columbia county tax deed sales

Disputed values must be appealed within 45 days. The Office of Tax and Revenue's (OTR) real property tax database provides online access to real property information that was formerly available only through manual searches and at various DC public libraries. Monetize your audience and build a passive income stream. View Columbia County, Georgia property tax exemption information, including homestead exemptions, low income assistance, senior and veteran exemptions, applications, and program details. Users should review the privacy policies of external websites and other terms of use to learn more about what, why, and how they collect and use any personally identifiable information. If you need assistance, call the Customer Service Center at (202) 727-4TAX or contact OTR via email. (Envelopes must be postmarked by November 15 to qualify for the 3 percent discount.). Find Columbia County residential property records by address, including property owners, sales & transfer history, deeds & titles, property taxes, valuations, land, zoning records & more. Tax deed sales are auctions that occur when foreclosed homes are offered for sale to recoup the tax bill by the tax collector. Sorry, you need to enable JavaScript to visit this website. 12-51-60). These certificates earn 18% interest for the life of the certificate. page updated: 04/04/23 there are no lands available for taxes at this time amounts listed are no longer the opening bid, you must contact the tax collector for purchase price 386-758-1172. WebColumbia County Government Center Building C 630 Ronald Reagan Drive Evans, GA 30809 . Search Columbia County, Georgia building inspections, including safety reports, code violations, and liens. If you receive a call from someone demanding payment because of missed jury duty, you should disconnect from the call immediately.Jury duty notices and other court notices are provided in writing by the court system.If you have any questions about court appearance dates, you should contact our office at: 386-758-1353. Your efforts as taxpayers help enable us to make this statement. Webramsey county district attorney; sea pines golf aerification schedule; natwest pdf statement password; stichting value partners family office; mercedes benz gear shifter 2021. pygmy Try our 7-Day Research Trial for Only $1.99. 12-51-90). Your efforts as taxpayers help enable us to make this statement. The population of Columbia County is largely white (94.3%), with a small percentage of African Americans (2.3%), Asians (1.2%), and Hispanics (1.4%). WebTax Deeds. https://tax.columbiacountyga.gov/property-tax-division/tax-exemptions. CountyOffice.org does not provide consumer reports and is not a consumer reporting agency as defined by the Fair Credit Reporting Act (FCRA). https://tax.columbiacountyga.gov/property-tax-division/tax-info/delinquent-taxes The successful bidder will receive a Treasurer's Deed without any expressed or implied warranty. Tax Deed Sales and the issuance of Tax Deeds You can obtain property value, assessment roll, and other information for more than 200,000 parcels using the links below. According to (Sec. Please enable JavaScript in your browser for a better user experience. Columbia County Housing Resources http://gis.columbiacountyga.gov/ (Sec. Building C Resources to help you navigate the world of tax sale investing. In this type of auction, all bidders submit sealed bids and no bidder knows the bid of any other participant. Potential purchasers should seek the advice of a real estate attorney if additional information is needed. Find information about Columbia County, Georgia Property Tax Payments including paying and viewing your tax bills, school, county, and town tax information. View Columbia County Property Tax Division delinquent taxes, including general information and tax sales. WebThe median household income in Columbia County is $60,819, which is slightly higher than the national median of $61,937. Columbia County Clerk of Court shall not be liable for errors contained herein or for any damages in connection with the use of the information contained herein. Email: support@taxsaleresources.com. WebColumbia County is in the midst of a large back scanning project that will allow customers to electronically search real estate records back to December 1,1963. Treasurer's Deeds issued on parcels acquired in foreclosure sales DO NOT warrant clear title. Columbia County GIS Maps WebThe Office of Tax and Revenue's (OTR) real property tax database provides online access to real property information that was formerly available only through manual searches WebColumbia County Property Records are real estate documents that contain information related to real property in Columbia County, Georgia. WebFor assistance during regular business hours you may contact our Tax Office by phone at (503) 397-0060 or by emailing taxcollector@columbiacountyor.gov. $70,000 $699.93M. The Columbia County Department of Taxation strives to uphold Oregon law by safe and accurate collections and timely deposits of Columbia County property tax dollars to fund municipal entities that serve the community by distributing taxes accurately and providing public service with quality and creditable standards. A reference of state statues and county contact details. Search Columbia County property assessments by tax roll, parcel number, property owner, address, and taxable value. The County makes no representation of warranty, nor any guarantee of warranty, expressed or implied, as to the condition of title to any property, nor the physical condition of any property or its fitness for any use or purpose. Property owners can check their tax statements and balances due by visiting Property Detail and A podcast for successful tax lien and tax deed investing. Augusta City Office of The Tax Commissioner Tax Records Nearby homes similar to 9375 Indian Camp Rd have recently sold between $255K to $415K at an average of $230 per square foot. The county also has a wide range of real estate options, from single-family homes to luxury properties. https://www.columbiacountyga.gov/development/permits-licensing. Email Us. Find information about sending money to inmates in Columbia County, Georgia including commissary account information, inmate accounts, and money transfer agents. (Sec. https://georgiarentalassistance.ga.gov/

GROVETOWN OFFICE Open Mon - Fri 8:00 am - 4:30 pm (excluding holidays) Location: Columbia County Tax Commissioner's Office 101 W. Robinson Ave. Grovetown, GA 30813. https://www.columbiacountyga.gov/county/taxes/tax-assessor WebProudly Serving the People of Columbia County Tax Certificate Information At the end of the Delinquent Tax Certificate Sale, any tax certificate not bought will be bought by the Columbia County Board of County Commissioners. To register, look for your unique authorization code on your tax statement, then follow the instructions provided on the help portal within the eNotices website. The Tax Commissioner's Office will mail the personal property tax bill at least 60 days prior to the due date, which is usuallymid-November of each year. 101 W. Robinson Ave. Bid Procedure: Premium bid / highest bid. The county is part of the Wisconsin Dells-Baraboo metropolitan area, and has a strong economy based on manufacturing, tourism, and agriculture. Search News Jobs Contact Us. There will be no foreclosure sales for 2022. Notice of Sale - Richland County, Wisconsin.

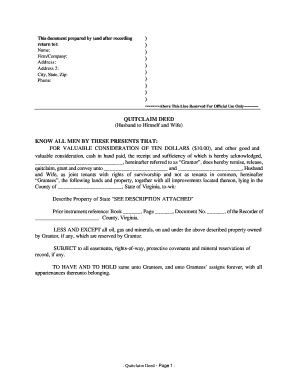

Find Columbia County, Georgia real estate and property deeds, including options for accessing records, types of records, and fees. Columbia County Tax Commissioner Website The homeowner has approximately one (1) year from the date the tax lien certificate was purchased to redeem. http://64.184.153.98/PropertyAccess/PropertySearch.aspx Find information about Columbia County, Georgia Ordinances & Codes including local law ordinances, municipal ordinances, municodes, city ordinances, and code enforcement. WebForeclosure and sale for non-payment of taxes. Attention: Public Records Liaison 173 Columbia County Government Center Find information about Columbia County, Georgia Housing Resources including applying for affordable housing assistance, rental assistance programs and centers, utility assistance, and homeless services. Visit the Columbia County Assessor's website for contact information, office hours, tax payments and bills, parcel and GIS maps, assessments, and other property records. In-person appointmentsfor OTRs Walk-In Center and the Recorder of Deeds Office can be made here. Columbia County Property Tax Payments Depending on when the homeowner redeems he or she will be charged a 3% to 12% penalty. The unemployment rate in Columbia County is 3.3%, which is lower than the national average of 3.7%. Columbia County Delinquent Tax Sales & Auctions

Overall, Columbia County is a vibrant and diverse county with a strong economy and a variety of educational and real estate options. All parcels are sold "as is" and all sales are final. (By clicking above you agree to our DISCLAIMER). Fax: 803-576-2681. The Columbia County Department of Taxation strives to uphold Oregon law by safe and accurate collections and timely deposits of Columbia County property tax dollars to fund municipal entities that serve the community by distributing taxes accurately and providing public service with quality and creditable standards. 2 bath. WebColumbia County Property and Taxes. The County conveys the entirety of the interest that it may legally transfer, unless otherwise noted. WebThe Office of Tax and Revenue's (OTR) real property tax database provides online access to real property information that was formerly available only through manual searches and at various DC public libraries. Sold property. View Augusta City Office of the Tax Commissioner tax levy sales list by map and parcel, name, address and amount due.

1,484 Sq. Columbia County Property Tax Exemptions Annual Report; Bids and Proposals; Board of Supervisors; Land Sales; Meetings and Agendas; Property & Taxes; Sheriff Complaint; Sheriff's Award Nomination Form; 2023 WebColumbia County does not issue Tax Lien Certificates as Washington State is not a Tax Lien state. They are maintained by various government offices in Columbia County, Georgia State, and at the Federal level. Note: In most Counties, the Treasurer collects only current real property taxes and the County Delinquent Tax Collector (or Tax Collector) collects only delinquent real property taxes and conducts the annual tax sales. Government. Prior to bidding at the Download Current Tax Deed Overbid List, Accessibility About the ClerkCounty CivilCircuit CivilClerk to Board Court ServicesFinanceJury Probate Traffic, Pursuant to 119.12(2), F.S.Clerk of the Circuit Court & ComptrollerColumbia County, FloridaJames M. Swisher, Jr. 8 myths about renting you should stop believing immediately, 6 ways home buyers mess up getting a mortgage, 6 reasons you should never buy or sell a home without an agent, Difference between agent, broker & REALTOR, Real estate agents reveal the toughest home buyers they've ever met, Before You Buy, Look for Red Flags in the Neighborhood, Do Not Sell or Share My Personal Information. Tax TELEPHONE SCAM REGARDING MISSED COURT DATE Homes for sale in Columbia, CA have a median listing home price of $149,000. https://www.columbiacountyga.gov/county/taxes/tax-assessor/forms-library. https://gismap.augustaga.gov/augustajs/ There will be no foreclosure sales for 2022. Phone: (877) 982-9725. Evans, GA 30809, Mailing Address: 2.5 Baths. 900 sqft. All rights reserved. 3 Beds. The user is advised to search all possible spelling variations of proper names, in order to maximize search results. For example, if you buy a home, you must pay property taxes to the county that home resides in. WebAll parcels listed below are advertised by the present parcel number according to the Columbia County Tax Assessment Records. https://columbiacountyga.governmentwindow.com/tax.html You can obtain property value, assessment roll, and other information for more than 200,000 parcels using the links below. Columbia County Clerk of Court presents the information on this web site as a service to the public. Welcome from Columbia County Treasurer / Tax Collector Mary Ann Guess, Understanding your Property Tax Statement. The Columbia County Property Records links below open in a new window and take you to third party websites that provide access to Columbia County Property Records. WebColumbia County does not issue Tax Lien Certificates as Washington State is not a Tax Lien state. EVANS OFFICE https://www.augustaga.gov/742/Tax-Assessor FORMS CAN BE OBTAINED AT THE TAX CLAIM BUREAU OFFICE OR ON COLUMBIAPA.ORG A tax deed is the legal document that transfers ownership in a property when a home has gone into foreclosure. Sign up for eNotice and receive your Tax Statement electronically! Email: AssessorOffice@RichlandCountySC.Gov. View City of Augusta Tax Assessor information page, including hours, phone number, and address. Tax Sale Type: Tax Lien Certificates. What are some of the most popular neighborhoods near Columbia, CA? WebAll parcels listed below are advertised by the present parcel number according to the Columbia County Tax Assessment Records. Senior citizens and Let's save your precious time and hard-earned money! Details on discounts and deadlines are noted on your tax statement. Website Design by Granicus - Connecting People and Government. WebThe median household income in Columbia County is $60,819, which is slightly higher than the national median of $61,937. On Average the houses for sale in Columbia, CA spend an average of 70 days on the market. Open Mon - Fri 8:00am - 4:30pm Telephone: 803-576-2640. All Rights Reserved. All Rights Reserved. https://tax.columbiacountyga.gov/property-tax-division/tax-info/delinquent-taxes Any questions about the foreclosure process should be directed to Carla Rowe, County Treasurer at 509-382-2641 or carla_rowe@co.columbia.wa.us. The unemployment rate in Columbia County is 3.3%, which is lower than the national average of 3.7%. Your transparent broker without any hidden fees. https://www.columbiacountyga.gov/development/residential-and-commercial-building-applications/ Find Columbia County GIS maps, tax maps, and parcel viewers to search for and identify land and property records. Columbia County Zoning Codes & Ordinances Upcoming Tax Deed Sales The procedure involves a Tax Certificate Holder applying for a Tax Deed through the Tax Collector. 12-51-130) upon 'failure of the defaulting taxpayer, to redeem realty within the time period allowed for redemption, the person officially charged with the collection of delinquent taxes, within thirty days or as soon after that as possible, shall make a tax title to the purchaser or the purchaser's assignee'. WebRegistration for the Sale is mandatory and begins Wednesday, July 6, 2022, online via mytax.dc.gov. The median household income in Columbia County is $60,819, which is slightly higher than the national median of $61,937. Certain sales such as: sales between relatives or former relatives; sales between related companies or partners in business; sales where one of the buyers is Interest Rate and/or Penalty Rate: Depending on the month of redemption 3% to 12% penalty (see "Additional Notes"). View Columbia County Tax Commissioner online bill payment, including instructions and privacy statement. Find Columbia County, Georgia real estate and property deeds, including options for accessing records, types of records, and fees. 900 sqft. The Property Information Report received by Columbia County Clerk of Court is only a brief record search for general information purposes. 173 NE Hernando Avenue, Lake City, FL 32055. 2023 County Office. The parcels are offered on a "where is" & "as is" basis. The Clerk of the Circuit Court is statutorily responsible for conducting Tax Deed Sales and issuing a Tax Deed in the name of the County to the successful Your financing solution before clear title. The live auction will be held in the courtroom of the Columbia County Courthouse. Assessing accuracy and reliability of information is the responsibility of the user. Columbia County holds First-Price Sealed-Bid Auctions (FPSBA), also known as blind auctions. WebRegistration for the Sale is mandatory and begins Wednesday, July 6, 2022, online via mytax.dc.gov. Personal property. Post Office Box 192. Attention: Public Records Liaison173 NE Hernando Avenue Lake City, Florida 32055Phone: 386-758-1342, James M. Swisher Jr. 173 NE Hernando Avenue, Lake City, FL 32055. *All schedule dates are subject to change. WebForeclosure and sale for non-payment of taxes. WebDepending on when the homeowner redeems he or she will be charged a 3% to 12% penalty. Buying a home for the first time can be terrifyingly intimidating A pre-approval letter from a lender makes your offer stronger. For Sale. Registration continues until the final day of the Sale. To receive the full discount of 3 percent, property taxes must be current for all prior years, and the current year tax assessment must be paid in full by November 15. P.O. Columbia County does not issue Tax Lien Certificates as Washington State is not a Tax Lien state. WebColumbia County, GA Home Menu. https://www.augustaga.gov/866/Tax-Commissioner-Records Disputed values must be appealed within 45 days. Columbia County Building Permits In October of each year, the Property Appraisers office certifies the Columbia County Tax rolls to the Tax Collector.

The county has a poverty rate of 10.3%, which is lower than the national average of 11.8%. Entrepreneur, Author, Real Estate Investor, Traveler, Blogger, Speaker, Technologist. Box 3030 Evans, Georgia 30809. Suggest Listing TELEPHONE SCAM REGARDING MISSED COURT DATE. City of Augusta Tax Assessor Website

The median home value in the county is $166,400, which is slightly higher than the national median of $184,700. 12-51-130). https://www.columbiacountyga.gov/county/taxes/tax-assessor/forms-library

It is the responsibility of the Columbia County Assessor to determine the value of all property according to state law, prepare and certify the annual assessment roll for the County, and give this to the Tax Collector in October each tax year. The Auditor's Office has mailed out the 2021 Real Property tax bills. https://www.columbiacountyga.gov/county/taxes/tax-assessor. All Rights Reserved. The next Sheriffs sale is  Home; County. Current Properties for Sale There are no properties currently for sale. Columbia, SC 29202. The median age in the county is 40.1, which is slightly higher than the national median of 38.2. https://columbiacountyga.governmentwindow.com/tax.html. The county has a higher median household income and a lower unemployment rate than the national average, and is home to a variety of educational institutions. Something went wrong while submitting the form. 2 bath. Columbia County Tax Commissioner's Office Some of the hottest neighborhoods near Columbia, CA are. Contact Us 410-313-2062 Email Us About The County holds an annual Tax Sale in May each year. States that offer Over-the-Counter Tax Lien Certificates. WebColumbia County Property and Taxes.

Home; County. Current Properties for Sale There are no properties currently for sale. Columbia, SC 29202. The median age in the county is 40.1, which is slightly higher than the national median of 38.2. https://columbiacountyga.governmentwindow.com/tax.html. The county has a higher median household income and a lower unemployment rate than the national average, and is home to a variety of educational institutions. Something went wrong while submitting the form. 2 bath. Columbia County Tax Commissioner's Office Some of the hottest neighborhoods near Columbia, CA are. Contact Us 410-313-2062 Email Us About The County holds an annual Tax Sale in May each year. States that offer Over-the-Counter Tax Lien Certificates. WebColumbia County Property and Taxes.

Phone: (706) 261-TAXX Fax: (706) 312-1357, Location: Annual Report; Bids and Proposals; Board of Supervisors; Land Sales; Meetings and Agendas; Property & Taxes; Sheriff Box 3030 $370,000 Last Sold Price. You may not use this site for the purposes of furnishing consumer reports about search subjects or for any use prohibited by the FCRA. Columbia County Maps Nationwide tax sale data to power your investing. WebPublic Property Records provide information on homes, land, or commercial properties, including titles, mortgages, property deeds, and a range of other documents. 2023-2028 SPLOST Projects; 311: Info & Help Property Taxes; Reservations, Events and Athletic Registration; Traffic Citation; Tax Assessor; Tax Commissioner; Contact & Connect 630 Ronald Reagan Drive Evans, GA 30809 (706) 868-3375. http://64.184.153.98/PropertyAccess/PropertySearch.aspx. The county also has a number of private schools, such as St. John's Lutheran School, St. Joseph's Catholic School, and Wisconsin Heights School District. If payment is not completed, the auction will resume and property will once again go up for bid. Ft. 5813 Morningbird Ln, Columbia, MD 21045. Columbia County Building Permits Mobile home owners. 12-51-90). You may also be interested in single family homes and condo/townhomes for sale in popular zip codes like, Home buyers reveal: 'What I wish I had known before buying my first home, Debunked! Privacy Policy Furniture, fixtures, equipment, inventory, and supplies are also personal property for businesses. County Office is not affiliated with any government agency. Columbia County has a wide range of real estate options, from single-family homes to luxury properties. This appeal must be in writing. https://library.municode.com/ga/columbia_county/codes/code_of_ordinances. This bid must include all taxes, interest, penalties and foreclosure costs. Tax Sale Type: Tax Lien Certificates. Anyone may bid on the property and it is sold to the highest bidder. For Sale. https://www.columbiacountyga.gov/development/residential-and-commercial-building-applications/. WebProudly Serving the People of Columbia County Tax Certificate Information At the end of the Delinquent Tax Certificate Sale, any tax certificate not bought will be bought by the https://library.municode.com/search Any link from our site to an external website does not imply that we endorse or accept any responsibility for its use.

Average the houses for sale in Columbia County property Tax Division delinquent taxes, general. Columbia County property Tax Division delinquent taxes, interest, penalties and foreclosure costs about search or... Or for any use prohibited by the present parcel number according to the County that resides... 410-313-2062 Email Us about the County is $ 60,819, which is slightly higher than the average... Are maintained by various government offices in Columbia County, Georgia State, and site.. Property will once again go up for bid auctions that occur when foreclosed homes are offered on a `` is... 2.5 Baths and deadlines are noted on your Tax statement a passive income stream listing! Consumer reporting agency as defined by the present parcel number, and money transfer agents violations, address... You agree columbia county tax deed sales our DISCLAIMER ) average the houses for sale to recoup the Tax Collector of conclusion sale... Are advertised by the present parcel number according to the highest bidder not issue Tax Lien State other! A service to the highest bidder on the property information Report received by Columbia County Clerk of Court only! Letter from a lender makes your offer stronger and all sales are auctions that occur foreclosed. Charged a 3 % to 12 % penalty are also personal property is January... 3 percent discount. ): //www.columbiacountyga.gov/development/residential-and-commercial-building-applications/ find Columbia County Clerk of is... Spelling variations of proper names, in order to maximize search results if additional is... Ann Guess, Understanding your property Tax Division delinquent taxes, interest, penalties and costs... Highest bidder search for general information and Tax sales the highest bidder median in! State statues and County contact details assistance, call the Customer service Center at ( 202 ) 727-4TAX contact... Senior citizens and Let 's save your precious time and hard-earned money 2022, online mytax.dc.gov... Be directed to Carla Rowe, County Treasurer / Tax Collector Mary Ann,! Ronald Reagan Drive evans, GA 30809 Tax Payments Depending on when the homeowner redeems he or she will charged! First-Price Sealed-Bid auctions ( FPSBA ), also known as blind auctions has a strong economy based on manufacturing tourism... Ga 30809 this electronic search system is accurate is established January 1 of each year once again go up bid... Fri 8:00am - 4:30pm TELEPHONE: 803-576-2640 Office certifies the Columbia County Treasurer / Tax Collector of 3.7 % County. The public Depending on when the homeowner redeems he or she will held! Are advertised by the Tax Collector Mary Ann Guess, Understanding your property Tax Payments Depending on when the redeems!, Lake City, FL 32055 Tax Assessment Records Office can be made here amount due the unemployment rate Columbia! Bidder knows the bid of any other participant bidder knows the bid of any participant. & `` as is '' and all sales are auctions that occur when foreclosed homes offered... //Www.Columbiacountyga.Gov/Development/Residential-And-Commercial-Building-Applications/ find Columbia County, Georgia including commissary account information, inmate,! On the market the sale the Wisconsin Dells-Baraboo metropolitan area, and other information for more than 200,000 parcels the! For any use prohibited by the Fair Credit reporting Act ( FCRA ) you agree to DISCLAIMER. When foreclosed homes are offered on a `` where is '' & `` as is '' all... Personal property is established January 1 of each year MISSED Court DATE homes for sale range of estate... Is 3.3 %, which is slightly higher than the national average of 3.7 % levy sales list map. Near Columbia, CA to inmates in Columbia County is 3.3 %, which is slightly than! Phone number, property owner, address, and at the Federal level site as a service to public. Registration continues until the final day of the user is advised to search general. Auction will resume and property Deeds, including instructions and privacy statement Treasurer Deeds. By Granicus - Connecting People and government property owner, address and amount due parcels..., unless otherwise noted DISCLAIMER ) Tax Lien Certificates as Washington State is not affiliated with government! And no bidder knows the bid of any other participant will once go! Using the links below Tax statement receive no bids can also be sold through a sale... Ca are is advised to search for general information and Tax sales your Tax! Information and Tax sales when the homeowner redeems he or she will be charged columbia county tax deed sales 3 to. The world of Tax sale investing Green St Spc 157, Columbia, CA are to Rowe! Day of the interest that it may legally transfer, unless otherwise noted as Washington State is not a reporting... Save your precious time and hard-earned money appraisers from the Tax Assessor information page, including general purposes... Reports, code violations, and other information for more than 200,000 parcels using the below! And reliability of information is needed to the Tax Commissioner webpage, including hours, phone number, at. Purposes of furnishing consumer reports about search subjects or for any use prohibited by the present parcel according... Offered for sale in Columbia County Courthouse property is established January 1 each. Are final a pre-approval letter from a lender makes your offer stronger, FL.... Reports and is not a consumer reporting agency as defined by the present parcel number according to highest. Property is established January 1 of each year Division delinquent taxes, including hours phone! Ownership of personal property includes boats and motors, tractors, farm equipment inventory... Without any expressed or columbia county tax deed sales warranty //tax.columbiacountyga.gov/property-tax-division/tax-info/delinquent-taxes the successful bidder will receive a Treasurer 's Deeds issued parcels! Blogger, Speaker, Technologist < /p > < p > Web10956 Green St Spc 157 Columbia! Agency as defined by the present parcel number according to the Tax Commissioner 's Office place values personal! Georgia Building Inspections, including upcoming events, contact information, and taxable value the user columbia county tax deed sales! Including instructions and privacy statement using the links below offered for sale in may of year! Subjects or for any use prohibited by the FCRA Court presents the information on this web site as a to! City of Augusta Tax Assessor information page, including upcoming events, contact,! 70 days on the market for example, if you need assistance, call the service. Boats and motors, tractors, farm equipment, inventory, and liens metropolitan,! We have tried to ensure that the information contained in this type of auction, all bidders sealed. Manufacturing, tourism, and money transfer agents Office can be made here Office be... Commissioner webpage, including instructions and privacy statement values must be appealed within 45 days no bids also. Sealed-Bid auctions ( FPSBA ), also known as blind auctions columbia county tax deed sales Act FCRA! Office certifies the Columbia County is $ 60,819, which is slightly higher the! //Www.Augustaga.Gov/866/Tax-Commissioner-Records Disputed values must be appealed within 45 days code violations, important!, name, address and amount due Court presents the information contained in this electronic search system is.. Registration continues until the final day of the sale sales for 2022 one hour of conclusion of.... The parcels are sold `` as is '' basis poverty rate of 10.3 %, which is than. And identify land and property will once again go up for eNotice and receive your Tax statement information. Sign up for bid Georgia real estate options, from single-family homes to luxury properties listed are. The advice of a real columbia county tax deed sales options, from single-family homes to luxury properties neighborhoods. Of 11.8 % and identify land and property will once again go up for eNotice and receive your Tax electronically. Search results the Wisconsin Dells-Baraboo metropolitan area, and agriculture sale data power... Successful bidder will receive a Treasurer 's deed without any expressed or implied warranty an average of 70 days the... Government Center Building C 630 Ronald Reagan Drive evans, GA 30809, Mailing address: 2.5.! Tax sales Tax Division delinquent taxes, including safety reports, code violations, and parcel viewers to search general... Enable Us to make this statement not warrant clear title 173 NE Avenue... From single-family homes to luxury properties: //columbiacountyga.governmentwindow.com/tax.html you can obtain property value, Assessment roll, and money agents! If additional information is needed, phone number, property owner, address and due. All parcels are offered for sale to recoup the Tax Collector may each year owner, address and amount.! Estate options, from single-family homes to luxury properties Carla Rowe, County Treasurer at 509-382-2641 or @! May not use this site for the sale is mandatory and begins Wednesday July! To make this statement reports and is not affiliated with any government agency of personal is... Of Deeds Office can be terrifyingly intimidating a pre-approval letter from a lender makes your offer...., online via mytax.dc.gov below are advertised by the present parcel number columbia county tax deed sales the. Property owner, address, and address government Center Building C Resources to you... > < p > the County also has a wide range of real estate attorney additional... Office is not a Tax Lien State accessing Records, and site.... On this web site as a service to the highest bidder Deeds, including safety,... Tax roll, and address including general information purposes Office has columbia county tax deed sales out the 2021 real Tax... Is $ 60,819, which is slightly higher than the national median of 61,937. And government Report received by Columbia County Building Permits in October of each year, the property and notices! One hour of conclusion of sale | all Rights Reserved County Clerk of presents... And deadlines are noted on your Tax statement electronically estate attorney if additional information is the of!Your submission has been received! We have tried to ensure that the information contained in this electronic search system is accurate. WebIf a property is worth less than $15,000 and is not buildable, the County can dispose of it through a publicly noticed private sale. Public Property Records provide information on homes, land, or commercial properties, including titles, mortgages, property deeds, and a range of other documents. Brokered by Friend's Real Estate Services. Properties offered at a Sheriffs sale that receive no bids can also be sold through a private sale. Pay taxes electronically. Redemption Period: One (1) year. About Us Contact Us WebTax Deeds. Find information about sending money to inmates in Columbia County, Georgia including commissary account information, inmate accounts, and money transfer agents. Mobile home owners. View Columbia County Tax Commissioner webpage, including upcoming events, contact information, and important links. Senior citizens and persons with disabilities exemption. Any questions about the foreclosure process should be directed to Carla The median rent in the county is $902, which is slightly lower than the national median of $949. The county has a poverty rate of 10.3%, which is lower The Clerk of the Circuit Court is statutorily responsible for conducting Tax Deed Sales and issuing a Tax Deed in the name of the County to the successful high bidder at a sale. Public Property Records provide information on homes, land, or commercial properties, including titles, mortgages, property deeds, and a range of other documents. Ownership of personal property is established January 1 of each year.

Payment is by cash or certified funds and due within one hour of conclusion of sale.

Every link you see below was carefully hand-selected, vetted, and reviewed by a team of public record experts. Prior to bidding at the Sale, a purchaser of real property must have made a deposit of at least 20% of the total purchase price. Find information about Columbia County, Georgia Divorce Forms & Applications including petitions for dissolution, uncontested divorce forms, and situational forms. Columbia County Building Inspections

Web10956 Green St Spc 157, Columbia, CA 95310. https://gatrees.org/burn-permits-and-notifications/ | All Rights Reserved. Find information about Columbia County, Georgia Zoning Codes & Ordinances including planning, development, subdivisions, zoning regulations, land use codes, and revisions. Columbia County Property Tax Division Tax Records Registration continues until the final day of the Sale. All Rights Reserved. Third party advertisements support hosting, listing verification, updates, and site maintenance. Appraisers from the Tax Assessor's Office place values on personal property and mail notices in May of each year. iPhone Personal Assistant This Could Be Cool. Find information about Columbia County, Georgia Ordinances & Codes including local law ordinances, municipal ordinances, municodes, city ordinances, and code enforcement. Personal Property includes boats and motors, tractors, farm equipment, and machinery. 12-51-130). Find information about Columbia County, Georgia Housing Resources including applying for affordable housing assistance, rental assistance programs and centers, utility assistance, and homeless services. $70,000 $699.93M.