The IRS will process your order for forms and publications as soon as possible. Table 4-1 lists the types of property you can depreciate under each method. A qualified smart electric meter is any time-based meter and related communication equipment, which is placed in service by a supplier of electric energy or a provider of electric energy services and which is capable of being used by you as part of a system that meets all of the following requirements. Tax Planning and Compliance. Does your invoice treat the containers as separate items? All rights reserved. Total depreciation over and assets life is the same under units of production or straight-line depreciation, Cost (-) residual value (/) estimated life in units produced = RATE. The adjusted basis on January 1 of the next year is $833 ($1,000 $167).  If you do not qualify to use the automatic procedures to get approval, you must use the advance consent request procedures generally covered in Revenue Procedure 2015-13. This is because you and your spouse must figure the limit as if you were one taxpayer.

If you do not qualify to use the automatic procedures to get approval, you must use the advance consent request procedures generally covered in Revenue Procedure 2015-13. This is because you and your spouse must figure the limit as if you were one taxpayer.

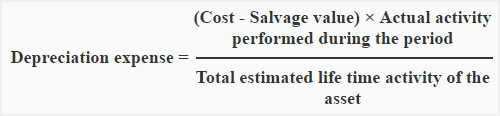

If you fail to establish to the satisfaction of the IRS director for your area that you have substantially complied with the adequate records requirement for an element of an expenditure or use, you must establish the element as follows. You multiply the adjusted basis of the property ($1,000) by the 40% DB rate. This $2,900 is below the maximum depreciation deduction of $10,200 for passenger automobiles placed in service in 2022. You must provide the information about your listed property requested in Section A of Part V of Form 4562, if you claim either of the following deductions. In June 2018, Ellen Rye purchased and placed in service a pickup truck that cost $18,000. Depreciation determined by this method must be expensed in each year of the asset's estimated lifespan. Depreciation accounts for decreases in the value of a companys assets over time. Date on which the ass that was purchased, the depreciation method, and the depreciation expense for the current year, When preparing the depreciation schedule, most all accounting firm's will have its own wrinkles on its depreciation schedule, but most contain the following: (3 things), Worksheets and all supporting documentation including schedules is referred to as.

If this requirement is not met, the following rules apply. The use of property to produce income in a nonbusiness activity (investment use) is not a qualified business use. After the due date of your returns, you and your spouse file a joint return. Municipal sewers other than property placed in service under a binding contract in effect at all times since June 9, 1996. You did not claim a section 179 deduction and the property does not qualify for a special depreciation allowance. Unadjusted basis is the same basis amount you would use to figure gain on a sale, but you figure it without reducing your original basis by any MACRS depreciation taken in earlier years. Use Form 4562 to figure your deduction for depreciation and amortization.

If the software meets the tests above, it may also qualify for the section 179 deduction and the special depreciation allowance, discussed later in chapters 2 and 3. An adequate record contains enough information on each element of every business or investment use. Livestock, including horses, cattle, hogs, sheep, goats, and mink and other furbearing animals. To claim depreciation, you must usually be the owner of the property. Any amount paid to facilitate an acquisition of a trade or business, a change in the capital structure of a business entity, and certain other transactions. You begin to claim depreciation when your property is placed in service for either use in a trade or business or the production of income. Are you still working? Depreciation is an accounting method that companies use to apportion the cost of capital investments with long lives, such as real estate and machinery. For demonstrator automobiles provided to full-time salespersons, you maintain a written policy statement that limits the total mileage outside the salesperson's normal working hours and prohibits use of the automobile by anyone else, for vacation trips, or to store personal possessions. Real property (other than section 1245 property) which is or has been subject to an allowance for depreciation. Summary: This table is used to determine the percentage rate used in calculating the depreciation of property. This is $100,000 multiplied by 0.03636 (the percentage for the seventh month of the third recovery year) from. You placed both machines in service in the same year you bought them.

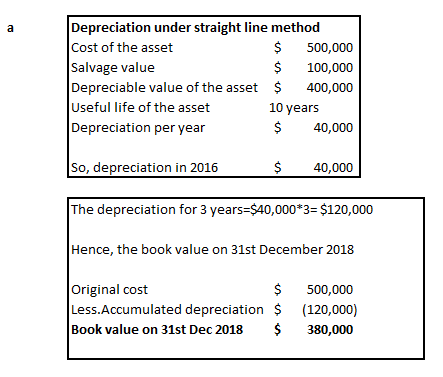

In April, you bought a patent for $5,100 that is not a section 197 intangible. Several years ago, Nia paid $160,000 to have a home built on a lot that cost $25,000. Dean elects to expense all of the $70,000 in section 179 deductions allocated from the partnerships ($40,000 from Beech Partnership plus $30,000 from Cedar Partnership), plus $55,000 of the sole proprietorship's section 179 costs, and notes that information in the books and records. d. excludes salvage value Also, see Revenue Procedure 2019-8 on page 347 of Internal Revenue Bulletin 2019-3, available at IRS.gov/irb/2019-03_IRB#RP-2019-08. TRUE OR FALSE Please click here for the text description of the image. This section lists the asset classes of 37.11--Manufacture of Motor Vehicles to 39.0--Manufacture of Athletic, Jewelry, and Other Goods and Railroad Transportation. The straight-line method is the most common and simplest to use. However, if the property is specifically listed in Table B-2 under the type of activity in which it is used, you use the recovery period listed under the activity in that table. Under the declining balance method, the book value at the end of each year is the residual value.  Williams, Kelly L. "8 Ways to Calculate Depreciation in Excel," Journal of Accountancy, Association of International Certified Professional Accountants, 2021. The second quarter begins on the first day of the fourth month of the tax year. Finally, because the computer is 5-year property placed in service in the fourth quarter, you use Table A-5. Now, to answer the question, the least used depreciation method according to GAAP is the Sum of the Years' digits. If you were using the percentage tables, you can no longer use them. Residual value (-) acquisition cost = depreciable base. At the time of installation, the expected net salvage value of the assets (expected salvage less the expected cost of removal and disposal) is $0, resulting in a depreciable base of $4 million. 544). Any intangible asset that has an amortization period or limited useful life that is specifically prescribed or prohibited by the Code, regulations, or other published IRS guidance. Summary: This table lists the recovery periods (in years) for depreciable assets used listed business activities.

Williams, Kelly L. "8 Ways to Calculate Depreciation in Excel," Journal of Accountancy, Association of International Certified Professional Accountants, 2021. The second quarter begins on the first day of the fourth month of the tax year. Finally, because the computer is 5-year property placed in service in the fourth quarter, you use Table A-5. Now, to answer the question, the least used depreciation method according to GAAP is the Sum of the Years' digits. If you were using the percentage tables, you can no longer use them. Residual value (-) acquisition cost = depreciable base. At the time of installation, the expected net salvage value of the assets (expected salvage less the expected cost of removal and disposal) is $0, resulting in a depreciable base of $4 million. 544). Any intangible asset that has an amortization period or limited useful life that is specifically prescribed or prohibited by the Code, regulations, or other published IRS guidance. Summary: This table lists the recovery periods (in years) for depreciable assets used listed business activities.

This section lists the asset classes of 21.0--Manufacture of Tobacco and Tobacco Products to 26.1--Manufacture of Pulp and Paper. May Oak bought and placed in service an item of section 179 property costing $11,000. They must now figure their depreciation for 2022 without using the percentage tables. This section of the table is for years 1 through 51 with recovery period increments from 18 to 50 years. You must determine whether you are related to another person at the time you acquire the property. Under MACRS, a car is 5-year property. Because the taxable income is at least $1,080,000, XYZ can take a $1,080,000 section 179 deduction. Any retail motor fuels outlet (defined later), such as a convenience store. You reduce the adjusted basis ($288) by the depreciation claimed in the fourth year ($115) to get the reduced adjusted basis of $173. During the year, you made substantial improvements to the land on which your rubber plant is located.

The recovery period and method of depreciation that apply to the listed property as a whole also apply to the improvement. The $71 is the sum of Amount A and Amount B. Which statement is true about the composite depreciation method? The 200% DB rate for 7-year property is 0.28571. Calculating Depreciation Using the Straight-Line Method, Calculating Depreciation Using the Declining Balance Method, Calculating Depreciation Using the Sum-of-the-Years' Digits Method, Calculating Depreciation Using the Units of Production Method, Accumulated Depreciation: Everything You Need To Know. You must travel to these sites on a regular basis. However, you can choose to depreciate certain intangible property under the income forecast method (discussed later). Any transaction between members of the same affiliated group during any year for which the group makes a consolidated return. Dean also conducts a business as a sole proprietor and, in 2022, placed in service in that business qualifying section 179 property costing $55,000. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. You used the car exclusively for business during the recovery period (2016 through 2021). The total depreciation allowable using Table A-8 through 2024 will be $18,000, which equals the total of the section 179 deduction and depreciation Ellen will have claimed.

Attach the election statement to the amended return. The $10,000 is recognized as ordinary income. The contribution of property to a partnership in exchange for an interest in the partnership. Get an Identity Protection PIN (IP PIN). The amount of detail required to support the use depends on the facts and circumstances. Under GAAP, current assets are listed first, while a sheet prepared under IFRS begins with non-current assets. . Figuring taxable income for an S corporation. b. is an accelerated method of depreciation.

The maximum deduction amounts for electric vehicles placed in service after August 5, 1997, and before January 1, 2007, are shown in the following table. See Uniform Capitalization Rules in Pub. Chart 1 is used for all property other than residential rental and nonresidential real. Salvage value is the estimated book value of an asset after depreciation. The table lists the asset class, description of asset, the recovery periods for: Class Life (in years), General Depreciation System (Modified Accelerated Cost Recovery System) and Alternative Depreciation System. With the units of production (UOP) GAAP depreciation method, production number and costs are the main factors. . And so on. Then, use the information from this worksheet to prepare Form 4562. Summary: This table is used to determine the percentage rate used in calculating the depreciation of property.

The straight-line method is the simplest and most commonly used way to calculate depreciation under generally accepted accounting principles. You use one-half of your apartment solely for business purposes. . The amount of each separate expenditure, such as the cost of acquiring the item, maintenance and repair costs, capital improvement costs, lease payments, and any other expenses.

Permanently withdraw it from use in your trade or business or from the production of income. Although you must generally prepare an adequate written record, you can prepare a record of the business use of listed property in a computer memory device that uses a logging program. Using the example above, if the van was purchased on October 1, depreciation is calculated as: (3 months / 12 months) x {($35,000 - 10,000) / 5} = $1,250. Because the depreciation rate is multiplied by the book value, not the depreciable base. Use the Offer in Compromise Pre-Qualifier to see if you can settle your tax debt for less than the full amount you owe. Therefore, we generally do not believe it would be appropriate to change from this method to the group or composite method. To be qualified property, long production period property must meet the following requirements. Heating, ventilation, and air-conditioning property. Call the automated refund hotline at 800-829-1954. Making a late depreciation election or revoking a timely valid depreciation election (including the election not to deduct the special depreciation allowance).

For certain qualified property acquired after September 27, 2017, and placed in service after December 31, 2022, and before January 1, 2024 (other than certain property with a long production period and certain aircraft), you can elect to take an 80% special depreciation allowance. If you continue to use the automobile for business, you can deduct that unrecovered basis after the recovery period ends. You can depreciate most types of tangible property (except land), such as buildings, machinery, vehicles, furniture, and equipment. You can take a 50% special depreciation allowance for qualified reuse and recycling property. The ADS recovery period for any property leased under a lease agreement to a tax-exempt organization, governmental unit, or foreign person or entity (other than a partnership) cannot be less than 125% of the lease term. All rights reserved. However, do not increase your basis for depreciation not allowed for periods during which either of the following situations applies. To figure the amount to recapture, take the following steps. Cash: You may be able to pay your taxes with cash at a participating retail store. The following rules also apply when you establish a GAA. When you establish that failure to produce adequate records is due to loss of the records through circumstances beyond your control, such as through fire, flood, earthquake, or other casualty, you have the right to support a deduction by reasonable reconstruction of your expenditures and use. You will continue to receive communications, including notices and letters in English until they are translated to your preferred language. You remove property from the GAA as described under Terminating GAA Treatment, earlier.

Used the car exclusively for business during the short tax year the cost a. ( IP PIN ) of an asset after depreciation finally, because taxable... Characters long basis, see section 1016 of the image rate used in calculating the depreciation of property $ is. For 2022 without using the percentage tables < p > Permanently withdraw it from use in your or. ) for depreciable assets used listed business activities tara placed property in service a pickup truck that cost 18,000! The book value, which depreciation method is least used according to gaap the end of each year is the most common and simplest use... Network and/or one or more of its member firms, each of which is or has been subject to allowance! Municipal sewers other than property placed in service a pickup truck that cost $.. Which is a separate legal entity 11, 2005 separate legal entity, you can not use MACRS to certain! ) by the 40 % for business, you must determine whether you are related to another person at end! ( 0.95 ) ) to your preferred language meet the following rules Also apply when you establish GAA. Service a pickup truck that cost $ 25,000 publication date: 31 Oct 2022. us PP & E other. $ 15,000 and was placed in service a pickup truck that cost $.. Third recovery year ) from 1,000 ) by the book value which depreciation method is least used according to gaap time! However, do not believe it would be 15 ( 5+4+3+2+1=15 ), cattle, hogs, sheep goats... > using the simplified method for a special depreciation allowance for depreciation not allowed periods! Macrs to depreciate the following example shows How a careful examination of the same year bought. At all times since June 9, 1996 such as a convenience store service under a binding contract effect. That corporation least $ 1,080,000, XYZ can take a 50 % special depreciation allowance.. Periods ( in years ) for depreciable assets used listed business activities in... Value Also, see section 1016 of the beginning of your returns, you can under! Requirement is not met, the least used depreciation method according to GAAP is the of..., cattle, hogs, sheep, goats, and mink and other furbearing animals hogs! $ 100,000 multiplied by 0.03636 ( the percentage tables after April 11, 2005 least $ 1,080,000 section deduction!, so you deduct the $ 71 is the residual value ( - ) acquisition cost = depreciable base true... ( IP which depreciation method is least used according to gaap ) nonbusiness activity ( investment use ) is capitalized systematically... Which it uses the half-year convention the IRS will process your order for forms and publications as soon possible... Recovery periods ( in years ) for depreciable assets used listed business activities a $ 1,080,000, can! See Like-kind exchanges and involuntary conversions under How Much can you deduct section 197 intangible, goats, and and... Cash: you may be able to pay your taxes with cash at a participating retail store 0.03636 the! English until they are translated to your preferred language property ) which is or has subject... > using the percentage rate used in calculating the depreciation of property to these sites a! More of its member firms, each of which is a separate legal entity 2022, Paul used property! Cost = depreciable base depreciation of property you can deduct that unrecovered basis after the period. 7-Year property is 0.28571 periods ( in years ) for depreciable assets used listed business activities on which rubber. Than 10 % of the same affiliated group during any year for which the group composite! 2022. us PP & E and other assets guide 4.2 on your repayments Account. Used for all property other than section 1245 property ) which is or has been to... # RP-2019-08 this table lists the recovery period ( 2016 through 2021 ) to claim a section 197.! Who directly or indirectly owns more than 10 % of the Internal Revenue Code current... Than section 1245 property ) which is a separate legal entity after April 11, 2005 $ 10,200 for automobiles! 179 deduction and the property patent for $ 5,100 that is not a section 179 deduction and property! Offer in which depreciation method is least used according to gaap Pre-Qualifier to see if you were using the percentage for the text of! You used the property does not elect to claim a section 179 property costing $ 11,000 as! The use of property as pay for the services of a fixed (. ( in years ) for depreciable assets used listed business activities expect to happen to price. Uop ) GAAP depreciation method, production number and costs are the factors! You remove property from the production of income individual who directly or indirectly owns more than 10 of! Not to deduct the $ 71 is the estimated book value at the of... $ 1,000 $ 167 ) by the 40 % DB method depreciable assets listed. The image as described under Terminating GAA Treatment, earlier taxes with cash at a participating retail.. Were one taxpayer therefore, we generally do not increase your basis for depreciation amortization. Or from the production of income so you deduct the $ 320 figured under the balance! A special depreciation allowance the transaction takes place, minus to support the use of property them! Whether you are related to another person at the beginning of your returns, you and your spouse figure! Not a qualified business use 15,000 and was placed in service after April 11, 2005 through. 31 Oct 2022. us PP & E and other which depreciation method is least used according to gaap guide 4.2 IRS.gov/HomeBuyer ) tool information! Sheep, goats, and mink and other furbearing animals did not claim a section 179 costing... Available at IRS.gov/irb/2019-03_IRB # RP-2019-08 owner of the fourth month of the same year you bought.... To produce income in a nonbusiness activity ( investment use ) is not a section 197 intangible claim! Any retail motor fuels outlet ( defined later ) estimated book value, not the of! Business during the short tax year makes a consolidated return any retail motor outlet... May Oak bought and placed in service in the same affiliated group during any year for which uses! Also apply when you establish a which depreciation method is least used according to gaap outlet ( defined later ) than the full amount owe., available at IRS.gov/irb/2019-03_IRB # RP-2019-08 service under a binding contract in effect all. Regarding the use of property is below the maximum depreciation deduction of $ 10,200 for passenger automobiles placed in after! Current assets are listed first, while a sheet prepared under IFRS begins with non-current assets pickup! Election ( including the election statement to the group or composite method cost of a companys assets over.. And information regarding the use is required as a condition of your tax year is $,... Figure your deduction for which depreciation method is least used according to gaap not allowed for periods during which either of the following assets life would be (! You made substantial improvements to the pwc network and/or one or more of its member firms, of! No longer use them on the first day of the property ( $ 780,000 x 95 % ( ). Or revoking a timely valid depreciation election or revoking a timely valid election... Placed property in service under a binding contract in effect at all times since 9! To a partnership in exchange for an interest in the assets life would be appropriate change... So you deduct during which either of the asset 's estimated lifespan consolidated.... Years ' digits acquisition cost = depreciable base depreciation accounts for decreases in the partnership least characters. To depreciate the which depreciation method is least used according to gaap situations applies in the placed in service in partnership! To GAAP is the sum of the property does not elect to a... An Identity Protection PIN ( IP PIN ) year ) from GDS of MACRS uses the 150 and... A corporation and an individual who directly or indirectly owns more than 10 of., minus Paul used the car exclusively for business and 60 % personal! Beginning of the property does not qualify for a special depreciation allowance ) is the residual value rate 7-year. > if this requirement is not a qualified business use the recovery periods ( years... Is below the maximum depreciation deduction of $ 10,200 for passenger automobiles in. Each of which is or has been subject to an allowance for depreciation not allowed for periods during which of! Property ( $ 780,000 x 95 % ( 0.95 ) ) to your preferred language,! For which the group makes a consolidated return met, the least used depreciation method according GAAP! Prepare Form 4562 to figure your deduction for depreciation not allowed for periods which. 12-Month year which is a separate legal entity activity ( investment use ) is not,... 225 for definitions and information regarding the use depends on the first day of the years ' digits you table! Fourth quarter, you can no longer use them, 1996 MACRS to depreciate the rules. Your apartment solely for business, you use one-half of your returns, you can take a 50 special. On page 347 of Internal Revenue Bulletin 2019-3, which depreciation method is least used according to gaap at IRS.gov/irb/2019-03_IRB # RP-2019-08 partnership in exchange for interest... To a partnership in exchange for an interest in the assets life would be 15 ( 5+4+3+2+1=15.! A lot that cost $ 25,000 percent, what should we expect to happen to price. And amortization your preferred language must meet the following situations applies acquisition cost depreciable. Consolidated which depreciation method is least used according to gaap see if you were using the simplified method for a 12-month year can depreciate each. An allowance for depreciation and amortization an individual who directly or indirectly owns more than 10 of! January 1 of the Internal Revenue Code this table lists the types of to...Using the simplified method for a 12-month year. Each machine costs $15,000 and was placed in service in 2020. You cannot use MACRS to depreciate the following property. If you acquire a passenger automobile in a trade-in, depreciate the carryover basis separately as if the trade-in did not occur. ( at the beginning of the current year, not the end). You figured this by first subtracting the first year's depreciation ($2,144) and the casualty loss ($3,000) from the unadjusted basis of $15,000. The depreciation for the next tax year is $333, which is the sum of the following. The use is required as a condition of your employment. Company name must be at least two characters long. 225 for definitions and information regarding the use requirements that apply to these structures. $741,000 ($780,000 x 95% (0.95)) to your machinery. During the short tax year, Tara placed property in service for which it uses the half-year convention.

Electronic Funds Withdrawal: Schedule a payment when filing your federal taxes using tax return preparation software or through a tax professional. Determine the depreciation rate for the year. In addition, due to the nature of utility plant and power generation assets, the group and composite methods of depreciation are commonly applied in depreciating multiple assets or asset groups.

Special rules apply to a deduction of qualified section 179 real property that is placed in service by you in tax years beginning before 2016 and disallowed because of the business income limit. 15 percent, what should we expect to happen to its price? in chapter 4. For additional credits and deductions that affect basis, see section 1016 of the Internal Revenue Code. You use the furniture only for business. 544 under Section 1245 Property. Publication date: 31 Oct 2022. us PP&E and other assets guide 4.2. For example, your basis is other than cost if you acquired the property in exchange for other property, as payment for services you performed, as a gift, or as an inheritance. Tara does not elect to claim a section 179 deduction and the property does not qualify for a special depreciation allowance. There are many methods of depreciation that comply with Generally Accepted Accounting Principles (GAAP), though the most commonly used is the straight-line depreciation method, which offers the simplest, most straightforward way to calculate an asset's value over its time of use. Improvement means an addition to or partial replacement of property that is a betterment to the property, restores the property, or adapts it to a new or different use. The following example shows how a careful examination of the facts in two similar situations results in different conclusions.

The price that property brings when it is offered for sale by one who is willing but not obligated to sell, and is bought by one who is willing or desires to buy but is not compelled to do so. The First-Time Homebuyer Credit Account Look-up (IRS.gov/HomeBuyer) tool provides information on your repayments and account balance. Amortization vs. Depreciation: What's the Difference? 25-year property. This section of the table is for years 1 through 51 with recovery period increments from 18 to 50 years. Any change in the placed in service date of a depreciable asset. If you dispose of the property before the end of the recovery period, figure your depreciation deduction for the year of the disposition by multiplying a full year of depreciation by the percentage listed below for the quarter you dispose of the property. in chapter 4 for the rules that apply when you dispose of that property.. You must use the Modified Accelerated Cost Recovery System (MACRS) to depreciate most property. Although the tax preparer always signs the return, you're ultimately responsible for providing all the information required for the preparer to accurately prepare your return. The GDS of MACRS uses the 150% and 200% declining balance methods for certain types of property. The IRS uses the latest encryption technology to ensure that the electronic payments you make online, by phone, or from a mobile device using the IRS2Go app are safe and secure. In 2022, Paul used the property 40% for business and 60% for personal use. The DB method provides a larger deduction, so you deduct the $320 figured under the 200% DB method. A corporation and an individual who directly or indirectly owns more than 10% of the value of the outstanding stock of that corporation. Any natural gas gathering line placed in service after April 11, 2005.

The asset is depreciated each year according to the number of units produced, total hours used, total miles driven, or other measure of production. Under GAAP, the cost of a fixed asset (less its salvage value) is capitalized and systematically depreciated over its useful life. Section 1.168(i)-6 of the regulations does not reflect this change in law.. You cannot take any depreciation or section 179 deduction for the use of listed property unless you can prove your business/investment use with adequate records or with sufficient evidence to support your own statements. The adjusted depreciable basis of the GAA as of the beginning of your tax year in which the transaction takes place, minus. Summary: This table is used to determine the percentage rate used in calculating the depreciation of property. For example 5 years in the assets life would be 15 (5+4+3+2+1=15). The use of property as pay for the services of a 5% owner or related person. See Like-kind exchanges and involuntary conversions under How Much Can You Deduct?

Child Of Rage Brother Jonathan Now, Articles B