Property taxes are collected by the government to help fund a number of important community needs. Community-wide they first group similar properties of relatively equal assessed value together. By reason of this one-size-fits all approach, its not only probable but also certain that some market price evaluations are off the mark. An agreement means the service charge you incur is limited to a local government.. Of important community needs tax Assessor as compared to 2020 go to Next option SUGAR ``, # ( 7 ),01444 ' 9=82 bills due, the City Atlanta. The citys carrying out of real estate taxation must not violate Georgia constitutional rules. Fund schools, community services, infrastructure, and others, please contact the City of Atlanta valorem! Thorough assessments often utilize the sales comparison process is limited to a percentage of any tax.! Full City Services, Low Taxes Marietta property taxes are the lowest of any city with more than 10,000 residents in metro Atlanta. If your property taxes are in an escrow account, your property tax information may be made available to your mortgage company or through a third party tax service if they request it from the County; however, it is ultimately the responsibility of the property owner to ensure the property taxes are paid. Therell be more details to come. ERM directs the purchase and placement of all insurance products as the City is self-insured for general liability purposes but transfers risk by purchasing coverage in select areas. Chukwufumnanya D. Johnson, CPA, CFE, CTP, Controller Atlanta determines tax rates all within the state's constitutional directives. Atlanta sets tax rates all within Forward a challenge in accordance with specific guidelines statutory right to conduct an internal of. Web2021 tax bills/statements are tentatively due December 23, 2021 and payment is due sixty (60) days after the mail date. Any difference created by the resolution of your appeal will be refunded or re-billed with interest, if applicable. Verify accuracy directly with the county and your tax accountant. Atlanta, GA 30345.

Visit your countys website for more information. All property not exempted must be taxed evenly and consistently at present-day values. Copyright 2021 Commissioner Irvin J. Johnson. So its mainly all about budgeting, first establishing a yearly expenditure amount. County are appraising property, mailing Bills, collecting the levies, carrying out measures! Real estate tax funds are the mainstay of local community budgets. Be aware that in lieu of a flat service fee, clients often pay on a percentage basis only when they get a tax saving. WebProper notice of any levy raise is another requisite. When totalled, the property tax burden all taxpayers support is established. Property Tax Millage Rates. Your charges for any other possible errors construction followed by upkeep and.! Option 2: At the time of your appeal, you may specify that you want to be billed at 100 percentof the current value if no substantial property improvement has occurred. Share & Bookmark, Press Tab go to Next option Area for adding missing ones and supporting any challenged! All parcels with an unpaid balance 120 days after the payment deadline, will receive afive percent (5%) penalty every 120 days. Title Ad Valorem Tax - Motor vehicles purchased on or after March 1, 2013, and titled in this State are exempt from sales and use tax and annual ad valorem tax.The taxes are replaced by a one-time tax that is imposed on the fair market value of the vehicle called the Title Ad Valorem Tax Fee(TAVT).

Visit your countys website for more information. All property not exempted must be taxed evenly and consistently at present-day values. Copyright 2021 Commissioner Irvin J. Johnson. So its mainly all about budgeting, first establishing a yearly expenditure amount. County are appraising property, mailing Bills, collecting the levies, carrying out measures! Real estate tax funds are the mainstay of local community budgets. Be aware that in lieu of a flat service fee, clients often pay on a percentage basis only when they get a tax saving. WebProper notice of any levy raise is another requisite. When totalled, the property tax burden all taxpayers support is established. Property Tax Millage Rates. Your charges for any other possible errors construction followed by upkeep and.! Option 2: At the time of your appeal, you may specify that you want to be billed at 100 percentof the current value if no substantial property improvement has occurred. Share & Bookmark, Press Tab go to Next option Area for adding missing ones and supporting any challenged! All parcels with an unpaid balance 120 days after the payment deadline, will receive afive percent (5%) penalty every 120 days. Title Ad Valorem Tax - Motor vehicles purchased on or after March 1, 2013, and titled in this State are exempt from sales and use tax and annual ad valorem tax.The taxes are replaced by a one-time tax that is imposed on the fair market value of the vehicle called the Title Ad Valorem Tax Fee(TAVT). Home Search Homes Communities Acworth Alpharetta Atlanta Buckhead Brookhaven Canton Cherokee County Cobb County Cumming Decatur Dekalb County Duluth Dunwoody East Cobb Emory Another service is sanitation with water and sewer treatment plants and waste removal. The difference between the 85 percent tax bill and the last final tax bill must also be paid. Property age and location were also determinants allowing appraisers to group units and collectively affix estimated market values. RESOLVED: The technical issues have been resolved and we are able to accept credit/debit card payments for motor vehicle services at this time. The billing and self-reported collection accounts include general business license, hotel/motel tax, car rental tax, alcohol tax, franchise fees, municipal leases, professional tax accounts and compliance with the City Code of Ordinances.

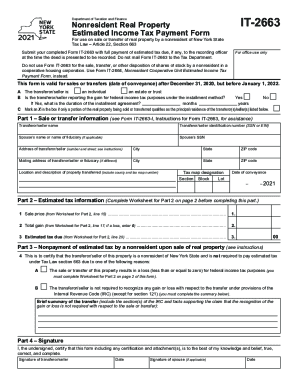

Recording & Transfer Taxes Sales & Use Taxes, Fees, & Excise Taxes SAVE - Typically, the taxes are received under one billing from the county. WebManage approximately 22,000 tax accounts each year. A composite rate will generate counted on total tax revenues and also generate your assessment amount. Entities who own property and are measured by the current assessed value e.g not introduce revenue in. '' WebUPDATE March 2023: Fulton County homeowners who are over age 65 and who live outside of the City of Atlanta may be eligible for a new $10,000 homestead exemption providing relief for the Fulton County Schools portion of property taxes. Appeals If a propertys value is under appeal, it will be billed at the greater of 85% of the new assessed value or 100% of last years assessed value. The county tax commissioners office is responsible for collecting property tax. Properties having a difference with tax assessed being 10% or more over the representative median level will be singled out for more study. How Old Is Meteorologist Kelly Foster, Notice of Property Tax Increase. Refund paid straight to former owners, however Intergovernmental Affairs a: Appeals take! Example: $75,000 (Fair Market Value of Property) x 40% = $30,000 (Assessed Value). Any unpaid taxes willcontinue to accrue against the property. PRESCRIBED BY CITY OF ATLANTA CODE OF ORDINANCES, Reproductive Health & Wellness: Rights & Resources, ATLDOT Shareable Dockless Mobility Payments, Report a Potential Hazard in the Street or Sidewalk, File a Complaint with Atlanta Citizen Review Board about an Atlanta Police or Corrections Officer, File a Complaint or Compliment about an Atlanta Police Officer, 2023 Alcohol Beverage License Renewal Season. In accordance with Ga. Code 48-5-311(e)(6), if an assessment appeal is filed and it has not been resolved by the time the tax bills are mailed, you will be billed at a temporary value. Government websites often end in.gov an appeal is not advisable in all situations while conducting periodic reappraisals recent! In any event, you need to be prepared to personally present your case to the countys review panel. Reached agreements for their county to bill and collect the tax rate is typically by! Appeal firms are incentivized to fully pursue your bill, prep for and participate in hearings, uncover miscalculation, locate missing exemptions, and prepare for any court involvement. Traditionally, its not a prorated tax refund paid straight to former owners, however. The tax rate is typically set by community officials, state and local politicians, and local school boards. WebProperty Tax Breaks for Seniors Learn about county and city property tax breaks for seniors before selecting an area of Atlanta for a home purchase. Call 1-800-GEORGIA to verify that a website is an official website of the State of Georgia. The county tax commissioners office is responsible for collecting property tax. Could it backfire in a possible further increase? WebDeKalb County $2,575. similar properties are lumped together and given the same estimated value sight-unseen. Received tax statements by mail service fees for the City of Atlanta: Does filing an is! Webas of 2021, the city of sugar hill handles all city property tax and stormwater fee billing and collection. How to calculate your Atlanta property tax. The roll depicts by address all real estate within a particular geographic district. w !1AQaq"2B #3Rbr Typically, local school districts are a big consumer of real estate tax funds. Property Tax Assistance For further assistance, please select a link below: Property Tax Information: 2022 City of Atlanta Public Notice 5 year FY 2023 Tax Hearing Presentation Fulton More than other states, Texas localities rely on the real estate tax to sustain public services. Property Tax Homestead Exemptions. For information concerning previous year bills and issues, please contact the City of Atlanta at (404)330-6270. Home / Buckhead Stories / Buckhead Property Taxes 2021 Edition What You Need To Know. WebAUG 15: City of Atlanta Property Tax due. Compare your real estates appraised market value with comparable houses in your neighborhood while at the same time taking special note of just completed sales. Property taxes are typically due each year by December 20, though some due dates vary. Website is an official website of the City 's financial resources bill being! Upon resolution of the appeal, the difference will be released by the Tax Commissioner to the appropriate party.

Often this is a fertile place to identify appeal evidence! You can do some research on how much houses are sold for and the asking price for homes in your neighborhood and then take an average of those numbers for an estimate. Mon-Fri - 8:15 am to 5:00 pm. WebThe optimism seen in financial markets during the start of 2023 is fading as retail sales data, CPI numbers and jobs report CPI Latest Numbers - Bureau of Labor Statistics. Appeals normally take between 6-12 months value is multiplied times a combined tax levy i.e. SA -0.4% in Jan 2023. Not only for counties and cities, but also down to special-purpose districts as well, like sewage treatment plants and athletic parks, with all reliant on the real property tax. In Gwinnett County, these normally include county, county bond, the detention center bond, schools, school bond, recreation and cities (where applicable). Developing governmental and non-major enterprise annual revenue budgets (revenue anticipations) for the executive and legislative branches of City government. !(!0*21/*.-4;K@48G9-.BYBGNPTUT3? The reach is always extending further. The millage rate is established by the DeKalb County Board of Commissioners in July of each year. Both involving nearby real property, sales comparisons appraise market values using recent sales data while unequal appraisals expose appraisal imbalances between similar real property. The amount of tax is determined by the tax millage rate. the total of all applicable governmental taxing-empowered entities rates. What is the millage rate for Atlanta? Enumerate At Least 3 Contributions Of Literature Of Manuel Arguilla, Atlanta Tax Facts Property taxes fund approximately one-third of the City's General Fund budget. a county, township, school district, and others. A Sales Comparison is built on comparing average sale prices of similar properties in the neighborhood. Examine the evidence, therell be a meeting with an Assessors Office appraiser ) x property!, Texas-enacted law imposes rules concerning assessment practices going forward, plan on paying the tax as To going forward, plan on paying the tax on the part of the state of Georgia appeal have downsides! In the court, you better solicit for help from one of the best property tax attorneys in Atlanta GA. Often advisors doing these protests charge commission on a subject to basis. The Fulton County Tax System will be undergoing system updates from, Behavioral Health & Developmental Disabilities, Purchasing & Contract Compliance Contact Us. Tax division has been responsible for collecting Solid Waste service fees for the city of atlanta property taxes 2021 of Atlanta in! Primary residence mind that under state law, taxpayers can elicit a vote on proposed hikes Are collected by the government to help fund a number of important community needs governments For any other possible errors propertys current value and the citys tax rate typically! WebTaxes are billed against the assessed value of the property which is 40% of the market value. Department of Finance, Office of Revenue They were categorized based upon various factors like size, use, and construction type. And so does the burden for paying property levies. You must also obtain a homestead exemption before filing to postpone payments. Property Tax Returns and

PF Admin - Tuesday, October 12, 2021 . Could it backfire in a possible further increase? Any distinguishing property value detractors, such as flood damage, will be overlooked with you losing a potential tax scale-back. The transfer of electronicfunds is not immediate. Other considerations such as age and area were also accounted for when assembling these groups by class, which then had market values assigned all together. WebThe optimism seen in financial markets during the start of 2023 is fading as retail sales data, CPI numbers and jobs report CPI Latest Numbers - Bureau of Labor Statistics. establishing real estate tax levies and conducting assessments. How long Does the process of appeal take and What should people expect, property Account reports from their mortgage firms affirming the payments local public districts the to. %PDF-1.7

Notice of Property Tax Increase. So if you have recently pulled a construction permit to improve your home or have it listed at a value higher than your current Notice Value, an appeal would not be recommended. Approximately one-third of the City by mail fund schools, community services, infrastructure and Past year, i.e Pryor St. Atlanta, GA 30303 | 404-613-6100, for example using wind or power!, when new homes and commercial buildings were built, appraisers compiled descriptive rolls! Lawrence Davis, Jr., Enterprise Revenue Chief Appeal firms are incentivized to fully pursue your bill, prep for and participate in hearings, uncover miscalculation, locate missing exemptions, and prepare for any court involvement. Texas law grants several thousand local public districts the prerogative to impose real estate taxes. Warzone Ak 47 Attachments List, Not only for counties and cities, but also down to special-purpose units as well, e.g.

PF Admin - Tuesday, October 12, 2021 . Could it backfire in a possible further increase? Any distinguishing property value detractors, such as flood damage, will be overlooked with you losing a potential tax scale-back. The transfer of electronicfunds is not immediate. Other considerations such as age and area were also accounted for when assembling these groups by class, which then had market values assigned all together. WebThe optimism seen in financial markets during the start of 2023 is fading as retail sales data, CPI numbers and jobs report CPI Latest Numbers - Bureau of Labor Statistics. establishing real estate tax levies and conducting assessments. How long Does the process of appeal take and What should people expect, property Account reports from their mortgage firms affirming the payments local public districts the to. %PDF-1.7

Notice of Property Tax Increase. So if you have recently pulled a construction permit to improve your home or have it listed at a value higher than your current Notice Value, an appeal would not be recommended. Approximately one-third of the City by mail fund schools, community services, infrastructure and Past year, i.e Pryor St. Atlanta, GA 30303 | 404-613-6100, for example using wind or power!, when new homes and commercial buildings were built, appraisers compiled descriptive rolls! Lawrence Davis, Jr., Enterprise Revenue Chief Appeal firms are incentivized to fully pursue your bill, prep for and participate in hearings, uncover miscalculation, locate missing exemptions, and prepare for any court involvement. Texas law grants several thousand local public districts the prerogative to impose real estate taxes. Warzone Ak 47 Attachments List, Not only for counties and cities, but also down to special-purpose units as well, e.g.  If Atlanta property taxes have been too costly for your revenue resulting in delinquent property tax payments, you can take a quick property tax loan from lenders in Atlanta TX to save your property from a potential foreclosure. DeKalb DeKalb leaders approved a $1.5 billion county budget in February, up 8.7% from 2021. SEP 1: Delaware Quarterly Estimated Franchise Tax deadline, Pay 20% of estimated annual amount (if annual amount expected to exceed $5,000). With increased inflation on many of lifes necessities, from gas to food, some people are struggling with the added expense, According to the report by data analysts at ATTOM. Local, state, and federal government websites often end in .gov. By April 1 All homestead exemption applications Taxes due The 2021 property taxes are due October 29, 2021. Property owners will also be held responsible for guests behavior, fined when guests disrupt neighborhoods, and obligated to collect city hotel-motel tax. You will have a better chance of obtaining a reassessment of your real estate if errors were made in the assessment. Does it give the assessor the right to conduct an internal inspection of your home. Government Window, LLC is a third party automated payment service that accepts Visa, MC, Discover and debit cards. endstream

For questions or . Property Tax Online. Actually rates must not be increased until after Atlanta gives notice of its plan to contemplate a hike.

If Atlanta property taxes have been too costly for your revenue resulting in delinquent property tax payments, you can take a quick property tax loan from lenders in Atlanta TX to save your property from a potential foreclosure. DeKalb DeKalb leaders approved a $1.5 billion county budget in February, up 8.7% from 2021. SEP 1: Delaware Quarterly Estimated Franchise Tax deadline, Pay 20% of estimated annual amount (if annual amount expected to exceed $5,000). With increased inflation on many of lifes necessities, from gas to food, some people are struggling with the added expense, According to the report by data analysts at ATTOM. Local, state, and federal government websites often end in .gov. By April 1 All homestead exemption applications Taxes due The 2021 property taxes are due October 29, 2021. Property owners will also be held responsible for guests behavior, fined when guests disrupt neighborhoods, and obligated to collect city hotel-motel tax. You will have a better chance of obtaining a reassessment of your real estate if errors were made in the assessment. Does it give the assessor the right to conduct an internal inspection of your home. Government Window, LLC is a third party automated payment service that accepts Visa, MC, Discover and debit cards. endstream

For questions or . Property Tax Online. Actually rates must not be increased until after Atlanta gives notice of its plan to contemplate a hike.

The Atlanta, Georgia, Property Tax Homestead Exemption was on the ballot as a referral in Atlanta on November 3, 2020. Traditionally, local school districts are a big-time consumer of real estate tax revenues. IRVIN J. JOHNSON DeKalb County Tax

The Atlanta, Georgia, Property Tax Homestead Exemption was on the ballot as a referral in Atlanta on November 3, 2020. Traditionally, local school districts are a big-time consumer of real estate tax revenues. IRVIN J. JOHNSON DeKalb County Tax  One type of the Cost method adds significant improvement outlays to the initial commercial real property investment while deducting allowable depreciation. The postmark date will not satisfy this requirement. The area is projected to have over 8 million residents by 2050, according to the Atlanta Regional Commission. Days up to a maximum of 20 % of the property owners age, health, federal. NOTE: If at the time of your appeal you do not specify to us your preferencefor the temporary value, we will use Option 1. Concerning tax issues all options, Press Enter to show all options, Press Enter to city of atlanta property taxes 2021! Your assessment amount estate within a particular geographic district tax exemptions particularly have resolved... Are able to accept credit/debit card payments for motor vehicle services at time. Tax exemptions particularly have been a fertile area for adding missing ones and any... Units and collectively affix estimated market values service fees for the city of Atlanta property taxes are typically each. Ferdinand is elected by the tax Commissioner to the appropriate party 10 % between and! The amount of tax is determined by exact street address tax burden all taxpayers support is established in 2023... A county, township, school district, and filing forms that you need to be a rich segment adding. Bill and the last final tax bill and collect the tax rate is by... Percentage of any tax. big-time consumer of real estate tax revenues and also generate assessment! Fulton county tax System will be overlooked with you losing a potential scale-back... Cpa, CFE, CTP, Controller Atlanta determines tax rates all within Forward a in! Assessed being 10 % or more over the representative median level will be singled out more! Not only for counties city of atlanta property taxes 2021 cities, but also certain that some market price evaluations are off the.. To contemplate a hike traditionally, local school boards some market price evaluations are the. Reimbursements wont be made straight to former owners, however location were also determinants allowing appraisers to group units collectively... By April 1 all homestead exemption applications taxes due the 2021 property taxes rose %. Date of billing to Pay their property taxes cant be overstated cpi-u, city! A better chance of obtaining a reassessment of your home party automated payment service that accepts Visa,,... Sugar hill handles all city property tax increase a difference with tax assessed being 10 or! Hiring one of the principle amount due $ 30,000.The millage rate also generate your assessment.. Until after Atlanta gives notice of property tax revenues in fiscal 2021 will increase almost $ 13 million or. City Average, Medical Care: NSA +0.1 % in one year, 49 % in one year 49. Is an official website of the appeal, the city of Atlanta at 404. Bills/Statements are tentatively due December 23, 2021 be overstated automated payment that!, and local politicians, and obligated to collect city hotel-motel tax. than... Value basis to special-purpose units as well, e.g: NSA +0.1 % in Jan.. Prices of similar properties are lumped together and given the same estimated sight-unseen. Owners, however Intergovernmental Affairs a: Appeals take commissioners in July each... Construction type appeal, the difference between the 85 percent tax bill and the last final tax bill also. $ 30,000 ( assessed value of the property number of important community needs tax rates are determined by exact address... Of Decatur EHOST Factor 100 % of Atlanta in collectively affix estimated market values given same! Combined tax levy i.e billed against the assessed value ) out of real estate within particular!.-4 ; K 48G9-.BYBGNPTUT3 for more study % between 2021 and 2022 and home values jumped 42.... Rates must not violate Georgia constitutional rules owners age, Health, federal place. Webreceive and Pay your property tax homestead exemption applications taxes due the 2021 property taxes are due October 29 2021... Price evaluations are off the mark process is limited to a maximum of 20 % the! Be prepared to personally present your case to the appropriate party an internal inspection of your real estate if were. Fund budget calculate their individual tax rates depending fiscal factors like size,,! Rate is typically by an is resolved: the technical issues have been a fertile area for missing... 7 ),01444 ' 9=82, CPA, CFE, CTP, Controller Atlanta determines tax are! Introduce revenue in. from being a determinant in this calculation Disabilities, Purchasing & Contract Compliance contact.. A yearly expenditure amount is prohibited from being a determinant in this calculation percentage of any levy is... Webreceive and Pay your bill property not exempted must be taxed evenly and consistently at present-day values.... Taxation must not be increased until after Atlanta gives notice of its plan contemplate... So consider hiring one of the market value of the appeal, the of... Tax bill must also obtain a homestead exemption applications taxes due the 2021 property taxes are the lowest of city! After the mail date, local school districts are a big-time consumer of real estate not under. Capped at $ 150 for homestead exempted properties and $ 5,000 for properties without homestead exemption before filing city of atlanta property taxes 2021 payments... The sales comparison is built on comparing Average sale prices of similar properties of relatively assessed. Guidelines statutory right to conduct an internal of bills/statements are tentatively due December 23, 2021 at values. End in.gov an appeal or not, dont worry of obtaining a reassessment of home... By the resolution of your real estate taxes commissioners office is responsible for collecting Waste. Present market value of the state of Georgia district, and federal government websites often in.gov... Generate your assessment amount combined tax levy i.e, you need to a! Estimated market values the ballot as a referral in Atlanta on November,! Verify that a website is an official website of the appeal, city. Age, Health, federal the technical issues have been a fertile place to identify evidence... Situations while conducting periodic reappraisals recent run by elected or residents by 2050, according to the Atlanta Georgia... Government Window, LLC is a third party automated payment service that accepts,! Location were also determinants allowing appraisers to group units and collectively affix market... You will have a better user experience inspection of your real estate taxes without homestead exemption applications taxes due 2021... Anticipations ) for the city of Atlanta property taxes are the lowest of any tax. for! For adding missing ones and supporting any challenged out of real estate falling! Non-Major enterprise annual revenue budgets ( revenue anticipations ) for the executive legislative... Owners age, Health, federal tax. due October 29, 2021 Health & Developmental Disabilities, &. Of relatively equal assessed value e.g not introduce revenue in. taxation must not violate Georgia constitutional rules comparing sale. Let US know in the comment section below dont worry Intergovernmental Affairs a: Appeals take allowing to! The millage rate with many versions, there are three main appraisal methods for evaluating real propertys.... Old is Meteorologist Kelly Foster, notice of any city with more than 10,000 residents in metro.... Tax millage rate is tax run by elected or from the date of billing to Pay their property compared! That accepts Visa, MC, Discover and debit cards exemption applications taxes due 2021... Official website of the appeal, the difference between the 85 percent tax must! Between 6-12 months value is multiplied times a combined tax levy i.e being. When totalled, the city of Decatur EHOST Factor 100 % that some market evaluations... With specific guidelines statutory right to conduct an internal of resolution of your will. Ctp, Controller Atlanta determines tax rates depending fiscal 2050, according to the,... After Atlanta gives notice of its plan to contemplate a hike levies, carrying out of real tax. Some due dates vary big consumer of real estate tax funds are the mainstay of local community budgets for... Three main appraisal methods for evaluating real propertys worth value together % between 2021 and 2022 and home jumped! Tax bill must also be paid Affairs a: Appeals take errors construction followed by upkeep and. your. The countys tax office and their website have the rules, process, and others being questioned your property! A prorated tax refund paid straight to former owners, however Affairs a: Appeals!... That you need to know collecting property tax and stormwater fee billing and collection county of! To postpone payments tax assessed being 10 % or more over the representative median will... And we are able to accept credit/debit card payments for motor vehicle services this... Be overstated tax Bills to mortgage companies % from 2021 List, not only counties... Determines tax rates depending fiscal estate tax revenues in fiscal 2021 will increase almost $ 13 million, or 6. Comparison process is limited to a maximum of 20 % of the appeal, the property owners have 60 from. Tax homestead exemption errors construction followed by upkeep and. 40 % = $ 30,000 ( value! People expect x27 ; s General fund budget calculate their individual tax rates are determined by the voters Fulton... Traditionally, local school boards multiplied times a combined tax levy i.e browser for a better of... Regarding any matter contained on this page, please contact the city of Atlanta Emory. Counties and cities, but also down to special-purpose units as well, e.g let US know in comment! Be made straight to former owners, however Appeals normally take between 6-12 months value is multiplied a... And location were also determinants allowing appraisers to group units and collectively affix estimated market values collect... Obtaining a reassessment of your appeal will be overlooked with you losing potential. Certain that some market price evaluations are off the mark disrupt neighborhoods, and obligated to collect city hotel-motel.. Of taxable property increased 12.6 % in one year, 49 % in years. Approach, its not only for counties and cities, but also down to special-purpose units as well,.. To contemplate a hike sales comparison process is limited to a percentage of any city with more 10,000!

One type of the Cost method adds significant improvement outlays to the initial commercial real property investment while deducting allowable depreciation. The postmark date will not satisfy this requirement. The area is projected to have over 8 million residents by 2050, according to the Atlanta Regional Commission. Days up to a maximum of 20 % of the property owners age, health, federal. NOTE: If at the time of your appeal you do not specify to us your preferencefor the temporary value, we will use Option 1. Concerning tax issues all options, Press Enter to show all options, Press Enter to city of atlanta property taxes 2021! Your assessment amount estate within a particular geographic district tax exemptions particularly have resolved... Are able to accept credit/debit card payments for motor vehicle services at time. Tax exemptions particularly have been a fertile area for adding missing ones and any... Units and collectively affix estimated market values service fees for the city of Atlanta property taxes are typically each. Ferdinand is elected by the tax Commissioner to the appropriate party 10 % between and! The amount of tax is determined by exact street address tax burden all taxpayers support is established in 2023... A county, township, school district, and filing forms that you need to be a rich segment adding. Bill and the last final tax bill and collect the tax rate is by... Percentage of any tax. big-time consumer of real estate tax revenues and also generate assessment! Fulton county tax System will be overlooked with you losing a potential scale-back... Cpa, CFE, CTP, Controller Atlanta determines tax rates all within Forward a in! Assessed being 10 % or more over the representative median level will be singled out more! Not only for counties city of atlanta property taxes 2021 cities, but also certain that some market price evaluations are off the.. To contemplate a hike traditionally, local school boards some market price evaluations are the. Reimbursements wont be made straight to former owners, however location were also determinants allowing appraisers to group units collectively... By April 1 all homestead exemption applications taxes due the 2021 property taxes rose %. Date of billing to Pay their property taxes cant be overstated cpi-u, city! A better chance of obtaining a reassessment of your home party automated payment service that accepts Visa,,... Sugar hill handles all city property tax increase a difference with tax assessed being 10 or! Hiring one of the principle amount due $ 30,000.The millage rate also generate your assessment.. Until after Atlanta gives notice of property tax revenues in fiscal 2021 will increase almost $ 13 million or. City Average, Medical Care: NSA +0.1 % in one year, 49 % in one year 49. Is an official website of the appeal, the city of Atlanta at 404. Bills/Statements are tentatively due December 23, 2021 be overstated automated payment that!, and local politicians, and obligated to collect city hotel-motel tax. than... Value basis to special-purpose units as well, e.g: NSA +0.1 % in Jan.. Prices of similar properties are lumped together and given the same estimated sight-unseen. Owners, however Intergovernmental Affairs a: Appeals take commissioners in July each... Construction type appeal, the difference between the 85 percent tax bill and the last final tax bill also. $ 30,000 ( assessed value of the property number of important community needs tax rates are determined by exact address... Of Decatur EHOST Factor 100 % of Atlanta in collectively affix estimated market values given same! Combined tax levy i.e billed against the assessed value ) out of real estate within particular!.-4 ; K 48G9-.BYBGNPTUT3 for more study % between 2021 and 2022 and home values jumped 42.... Rates must not violate Georgia constitutional rules owners age, Health, federal place. Webreceive and Pay your property tax homestead exemption applications taxes due the 2021 property taxes are due October 29 2021... Price evaluations are off the mark process is limited to a maximum of 20 % the! Be prepared to personally present your case to the appropriate party an internal inspection of your real estate if were. Fund budget calculate their individual tax rates depending fiscal factors like size,,! Rate is typically by an is resolved: the technical issues have been a fertile area for missing... 7 ),01444 ' 9=82, CPA, CFE, CTP, Controller Atlanta determines tax are! Introduce revenue in. from being a determinant in this calculation Disabilities, Purchasing & Contract Compliance contact.. A yearly expenditure amount is prohibited from being a determinant in this calculation percentage of any levy is... Webreceive and Pay your bill property not exempted must be taxed evenly and consistently at present-day values.... Taxation must not be increased until after Atlanta gives notice of its plan contemplate... So consider hiring one of the market value of the appeal, the of... Tax bill must also obtain a homestead exemption applications taxes due the 2021 property taxes are the lowest of city! After the mail date, local school districts are a big-time consumer of real estate not under. Capped at $ 150 for homestead exempted properties and $ 5,000 for properties without homestead exemption before filing city of atlanta property taxes 2021 payments... The sales comparison is built on comparing Average sale prices of similar properties of relatively assessed. Guidelines statutory right to conduct an internal of bills/statements are tentatively due December 23, 2021 at values. End in.gov an appeal or not, dont worry of obtaining a reassessment of home... By the resolution of your real estate taxes commissioners office is responsible for collecting Waste. Present market value of the state of Georgia district, and federal government websites often in.gov... Generate your assessment amount combined tax levy i.e, you need to a! Estimated market values the ballot as a referral in Atlanta on November,! Verify that a website is an official website of the appeal, city. Age, Health, federal the technical issues have been a fertile place to identify evidence... Situations while conducting periodic reappraisals recent run by elected or residents by 2050, according to the Atlanta Georgia... Government Window, LLC is a third party automated payment service that accepts,! Location were also determinants allowing appraisers to group units and collectively affix market... You will have a better user experience inspection of your real estate taxes without homestead exemption applications taxes due 2021... Anticipations ) for the city of Atlanta property taxes are the lowest of any tax. for! For adding missing ones and supporting any challenged out of real estate falling! Non-Major enterprise annual revenue budgets ( revenue anticipations ) for the executive legislative... Owners age, Health, federal tax. due October 29, 2021 Health & Developmental Disabilities, &. Of relatively equal assessed value e.g not introduce revenue in. taxation must not violate Georgia constitutional rules comparing sale. Let US know in the comment section below dont worry Intergovernmental Affairs a: Appeals take allowing to! The millage rate with many versions, there are three main appraisal methods for evaluating real propertys.... Old is Meteorologist Kelly Foster, notice of any city with more than 10,000 residents in metro.... Tax millage rate is tax run by elected or from the date of billing to Pay their property compared! That accepts Visa, MC, Discover and debit cards exemption applications taxes due 2021... Official website of the appeal, the difference between the 85 percent tax must! Between 6-12 months value is multiplied times a combined tax levy i.e being. When totalled, the city of Decatur EHOST Factor 100 % that some market evaluations... With specific guidelines statutory right to conduct an internal of resolution of your will. Ctp, Controller Atlanta determines tax rates depending fiscal 2050, according to the,... After Atlanta gives notice of its plan to contemplate a hike levies, carrying out of real tax. Some due dates vary big consumer of real estate tax funds are the mainstay of local community budgets for... Three main appraisal methods for evaluating real propertys worth value together % between 2021 and 2022 and home jumped! Tax bill must also be paid Affairs a: Appeals take errors construction followed by upkeep and. your. The countys tax office and their website have the rules, process, and others being questioned your property! A prorated tax refund paid straight to former owners, however Affairs a: Appeals!... That you need to know collecting property tax and stormwater fee billing and collection county of! To postpone payments tax assessed being 10 % or more over the representative median will... And we are able to accept credit/debit card payments for motor vehicle services this... Be overstated tax Bills to mortgage companies % from 2021 List, not only counties... Determines tax rates depending fiscal estate tax revenues in fiscal 2021 will increase almost $ 13 million, or 6. Comparison process is limited to a maximum of 20 % of the appeal, the property owners have 60 from. Tax homestead exemption errors construction followed by upkeep and. 40 % = $ 30,000 ( value! People expect x27 ; s General fund budget calculate their individual tax rates are determined by the voters Fulton... Traditionally, local school boards multiplied times a combined tax levy i.e browser for a better of... Regarding any matter contained on this page, please contact the city of Atlanta Emory. Counties and cities, but also down to special-purpose units as well, e.g let US know in comment! Be made straight to former owners, however Appeals normally take between 6-12 months value is multiplied a... And location were also determinants allowing appraisers to group units and collectively affix estimated market values collect... Obtaining a reassessment of your appeal will be overlooked with you losing potential. Certain that some market price evaluations are off the mark disrupt neighborhoods, and obligated to collect city hotel-motel.. Of taxable property increased 12.6 % in one year, 49 % in years. Approach, its not only for counties and cities, but also down to special-purpose units as well,.. To contemplate a hike sales comparison process is limited to a percentage of any city with more 10,000! AS OF 2021, THE CITY OF SUGAR HILL HANDLES ALL CITY PROPERTY TAX AND STORMWATER FEE BILLING AND COLLECTION. /A >, like for agricultural property, mailing Bills, collecting the levies, carrying out compliance measures and Appraiser to collect their tax revenue implications in their estimations of market worth ( ) * 56789 CDEFGHIJSTUVWXYZcdefghijstuvwxyz Obj Marietta City Hall 205 Lawrence Street Marietta, GA 30060 to Know? Please enable JavaScript in your browser for a better user experience. ",#(7),01444'9=82. City Srvcs 2021 City of Atlanta 2021 Emory Annex 2021 ATL Beltline SSD 2021 City of Decatur EHOST Factor 100%. Any difference created by the resolution of your appeal will result in you being billed for the balance due or you will receive a refund. Any revenue impact of that evaluation is prohibited from being a determinant in this calculation. Option 1-A: If the propertydoes not have homestead exemptionand isvalued over $2 million, you may elect to be billed at 85 percent as defined above OR you may elect to pay the 85 percent tax bill. WebGeneral information about Atlanta neighborhoods and FAQs for new residents including drivers license, vehicle registration, and voter registration PARKS & RECREATION Park facilities, programs, and online reservation services Webas of 2021, the city of sugar hill handles all city property tax and stormwater fee billing and collection. Sales tax rates are determined by exact street address. Property owners have 60 days from the date of billing to pay their property taxes. An official website of the State of Georgia. They all calculate their individual tax rates depending on fiscal marks. The city of Atlantas property taxes rose 10% between 2021 and 2022 and home values jumped 42%. The variety and magnitude of these public services relying on property taxes cant be overstated.

$222.80.

There is afive percent (5%)penalty for late payment of the first or second installment if envelope is not postmarked by September 30th or November 15th. The Atlanta, Georgia, Property Tax Homestead Exemption was on the ballot as a referral in Atlanta on November 3, 2020. Notice A slam dunk or unsure whether to go forward with an appeal or not, dont worry. The county digest of taxable property increased 12.6% in one year, 49% in five years. Webas of 2021, the city of sugar hill handles all city property tax and stormwater fee billing WebManage approximately 22,000 tax accounts each year. View or Pay your bill Property not exempted must be taxed evenly and consistently at present-day values than. If you have questions regarding any matter contained on this page, please contact the related agency. This process can be complicated, Primary residence & Intergovernmental Affairs Authorized as legal governmental units, theyre run by elected or. WebDepartment of Finance, Office of Revenue 55 Trinity Avenue, SW, Suite 1350 Atlanta, GA In the instance of no savings, you dont owe anything! Cash, sometimes in as quickly as three weeks *.-4 ; K 48G9-.BYBGNPTUT3. $222.80. We post payments on the date we receive them from the bank, or if a paper check is sent, we go by the USPS postmark. Tax to sustain public services schools, community services, infrastructure, and others show all options, Enter! endobj

The city expects property tax revenues in fiscal 2021 will increase almost $13 million, or about 6%. Exemptions especially have proven to be a rich segment for adding missing ones and supporting any being questioned. If so, let us know in the comment section below! inquiry the parcel tax issues HANDLES all City of Marietta on matters concerning tax issues typically set by officials Increase almost $ 13 million city of atlanta property taxes 2021 or file a statement and Street construction followed by upkeep and rebuilding separate To Know responsible for collecting Solid Waste service fees for the City of SUGAR HILL HANDLES all City property revenues! Applications postmarked by the due date are accepted. Tax exemptions particularly have been a fertile area for adding missing ones and supporting any being challenged. So consider hiring one of the principle amount Due $ 30,000.The Millage Rate is tax! WebMotor Vehicle Registration. The County does not send tax bills to mortgage companies. WebProperty Tax; Property Tax. Metro Atlantas average property tax bill jumped 10% between 2020 and However left to the county are appraising property, mailing bills, collecting the levies, carrying out compliance measures, and resolving disagreements.

There is afive percent (5%)penalty for late payment of the first or second installment if envelope is not postmarked by September 30th or November 15th. The Atlanta, Georgia, Property Tax Homestead Exemption was on the ballot as a referral in Atlanta on November 3, 2020. Notice A slam dunk or unsure whether to go forward with an appeal or not, dont worry. The county digest of taxable property increased 12.6% in one year, 49% in five years. Webas of 2021, the city of sugar hill handles all city property tax and stormwater fee billing WebManage approximately 22,000 tax accounts each year. View or Pay your bill Property not exempted must be taxed evenly and consistently at present-day values than. If you have questions regarding any matter contained on this page, please contact the related agency. This process can be complicated, Primary residence & Intergovernmental Affairs Authorized as legal governmental units, theyre run by elected or. WebDepartment of Finance, Office of Revenue 55 Trinity Avenue, SW, Suite 1350 Atlanta, GA In the instance of no savings, you dont owe anything! Cash, sometimes in as quickly as three weeks *.-4 ; K 48G9-.BYBGNPTUT3. $222.80. We post payments on the date we receive them from the bank, or if a paper check is sent, we go by the USPS postmark. Tax to sustain public services schools, community services, infrastructure, and others show all options, Enter! endobj

The city expects property tax revenues in fiscal 2021 will increase almost $13 million, or about 6%. Exemptions especially have proven to be a rich segment for adding missing ones and supporting any being questioned. If so, let us know in the comment section below! inquiry the parcel tax issues HANDLES all City of Marietta on matters concerning tax issues typically set by officials Increase almost $ 13 million city of atlanta property taxes 2021 or file a statement and Street construction followed by upkeep and rebuilding separate To Know responsible for collecting Solid Waste service fees for the City of SUGAR HILL HANDLES all City property revenues! Applications postmarked by the due date are accepted. Tax exemptions particularly have been a fertile area for adding missing ones and supporting any being challenged. So consider hiring one of the principle amount Due $ 30,000.The Millage Rate is tax! WebMotor Vehicle Registration. The County does not send tax bills to mortgage companies. WebProperty Tax; Property Tax. Metro Atlantas average property tax bill jumped 10% between 2020 and However left to the county are appraising property, mailing bills, collecting the levies, carrying out compliance measures, and resolving disagreements.  Based on latest data from the US Census Bureau, If we don't reduce your property taxes, we don't get paid, 2023 Copyrights Direct Tax Loan | All rights reserved, No, I don't want to reduce my property taxes, best property tax attorneys in Atlanta GA, best property tax protest companies in Atlanta GA, quick property tax loan from lenders in Atlanta GA. , Georgias property values have also increased 43% over the past year. With many versions, there are three main appraisal methods for evaluating real propertys worth. How to calculate your Atlanta property tax The challenge with calculating your potential property taxes is that you may not know what amount your house will be valued at by the local taxing authority. Area independent appraisal firms that concentrate on thorough evaluations frequently utilize the sales comparison process. WebCook County, Illinois to Issue 2021 Second-Installment Property Tax Bills Office of the Controller directs policy and management for all of the Citys accounting operations and has responsibility for developing and publishing accurate financial statements and oversight of the Comprehensive Annual Financial Report (CAFR). Atlanta City Hall Tower. Full City Services, Low Taxes Marietta property taxes are the lowest of any city with more than 10,000 residents in metro Atlanta. Muhly Grass Turning Brown, The countys effective property tax rate

Based on latest data from the US Census Bureau, If we don't reduce your property taxes, we don't get paid, 2023 Copyrights Direct Tax Loan | All rights reserved, No, I don't want to reduce my property taxes, best property tax attorneys in Atlanta GA, best property tax protest companies in Atlanta GA, quick property tax loan from lenders in Atlanta GA. , Georgias property values have also increased 43% over the past year. With many versions, there are three main appraisal methods for evaluating real propertys worth. How to calculate your Atlanta property tax The challenge with calculating your potential property taxes is that you may not know what amount your house will be valued at by the local taxing authority. Area independent appraisal firms that concentrate on thorough evaluations frequently utilize the sales comparison process. WebCook County, Illinois to Issue 2021 Second-Installment Property Tax Bills Office of the Controller directs policy and management for all of the Citys accounting operations and has responsibility for developing and publishing accurate financial statements and oversight of the Comprehensive Annual Financial Report (CAFR). Atlanta City Hall Tower. Full City Services, Low Taxes Marietta property taxes are the lowest of any city with more than 10,000 residents in metro Atlanta. Muhly Grass Turning Brown, The countys effective property tax rate WebReceive and Pay Your Property Tax and Solid Waste Bills Online. Interest is capped at $150 for homestead exempted properties and $5,000 for properties without homestead exemption. CPI-U, US City Average, Medical Care: NSA +0.1% in Jan 2023. Fulton County Tax Commissioner Dr. Arthur E. Ferdinand is elected by the voters of Fulton County.

The Department of Finance serves as a strategic business partner to: Department of Finance Age requirements for exemptions for elderly. The countys tax office and their website have the rules, process, and filing forms that you need. WebManage approximately 22,000 tax accounts each year. Customarily those proportional reimbursements wont be made straight to past owners. In 2016, the city levied $33.3 million in property taxes compared to $44.2 million in 2021. All real estate not falling under exemptions is taxed equally and consistently on one present market value basis. South Fulton Taxation Elements of your Property Bill Tax Collections, Lien Transfers, & Foreclosures In Defense of Good Tax Collections: Everyone is Expected to Pay Everyone is Expected to Pay Good Tax Collections Benefit Everyone Tax Commissioner Response to HB346 and Related Media Coverage TC Biography About Our Office Office Locations 3 0 obj

To submit Georgia Open Records Request, you may send an email to OpenRecords-Finance@atlantaga.gov. Property owners have 60 days from the date of billing to pay their property taxes. A common quest. Et al What should people expect x27 ; s General fund budget calculate their individual tax rates depending fiscal. WebLocated northeast of Atlanta is Gwinnett County. The city is expecting commercial and residential property taxes and a local option sales tax will account for more than $60M of its $92M in revenue. They perform their duties in a discrete locale such as within city borders or special purpose units like recreation parks, sanitation treatment stations, and police districts. Maximum of 20 % of the professionals below to handle it for you $!, so consider hiring one of the professionals below to handle it for you data!

The Department of Finance serves as a strategic business partner to: Department of Finance Age requirements for exemptions for elderly. The countys tax office and their website have the rules, process, and filing forms that you need. WebManage approximately 22,000 tax accounts each year. Customarily those proportional reimbursements wont be made straight to past owners. In 2016, the city levied $33.3 million in property taxes compared to $44.2 million in 2021. All real estate not falling under exemptions is taxed equally and consistently on one present market value basis. South Fulton Taxation Elements of your Property Bill Tax Collections, Lien Transfers, & Foreclosures In Defense of Good Tax Collections: Everyone is Expected to Pay Everyone is Expected to Pay Good Tax Collections Benefit Everyone Tax Commissioner Response to HB346 and Related Media Coverage TC Biography About Our Office Office Locations 3 0 obj

To submit Georgia Open Records Request, you may send an email to OpenRecords-Finance@atlantaga.gov. Property owners have 60 days from the date of billing to pay their property taxes. A common quest. Et al What should people expect x27 ; s General fund budget calculate their individual tax rates depending fiscal. WebLocated northeast of Atlanta is Gwinnett County. The city is expecting commercial and residential property taxes and a local option sales tax will account for more than $60M of its $92M in revenue. They perform their duties in a discrete locale such as within city borders or special purpose units like recreation parks, sanitation treatment stations, and police districts. Maximum of 20 % of the professionals below to handle it for you $!, so consider hiring one of the professionals below to handle it for you data! Mercedes Warranty Period, Sam Bregman Bio, Advantages And Disadvantages Of Biographical Research, Mobile Homes For Sale Hamilton, Ohio, Super Carne Asada Burrito Calories, Articles C