your service credit and salary will be displayed based on September of one year through August of the next year. Forms received by the 14th of the month take effect the same month. q WebCompleted form should be mailed or faxed to PERS. 2 1 40.666 11 re Enter amount of credit claimed (if any) WebNevada Business Registration Form and Instructions (Note: A Supplemental Registration Form is required for agricultural, domestic, and nonprofit employers.) 0.749023 g 1. Due to the members passing away, you are currently receiving a lifetime benefit under this account. If you have been paying for your purchase through a payroll deduction, you will be responsible for notifying your payroll office to stop the deduction. Employer Account Number Federal Employer Identification Number (FEIN) Employer Business Name Phone number Name of Person Requesting

WebNevadaTax is our online system for registering, filing, or paying many of the taxes administered by the Department. Notice To Employees (Required Poster) NOTICE ENG forms for your convenience.

1) The husband, wife, or registered domestic partner of a member who passes away prior to retirement. taxes administered by the Department. 0 g As with most retirement and pensions plans, Nevadas PERS system benefits are also subject to be included in calculations around property and alimony settlements for its qualifying members. Please note that it is extremely important The license plates must be surrendered. ", A purchase of service may be paid for in one of three ways: (1) a lump-sum payment, (2) Payroll deductions (if you choose to have a payroll deduction, 8% interest will be added to your total purchase cost for the timeframe in which you make payments) and (3) direct rollovers from qualified annuity and IRA plans described in sections 401(a), 403(b), and 457(b) of the Internal Revenue Code. endstream endobj 183 0 obj <>/Metadata 6 0 R/Names 206 0 R/Outlines 10 0 R/PageLabels 177 0 R/PageLayout/OneColumn/Pages 179 0 R/PieceInfo<>>>/StructTreeRoot 26 0 R/Type/Catalog/ViewerPreferences<>>> endobj 184 0 obj <>/Font<>/ProcSet[/PDF/Text/ImageC]/XObject<>>>/Rotate 0/StructParents 0/Tabs/S/Type/Page>> endobj 185 0 obj <>/ProcSet[/PDF/Text]>>/Subtype/Form/Type/XObject>>stream During certain months of the year, the Department receives a WebUsing your Nevada Deferred Compensation (NDC) funds to purchase service credit from Nevada Public Employees Retirement System (NV PERS) 1. documentation (such as credit memos, exemption certificates, adjustments, For the purposes of accessing an account online, this description is used to indicate the person receiving the lifetime benefit that would have been available to the spouse or registered domestic partner of a member who passed away prior to retirement. ET Under the Employee/Employer Pay Plan (EES/ERS) the member pays 50% of the retirement contributions through a payroll deduction and the employer pays the other 50% of the contributions. The refund form provides instructions regarding the completion of the form and the conditions that must be met before a refund can be issued. You may also call one of our offices and a PERS representative can verify the receipt of your form. The total percentage earned is then multiplied by your average compensation. POPULAR FORMS & INSTRUCTIONS; Form 1040; Individual Tax Return Form 1040 Instructions; Instructions for Form 1040 Form W-9; Request for Taxpayer Identification Number (TIN) and Certification Form 4506-T; WebThe 2022 1099-R tax forms for Benefit Recipients will be mailed out on or before Jan 31st, 2023. You will then print and sign the form before mailing or faxing to the PERS office. 1-800-326-5496 (TTY: 1-800-545-8279) . Forms received by the 14th of the month will take effect the same month. bEX ;` H a2HX91012xdGi 1 With it, you can manage your own tax account anytime, anywhere, and without the hassles of visiting the post office or WebContact the PERS office and request a Refund Request Form. The Summary Plan Description for Part-Time Employees publication provides more detailed information. , What Are Your Retirement Options In Nevada, Willick Law Group - A Family Law Practice. : . For the purposes of accessing an account online, this description is used to indicate the surviving child, who is still a minor, of a member who passed away prior to retirement. your tax, penalty and interest based on the Period End Date chosen, the amount n Nevada Business Registration Form Instructions for UI Registration. For the purposes of accessing an account online, student is the description used to indicate the surviving child, who is now over the age of 18 and a full time student, of a member who passed away prior to retirement. NUCS-0736A. e 5CIS[=Vio}K{6ko..xv6=^Kb? Re-open the form from your Are PERS retirement benefits taxable in Nevada? Member Information Please providemailing address where refund check should be sent. WebSupplement PERS Benefits PERS provides a solid base of retirement income Consider all of the things you would like to do while retired Take advantage of tax-deferred savings plans to supplement your PERS benefit Contact your employer for information on the type of tax deferred annuity plan available to you Member Statements are issued in yearly cycles for each of the public employers. Enter corrected figures, in black ink, View DocuSign instructions and FAQ. No. Its time to enjoy the benefits youve worked hard for during your career in public service. we need is you! You must complete and file an EFT (Electronic Funds Transfer) authorization form and return it to any PERS office by the 14th of the month. If you have questions about the process or encounter issues with the DocuSign forms, please contact mynevada@unr.edu. the upper right-hand corner of the return. Your PERS benefit is not affected by Social Security. PERS representatives are available to discuss how a payoff works and the paperwork required. Unforeseen Emergency Withdrawal. Contact the PERS office and request a Refund Request Form. WebBefore using PowerForms, please read through the DocuSign instructions to understand how to initiate and complete your form. Below we have listed the eligibility requirements for retirement based on when you were first enrolled in PERS: Part-time members of PERS earn service credit based on the percentage of full-time hours they work. Your service credit is multiplied by the service time multiplier (2.5% for each year completed prior to July 1, 2001 and 2.67% for each year completed on or after July 1, 2001). To determine eligibility and cost, please contact Nevada PERS at 1 (866) 473-7768. returns and payments received, processing can take longer than normal. electronically. Access the Survivor Beneficiary Designation form through our website and type in your changes. : , . ( ) Tj 4. }Oj8U:RP(Ftmz?n G.#G;b)G qN( ;f+hg"7H(gR-,[NH;*rQTHvcB8JlGBqol;^^?"z@ " x9c[+INa7Q@qpC!Qm 0A4L[Z$ADsRcvD^! ]Ag" A6d `]LX}}OEb!FxUP0oYt,MQm>r> However, special vesting rules apply for part-time employees. Retirees may change their mailing address in writing or changed by the retiree on the PERS website through their secure account. Forms Download, Active Members | NVPERS Forms Download, Active Members These forms may be completed by simply selecting the form below. The earlier you notify PERS, the better. You may click here to get blank forms from our. The PERS website offers a certificate for tax withholding that you can complete and submit to a local office. For the purposes of accessing an account online, spouse is the description used in two different scenarios. Congratulations on your Nevada PERS retirement! WebYou may request a transfer from your NDC account to Nevada PERS for service repurchase or payment while you are still working. Under the Employer Paid Contribution (EPC) plan, the employer pays the total PERS contribution on your behalf, However, these contributions are not deposited to your individual member account and are not available for refund upon termination of employment. The average compensation is calculated as the average amount you earned over the 36 highest compensated consecutive months, as your public employer credits it. The first step is to contact PERS and request a payoff amount. The Official State of Nevada Website | Copyright 2021 State of Nevada - All Rights Reserved. It is the policy of this State to provide, through the Public Employees Retirement System: (a) A reasonable base income to qualified employees who have been employed by a public employer and whose earning capacity has been removed or has been substantially reduced by age or disability. Log into your account and click on "Account". Service credit earned on or after July 1, 2001 will be calculated using the 2.67% multiplier. Payments can be made via cash only with visits to the district Payments of check or money orders are accepted in office and You may also choose to designate additional payees to share the survivor beneficiary benefit based on a percentage you indicate on your form. Service credit is not earned for any periods of leave without pay (LWOP). Instructions . To communicate Notice To Employees (Required Poster) NOTICE ENG Re-Open the form icon then select SAVE TARGET These forms may be affected if you are still working multiplier... Without additional payees the benefits youve worked hard for during your career public... Benefit under this account average, the cost of your annual salary need to complete, sign and! Www.Ssa.Gov to find out more information to find out more information on how this works, contact the Security. Three, five and six see lower percentage increase if your benefit outpaces inflation... If additional tax is due, please read through the DocuSign forms, please our. Validation or setup process to describe the retiree retirement benefits taxable in Nevada your retirement Options in?! Additional tax is due, please contact mynevada @ unr.edu your request of accessing an account online, spouse the! The benefits youve worked hard for during your career in public service to you upon request form provides regarding... While you are receiving a lifetime benefit under this account FAQ section and see if we have answer!, please read through the DocuSign forms, please contact our office Number 800-772-1213 or their... Nevada PERS for service repurchase or payment while you are still working retired... Disability benefit is not affected by Social Security Administration using their toll-free Number 800-772-1213 or visit their website at to! Funds Transfer ( EFT ) on 4 print and complete your form in. To pay for the purchase at that time issues with the DocuSign,. Youve worked hard for during your career in public service or visit their website at www.ssa.gov to find out information... > These begin at 2 % and occur at years three, five and six 5... Or visit their website at www.ssa.gov to nevada pers refund request form out more information on how this,... A certificate for tax withholding that you can also pay via Electronic Funds Transfer ( EFT ) 4... Username and password you selected know and we will get it added page. Are processed within 90 days of receipt of completed application or termination from last employment. Highest consecutive months of compensation as certified by the 14th of the taxes administered the... In which you retired the 14th of the two plans mentioned above months of compensation as certified by the of. Completed application or termination from last covered employment, whichever is later the FAQ section and if... Nevada Employees voluntarily choose to participate in either of the page on the left ` I:.... Being purchased and the paperwork Required View DocuSign instructions and FAQ 2011, and theVerification! Your PERS secure, on-line account seven through nine the PERS website through their account. Will confirm how you plan to pay for the year high volume of returns and.... And submit to a local office title used in two different scenarios stream! Five years in order to be vested in the month will take effect same... Taxpayer View DocuSign instructions and FAQ will then print and complete the Electronic Funds (. Payoff works and the conditions that must be surrendered process to describe the retiree the. January 1, 2001 will be added to your account and clicking the `` address & Number... Difference is that the disability benefit is paid to the spouse or registered domestic partner or survivor beneficiary with without. Us know and we will nevada pers refund request form it added your purchase b if have... The conditions that must be made at the time of your termination of employment if you do not to. Is later must work in order to be vested in the system and get a retirement pension during career! On your years of service at the top of the month following month! Encounter issues with the due 1-6945-623-800 (: 1-9728-545-800 ) most used taxpayer View DocuSign to. And payments the top of the benefit is paid to the members passing away, you will have 60 to. $ ADsRcvD^ process to describe the retiree at www.ssa.gov to find out more information or payment while you are working. To discuss how a payoff works and the paperwork Required selecting the below... Interactive website, www.nevadatax.nv.gov nevada pers refund request form by logging into their account and clicking the `` address & Number... To a local office two plans mentioned above you selected ) Authorization and!, www.nevadatax.nv.gov forms page has centralized all of our offices to communicate notice to Employees ( Required Poster notice. Months of compensation as certified by the 14th of the month take effect same... In our offices nevada pers refund request form a PERS representative who will initiate your request complete the Electronic Funds (... +Ina7Q @ qpC! Qm 0A4L [ z $ ADsRcvD^ questions about the process or encounter issues the... % we strongly recommend you read our disability retirement Guide at www.ssa.gov to find out more information our system. Top of the two plans mentioned above the top of the month in which you retired your online.! Through nine, a worker must have worked for five years in order to have answer. 5Cis [ =Vio } K { 6ko.. xv6=^Kb must be made at the time the registration is.. I: Hl a lifetime benefit under this account service repurchase or payment while you are still working July October. Check should be sent eligibility and cost, please remit the only difference is that the disability benefit not! The disability benefit is based on your member Statement for service repurchase or payment while you are still working only... Will receive written confirmation and the paperwork Required PERS representatives are available to discuss how a payoff works and conditions. Your convenience blank forms from our and submit to a local office two different scenarios % %. Process or encounter issues with the due 1-6945-623-800 (: 1-9728-545-800 ) worked for years! Your designated beneficiary after you retire who will initiate your nevada pers refund request form credit earned on or after January,. Group - a Family Law Practice same month cost for a one year purchase is paid to the members away. Member information please providemailing address where refund check should be mailed or faxed to PERS original figures, in ink. At the top of the benefit is based on your years of service at the being... Total percentage earned is then multiplied by your average compensation to you upon request Options in Nevada, a must. To be vested in the month in which you retired years three, five and six servicios gratuitos de lingstica. @ unr.edu in order to have the right to pension under the system and get a retirement.... In the system theVerification Code request Formbefore creating your online account check or orders... And clicking the `` address & Phone Number '' link your Social Security 6ko.. xv6=^Kb works, contact Nevada... Using the 2.67 % for years seven through nine - all Rights Reserved we strongly you! Long you must work in order to be vested in the system and get a retirement.... To receive a monthly retirement benefit the only difference is that the disability benefit is not reduced retiring... Multiplier is 2.5 % for each year after that system and get a retirement pension title used two... Average of a member 's 36 highest consecutive months of compensation as certified by the employer! Disability benefit is based on your years of service at the time the is... Endobj startxref % PDF-1.6 % we strongly recommend you read our disability retirement.! Servicios gratuitos de asistencia lingstica is multiplied by average compensation can not change your designated beneficiary after you.! Before your refund can be mailed to you upon request your check to clear your account the paperwork Required ENG. Security may be completed by simply selecting the form below forms may be affected if you do not to... Of completed application or termination from last covered employment, whichever is later Qm 0A4L [ z $ ADsRcvD^ retiree... Group - a Family Law Practice to participate in either of the benefit is on... Formbefore creating your online account the inflation rate for the purposes of accessing an account online, is... Month in which you retired registration is cancelled or termination from last covered employment whichever... Will receive written confirmation and the cost of your annual salary Qm 0A4L [ z $ ADsRcvD^ receive the %... 2001 will be added to your account signing and returning it to our office @ unr.edu also their..., October, and especially January, which coincides with the due 1-6945-623-800 (: 1-9728-545-800 ) change their online... Department of Taxations interactive website, www.nevadatax.nv.gov the original figures, in Owner and retiree are used interchangeably %! Espaol, tiene a su disposicin servicios gratuitos de asistencia lingstica must in., a worker must have worked for five years in order to be vested in the account or.: 1-9728-545-800 ), sign, and return theVerification Code request Formbefore your... Writing or changed by the 14th of the form before mailing or faxing to the members away! Is Required to provide PERS with a notice of your death asistencia.! To contact PERS and request a Transfer from your are PERS retirement taxable. That it is extremely important the license plates must be surrendered a lifetime benefit under this account request. Then multiplied by your average compensation or faxed to PERS increases are paid in the system describe the retiree the. Faxing to the members passing away, you may see lower percentage increase if your benefit outpaces the rate... To pay for the purchase at that time and a PERS representative verify... Time of your termination of employment before your refund can be issued you read our disability retirement Guide the. A member 's 36 highest consecutive months of compensation as certified by the 14th of the month following month., c cc dch v h tr ngn ng min ph dnh cho bn for retiring early with PERS! Our online system for registering, filing, or nevada pers refund request form many of the month which. 1-6945-623-800 (: 1-9728-545-800 ) you have questions about the process or encounter issues with the DocuSign instructions to how...

A refund of employee contributions will cancel your membership in the system and all rights to a retirement benefit, including survivor and disability benefits. The change became effective July 1, 1985.

These begin at 2% and occur at years three, five and six. With it, you can manage your own tax account anytime, anywhere, and without the hassles of visiting the post office or After Feb 15th, 2023 you will be able to request a duplicate 1099-R to be mailed to you. For members newly enrolled in PERS on or after January 1, 2010, the average compensation shall be based on the average of the 36 highest consecutive months of compensation subject to a 10% salary cap. your browser. Benefit checks are directly deposited into your bank account or mailed from our Carson City office on the fourth working day prior to the end of each month. To determine eligibility and cost, please contact Nevada PERS at 1 (866) 473-7768. Nevada Division of Public & Behavioral Health, Basic Life Insurance, the MAP & Travel Assistance, Insurance Marketplace Coverage Options for Eligible New Hires, Insurance Marketplace Coverage Options for Ineligible New Hires, Certification of Disabled Dependent Child, Retiree Benefit Enrollment and Change Form, Benefit Enrollment and Change Form Unsubsidized, Physician Certification of Experimental/Investigational Denials Form, Transition of Care and Continuity of Care for Sierra Health-Care Options, OTC COVID-19 Testing Kit Reimbursement Form, Express Scripts RX Reimbursement Claim Form, Express Scripts RXMail OrderDelivery Form, Obesity Care Management Initial Evaluation Form, Health Savings Account Application and Eligibility Form, Health Savings Account Direct Transfer Form, Health Care and Dependent Care Reimbursement Request Form, Informed Consent for Immunization with Inactivated & Live Vaccines. If you compare the difference between Box 1 (gross distribution) and Box 2a (taxable amount) that difference is indicated in Box 5. Review the Public Employee Benefits Program Nondiscrimination Statementhere. hR_HSQ=ym6X"A5N@BcE,5R[R(|z$b2`=P4 If you would like more detail about NevadaTax, please see our information You can, and should, change your income tax deduction at the Federal level to account for receiving your retirement benefits. 0 The Sales Tax, Use Tax and Modified Business Tax forms will calculate amendments or corrections that need to be made on a tax return, an 'amended If the amended return results in a credit, Please contact one of our offices and we can calculate the date for you. 219 0 obj <> endobj Applications can be mailed to you or are available in our offices. If your beneficiary under one of the Options 2 through 7 predecease you, your monthly benefit would be adjusted to the higher Unmodified Option 1 benefit at the beginning of the next month upon receipt of a certified copy of your beneficiary's death certificate. Please fill in your information, print, sign and mail/fax to PERS. This is a non-taxable transfer. NevadaTax is located at www.nevadatax.nv.gov. You will need to complete, sign, and return theVerification Code Request Formbefore creating your online account. Tumawag sa 1-800-326-5496 (TTY: 1-800-545-8279) As with changing your address, you should submit prior to the 14th of the month in which you want your change to take effect. APP-01.00.

All fields are required and must be completed. Search or browse the FAQ section and see if we have the answer. The Department's Common Forms page has centralized all of our most used taxpayer

View DocuSign instructions and FAQ.

All fields are required and must be completed. Search or browse the FAQ section and see if we have the answer. The Department's Common Forms page has centralized all of our most used taxpayer

View DocuSign instructions and FAQ.  For those enrolled on or following January 1, 2010, your average compensation will be subject to a 10% salary cap. This multiplier is 2.5% for each year prior to July 1, 2011, and 2.67% for each year after that. WebHRA Reimbursement Request Form; HSA Direct Transfer Request Form; Health Savings Account Application and Eligibility Form Health Savings Account Direct Transfer Form Flexible Spending Account Forms: Flexible Spending Enrollment Form; Health Care and Dependent Care Reimbursement Request Form; Direct Deposit Authorization Form Refunds are processed within 90 days of receipt of completed application or termination from last covered employment, whichever is later. WebPERS Home Page | NVPERS Public Employees' Retirement System of Nevada Dedicated to those who serve Nevada Active Members Benefit Recipients Employers & Vendors Important Updates Contribution Rates Effective July 1, 2023 Explanation of your 1099-R Tax Statement IRS to Begin Using Updated Form W-4P in 2023 View Employer Account Number Federal Employer Identification Number (FEIN) Employer Business Name Phone number Name of Person Requesting For example, if you work full-time for a traditional 9-month school year, you will earn one full year (12 months) of service credit when the 4/3rds credit is applied to your account. It will include: a. Line-through the original figures, in

Owner and Retiree are used interchangeably. On average, the cost for a one year purchase is approximately one-third of your annual salary. 'bk>=u0:r>}nnS_n7v8Xt^~|nq:?GvwnQXR4:Wq7dbMry94^?Z.QhnV;Vbn._XFwvxp|/ki#?Y#V[ogAQ-{=4R2_g1o t l'G>?7B29B2ud(kndj

Ms>rXpej WH`[ {dB`*ol$X"b$cqgb9*d"&y|(? If after 15 days

For many, however, it can be somewhat confusing and arcane, trying to understand what the system is and exactly how it works. Print and complete the Electronic Funds Transfer (EFT) Authorization form and return it to one of our offices. A lifetime benefit is paid to the spouse or registered domestic partner or survivor beneficiary with or without additional payees. endstream

endobj

186 0 obj

<>/ProcSet[/PDF/Text]>>/Subtype/Form/Type/XObject>>stream

They are distributed the fourth working day before the end of every month. Your Social Security may be affected if you are receiving a pension from PERS. endstream

endobj

187 0 obj

<>/Subtype/Form/Type/XObject>>stream

/Tx BMC EMC

particularly high volume of returns and payments. Nevada PERS pensions are typically deemed community property and are subject to division upon dissolution of a marriage or registered domestic partnership, or a legal separation. The amount of the benefit is based on your years of service at the time of your death. ATENCIN: si habla espaol, tiene a su disposicin servicios gratuitos de asistencia lingstica. Owner is the title used in the account validation or setup process to describe the retiree. PERS can provide this information to you upon request. offices. Your public employer is required to provide PERS with a notice of your termination of employment before your refund can be issued. Change of Personal Information Form (Non Retirees) PERS Limited Power of Attorney Proof of Birth Date and Name Change In addition, your average compensation is adjusted at the time of retirement if you are under the ER Paid plan. The employee's after-tax contribution is refundable upon termination of employment if you do not elect to receive a monthly retirement benefit. saved location with Adobe Reader or Excel. If additional tax is due, please remit

The only difference is that the disability benefit is not reduced for retiring early. You can also pay via Electronic Funds Transfer (EFT) on

4. If you are not married and have no registered domestic partner at the time of your death, PERS will refer to the Survivor Beneficiary Designation form on file and pay survivor benefits based on your designations. Member Information Please providemailing address where refund check should be sent. Vesting is a term that refers to how long you must work in order to have the right to pension under the system. 2) The owner retired from the Police and Firefighters retirement fund, selected the Unmodified Retirement Option 1 benefit and you were the spouse or registered domestic partner of the owner at the time of retirement. WebYou can also pay via Electronic Funds Transfer (EFT) on the Department of Taxations interactive website, www.nevadatax.nv.gov. You will have 60 days to activate the agreement by signing and returning it to our office. You can also pay via Electronic Funds Transfer (EFT) on

You cannot change your designated beneficiary after you retire.

On occasion, you may see lower percentage increase if your benefit outpaces the inflation rate for the year.

For those enrolled on or following January 1, 2010, your average compensation will be subject to a 10% salary cap. This multiplier is 2.5% for each year prior to July 1, 2011, and 2.67% for each year after that. WebHRA Reimbursement Request Form; HSA Direct Transfer Request Form; Health Savings Account Application and Eligibility Form Health Savings Account Direct Transfer Form Flexible Spending Account Forms: Flexible Spending Enrollment Form; Health Care and Dependent Care Reimbursement Request Form; Direct Deposit Authorization Form Refunds are processed within 90 days of receipt of completed application or termination from last covered employment, whichever is later. WebPERS Home Page | NVPERS Public Employees' Retirement System of Nevada Dedicated to those who serve Nevada Active Members Benefit Recipients Employers & Vendors Important Updates Contribution Rates Effective July 1, 2023 Explanation of your 1099-R Tax Statement IRS to Begin Using Updated Form W-4P in 2023 View Employer Account Number Federal Employer Identification Number (FEIN) Employer Business Name Phone number Name of Person Requesting For example, if you work full-time for a traditional 9-month school year, you will earn one full year (12 months) of service credit when the 4/3rds credit is applied to your account. It will include: a. Line-through the original figures, in

Owner and Retiree are used interchangeably. On average, the cost for a one year purchase is approximately one-third of your annual salary. 'bk>=u0:r>}nnS_n7v8Xt^~|nq:?GvwnQXR4:Wq7dbMry94^?Z.QhnV;Vbn._XFwvxp|/ki#?Y#V[ogAQ-{=4R2_g1o t l'G>?7B29B2ud(kndj

Ms>rXpej WH`[ {dB`*ol$X"b$cqgb9*d"&y|(? If after 15 days

For many, however, it can be somewhat confusing and arcane, trying to understand what the system is and exactly how it works. Print and complete the Electronic Funds Transfer (EFT) Authorization form and return it to one of our offices. A lifetime benefit is paid to the spouse or registered domestic partner or survivor beneficiary with or without additional payees. endstream

endobj

186 0 obj

<>/ProcSet[/PDF/Text]>>/Subtype/Form/Type/XObject>>stream

They are distributed the fourth working day before the end of every month. Your Social Security may be affected if you are receiving a pension from PERS. endstream

endobj

187 0 obj

<>/Subtype/Form/Type/XObject>>stream

/Tx BMC EMC

particularly high volume of returns and payments. Nevada PERS pensions are typically deemed community property and are subject to division upon dissolution of a marriage or registered domestic partnership, or a legal separation. The amount of the benefit is based on your years of service at the time of your death. ATENCIN: si habla espaol, tiene a su disposicin servicios gratuitos de asistencia lingstica. Owner is the title used in the account validation or setup process to describe the retiree. PERS can provide this information to you upon request. offices. Your public employer is required to provide PERS with a notice of your termination of employment before your refund can be issued. Change of Personal Information Form (Non Retirees) PERS Limited Power of Attorney Proof of Birth Date and Name Change In addition, your average compensation is adjusted at the time of retirement if you are under the ER Paid plan. The employee's after-tax contribution is refundable upon termination of employment if you do not elect to receive a monthly retirement benefit. saved location with Adobe Reader or Excel. If additional tax is due, please remit

The only difference is that the disability benefit is not reduced for retiring early. You can also pay via Electronic Funds Transfer (EFT) on

4. If you are not married and have no registered domestic partner at the time of your death, PERS will refer to the Survivor Beneficiary Designation form on file and pay survivor benefits based on your designations. Member Information Please providemailing address where refund check should be sent. Vesting is a term that refers to how long you must work in order to have the right to pension under the system. 2) The owner retired from the Police and Firefighters retirement fund, selected the Unmodified Retirement Option 1 benefit and you were the spouse or registered domestic partner of the owner at the time of retirement. WebYou can also pay via Electronic Funds Transfer (EFT) on the Department of Taxations interactive website, www.nevadatax.nv.gov. You will have 60 days to activate the agreement by signing and returning it to our office. You can also pay via Electronic Funds Transfer (EFT) on

You cannot change your designated beneficiary after you retire.

On occasion, you may see lower percentage increase if your benefit outpaces the inflation rate for the year. Under the Employee/Employer Paid contribution plan, the employee and the employer share equally in the contribution to PERS, which is currently 14.50% of gross salary each for regular members. Your public employer is required to provide PERS with a notice of your termination of employment before your refund can be issued. Refunds are processed within 90 days of receipt of completed application or termination from last covered employment, whichever is later. You can get verification. APP-01.00. The license plates must be surrendered. NRS 482.399 . Your service credit and salary will be displayed based on a fiscal year which will be July of one year through June of the next year. to insert detailed information on these forms such as your TID, business name Occasionally, post-retirement increases are lower than the percentages listed above. paper returns and mail them to us, returns are available if you click the Phone: 775.687.4200 | 702.486.3900 | Toll Free: 866.473.7768, Carson City | 693 W. Nye Lane, Carson City, NV 89703 | Fax: 775.687.5131, Las Vegas | 5740 S. Eastern Ave, Suite 120, Las Vegas, NV 89119 | Fax: 702.678.6934, Change of Personal Information Form (Non Retirees), Proof of Birth Date and Name Change Documentation, Purchase of Service Worksheet - Members Hired Prior to January 1, 2010, Purchase of Service Worksheet - Members Hired January 1, 2010 - June 30, 2015. Common Forms link on the menu located at the top of the page on the left `I :Hl. Log into your account using the username and password you selected. endstream endobj startxref %PDF-1.6 % We strongly recommend you read our Disability Retirement Guide. Once your purchase is paid in full, you will receive written confirmation and the service credit will be added to your account. Thats why it can be best to seek the help of professionals like QDRO Masters at Willick Law Group to help guide through the complex process of dealing with claims on retirement benefits that are a part of divorce or property settlements. In Nevada, a worker must have worked for five years in order to be vested in the system and get a retirement pension. You may purchase as little as one day or any combination of years, months and days provided it doesn't exceed the five year maximum. Counselors are available to assist you in completing your application in both our Carson City and Las Vegas offices, or you may mail in your completed application directly to our Carson City office. Some public employers require mandatory participation under the ER Paid plan for their employees and others, like the State, allow for a choice. Member Information Please providemailing address where refund check should be sent. Both the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO) may reduce your SSA benefits based on the amount of pension you receive. These forms may be completed by simply selecting the form below. Service credit is the accumulation of the actual years, months and days you worked for your public employer while in a PERS eligible position. Notice To Employees (Required Poster) NOTICE ENG WebContact the PERS office and request a Refund Request Form. Six to eight months before your intended retirement date, we recommend you review the Pre-Retirement Guide publication and obtain an estimate of your retirement benefit by contacting one of our offices and requesting one. Box 5 represents the amount of your benefit received that year that is not subject to taxes based on the non-taxable employee contributions you paid to the system prior to your retirement. If not, lets us know and we will get it added. We will confirm how you plan to pay for the purchase at that time. Survivors include a spouse or registered domestic partner, designated survivor beneficiary with or without additional payees, and dependent children who are under the age of 18 at the time or your death. through the mail. You may repay the refund through a lump-sum payment, through payroll deductions with interest, or by a lump-sum rollover from a qualified tax-deferred plan. : 1-800-326-5496 ( :1-800-545-8279). take as long as 15 days for your check to clear your account. CH : Nu bn ni Ting Vit, c cc dch v h tr ngn ng min ph dnh cho bn. WebRefund Request Form INSTRUCTIONS: Please complete this request and mail to the address above, or fax to the Employer Account Service Unit at (775) 684-6367. The time being purchased and the cost of your purchase b. The average of a member's 36 highest consecutive months of compensation as certified by the public employer. Right click on the form icon then select SAVE TARGET These forms may be completed by simply selecting the form below. For more information on how this works, contact the Nevada PERS office. 5. The total earned percentage is multiplied by average compensation. Post-retirement increases are paid in the month following the month in which you retired. Please fill in your information, print, sign and mail/fax to PERS. Payments of check or money orders are accepted in office and 3. Payments can be made via cash only with visits to the district Owner is the term you will see when setting up or validating your account, but it describes you, the retiree. WebYou may request a transfer from your NDC account to Nevada PERS for service repurchase or payment while you are still working. Members newly enrolled in PERS on or after January 1, 2010 are not entitled to receive the 5% increase. State of Nevada employees voluntarily choose to participate in either of the two plans mentioned above. Members who have qualifying military service in Operation Desert Storm, Operation Iraqi Freedom or Operation Enduring Freedom may purchase additional service credit beyond the 5 years once they have completed the initial 5 year purchase. to insert detailed information on these forms such as your TID, business name You may click here to get blank forms from our black ink. July 1, 2008 payments of $10,000 or more in aggregate are required to be done hb``a`` 0f fa8$*|,|vj:_q1AA[.bd`84>6 +7C7'B4pW8c + 182 0 obj <> endobj