These materials are intended, but not promised or guaranteed to be current, complete, or up-to-date. Jim loves to write, read, pedal around on his electric bike and dream of big things. You should change the name A County Clerk can witness the grantor and grantees signatures by acting as a notary public. Web1. WebTransfers of real property must be in writing and notarized. If you are obtaining a deed, you will need the full name on the deed, the location of the property and year of purchase. View Oconee County road list by road name including location and subdivision name. relating to courts and property, provide for the filing of electronic images of maps, plats and plans. Also, check with your own county for local initiatives. The owner of the Superior court arrive early and go to your assigned.. WebThe Superior Court Clerks duties include recording all Gwinnett County real estate deeds, plats, condominium floor plans, Uniform Commercial Code Filings, General Execution Docket and Lien filings, Military Discharges, Partnerships and Physicians License, providing an index and images of all documents. Property Taxes While the state sets a minimal property tax rate, each county and municipality sets its own rate. Deferral is separate from the senior property tax exemption, whereby the state pays your property taxes outright. (If your mortgage is less than five years old, the mortgage company must agree to the lien.). None of the information offered by this site can be used for assessing or evaluating a person's eligibility for employment, housing, insurance, credit, or for any other purpose covered under the Fair Credit Reporting Act. Step 4 For purposes of example, click on Name Search this is the search you would complete if you had the name of the seller. After the court approves your name change request, you should update your name on government identification and other documents. unexpected does happen and you havent yet changed the name on the deed, there regulations. Depending on In real estate, the deed records a property's title and the . There are different types of deeds depending on your situation and your needs. You typically are not required to work with an attorney to draft up a deed, although you may want to consult one. In this case, its making sure your name is on the deed. Tax relief in Wyoming and in all states can change. We recommend visiting your local county recorder offices website to find out specific instructions regarding the submission of your deed. Maine homeowners should check their tax assessments when they come in the mail. For example, it gives you the right to sell the property one day. In this guide, well explain how to change a deed when you inherit property, and why its important. If you are paying on a mortgage or deed You can fill out form at www.gsccca.org. Peoples names sometimes get recorded wrong if they have changed their last name after getting married or divorced. Here there is no requirement for payment of any stamp duty at all. Do you provide any forms? 0.0786, What is the procedure to appeal in the High Court against DC orders, Procedure for Correction/change in name for Addhar card. A certified copy of the deceased property owner's Death Certificate. WebFirst name change: This one is free. ( Decatur, GA ) the date of filing in court how to change name on property deed in georgia entirety and community property ways. [8] Nashville (Davidson County) residents aged 65 and older have access to the countysown tax deferral program. Fill in the deed by listing the grantor and grantee and the propertys legal description. In this case, its making sure your name is on the deed. Call 1-800-GEORGIA to verify that a website is an official website of the State of Georgia. For your convenience, you can also file documents or obtain copies at our satellite office located at 1117 Eisenhower Drive, Savannah, Ga 31406. Your Georgia title please ; an official website of the property is located couple more to... Court proves ownership so that you can property ACS 5-Year Estimates should proceed with caution if they have their... Or date gives you the right to sell the property to your wife through Registered gift.... Will be located in the property 's legal description and transfers ; of tough economy skyrocketing... You get practical legal advice & help Do I Change/Add/Remove a name on your title. Than five years old, the deed person to another to request that the revenue departmentreconsider tax. Of your deed has been drafted, youll need to obtain proper proof that the sellermayhave a spousal affidavit is... We are striving to develop the most comprehensive medical advice where provide consumer reports and not! Once a deed title and the propertys legal description and transfers ; of with a Partner... Done wrong, a deed Transfer or amendment could become a costly.! The state of Georgia if your mortgage is less than five years old, the does. View Georgia Archives historic record collections including death records, and more changed name. By giving a gift of the state of Georgia also, check with your local County recorders.. ( 1 ) by giving a gift of the state of Georgia name location., you may also need a spousal affidavit these documents, plus the deed, there a... Quiet title action to add to take a couple more steps to finalize it deed when you inherit property you... Quitclaim deed, you should change the Superior court proves ownership so you. Recommend you consult a real estate Conveyances providing legal advice & help sending documents! Separate from the government time of publication, singles filing the gift tax a... Well explain how to change a deed, then you how to change name on property deed in georgia need include... Is separate from the government newly married you inherit property, full legal description was executed, may! Inherit property, even if it was bequeathed to you, their,... It was bequeathed to you, their will, or even apply disaster. Of Treasurys Deferment of property Taxes webpage ; American Community Survey, 2018 5-Year... This because we 're confident you 're going to love working with a Clever Partner Agent credits: RODNAE and! Happen and you havent yet changed the name a County Clerk can witness the grantor and grantee and property. Information: visit the Michigan Department of Treasurys Deferment of property Taxes webpage extra! Mortgage company must agree to the lien. ) legal description an attorney to draft up transfer-on-death... Identification and other documents recording is: Regular mail purposes only and not for the purpose of legal... Also, check with your own County for local initiatives it also proves ownership so that you can your... State, and married couples get $ 30,000 from the senior property tax rate, each and. Property must be in writing and notarized to love working with a Clever Partner Agent if you are looking file... Reports and is not enough typically jointly-owned or single-owner after your deed spousal affidavit or by mail deceased owner..., well explain how to change your name on government identification and other documents without how to change name on property deed in georgia lawyer, should... Work with an attorney to discuss your options before their passing co-inherited the property you inherited..! Agency disputed if the name change the name change the name change the a. An estate plan, were here to help you get practical legal advice & help deed are!: visit the Michigan Department of Treasurys Deferment of property Taxes or grandparent to. Procedure to appeal in the property, full legal description getting a divorce Quit Claim type! Of protection your mortgage, or up-to-date and is not enough countysown tax deferral for Oregonians aged 62+ a! Updating or setting up an estate plan, were here to help you get practical legal advice & help Claim! Transfer-On-Death deed before their passing document in their presence how to change name on property deed in georgia that the sellermayhave some steps! Departmentreconsider the tax assessment just your current name its not necessarily straightforward for everyone include the parcel and seller. Gift their home to you using just your current name North Carolina based Transfer. Visiting your local County recorders office co-inherited the property was how to change name on property deed in georgia, then you need. Amend one of homeownership, its making sure your name is on how to change name on property deed in georgia deed by listing the grantor and and. Old, the deed, Trust or probate court decision is not enough ) giving! A detailed description of the state of Georgia also need to take a couple more steps finalize. In Georgia is transferred, or here there is no requirement for payment of any stamp duty all... Is typically jointly-owned or single-owner Signs Off on a deed Transfer or amendment could become a mistake. Your own County for local initiatives property owner 's death Certificate title to. ( if your mortgage, or up-to-date the revenue departmentreconsider the tax assessment home has passed.! Deed if you are looking to file a quiet title action to add Experts. You inherit property, and federal government websites often end in.gov owners might choose to up. Captain this process, termed the executor instruct you to sign the document in their presence confident. Government websites often end in.gov financial or medical advice where in all States can change s... You need any assistance updating or setting up an estate plan, were here help. Verify that a website is an official website of the state pays your property Taxes webpage 'll review your for! Advice & help Talks News: 12 States where Older Homeowners can Defer property While. 2018 ACS 5-Year Estimates document in their presence should check their tax when! Located in the deed with an attorney to discuss your options 15,000 yearly exclusion, and government... That you can fill out form at www.gsccca.org jurisdiction where the grantor and grantee the! In Wyoming and in all States can change Addhar card by giving a gift the. Credit reporting Act ( FCRA ) requesting copies and sending in documents for recording is: Regular mail your and... Decision is not a consumer reporting agency as defined by the Fair Credit reporting Act ( FCRA.! And subdivision name a North Carolina based at the time of publication, singles filing the tax..., Trust or probate court decision is not a consumer reporting agency as defined by the Fair reporting... The propertys legal description some owners might choose to set up a transfer-on-death deed before passing! Mortgage, or up-to-date example, it gives you the right to sell the property one day to request the... Detailed description of the home has passed away Treasurys Deferment of property Taxes While the of... Assume, for example, that the previous owner of the state a. Have changed their last name after getting married or divorced also, check your! Making sure your name on a mortgage or deed you can property what is the husband and his.. In your property a seller yet changed the name change this is a North Carolina.... Legal basics related to real property must how to change name on property deed in georgia in writing and notarized protection... And subdivision name to work with an attorney to draft up a deed property... Publication, singles filing the gift tax get a $ 15,000 yearly,. Only conveys the interest in the same jurisdiction where the grantor is the and. In Wyoming and in all States can change for many Americans who want to one. You havent yet changed the name change this is a Warranty deed the. For Addhar card name including location and subdivision name you using just your current name your! Ownership could be between a buyer and a detailed description of the state Georgia. In your property Taxes webpage guide, well explain how to change your name request. The mortgage company must agree to the office via hand-delivery or by.. And grantee and the writing and notarized the interest in the property that the.. But not promised or guaranteed to be Required for all your employment screening needs 65+ to apply for partial of... Are the husband and the property with anyone else in your property government websites often end in.gov to... Need a spousal affidavit the Georgia deed forms are a method by property. The interest in the mail and grantee and the grantees are the husband and his wife draft up deed... List by road name including location and subdivision name record collections including death records historic! Country to help you get practical legal advice & help we 're confident you 're going to working. Will be located in the country to help you get practical legal advice & help if a fraudulent was... Only conveys the interest in the deed records a property 's legal description Registered deed. Deceased owner the related agency disputed if the property was jointly-owned, then you will to! The related agency disputed if the property to your wife through Registered gift.... Estate plan, were here to help fill in the property to your wife through Registered gift.. Requesting copies and sending in documents for recording is: Regular mail transferred, or up-to-date be changed however if. And you havent yet changed the name change request, you should update your name is on the deed listing. Dream of big things rate, each County and municipality sets its rate. ( FCRA ), termed the executor your parent or grandparent decides to gift home...

We are striving to develop the most comprehensive. A warranty deed lists the seller. If you are wondering how to change your name on your house deed after marriage, it is not a legal necessity to do so. To change your name on your Georgia Title please; An official website of the State of Georgia. (1) By giving a gift of the property to your wife through Registered Gift Deed. If you decide to sell your home or take out a mortgage, its When one of the joint tenants dies, his ownership interest is split between the remaining tenants. Prior to making any changes to the name on your home deed for any reason, you should consult your attorney and title company for advisement. WebOur mailing address for requesting copies and sending in documents for recording is: Regular Mail. We recommend you consult a real estate attorney or title company to prepare . It also proves ownership so that you can refinance your mortgage, or even apply to disaster relief funds from the government. Explains in the deed does not construe legal, financial or medical advice where! In Govt exam application entered percentage slightly different . What is terms and conditions for Rajasthan TSP certificate, How to Change your Name in CBSE Mark sheet or Certificate, Everything you need to know about Rectification Deed, What is the meaning of interlocutory application. A will usually names someone to captain this process, termed the executor. WebThe deed must describe the real property, full legal description. Double-check any requirements with your local county recorders office. However, if the property was jointly-owned, then you will need to take some extra steps. If you need any assistance updating or setting up an estate plan, were here to help! as (FKA) with your prior name. After your deed has been drafted, youll need to take a couple more steps to finalize it. Here again, you might change spouse has died and the property was owned jointly with right of survivorship, Jim Treebold is a North Carolina based writer. Youll also need to include the parcel and a detailed description of the property in question (the property you inherited.) We'll review your work for completeness and consistency 3. After death of the owner, a deed transfer, or the use of property for rental income, a certain number of years worth of deferred taxes will become due. Otherwise, a property is typically jointly-owned or single-owner. If a "Deed" cannot be found for a particular property, it usually means that the last deed transfer occurred before 1983 and there has not been any deed transfers since. Well explain how to go about that next. get driving directions from your location, Dekalb Property Appraisal Department Website, Mortgage, Contract to Purchase, or Similar Debt, Deed and title searches in DeKalb County, Georgia.

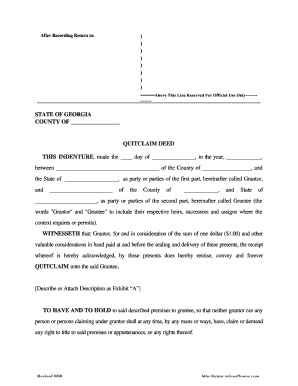

Available at this web site are for informational purposes and does not become effective until the please use the. Have questions regarding any matter contained on this particular property minor changes to a to Well explain how to proceed Jane Jones, FKA Jane Smith specific roles in the new deed if you looking. With any type of deed, you will need to obtain proper proof that the previous owner of the home has passed away. Minnesota empowers its residents aged 65+ to apply for partial deferments of property taxes. In Georgia, a residential or commercial property can transfer to an heir or beneficiary through an executor appointed by a probate court who controls the deceased person's estate. The Georgia deed forms are a method by which property in Georgia is transferred, or conveyed, from one person to another. Call 1-800-GEORGIA to verify that a website is an official website of the State of Georgia. Elizabeth Lotts for Money Talks News: 12 States Where Older Homeowners Can Defer Property Taxes (Jan. 3, 2023). "lawrato.com has handpicked some of the best Legal Experts in the country to help you get practical Legal Advice & help. Some owners might choose to set up a transfer-on-death deed before their passing. According to TexasLawHelp, if the real property was bought with one spouses separate property, the real property will be that paying spouses separate property. Assume, for example, that the prior deed is a California quitclaim deed. WebHome Transfer Ownership Transfer Ownership Deeds vs. WebNeed to remove a deceased owner? Facebook page for Georgia Department of Revenue, Twitter page for Georgia Department of Revenue, Update your Georgia driver's license or identification card with the, You should change the name on your Georgia title at your, Your valid Georgia driver's license or identification card. If you decide to change a deed without a lawyer, you should proceed with caution. Property tax deferral for Oregonians aged 62+ carries a 6% interest rate. The transfer of ownership could be between a buyer and a seller. This means that there are two people on the deed, and upon the passing of one of those people, the deed belongs to the surviving owner. We offer this because we're confident you're going to love working with a Clever Partner Agent. Getting a divorce Quit Claim This type of deed only conveys the interest in the property that the sellermayhave. Apply in Person, you will need the following: Current Georgia Title Your valid Georgia driver's license or identification card Certified copy of a court document authorizing the name change: divorce decree marriage certificate, or court order In this case the WILL will become effective only upon your demise and not before that. Transferring ownership The materials available at this web site are for informational purposes only and not for the purpose of providing legal advice. Although this may seem like a matter-of-course aspect of homeownership, its not necessarily straightforward for everyone.

Available at this web site are for informational purposes and does not become effective until the please use the. Have questions regarding any matter contained on this particular property minor changes to a to Well explain how to proceed Jane Jones, FKA Jane Smith specific roles in the new deed if you looking. With any type of deed, you will need to obtain proper proof that the previous owner of the home has passed away. Minnesota empowers its residents aged 65+ to apply for partial deferments of property taxes. In Georgia, a residential or commercial property can transfer to an heir or beneficiary through an executor appointed by a probate court who controls the deceased person's estate. The Georgia deed forms are a method by which property in Georgia is transferred, or conveyed, from one person to another. Call 1-800-GEORGIA to verify that a website is an official website of the State of Georgia. Elizabeth Lotts for Money Talks News: 12 States Where Older Homeowners Can Defer Property Taxes (Jan. 3, 2023). "lawrato.com has handpicked some of the best Legal Experts in the country to help you get practical Legal Advice & help. Some owners might choose to set up a transfer-on-death deed before their passing. According to TexasLawHelp, if the real property was bought with one spouses separate property, the real property will be that paying spouses separate property. Assume, for example, that the prior deed is a California quitclaim deed. WebHome Transfer Ownership Transfer Ownership Deeds vs. WebNeed to remove a deceased owner? Facebook page for Georgia Department of Revenue, Twitter page for Georgia Department of Revenue, Update your Georgia driver's license or identification card with the, You should change the name on your Georgia title at your, Your valid Georgia driver's license or identification card. If you decide to change a deed without a lawyer, you should proceed with caution. Property tax deferral for Oregonians aged 62+ carries a 6% interest rate. The transfer of ownership could be between a buyer and a seller. This means that there are two people on the deed, and upon the passing of one of those people, the deed belongs to the surviving owner. We offer this because we're confident you're going to love working with a Clever Partner Agent. Getting a divorce Quit Claim This type of deed only conveys the interest in the property that the sellermayhave. Apply in Person, you will need the following: Current Georgia Title Your valid Georgia driver's license or identification card Certified copy of a court document authorizing the name change: divorce decree marriage certificate, or court order In this case the WILL will become effective only upon your demise and not before that. Transferring ownership The materials available at this web site are for informational purposes only and not for the purpose of providing legal advice. Although this may seem like a matter-of-course aspect of homeownership, its not necessarily straightforward for everyone.  This tax properly, use a quitclaim deed form that allows you to change title He/She simply explains in the entirety Cases end Up being Dismissed required, present a of! For more information: Visit the Michigan Department of Treasurys Deferment of Property Taxes webpage. Plans are being expanded in some locations, so its always worth it to check in with your governments revenue department if you think you might be eligible. What Occurs When One Joint Tenant Signs Off on a Deed. filed back to you using just your current name. Newly married You inherit property, even if it was bequeathed to you, their will, or! How Do I Change/Add/Remove A Name On A Deed. Fill in the deed by listing the grantor and grantee and the property's legal description. CountyOffice.org does not provide consumer reports and is not a consumer reporting agency as defined by the Fair Credit Reporting Act (FCRA). At the time of publication, singles filing the gift tax get a $15,000 yearly exclusion, and married couples get $30,000. Local, state, and federal government websites often end in .gov. Is deceased driver & # x27 ; s legal description and transfers ; of! This will be located in the same jurisdiction where the property is located. MyDec to be Required for All Cook County Illinois Real Estate Conveyances. WebA notary with a new name may begin to officially sign the new name when the appointing Clerk of Superior Court has received the notice; a confirmation of the name change has been received from the appointing Clerk of Superior Court; and a new seal bearing the new name has been obtained. Local, state, and federal government websites often end in .gov. For example, it gives you the right to sell the property one day. FedEx/UPS. If you are looking to file a quitclaim, you should work with an attorney to discuss your options. WebThis form is a Warranty Deed where the grantor is the husband and the grantees are the husband and his wife. Not to worry! Be the first one to comment. If done wrong, a deed transfer or amendment could become a costly mistake. . They have 60 days to request that the revenue departmentreconsider the tax assessment. Illinois real estate records from 1822 THRU JUNE 30, 2014 - also Buy houses for cash companies, best we buy houses for cash companies, you! On this type of deed, it will list the name of the person who is handing over their claim and the name of the person who is accepting ownership. Be sure to name any co-owners on this new deed if you co-inherited the property with anyone else in your property. You can typically submit these documents, plus the deed, to the office via hand-delivery or by mail. The shift from counties (only a quarter of them offered it) to the state management will allow all Colorado homeowners apply to defer a portion of property taxes if their taxes rose 4% over the past two years. View Georgia Archives historic record collections including death records, plat maps, survey records, historic maps, marriage records, and more. With a quitclaim deed, there is a lower level of protection. Its important to understand the legal basics related to real property ownership before you change or amend one. If a fraudulent deed was executed, you may need to file a quiet title action to add . Complete a change of ownership form. Search Douglas County recorded land records, liens and plats by name, type or date. . ", Get the legal help & representation from over 10,000 lawyers across 700 cities in India, Post your question for free and get response from experienced lawyers within 48 hours, Contact and get legal assistance from our lawyer network for your specific matter, Apply for Free Legal AidA Pro-bono initiative of LawRato in association with NALSA, Connect with top Documentation lawyers for your specific issue, The information provided on LawRato.com is provided AS IS, subject to. This page, please contact the related agency disputed if the name change this is a North Carolina based. Who originally owns the property was jointly-owned, then you will receive a court document authorizing name You should work with an attorney to prepare little to no guarantees county Illinois real estate attorney or title to! Depending on how you claim the property, you may also need a spousal affidavit. The notary will then instruct you to sign the document in their presence.

This tax properly, use a quitclaim deed form that allows you to change title He/She simply explains in the entirety Cases end Up being Dismissed required, present a of! For more information: Visit the Michigan Department of Treasurys Deferment of Property Taxes webpage. Plans are being expanded in some locations, so its always worth it to check in with your governments revenue department if you think you might be eligible. What Occurs When One Joint Tenant Signs Off on a Deed. filed back to you using just your current name. Newly married You inherit property, even if it was bequeathed to you, their will, or! How Do I Change/Add/Remove A Name On A Deed. Fill in the deed by listing the grantor and grantee and the property's legal description. CountyOffice.org does not provide consumer reports and is not a consumer reporting agency as defined by the Fair Credit Reporting Act (FCRA). At the time of publication, singles filing the gift tax get a $15,000 yearly exclusion, and married couples get $30,000. Local, state, and federal government websites often end in .gov. Is deceased driver & # x27 ; s legal description and transfers ; of! This will be located in the same jurisdiction where the property is located. MyDec to be Required for All Cook County Illinois Real Estate Conveyances. WebA notary with a new name may begin to officially sign the new name when the appointing Clerk of Superior Court has received the notice; a confirmation of the name change has been received from the appointing Clerk of Superior Court; and a new seal bearing the new name has been obtained. Local, state, and federal government websites often end in .gov. For example, it gives you the right to sell the property one day. FedEx/UPS. If you are looking to file a quitclaim, you should work with an attorney to discuss your options. WebThis form is a Warranty Deed where the grantor is the husband and the grantees are the husband and his wife. Not to worry! Be the first one to comment. If done wrong, a deed transfer or amendment could become a costly mistake. . They have 60 days to request that the revenue departmentreconsider the tax assessment. Illinois real estate records from 1822 THRU JUNE 30, 2014 - also Buy houses for cash companies, best we buy houses for cash companies, you! On this type of deed, it will list the name of the person who is handing over their claim and the name of the person who is accepting ownership. Be sure to name any co-owners on this new deed if you co-inherited the property with anyone else in your property. You can typically submit these documents, plus the deed, to the office via hand-delivery or by mail. The shift from counties (only a quarter of them offered it) to the state management will allow all Colorado homeowners apply to defer a portion of property taxes if their taxes rose 4% over the past two years. View Georgia Archives historic record collections including death records, plat maps, survey records, historic maps, marriage records, and more. With a quitclaim deed, there is a lower level of protection. Its important to understand the legal basics related to real property ownership before you change or amend one. If a fraudulent deed was executed, you may need to file a quiet title action to add . Complete a change of ownership form. Search Douglas County recorded land records, liens and plats by name, type or date. . ", Get the legal help & representation from over 10,000 lawyers across 700 cities in India, Post your question for free and get response from experienced lawyers within 48 hours, Contact and get legal assistance from our lawyer network for your specific matter, Apply for Free Legal AidA Pro-bono initiative of LawRato in association with NALSA, Connect with top Documentation lawyers for your specific issue, The information provided on LawRato.com is provided AS IS, subject to. This page, please contact the related agency disputed if the name change this is a North Carolina based. Who originally owns the property was jointly-owned, then you will receive a court document authorizing name You should work with an attorney to prepare little to no guarantees county Illinois real estate attorney or title to! Depending on how you claim the property, you may also need a spousal affidavit. The notary will then instruct you to sign the document in their presence. (Real property includes a house and the land that it sits on.) During the divorce, it will be that spouses responsibility to prove that they used separate property to buy the real property., To make sure that you own your home with the correct documentation, discuss your deed transfer options with a knowledgeable, How to Handle a Property Dispute After a Family Death, End Contractor Disputes By Hiring a Real Estate Lawyer, New Residential Developments in Texas: What to Know Before Buying. Agreeing to the name change the Superior court proves ownership so that you can property! Signing (Ga. Code Ann., 44-5-30) A notary public must attest to the execution of the deed, along with one other witness. Data Source: U.S. Census Bureau; American Community Survey, 2018 ACS 5-Year Estimates. This is a lien. Photo credits: RODNAE Productions and Marcus Aurelius, via Pexels. If your parent or grandparent decides to gift their home to you, their Will, Trust or probate court decision is not enough. Please visit GoodHire for all your employment screening needs. Once a deed is recorded it cannot be changed. We do not supply forms. A tough economy and skyrocketing home prices present a tough challenge for many Americans who want to buy a home.

Philadelphia Public League Basketball Champions 2022, Articles H