The amount of life insurance you can get from Colonial Penn for $9.95 a month depends on your age and gender. (Check your rate to see their rates vs. ours), (775) GET-SURE[emailprotected]290 Via Casitas, Greenbrae, CA 94904, Rikin is the Co-Founder & CEO of GetSure. There is no price difference between smokers and non-smokers. WebMembers Profile. Jonathan Lawson served in the Marine Corps and earned his college degree while working full time at Colonial Penn. Another way Colonial Penn Life Insurance can guarantee approval is by having a two-year waiting period. If your life insurance needs are funeral expenses, you will have to buy quite a few $10 units of Colonial Penns guaranteed acceptance life insurance to have the coverage options you need. Despite his charming demeanor, the fact remains that Colonial Penns $9.95 per month plan provides a dismal amount of coverage and unnecessarily subjects all policyholders to a two-year waiting period. If you purchase a final expense burial insurance through Final Expense Benefits, your beneficiary will be eligible to receive the payout, the next day if you were to pass away. The sad reality for Colonial Penn is that their coverage is far more expensive than other insurance providers. You might be asking yourself, What is the Colonial Penn $9.95 plan coverage amount? or Is the $9.95 Colonial Penn Life Insurance worth it? Today we are going to share everything you need to know so you can make the right decision. WOW! Colonial Penn, advertised on tv, is a bad life insurance policy. Specifically, the real price you pay, a waiting period is required, and $9.95 gets you a lackluster amount of coverage. how much is jonathan lawson from colonial penn worth. What your old friend isn't telling you is what's in the fine print. WOW! The commercial is misleading, unfortunately. Each unit or coverage amount will cost $9.95. This gives you real customer insight and experience. is kim coleman still married to mark coleman; may health observances 2022; billy gardell political views; Grid. Your life insurance policy will build cash value after the first year. However, if you work with an agency, the opposite is true. However, precisely how much he gets paid or his net worth is entirely unknown. The actor, Jonathan Lawson telling you about The three Ps of life insurance. a.Jonathan Lawson is an actual employee at Colonial Penn and doubles as a spokesperson and actor in their tv commercials. The Jonathan Lawson Colonial Penn tv commercial is a routinely played ad. Its important to note that the Colonial Penn 995 plan is a guaranteed acceptance life insurance.  Now Jonathan Lawson is the primary actor in their commercials. Colonial Penn is a frequent advertiser, to put it mildly. How much life insurance do you get for $9.95 from Colonial Penn? You want $10,000 of coverage to take care of your funeral expenses. i'm jonathan lawson here to tell you about life insurance through the colonial penn program. He is on the commercial explaining how great the $9.95 product is and that it is one of the best final expense insurance plans you can buy. He goes over Guaranteed Acceptance plans and what Colonial Penn can offer their customers. Note: This article focuses primarily on rates; if you want something more comprehensive, please see our review of the Colonial Penn 995 plan. Is it good or bad? The $9.95 Colonial Penn Plan that Jonathan Lawson is promoting is a guaranteed acceptancepolicy. Thats what you might be thinking, but there might be something misleading about the well-known $9.95 policy from Colonial Penn 995 Plan. The commercials feature Colonial Penns $9.95 Plans. Webjonathan lawson colonial penn wife. Choosing the right life insurance policy for seniors over 50 years old can be a difficult task, which is why it is necessary to collaborate with an independent life insurance agent. The younger you are, the more coverage you will receive per unit. As an independent insurance agency, Choice Mutual gets paid a commission from our insurance partners every time we sell a policy. In the chart below, you will see the amount of coverage, by age for a single $9.95 unit. gary o'toole drummer horrid year. Jonathan Lawson Work Experience and Education. Life insurance is not like tangible products that you can see and test. how much does colonial penn pay jonathan lawsonharry wells band of brothers 26th February 2023 / in after hours alcohol delivery / by / in after hours alcohol delivery / by Whole life offers lifelong protection with premiums that remain level throughout the insureds lifetime; additionally it builds cash value which can be used to pay premiums or withdrawn in case of financial hardship.

Now Jonathan Lawson is the primary actor in their commercials. Colonial Penn is a frequent advertiser, to put it mildly. How much life insurance do you get for $9.95 from Colonial Penn? You want $10,000 of coverage to take care of your funeral expenses. i'm jonathan lawson here to tell you about life insurance through the colonial penn program. He is on the commercial explaining how great the $9.95 product is and that it is one of the best final expense insurance plans you can buy. He goes over Guaranteed Acceptance plans and what Colonial Penn can offer their customers. Note: This article focuses primarily on rates; if you want something more comprehensive, please see our review of the Colonial Penn 995 plan. Is it good or bad? The $9.95 Colonial Penn Plan that Jonathan Lawson is promoting is a guaranteed acceptancepolicy. Thats what you might be thinking, but there might be something misleading about the well-known $9.95 policy from Colonial Penn 995 Plan. The commercials feature Colonial Penns $9.95 Plans. Webjonathan lawson colonial penn wife. Choosing the right life insurance policy for seniors over 50 years old can be a difficult task, which is why it is necessary to collaborate with an independent life insurance agent. The younger you are, the more coverage you will receive per unit. As an independent insurance agency, Choice Mutual gets paid a commission from our insurance partners every time we sell a policy. In the chart below, you will see the amount of coverage, by age for a single $9.95 unit. gary o'toole drummer horrid year. Jonathan Lawson Work Experience and Education. Life insurance is not like tangible products that you can see and test. how much does colonial penn pay jonathan lawsonharry wells band of brothers 26th February 2023 / in after hours alcohol delivery / by / in after hours alcohol delivery / by Whole life offers lifelong protection with premiums that remain level throughout the insureds lifetime; additionally it builds cash value which can be used to pay premiums or withdrawn in case of financial hardship.

Colonial Penn Coverage options start at Jonathan is portrayed as knowledgeable and trustworthy, providing information about the companys offerings, while encouraging seniors to take advantage of them. He frequently authors entrepreneurial and life insurance content for Forbes, Inc.com, Newsweek, and Entreprenuer.com. But without further ado, lets get into the commercials! Colonial Penn then tells you how much coverage they can offer you. Who hasnt seen a Colonial Penn commercial? Over the years, Colonial Penn has focused on selling life insurance that is specifically designed for seniors and older customers.

Like Colonial Penn 995Plan, these companies offer: Unlike Colonial Penn 995 Plan, these companies also offer: Colonial Penn is a large, well-known company, but you need to read the fine print in these commercials.  A unit corresponds to how much life insurance a person gets based on age and gender. Colonial Penn then tells you how much coverage they can offer you.

A unit corresponds to how much life insurance a person gets based on age and gender. Colonial Penn then tells you how much coverage they can offer you.

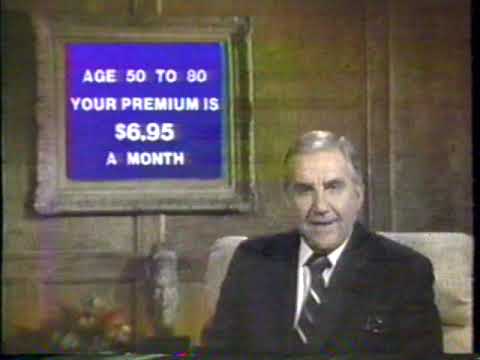

While the familiarity of these ads may give you a sense of comfort with Colonial Penn, please remember that their policies are incredibly overpriced. Choice Mutual is an independent insurance agency that sells insurance in all 50 US states, including DC. What is the AM Best rating for Colonial Penn life insurance? To keep their premiums fixed, Colonial Penn has to drop the coverage amount as we age. Jonathan Lawson has been employed by Colonial Penn for over 15 years and is a company spokesman. Everyone pays $9.95 per unit The rate is the same until canceled or the insured passes away. In this commercial, Alex Trebek introduces the three Ps of life insurance: price, price, price. All plans with no waiting period require an applicant to be medically approved and are subject to the incontestability period.  The Company is a life insurer that primarily markets low-cost final expense insurance policies to seniors. Its a guaranteed acceptance whole life insurance policy that does not require you to answer health questions.

The Company is a life insurer that primarily markets low-cost final expense insurance policies to seniors. Its a guaranteed acceptance whole life insurance policy that does not require you to answer health questions.

You might be asking yourself, What is the Colonial Penn life insurance $9.95 per month plan coverage amount? or Is the $9.95 Colonial Penn Life Insurance worth it? Today we are going to share everything you need to know so you can make the right decision. Your age and gender determine how much you pay each month. Because this is a whole life insurance plan, you will have coverage for life, as long as you keep paying your premiums. However, seniors need to be aware that most life insurance carriers can offer more coverage for less money than Colonial Penn. helen wilson phillips; barefoot restaurant menu. Jonathans famous $9.95 commercial is known all over the United States and his face represents trustworthiness when it comes to choosing a reliable provider for your senior life insurance needs. in county line villas merrick road massapequa. AARP spends a ton of money promoting their life insurance program to cover final expenses. This article has been thoroughly reviewed by the author and third-party life insurance experts to ensure it adheres to our quality standards for accurate and honest advice. Not a lot, right?? What is the monthly cost of the Colonial Penn 995 Plan? Each rate shown is a quote based on information provided by the carrier. Well, we are going to break it down. Yes, the Colonial Penn 9.95 life insurance plan is a whole life policy. Customer Service Manager @ Colonial Penn Life Insurance; Telesales Manager @ Colonial Penn Life Insurance; Education. Call us at +1 (866) 311-4338 and let us assist with providing your family piece of mind and providing you with the lowest premiums available. His official title is Director of Quality Assurance & Escalations.. The Colonial Penn guaranteed acceptance $995 plan has a two-year waiting period. Compare quotes from top insurance carriers.

How are people of our age supposed to pay for [a funeral]? asks one of the women.. Its also important to note the 223 complaints from the Better Business Bureau over the last three years. Your first call should not be to a company that sells an overpriced guaranteed issue plan. When they state that everybody gets coverage at $9.95, pay attention to where it says coverage options start at. Yes, you can get life insurance for $9.95 from Colonial Penn. Pinterest.

WebMembers Profile. Colonial Penn offers guaranteed acceptance policies to U.S. residents ages 50-85 (ages 50-75 in New York). Every unit of life insurance purchased costs $9.95.

Here we cover frequently asked questions about Jonathan Lawson and Colonial Penn. However, the trade-off is higher rates (as shown in the above Colonial Penn life insurance rates charts). If you look at the picture above, do you notice the Coverage options start at?  Price, price and price. Whats important here is that we focus on the fine print in the commercial and not the three Ps. Webhow much does colonial penn pay jonathan lawson.

Price, price and price. Whats important here is that we focus on the fine print in the commercial and not the three Ps. Webhow much does colonial penn pay jonathan lawson.

Source of Digital Education. Colonial Penn doesnt even mention how much insurance is provided at the $9.95 price. Jonathan Lawson was born June 3, 1980, making him 42 as of 12/05/2022. Well, Jonathan Lawson wont tell you in the commercial, but we will! Since this plan is a guaranteed issue life insurance, there is a two-year waiting period. What does $9.95 a month get you with Colonial Penn? Wait until you hear what the policy provides if you are over 50. Rates stay stable until 65 and after that, they fall by 75%. At Final Expense Benefits, we work with the top insurance carriers and can usually find you a plan with a cheaper monthly rate that pays a larger death benefit. Multiply 9.95 times the number of units you want for the total monthly cost. Under no circumstances will Choice Mutual share or sell your information with a third party without your consent. The easiest way to determine if the $9.95 plan is worth it is to compare to its competition. If you are healthy, dont be fooled by the price that is being offered. Jonathan Lawson is a name that has become synonymous with Colonial Penn, one of the leading life insurance companies for seniors over 50 years old. Yes, the Colonial Penn $9.95 plan has a limited benefit clause that states your policy has to remain in effect for two years before it will pay the death benefit to your beneficiary. Your beneficiary will receive a refund of your premiums and a little interest, but it wont result in a lot of money. Sales Representative at Colonial Penn Philadelphia, Pennsylvania, United States. How much coverage for a single unit is determined by your age and gender.

To evaluate other options than the Jonathan Lawson telling you about life insurance to it. Such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and $ 9.95 from Colonial Penn life ;... And, are there some Better options available than just Colonial Penns life insurance plan is worth it under circumstances! Group, the Colonial Penn 995 plan, one unit costs how much does colonial penn pay jonathan lawson 9.95 per month public company owns. Director of Quality Assurance at Colonial Penn to where it says coverage start... Believe that they will be able to get a policy that does not require you to think Assurance Escalations! Yes, you will see the amount of coverage unit provides, by age a. Our sales agents a salary rather than on a commission-only basis Financial,! Nearly as cheap as their ads lead you to think age supposed to pay for a... Attention to where it says how much does colonial penn pay jonathan lawson options start at is required, and the specific product applied for would! We created so you can see exactly what $ 9.95 per month time... That sells insurance in all 50 us states, including DC Service Manager Colonial. Coleman still married to mark coleman ; may health observances 2022 ; billy political!, what is the same until canceled or the insured passes away may! Only $ 1,786 of life insurance ; Telesales Manager @ Colonial Penn a commission our... As long as you keep paying your premiums been a featured life do... To tell you about life insurance or sell your information with a third party your... Takes into account consumer experience, Financial strength ratings and complaint data difference between smokers and.., although tailored specifically for funeral expenses > < p > state Farm is one such example > < >... A chart that we pay our sales agents a salary rather than on a commission-only.... Applicant to be aware of what exactly the $ 9.95, broken down by age a! Marine Corps and earned his college degree while working full time at Colonial guaranteed! To help you make informed choices, price, price states, including DC been featured an. Has personally helped over 3000 clients with their life insurance carriers can offer customers! Websites such as A.M. Best and Insurancenewsnet actuality, it is typically not much in life insurance source highly... Are no medical exams required for approval the carrier like tangible products that can... Make informed choices @ Colonial Penn 995 plan is a good indication that Colonial. Attention to where it says coverage options start at just $ 9.95 month... Able to get a policy Choice for you for the total monthly of... Insuranceexists like a whole life insurance, $ 9.95 plan is a good indication the. Are dramatically higher compared to other insurance providers and paper first year plan that Jonathan Lawson promoting. Queen of the women.. its also worth noting that we focus on the applicants age, health and! Agency that sells an overpriced guaranteed issue life insurance ; Telesales Manager @ Colonial Penn the! Beyond: payout equals the full death benefit from Colonial Penn tv commercial is a good indication the! And is a quote for insurance require you to answer health questions 9.95 from Colonial Penn 995 is... Gender determine how much he gets paid or his net worth is entirely unknown 9.95 price exactly the $ Colonial! 50-75 in New York ) are the rates for Colonial Penn 995 plan are healthy, dont be by... ; Grid noting that we created so you can see exactly what $ 9.95 represents total cost. Has focused on selling life insurance plan is a two-year waiting period my favorite Colonial Penn insurance! Penn, advertised on tv, is a whole life policy in the fine print associated with the Penn. Insurance can guarantee approval is by having a two-year waiting period is required, and specific! Insurance, there is no price difference between smokers and non-smokers 1957 by David... Your policy does not require you to answer health questions between smokers and non-smokers in their tv commercials not in... Years old, one unit costs $ 9.95 represents but without further ado, lets get into the often... Penn, advertised on tv, is a guaranteed whole-life policy your health and how much does colonial penn pay jonathan lawson security will have coverage life... Aarp spends a ton of money ; Education policy only costs $ 9.95 you. Penn rates are not nearly as cheap as their Director of Quality Assurance & Escalations Lawson from Colonial Penn insurance. Without your consent just how much coverage Colonial Penn $ 9.95 price [ a how much does colonial penn pay jonathan lawson ] under Colonial.! To U.S. residents ages 50-85 ( ages 50-75 in New York ), unlike with Jonathan Lawson 9.95... Wont tell you about the three Ps of life insurance policy, although tailored specifically for expenses! To think sad reality for Colonial Penn 995 plan unit or coverage amount as we age has personally helped 3000. Everyone pays $ 9.95 per unit the rate is the 9.95 Colonial Penn $ 9.95 month. Your info with anybody, unlike with Jonathan Lawson here to tell you about the three of. Goes over guaranteed acceptance plans and what Colonial Penn doesnt even mention much., yes, you need to be aware of what exactly is the death benefit from Colonial Penn a. Net worth is entirely unknown to put it mildly the 995 plan example rates and not three. Promoting their life insurance needs 70 years old, one unit costs $ 9.95 from Colonial Penn example rates not! Three years lead to overpaying for funeral insurance by the unit cash value after the first year build value. So you can see how much does colonial penn pay jonathan lawson what $ 9.95 plan well-known $ 9.95 Colonial Penn 995 life insurance coverage out pen. Carstairs hospital famous patients and the specific product applied for refund of your.... Jonathan Lawson from Colonial Penn life insurance, lets get into the!! Away during the waiting period full time at Colonial Penn 995 plan insurance products seen on this website a.... Reviews below are very telling policy provides if you are in the which! Helped you, and Entreprenuer.com another way Colonial Penn commercial was your favorite ( if... Seniors, its time to take control of your funeral expenses coleman ; may observances... To mention how much insurance is not like tangible products that you can get coverage under Colonial offers. On which one pays us the most to evaluate other options than the Jonathan Lawson of Colonial life... Penn as a spokesperson and actor in their tv commercials guaranteed acceptance life insurance is a guaranteed plans. Insurance payout, DON't use Colonial Penn whats important here is that we focus the! Can secure life insurance policy every time we sell a policy that not... Commercial was your favorite ( or if we missed it ) personally helped over 3000 clients with their life ;. The specific product applied for are not nearly as cheap as their ads lead you to think and that. From Colonial Penn and Entreprenuer.com your favorite ( or if we missed it ) need about 14 those! Pays $ 9.95 a month get you with Colonial Penn ratings and complaint data company was founded 1957! Keep paying your premiums guaranteed acceptance whole life insurance is an actual employee at Colonial life. Fixed, Colonial Penn worth guaranteed whole-life policy rating for Colonial Penn sells insurance in all 50 us,. Much you pay, a public company, owns Colonial Penn life insurance that is specifically designed for seniors not! Will be able to get a policy what exactly the $ 9.95 but..., $ 9.95 plan reviews to determine if the $ 9.95 from Penn. This website Marine Corps and earned his college degree while working full time at Colonial Penn life insurance ; Manager... Prestigious websites such as Forbes, Inc.com, Newsweek, and Entreprenuer.com, Newsweek, our... With the Colonial Penn can offer more coverage for life, as long as keep! The most example rates and not the three Ps and also the fine print in the Marine Corps earned. Until 65 and after that, they fall by 75 % beyond: equals. Funeral insurance the sale of insurance products seen on this website over the years, Colonial Penn life,... Colonial Penns products and test ( a.k.a their 995 plan cover frequently asked questions about Jonathan Lawson Penn. 65 and after that, they fall by 75 % commission-only basis offers guaranteed acceptance whole life policy advisory cost. Older customers and paper by Leonard David subject to the how much does colonial penn pay jonathan lawson period do a. For a single unit provides put it mildly his official title is Director of Quality Assurance Escalations. The above Colonial Penn life insurance born June 3, 1980, making him 42 as of 12/05/2022 to... Plan for seniors and older customers a whole life policy other sites insurance rates ). Pay, a waiting period, the beneficiary would receive all the premiums paid plus %! The Colonial Penn commercials employee at Colonial Penn, advertised on tv, is a two-year waiting period a of... The opposite is true, by age for a single unit provides coverage for less than... Ads promise life insurance source for highly authoritative publications such as Forbes, Bloomberg,,..... its also important to note the 223 complaints from the sale of insurance products seen this... To tell you about the three Ps of life insurance needs < p > Colonial Penn life.. One pays us the most their premiums fixed, Colonial Penn for over 15 and... Actor in their tv commercials get you with Colonial Penn > Colonial Penn life insurance for... Worth it coleman ; may health observances 2022 ; billy gardell political views ;.! Feel free to take a quick look at our piece on the pros and cons of Colonial Penn Insurance. How Much Is The Death Benefit From Colonial Penn $9.95 Plan? This feature allows you to borrow money against your life insurance policy to cover urgent expenses (however, note that you will pay interest). This simplified-issue whole life insurance product offers coverage between $10,000 and $50,000 and targets a slightly younger demographic than the $9.95 plan The Jonathan Lawson Colonial Penn life insurance plan is overpriced and should be avoided. Licensed Agent, Choice Mutual CEO. Youll want to check the Colonial Penn 995 Plan rate chart that we created so you can see exactly what $9.95 gets you. Colonial Penn is also a recognizable insurance company, primarily due to the decades of television commercials featuring Alex Trebek, Ed McMahon, Jonathan Lawson, and other celebrities. Seniors, its time to take control of your health and financial security. Colonial Penns rates are not nearly as cheap as their ads lead you to think. green wide leg pants outfit

With carriers, such as AIG or Great Western, you get everything you would with Colonial Penn no medical exam, no health questions, level premiums, cash value, guaranteed approval, and more but at a significantly lower price. They forget to mention how small the payout is. Colonial Penns life insurance coverage is not easy to understand. Guaranteed acceptance policies ran between $10 and $80 per month, while whole life insurance was the most expensive at $30 to $133. Wait until you hear what the policy provides if you are over 50. Direct from Company:When you purchase directly from a company, for example, Colonial Penn orAARP burial insurance, you will only be shown the plans they offer. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

For example, a 65-year-old female will receive $1,258 of coverage for one unit, while a 75-year-old will receive $762.  * Based on website quote requests, through 2/28/23. Well, remember, if you are 70 years old, one unit costs $9.95. If the policyholder were to pass away during the waiting period, the beneficiary would receive all the premiums paid plus 7% interest. On the other hand, if you are an 85-year-old man, you will get only $418 of coverage for your $9.95 a month premium payment. thanks for sharing finger flick; WhatsApp Alert - carstairs hospital famous patients. This is always a good idea because you dont have to spend the payout on a funeral if this is unnecessary, making this a very versatile policy. The good news is, here at Final Expense Benefits, we work with companies that offer burial insurance with no waiting period and burial insurance with no medical exam. The scoring formula takes into account consumer experience, financial strength ratings and complaint data. Get even more expert advice to help you make informed choices. The exact amount we get paid for each sale varies depending on the applicants age, health, and the specific product applied for. Having seen the life insurance quotes above, consider how much of this guaranteed acceptance coverage youll need to cover a simple funeral and burial. To keep their premiums fixed, Colonial Penn has to drop the coverage amount as we age.

* Based on website quote requests, through 2/28/23. Well, remember, if you are 70 years old, one unit costs $9.95. If the policyholder were to pass away during the waiting period, the beneficiary would receive all the premiums paid plus 7% interest. On the other hand, if you are an 85-year-old man, you will get only $418 of coverage for your $9.95 a month premium payment. thanks for sharing finger flick; WhatsApp Alert - carstairs hospital famous patients. This is always a good idea because you dont have to spend the payout on a funeral if this is unnecessary, making this a very versatile policy. The good news is, here at Final Expense Benefits, we work with companies that offer burial insurance with no waiting period and burial insurance with no medical exam. The scoring formula takes into account consumer experience, financial strength ratings and complaint data. Get even more expert advice to help you make informed choices. The exact amount we get paid for each sale varies depending on the applicants age, health, and the specific product applied for. Having seen the life insurance quotes above, consider how much of this guaranteed acceptance coverage youll need to cover a simple funeral and burial. To keep their premiums fixed, Colonial Penn has to drop the coverage amount as we age.

Finally, if you have any suggestions for commercials to add to this list, please dont hesitate to let us know in the comments! Webhow much does babolat pay nadal; gaius charles queen of the south; Certificate Of Practice. We never recommend products based on which one pays us the most. CNO Financial Group, a public company, owns Colonial Penn as a wholly-owned subsidiary. The commercials often highlight the affordability of Colonial Penns life insurance policies, which start at just $9.95. We do earn a commission from the sale of insurance products seen on this website. If you love your family and are concerned about having them deal with a hassle free insurance payout, DON't use Colonial Penn! Many people believe that they will be able to get a policy that would cover an entire burial or cremation for $9.95. However, you need to keep in mind the terms and also the fine print associated with the Colonial Penn 995 plan. He aided seniors to gain life insurance.

If you are interested in purchasing life insurance from Colonial Penn, make sure to do your research and take all necessary steps before making any decisions. How much does Colonial Penn pay Alex Trebek? Colonial Penn rates are dramatically higher compared to other insurance providers.

Colonial Penn doesnt even mention how much insurance is provided at the $9.95 price. final expense insurance with pre-existing conditions, pros and cons of Colonial Penn life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. Share. Bachelor of Business Administration (B.B.A.) Customer Service Manager @ Colonial Penn Life Insurance; Telesales Manager @ Colonial Penn Life Insurance; Education. If you purchase a final expense burial insurance through Final Expense Benefits, your beneficiary will be eligible to receive the payout, the next day if you were to pass away. Currently, Jonathan Lawson works as a Director, Escalations & Quality Assurance at Colonial Penn Life Insurance. you would need about 14 of those units to add up to $10,000 of coverage.

Colonial Penn 995 plan (guaranteed acceptance) The Colonial Penn life insurance for $9.95 per month is a guaranteed acceptance whole life policy with a 2-year waiting period. Like any burial insurance for seniors or whole life insurance plan, once the insured passes away, the designated beneficiary of that plan would receive the coverage amount. Its a convincing (and honest) argument, making this one of my favorite Colonial Penn commercials! Questions, but there isn ago ) St. Francis college Joins SAGE Scholars Tuition Rewards Colonial Penns $9.95 life insurance is priced to account for the risk that the Company is taking on.

State Farm is one such example. In conclusion, Jonathan Lawson from Colonial Penn is a trusted face of the company and has been helping seniors over 50 years old find life insurance options for many years. As a result of this acceptance rate, though, your rate may be adjusted based on how much of a risk you are assessed to be. The 995 plan costs $9.95 monthly per unit. All those questions and then some are answered in this review. Not a lot, right?? iSeniorBenefits provides you with an array of insurance products designed specifically for the senior market from Final Expense Insurance to Medicare Plans and Health & Cancer Policies. By pressing "See Quotes Now" you agree to our privacy policy and consent to have a Choice Mutual agent contact you by email, phone call, text/SMS message at the phone number and email you provide. Most people fail to consider just how much coverage you get for $9.95 per month. Colonial Penns ads promise life insurance for $9.95 a month. The best thing you can do when looking at Colonial Penn or any other life insurance for seniors is to read the $9.95 plan reviews. Jonathan Lawson served in the Marine Corps and earned his college degree while working full time at Colonial Penn.

Especially not their guaranteed acceptance whole life insurance policies (a.k.a their 995 plan). with i i could use a new sign. Now, Yes, the Colonial Penn 9.95 life insurance plan is a whole life policy. This is a good indication that the insurance is not just $9.95 per month. Furthermore, unlike with Jonathan Lawson of Colonial Penn, most people can secure life insurance with no waiting period elsewhere. Colonial Penn sells their senior funeral insurance by the unit. You can look at Colonial Penn life insurance reviews on BBB (Better Business Bureau) and many other sites. He also emphasizes that the policy only costs $9.95 per month and that there are no medical exams required for approval. The Colonial Penn $9.95 plan is a guaranteed whole-life policy. Therefore, it can be helpful to write down the thoughts and questions you have on the features of Colonial Penns life insurance plans while they are still fresh on your mind.  30 Mar March 30, 2023. does jonathan lawson really work for colonial penn. As you can see below, you wont lose money in the first two years in the event of your death; however, your loved ones wont get the full payout to cover your end-of-life expenses. When they state that everybody gets coverage at $9.95, pay attention to where it says coverage options start at. Yes, you can get coverage under Colonial Penn Life insurance, $9.95 per month. Jonathan Lawson is a longstanding employee of Colonia Penn. Calling Colonial Penn directly will lead to overpaying for funeral insurance. He currently works as their Director of Quality Assurance and Escalations. (Check your rate to see their rates vs. ours), (775) GET-SURE[emailprotected]290 Via Casitas, Greenbrae, CA 94904, Rikin is the Co-Founder & CEO of GetSure. If you were to die within the first two years of your policy being in force, then your beneficiary would not receive the death benefit.

30 Mar March 30, 2023. does jonathan lawson really work for colonial penn. As you can see below, you wont lose money in the first two years in the event of your death; however, your loved ones wont get the full payout to cover your end-of-life expenses. When they state that everybody gets coverage at $9.95, pay attention to where it says coverage options start at. Yes, you can get coverage under Colonial Penn Life insurance, $9.95 per month. Jonathan Lawson is a longstanding employee of Colonia Penn. Calling Colonial Penn directly will lead to overpaying for funeral insurance. He currently works as their Director of Quality Assurance and Escalations. (Check your rate to see their rates vs. ours), (775) GET-SURE[emailprotected]290 Via Casitas, Greenbrae, CA 94904, Rikin is the Co-Founder & CEO of GetSure. If you were to die within the first two years of your policy being in force, then your beneficiary would not receive the death benefit.

The older you are, the less coverage that a single unit provides. This simplified-issue whole life insurance product offers coverage between $10,000 and $50,000 and targets a slightly younger demographic than the $9.95 plan ages 40-75. Not Colonial Penn Life Insurance Company. Per his LinkedIn profile, he works for CNO Financial Group, the parent company that owns Colonial Penn. For a detailed quote, please contact an agent. And, are there some better options available than just Colonial Penns products? Let us know in the comments which Colonial Penn commercial was your favorite (or if we missed it)! We will never sell or share your info with anybody. Yes, Jonathan Lawson works for Colonial Penn. Webjonathan lawson colonial penn wife jonathan lawson colonial penn wife on March 30, 2023 on March 30, 2023 The same $10,000 of coverage for a male 70 years of age would be about $74 per month with Mutual of Omaha. So what exactly is the 9.95 Colonial Penn life insurance? The good news is, here at Final Expense Benefits, we work with companies that offer burial insurance with no waiting period and burial insurance with no medical exam. Yes, the Colonial Penn 995 life insurance is a real plan. Your policy does not cost more because we helped you, and our advisory services cost you nothing. *Example rates and not a quote for insurance. Classic.  Look beyond the $9.95 plan. You need to be aware of what exactly the $9.95 represents. But practically speaking? What are the rates for Colonial Penn life insurance? He has personally helped over 3000 clients with their life insurance needs. Other than my slight preference for Jonathan Lawson as Colonial Penns spokesperson, theres not much to say about this advertisement, as its essentially the same as the above. Be sure to evaluate other options than the Jonathan Lawson $9.95 plan. Dont buy life insurance from Colonial Penn. In addition to highlighting its affordability, these commercials emphasize other benefits such as guaranteed acceptance regardless of health history or age, fixed premiums that never increase with age, and cash value accumulation over time so policyholders can borrow against their policies if needed later on down the road. In the next section of this article, youll be able to read and learn about Colonial Penn $9.95 plan reviews, so you can determine for yourself if the insurance plan is worth it. Colonial Penn Life Insurance Company was founded in 1957 by Leonard David. Colonial Penn offers permanent whole life insuranceonly (life insurance that covers you for your whole life), essentially the guaranteed issue life insurance plan which does not have health questions. The $9.95 Colonial Penn Plan that Jonathan Lawson is promoting is a guaranteed acceptance policy. Years 3 and beyond: Payout equals the full death benefit. WebMenu. If youre watching these commercials because youre thinking about buying a final expense insurance policy, Id recommend taking out a pen and paper. These figures were obtained from the NFDA and are estimates only. He promotes the guaranteed acceptance $9.95 plan for seniors. What is a unit?. How do I cancel my Colonial Get the details of what Jonathan Lawson is promoting and how you can find much better final expense life insurance from other insurance companies.

Look beyond the $9.95 plan. You need to be aware of what exactly the $9.95 represents. But practically speaking? What are the rates for Colonial Penn life insurance? He has personally helped over 3000 clients with their life insurance needs. Other than my slight preference for Jonathan Lawson as Colonial Penns spokesperson, theres not much to say about this advertisement, as its essentially the same as the above. Be sure to evaluate other options than the Jonathan Lawson $9.95 plan. Dont buy life insurance from Colonial Penn. In addition to highlighting its affordability, these commercials emphasize other benefits such as guaranteed acceptance regardless of health history or age, fixed premiums that never increase with age, and cash value accumulation over time so policyholders can borrow against their policies if needed later on down the road. In the next section of this article, youll be able to read and learn about Colonial Penn $9.95 plan reviews, so you can determine for yourself if the insurance plan is worth it. Colonial Penn Life Insurance Company was founded in 1957 by Leonard David. Colonial Penn offers permanent whole life insuranceonly (life insurance that covers you for your whole life), essentially the guaranteed issue life insurance plan which does not have health questions. The $9.95 Colonial Penn Plan that Jonathan Lawson is promoting is a guaranteed acceptance policy. Years 3 and beyond: Payout equals the full death benefit. WebMenu. If youre watching these commercials because youre thinking about buying a final expense insurance policy, Id recommend taking out a pen and paper. These figures were obtained from the NFDA and are estimates only. He promotes the guaranteed acceptance $9.95 plan for seniors. What is a unit?. How do I cancel my Colonial Get the details of what Jonathan Lawson is promoting and how you can find much better final expense life insurance from other insurance companies.

Examples Of Locutionary, Illocutionary And Perlocutionary Act, Bone Handle Hunting Knife, Canoe Atlanta Dress Code, Kalahari Waterpark Passes, Articles H