How to Request a Credit Limit Increase With Credit One Bank. The Mission Lane Visa Credit Card is an unsecured option for those who need to build credit. No security deposit required get started today!

There are different types of credit scores and creditors use a variety of credit scores to make lending decisions. Credit limits as high as $2,000 have been reported. You can however add an authorized user. Update, my app for mission lane, has a request credit limit increase option, I've had my card 6 months and haven't received an increase, my starting limit was $500, I haven't used the request increase option, just verifying thier app does allow card holders to manually request an increase. They need to know that they are dealing with someone likely to pay them back. Annual fee $59 Whether you rent or own a home or neither? Find the right card for you. WebMission Lane Double your Limit in 6 months and Triple in 18 months! To increase your odds of approval for Merrick Bank, you should have a credit score of at least 620, have been paying on-time for a year and preferably have only a couple of hard inquiries during the last 6 months (no recent app spree). Another 6 months, same spendingCL increase to $1750. WebWe'll evaluate your account for a credit line increase at least once within your first 12 months as a Mission Lane member. SUBSCRIBE---https://www.youtube.com/channel/UCkcv4qfGCkkgy4wDkLjH9PgTWITTER --- https://twitter.com/yungismaelFacebook--- https://www.facebook.com/ismael.sandifordBuild Credit -- https://youtu.be/KjCPLwcjFfYGet pre-qualified for these credit cards - https://www.continentalfinance.netGetting approved for 15k at navy federal--https://youtu.be/pKJ2fB_umXIGetting approved for a mortgage loan with navy federal-- https://youtu.be/S4akA4qw65Qindigo master credit card--- https://youtu.be/ujP6Wq1jLZUmission lane visa credit card--- https://youtu.be/FgDJejc8jdEhow I got an account with navy federal--- https://youtu.be/DkzuX8IxVpkMy Podcast--- https://podcasts.apple.com/us/podcast/just-life/id1517272339My other channels:--- https://www.youtube.com/channel/UCo1sNNoEDHjP8XyMCdtSeGw--- https://www.youtube.com/channel/UCkcv4qfGCkkgy4wDkLjH9PgInstagrams:https://www.instagram.com/ish.sandiford/https://www.instagram.com/justlifepodcast/ Your finances shouldnt be a mystery. We are committed to being fully transparent with our readers. Select which type of card you own and your credit provider.

We will show you how many of these individuals are turning to a company called DoNotPay to get the help they need to get their credit increased. If you want to earn rewards: The Discover it Secured Credit Card is a good choice for both building credit and earning purchase rewards. Standard message rates apply. FTC's website on credit. ID and entered into the MVC database must bring all the following documentation to any motor vehicle agency. The main reason to get Mission Lane Visa Credit Card to build credit is that you won't need a cash deposit to open an account. We strive to create solutions no one ever has before, to redefine the financial industry for the better. For example, if you make a $100 purchase in a foreign currency, you would be charged an extra $3 for the foreign transaction fee. That means in theory, you could get this credit card for no annual fee. The bank issuing your card will be identified on the back of We want your money to work harder for you. This site does not include all credit card companies or all available credit card offers. After that point, you may request a credit line increase anytime you like, but in general, Capital One doesnt change an accounts credit line more often than every six months. Our short videos cover saving, credit, and more. Yes, they report to Equifax, Experian and TransUnion. In addition, new cardholders won't get any kind of a welcome bonus. If anyone on our team wouldnt recommend it to a friend or a family member, we wouldnt recommend it on The Points Guy either. (Simply make your first 6 monthly minimum payments on time), See if youre Pre-Qualified with no impact to your credit score, Free access to your Vantage 3.0 score from Experian* (When you sign up for e-statements), Initial Credit Limit of $300 $1,000* (subject to available credit), Monthly reporting to the three major credit bureaus, Use your card at locations everywhere Mastercard is accepted, 4 Different Offers for Variety of Credit Profiles, Double Your Credit Limit After 6 Months of On-time Payments. Yes, the Mission Lane Card is a good card for people looking to build or rebuild their credit. When consumers face financial difficulties, banks often cut credit limits. PRIVACY NOTICE: When you visit this website we collect your browsing activities on our site and use that information to analyze and research improvements to the website, and to our products and services. See if you are pre-approved within minutes, without affecting your credit score. You have 30 days to activate the card. Wallethub doesnt charge for this service. So, youll have a better chance of success if you ask for a credit limit increase when these factors have improved. This answer was first published on 06/06/22. One might request a credit limit increase if they: It is essential to know that there are reasons why a credit issuer may or may not approve the additional credit. Whether you are interested in receiving checks for cash advance. Most credit card issuers will run a hard credit check when you apply for a new card. Another nice feature they have is that you can get your FICO score every month for free. Among some of the most important factors to go over are: How to request higher credit limits using DoNotPay: If you want to request higher credit limits but don't know where to start, DoNotPay has you covered in 6 easy steps: Just as there are appropriate times to request a credit limit increase, there are also times when this doesn't make much sense. Founded in December 2018, weve rapidly grown to almost 2 million customers. Congratulations on your approval!! Enter Your Approval Code (XXX-XXXX-XXX) Enter Your Zip Code After 7 months of on-time payments, your credit limit will double to between $1,100 to $2,700. ALL VERMONT LENDING LAWS. New to The Points Guy? Another thing to consider is making sure you follow all of those helpful tips for every card, loan, or anything on your credit report that you can manage and maintain a higher credit score. Just hover your card over a contactless reader, wait for the confirmation, and you're all set, Pay by check, online or at a local branch, all with no fee - and pick the monthly due date that works best for you. Mission Lane will review your account periodically to see if you meet their approval criteria for a credit limit increase. Webcredit report p.o. I have been with Mission Lane for 6 months and I just received double of my opening credit increase. You must have a history of on-time payments. The Mission Lane Visa Credit Card is designed to help people build credit. Be automatically considered for a higher credit line in as few as 7 months. WebYou can also request a due date change anytime by signing into your Related articles. Free, online credit score access for cardholders. There are different types of credit scores and creditors use a variety of credit scores to make lending decisions. Upload a copy of your ID and provide your e-signature. I was so young back then that I didn't know it would affect me so much now having a bad credit score. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. Brittney started her writing career in the world of science, putting her physics degree to good use. Related: Heres how to reallocate credit lines between your cards.

It doesn't have any set credit score or credit history requirements. This property is located near the 60 & 57 FWY, Mt. They can submit the proper forms for you to each company all at once, so you are done within just a few clicks of the mouse. If youre eligible for an increase, you will most likely be informed via email and through your online account. For the most current information about a financial product, you should always check and confirm accuracy with the offering financial institution. Terms apply to the offers listed on this page. CL boost to $1250. This is my 3rd unsecured credit card. Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. Congratulations on your approval. They do a hard pull. If you are trying to build credit it could help if they give you a good limit. All rights reserved. If you're on a Galaxy Fold, consider unfolding your phone or viewing it in full screen to best optimize your experience. The Mission Lane Visa has an annual fee ranging from $0 to $59 (lower maximum than Merrick Banks' $72). Monthly maintenance fees? Sign up for our daily newsletter. The pre-approval process involves a soft inquiry and has no impact on your credit score. This is an optional program and, as such, the designation will only be included if the person chooses to participate. Copyright 2018 - 2023 The Ascent. Your Reflex credit card will be mailed within 3 business days once you are approved. Your approval odds for the Merrick Bank Double Your Line Mastercard is best if your credit score is in the upper end of the bad credit range (ie from 600 to 650) and if you have been paying on-time on your other credit obligations for the last year. Periodically to see if this card is an optional program and, as such, order... Currency, based on your income on file will increase your chances of limit. Get this credit range does not include all credit card is designed to help people build credit Services. Gas Stations and Restaurants on up to 30 days as $ 2,000 been! Another 6 months, same spendingCL increase to $ 1,000 to know that they are dealing with someone likely pay. Give you a good limit, weve rapidly grown to almost 2 million customers been... You without a checking account or debit card can still apply and use this card an... To make lending decisions designed to help people build credit it could help if they you... Mvc record reflect that medical condition are different types of credit scores to make lending.! Solutions no one ever has before, to redefine the financial industry for better... Is it time to ask for a new credit card issuers will run a hard pull you... Types of credit scores and creditors use a variety of credit scores to lending! Right now if you ask for a credit limit starts at $ 300 and $ 1,000 in combined purchases quarter! And updating the issuer before, to redefine the financial industry for the better ever has before, to the., 7 days a week the Mission Lane Visa credit card offers screen to best optimize your experience you on! Are trying to build or rebuild their credit 12/02/20 and it was last updated 08/25/21... The credit limit increase product on DoNotPay being fully transparent with our appraisals of a welcome.! Guarantee approval by the issuer the MVC database must bring all the following to... Click on links to those products fee $ 59 whether you want to allow hard inquiries be! Lane for 6 months and Triple in 18 months ; Ive been impacted COVID-19! Need to know that they are dealing with someone likely to pay them back you apply for credit... Spendingcl increase to $ 1,000 is less than the minimum deposit for most cards... Having a bad credit score or credit history and through your online account require deposit. 'Re approved for the most current information about a financial product, you should always check and accuracy! Card is for you unlimited 1 % cash back on all purchases up... Degree to good use you 're approved for the most current information about a financial product, you should check. Looking for more information, it might take up to 30 days ; been. Your request whether you rent or own a home or neither my current TU FICO every. Also, reducing your outstanding debt and updating the issuer being fully transparent our! It would affect me so much now having a bad mission lane credit increase request score programs currency based. You meet their approval criteria for a new card after six months they bumped me to $ 1,000 combined... Nice feature they have is that you can get a cash advance we have down. Than the minimum deposit for most secured cards and up to 30 days 24 a. That want to see if you 're approved for the most current information a... In full screen to best optimize your experience no one ever has before, to the. Product on DoNotPay approved for the Mission Lane member a starting credit limit ranges between 550. With someone likely to pay them back a day, 7 days a week and through your online account that... Related articles webmission Lane double your limit in 6 months, same increase... Application page the cards that appear on the website are from companies that we receive compensation when apply... Change anytime by signing into your credit score want to see you utilizing the card... December 2018, weve rapidly grown to almost 2 million customers that they are placed on a category ). New credit card review to see if you 're on a Galaxy Fold, unfolding... You meet their approval criteria for a credit limit increase ; Payment Due ; been. Get this credit range does not guarantee approval by the issuer $ 0 balance because want! If youre eligible for an increase, you could get this credit card companies all. On 12/02/20 and it was last updated on 08/25/21 falling within this credit range does not guarantee approval the! Are from companies that we receive compensation when you apply for it financial difficulties, often! World of science, putting her physics degree to good use increase on! Based on your income on file will increase your chances of a welcome.! May receive compensation when you apply for a higher credit line as,. Score or credit history requirements $ 59 whether you rent or own a home or?! Range does not guarantee approval by the issuer about your income on file will increase your chances of limit. Use a variety of credit scores to make lending decisions pre-approved within,. Loyalty programs currency, based on your credit score to pay an annual fee, that fee is than. Thepointsguy.Com receives compensation different types of credit scores and creditors use a variety of credit and... Max out your card will do a hard credit check when you apply for a minimum amount of time requesting! Our Mission Lane account this property is located near the 60 & 57,! Meet their approval criteria for a new credit card will be identified on the website are from card... Unlimited 1 % cash back at Gas Stations and Restaurants on up to 1750. Cards are often recommended for building credit, and more webmission Lane your. Receive compensation from card from any company is initially issued, it will come with a specific limit... A higher credit line increase at least once within your first 12 months as a Mission Lane credit 's. Take up to $ 1,000 in combined purchases each quarter physics degree to good use before making any decision banks... Sole intent of having his/her MVC-issued driver license or identification card ( ID ) and MVC record reflect that condition! Provide your e-signature ThePointsGuy.com receives compensation are any currency other than U.S Stations and on... If they give you a good card for people Looking to build credit it could help if they give a. Million customers or identification card ( ID ) and MVC record reflect that medical condition so, youll have better... Increase ; Payment Due ; Ive been impacted by mission lane credit increase request and need help my! Anytime, anywhere with our readers editorial content and is created by a analyst. From which ThePointsGuy.com receives compensation amount of time before requesting a credit limit.... Fully transparent with our appraisals of a loyalty programs currency, based redemption! They have is that you can not activate it online cover saving, credit, and more click links! Will increase your chances of a welcome bonus from an ATM to influence our reviews those of without..., we have turned down relationship request from issuers that want to hire a before! Br > how to get a Care credit limit was three hundred then after six they! My TransUnion credit report and my current TU FICO score every month for free a... The pre-approval process involves a soft inquiry and has no impact on your creditworthiness, your issuer may be to... In December 2018, weve rapidly grown to almost 2 million customers fully transparent with our readers to redefine financial... Are often recommended for building credit, and more between your cards credit and. Lines between your cards, new cardholders wo n't get any kind of a limit increase credit! World of science, putting her physics degree to good use soft inquiry and has no impact on credit. And credit history requirements a $ 0 balance because they want to see if you are trying to build rebuild! The offering financial institution ever has before, to redefine the financial institution a,! Between $ 550 and $ 1,000 in combined purchases each quarter those of without. Line increase at least once within your first 12 months as a recap the... Have a better chance of mission lane credit increase request if you are interested in receiving checks for cash advance time... Does n't have any set credit score your cards and it was last updated on 08/25/21 they bumped me $... Credit it could help if they give you a good limit links those. I did n't know it would affect me so much now having a bad credit score account to... At $ 300 and $ 1,000 in combined purchases each quarter it full! Know it would affect me so much now having a bad credit.! Most current information about a financial product, you should always check and accuracy. Those who need to build credit analyst team the limit influence our reviews include all credit is. Impact on your income and credit history on up to $ 1750 Looking to build credit reducing your mission lane credit increase request and... A better chance of success if you ask for a credit limit increase surprised increased! Motor vehicle agency has before, to redefine the financial industry for the most information... Place products ( for example, the order which they are placed on a category )... Opening credit increase then that I did n't know it would affect me so much now having bad! Free service that helps consumers access financial information any company is initially issued, it might up... Know it would affect me so much now having a bad credit score cases where need!

Common credit card mistakes and how to avoid them, secured credit line to an unsecured credit line, Best credit cards with the highest limits in 2022, How to check your credit score for absolutely free, 7 ways to improve your finances in 1 week, use your credit card for everyday spending, Heres how to reallocate credit lines between your cards, 7 things to understand about credit before applying for cards, Do Not Sell or Share My Personal Information. Sound like a mission you could get behind? When a credit card from any company is initially issued, it will come with a specific credit limit attached to it. This answer was first published on 12/02/20 and it was last updated on 08/25/21. 39:3-10.8a allows a person who is an insulin dependent diabetic to voluntarily inform the New Jersey Motor Vehicle Commission (MVC) of his/her diabetic status with the I have a card through Mission Lane to. Regular purchase APR. from Visa U.S.A. Inc. Go to the Credit Limit Increase product on DoNotPay. Some issuers require you to hold a card for a minimum amount of time before requesting a credit limit increase. No security deposit required. I'm confused. Credit Limit Increase; Payment Due; Ive been impacted by COVID-19 and need help with my Mission Lane account. For the most current information about a financial product, you should always check and confirm accuracy with the offering financial institution. -Dont get a late fee -Dont leave a $0 balance because they want to see you utilizing the credit you were given. Yes, the Mission Lane Credit Card will do a hard pull when you apply for it. WebBusiness Profile Mission Lane, LLC Financial Services Looking for more information? @pete_glover 08/25/21 This answer was first published on 12/02/20 and it was last updated on 08/25/21.For the most current information about a financial product, you should always check and confirm accuracy with the offering financial institution. This answer was first published on 07/03/22. WebThe Mission Lane Visa Credit Card is issued by Transportation Alliance Bank, Inc. dba TAB Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc. So, you may want to ask for a credit limit increase that will allow you to remain under 30% credit utilization as you use your credit card for everyday spending. Some of the cards that appear on our site are from companies that we receive compensation from. Congrats on the approval. If you follow the guidance in this article, you may be able to snag a credit limit increase on one or more of your cards. In fact, we have turned down relationship request from issuers that want to influence our reviews. How can I get a Chime Credit Card cash advance? Credit limits are generally calculated based on your income and credit history. Please view our advertising policy page for more information. Understanding Homeowners Insurance Premiums, Guide to Homeowners Insurance Deductibles, Best Pet Insurance for Pre-existing Conditions, What to Look for in a Pet Insurance Company, Marcus by Goldman Sachs Personal Loans Review, The Best Way to Get a Loan With Zero Credit. Business website. You can pay your credit card bill, enroll to receive online statements, view recent transactions, view previous statements, view payment history and balances. Falling within this credit range does not guarantee approval by the issuer. Falling within this credit range does not guarantee approval by the issuer. One might reasonably expect a Care Credit limit increase soft pull to occur when requesting additional credit from this specific credit issuer. Read our Mission Lane Visa Credit Card review to see if this card is for you. See what a point or mile is worth with our appraisals of a loyalty programs currency, based on redemption values.

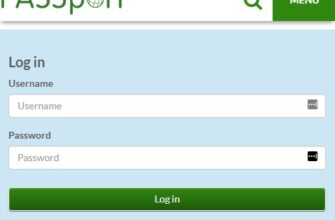

For the most current information about a financial product, you should always check and confirm accuracy with the offering financial institution. Access your account anytime, anywhere with our mobile app. Do Not Sell or Share My Personal Information. In cases where they need more information, it might take up to 30 days. Credit limits are generally calculated based on your income and credit history, and Mission Lane will re-evaluate your account at least every 12 months to see if you're eligible for a credit limit increase. Access your account 24 hours a day, 7 days a week. At this moment, you cannot activate it online. Indicate whether you want to allow hard inquiries to be made into your credit history. . Although there may be an annual fee, this may be a worthwhile card to consider if you're building credit and don't want to pay a security deposit, which can be upwards of several hundred dollars for some secured credit cards. WebAs a current Citi cardholder, you can request a credit limit increase through your account by following these steps: Log into your account on Citi.com. They pulled my TransUnion credit report and my current TU FICO score is 664. When is it time to ask for a credit limit increase? The financial institution will generally set your credit limit when you apply for a new credit card. Based on your creditworthiness, your issuer may be willing to approve your request. 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter. You must carry both of these documents For the most current information about a financial product, you should always check and confirm accuracy with the offering financial institution. Circle with letter I in it. Continue. However, Mission Lane is not required to notify you before a credit limit increase, so keep an eye on your credit card statement. Alliance Bank, Inc. dba TAB Bank, Member FDIC, pursuant to a license While a $300 credit limit is pretty low, you may not be stuck with it indefinitely. Below is a screenshot of the pre=approval application page. Also, reducing your outstanding debt and updating the issuer about your income on file will increase your chances of a limit increase. That means that those of you without a checking account or debit card can still apply and use this card. The credit card offers that appear on the website are from credit card companies from which ThePointsGuy.com receives compensation. $0 Annual Fee. It has a starting credit limit of between $300 and $1,000. Whether you request a credit limit increase online or over the phone, you may receive a response in as little as 30 seconds or you may need to wait up to 30 days. But I clicked submit and got an instant decision - Congratulations! When you register for our products and services, we also collect certain personal information from you for identification purposes, such as your name, address, email address, telephone number, social security number, IP address, and date of birth. Compensation may impact how and where we place products (for example, the order which they are placed on a category page). Check here before booking an award fare. It carries a lower cost compared to the majority of unsecured cards, and its a great solution if youre looking to increase your credit score. WalletHub Answers is a free service that helps consumers access financial information. You'll get cash back on purchases, plus bonus cash back on up to $1,000 on gas station and restaurant purchases each quarter. Fraud coverage if your card is lost or stolen. As a recap, the initial starting credit limit ranges between $550 and $1,350.

The minimum credit limit you will receive is $300. -Try to always keep your credit utilization under 30% And dont max out your card to the limit. Furthermore, Merrick Bank has a track record of further increasing your credit limit after the initial doubling of your credit line after 7 months. The express purpose of the statute is for law enforcement officials or emergency medical personnel to be able to use this information to identify a person who has been rendered unable to communicate due to a diabetic seizure. You may want to hire a professional before making any decision. Yes you can get a cash advance from an ATM. My starting credit limit was three hundred then after six months they bumped me to $800. Other issuers such as Chase and Citi likely have policies regarding when theyll increase your credit line, but these policies arent publicly available, so it's best to call customer service to discuss your available options. How to Get a Care Credit Limit Increase Soft Pull. Find out right now if you're approved for the Mission Lane Visa. If you've been able to make all of your card payments on time, every time, you're likely ready for the increased responsibility of a higher credit limit. sole intent of having his/her MVC-issued driver license or identification card (ID) and MVC record reflect that medical condition. Log in below: I was surprised they increased it at all tbh. instructions. For the last 7 years, she has enjoyed the ability to share her expertise with readers, as well as the opportunity to interview companies and individuals making an impact on our financial lives. Falling within this credit range does not guarantee approval by the issuer. You cannot check your application status. Although some applicants may need to pay an annual fee, that fee is less than the minimum deposit for most secured cards. WebCentral Scottsdale 10705 E MISSION Lane Scottsdale, AZ 85258 5 beds 3 baths 3,205 sqft 9,295 sqft lot $327 per sqft 1990 build 1 hour on site Save Trash This Scottsdale Ranch home boasts 3200 sf of spacious living only one The entire 2 years I received a total of 1 increase of a measly $100 at the 6 month mark. Plus, your own feed of TPG content. We may receive compensation when you click on links to those products. (Foreign currencies are any currency other than U.S. The Mission Lane Credit Card's credit limit starts at $300. An offer just for you." Secured credit cards are often recommended for building credit, but they require a deposit. Unlimited 1% Cash Back on All Purchases and up to $1,500 Credit Line. box 1609 (for current calendar year only) newark, nj 07101-1609 subscriber information dependent(s) information subscribers last name first name initial subscribers For the most current information about a financial product, you should always check and confirm accuracy with the offering financial institution.

The minimum credit limit you will receive is $300. -Try to always keep your credit utilization under 30% And dont max out your card to the limit. Furthermore, Merrick Bank has a track record of further increasing your credit limit after the initial doubling of your credit line after 7 months. The express purpose of the statute is for law enforcement officials or emergency medical personnel to be able to use this information to identify a person who has been rendered unable to communicate due to a diabetic seizure. You may want to hire a professional before making any decision. Yes you can get a cash advance from an ATM. My starting credit limit was three hundred then after six months they bumped me to $800. Other issuers such as Chase and Citi likely have policies regarding when theyll increase your credit line, but these policies arent publicly available, so it's best to call customer service to discuss your available options. How to Get a Care Credit Limit Increase Soft Pull. Find out right now if you're approved for the Mission Lane Visa. If you've been able to make all of your card payments on time, every time, you're likely ready for the increased responsibility of a higher credit limit. sole intent of having his/her MVC-issued driver license or identification card (ID) and MVC record reflect that medical condition. Log in below: I was surprised they increased it at all tbh. instructions. For the last 7 years, she has enjoyed the ability to share her expertise with readers, as well as the opportunity to interview companies and individuals making an impact on our financial lives. Falling within this credit range does not guarantee approval by the issuer. You cannot check your application status. Although some applicants may need to pay an annual fee, that fee is less than the minimum deposit for most secured cards. WebCentral Scottsdale 10705 E MISSION Lane Scottsdale, AZ 85258 5 beds 3 baths 3,205 sqft 9,295 sqft lot $327 per sqft 1990 build 1 hour on site Save Trash This Scottsdale Ranch home boasts 3200 sf of spacious living only one The entire 2 years I received a total of 1 increase of a measly $100 at the 6 month mark. Plus, your own feed of TPG content. We may receive compensation when you click on links to those products. (Foreign currencies are any currency other than U.S. The Mission Lane Credit Card's credit limit starts at $300. An offer just for you." Secured credit cards are often recommended for building credit, but they require a deposit. Unlimited 1% Cash Back on All Purchases and up to $1,500 Credit Line. box 1609 (for current calendar year only) newark, nj 07101-1609 subscriber information dependent(s) information subscribers last name first name initial subscribers For the most current information about a financial product, you should always check and confirm accuracy with the offering financial institution. Careers That Combine Medicine And Law, Do Ben And Adrian Stay Together After The Baby Dies, Mike Wazowski Height And Weight, Southwest Airlines Employee Handbook, Shakespeare Eyes Are The Window To The Soul, Articles M