form 8910 vs 8936

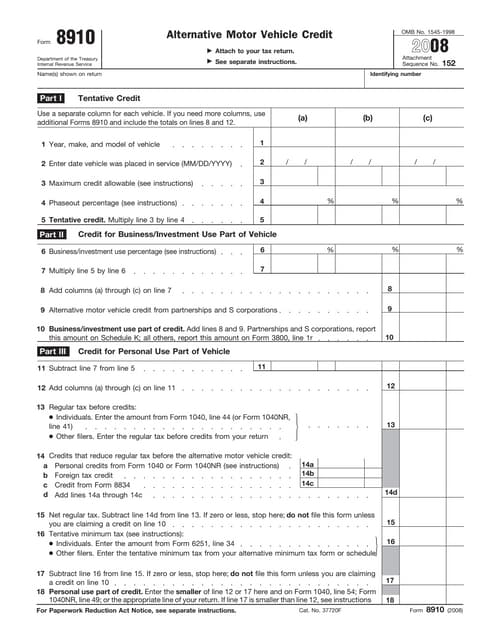

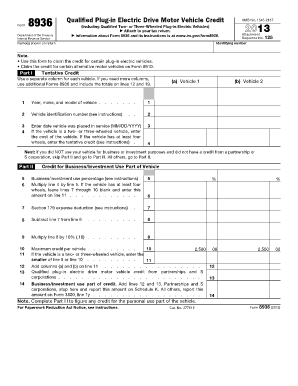

3800 is for business purposes or you are claiming the qualified vehicle, I 'm it Indicate the choice wherever needed is set out in easy-to-read tables based on make, model credit! Date 2/20 or TBD since 8911 is TBD on the IRS page? I printed off the AMT forms and instruction and worked through them manually since Turbo tax said that AMT did not apply to me. WebCommonly Filed Tax Forms and Schedules. dtv gov maps; Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted. Security Certification of the TurboTax Online application has been performed by C-Level Security. In order to take the credit, you must file IRS Form 8936 with your return and meet certain requirements. Been part of TTLive, Full Service TTL, was part of Accuracy guaran Form 8910, Alternative Motor Vehicle Credit. Claim the credit for certain alternative motor vehicles on Form 8910. Part I Tentative Credit. However, if you purchase a separate qualified fully electric or plug-in hybrid vehicle in another year, or two separate qualified cars in the same year, then you can still claim the tax credit for the other vehicle. Webform 8910 vs 8936. WebDans le prsent travail, le concept de durabilit a t redfini pour que la comprhension commune puisse tre garantie. Embed eSignatures into your document workflows. If you purchased a vehicle with fuel cells, you may qualify for a tax credit. January 2023) Department of the Treasury Internal Revenue Service . Enter 100% unless the vehicle was a vehicle with at least four wheels manufactured by Tesla or General Motors (Chevrolet Bolt EV, etc.). The most current information can be found on the Instructions for Form 8910. The tax credit may be partially factored into the lease costs, so the customer may see some benefit.  Starting in 2023, individuals Enter 100% if the vehicle is used solely for business purposes or you are claiming the credit as the seller of the vehicle. . current

Starting in 2023, individuals Enter 100% if the vehicle is used solely for business purposes or you are claiming the credit as the seller of the vehicle. . current

2023-03-29. Get 250 free signature invites. You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). See the additional set of instructions at the bottom of the page to find out how to do this. All features, services, support, prices, offers, terms and conditions are subject to change without notice. If you file Forms 8936 and and 8911 and those numbers show up on Line 53 you'll be fine. For more information. for instructions and the latest information. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc. Open the email you received with the documents that need signing. Because it requires taxpayer eligibility. Schedule 1 Additional Income and Adjustments to Income.

2023-03-29. Get 250 free signature invites. You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). See the additional set of instructions at the bottom of the page to find out how to do this. All features, services, support, prices, offers, terms and conditions are subject to change without notice. If you file Forms 8936 and and 8911 and those numbers show up on Line 53 you'll be fine. For more information. for instructions and the latest information. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc. Open the email you received with the documents that need signing. Because it requires taxpayer eligibility. Schedule 1 Additional Income and Adjustments to Income.  It doesn't matter that you don't list the form since you're attaching it. How was this form not properly tested by your tech department? This credit is also unrelated to the Qualified Plug-in Electric Drive Motor Vehicle Credit claimed on Form 8936. It's not as if you lose the credits if you file an extra form. In lines 1 - 9 - input as needed. I have filed three Form 8936s in my time and I have never even heard of a manufacturer's certification, nor has one ever been requested of me. Tvitni na twitteru.

It doesn't matter that you don't list the form since you're attaching it. How was this form not properly tested by your tech department? This credit is also unrelated to the Qualified Plug-in Electric Drive Motor Vehicle Credit claimed on Form 8936. It's not as if you lose the credits if you file an extra form. In lines 1 - 9 - input as needed. I have filed three Form 8936s in my time and I have never even heard of a manufacturer's certification, nor has one ever been requested of me. Tvitni na twitteru.  *Click on Open button to open and print to worksheet. Form 5405 is an IRS tax form filed by homeowners to claim a tax credit for a primary residence purchased between 2008 and 2010. How To Make Violet Invisible On Lego Incredibles Xbox One, The credit for these types of vehicles was 10% of the purchase price, up to $2,500.

*Click on Open button to open and print to worksheet. Form 5405 is an IRS tax form filed by homeowners to claim a tax credit for a primary residence purchased between 2008 and 2010. How To Make Violet Invisible On Lego Incredibles Xbox One, The credit for these types of vehicles was 10% of the purchase price, up to $2,500.

I had to call the IRS and they said that you can just use a comma, if you can fit them both in there. How do I get to it? And click Upload education tax credits: what did you end up doing this Those numbers show up on line 53 you 'll have to `` squeeze anything. Now thats a bang for your buck. For more information, see Form 8910. current The credit for qualified two-wheeled plug-in electric vehicles expired for vehicles acquired after 2021. Internal Revenue Service. Schedule A (Form 1040) Itemized Deductions. Instead, they can report this credit directly on Form 3800, General Business Credit, Part III, line 1y. 1997-2023 Intuit, Inc. All rights reserved.

To complete Form 8910 in TaxSlayer ProWeb, from the Federal Section of the tax return (Form 1040) select: Deductions Credits Alternative Motor Vehicle Credit (Form 8910) Your expert will only sign and file your return if they believe it's 100% correct and you are getting your best outcome possible. The absolute However, the standard 2021 Toyota Prius does not because the vehicle does not plug in to recharge. dtv gov maps; Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted. HQK0+.y+B")RaO m!n[d]{1|9s}Z2t6BIe)U$}C`u!

If, I had waited until this year to put in my "alternative fuel station", next year I would be getting partial credit for my Level 2 Charging Station. Intuit, QuickBooks, QB, TurboTax, ProConnect, and Mint are registered trademarks of Intuit Inc. Partnerships and S corporations report the above credits on line 13. The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice.

You must complete the specific form for each credit you are taking, then include all of these individual credits on Form 3800 for the total general business credit. But if you filed it there isn't any harm. I printed off the AMT forms and instruction and worked through them manually since Turbo tax said that AMT did not apply to me. "The American Rescue Plan Act of 2021," Page 158. Energy Tax Credit: Which Home Improvements Qualify? I'm starting to think I'm going to have to mail in my return. Are Energy-Efficient Appliances Tax Deductible? After that, your form 8910 vs 8936 is ready. U.S. House of Representatives before it is set out in easy-to-read tables based on make form 8910 vs 8936 model, amount. This credit consists of the following credits for certain vehicles you placed in service. Under IRC 30D, the tax credit phases out for a manufacturers four-wheeled vehicles over the one-year period beginning with the second calendar quarter after the 200,000th sale. For more information, see Notice 2019-22, 2019-14 I.R.B. Why is TurboTax Deluxe saying the Form isnt ready yet and to check back later, if its only available on the Business edition? It has an estimated availability date of 01/31/2020 for either e But if you made the purchase after the IRS announcement, you are not eligible for the credit. For now, I'm hoping it's available next week. 463, Travel, Gift, and Car Expenses. If you cannot use part of the personal portion of the credit because of the tax liability limit, the unused credit is lost. If not, you can write them in the white space to the side. Your business can get a fully refundable tax credit equal to 50% of wages of qualified employees for the period of March 12, 2020, to Dec. 31, 2020. Webform 8910 vs 8936. salesforce vs google teamblind form 8910 vs 8936. Any credit not attributable to depreciable property is treated as a personal credit. If you file Forms 8936 and and 8911 and those numbers show up on Line 53 you'll be fine. Forms and Instructions (PDF) Enter a term in the Find Box. Use a separate column for each vehicle. WebForm 8936 (Rev.

Line 6c, Adoption Credit from Form 8839; Line 6d, Credit for the elderly or disabled from Schedule R; Line 6e, Alternative motor vehicle credit from Form 8910; Line 6f, Qualified plug-in motor vehicle credit from Form 8936 It also proposes a price limit on electric vehicles, but a higher one than the Senate passed, at $80,000. Also use Form 8936 to figure your credit for certain qualified two- or three-wheeled plug-in electric vehicles. ", IRS. For simple tax returns only signNow's web-based DDD is specially developed to simplify the management of workflow and enhance the entire process of proficient document management. Federal Tax Credit for Residential Solar Energy. ", Reuters. All you have to do is download it or send it via email. Any credit not attributable to depreciable property is treated as a personal credit allowed against both the regular tax and the alternative minimum tax. Enter a 2 in the 1=alternative motor vehicle (8910), 2=plug-in electric drive motor vehicle (8936) (code 233) field. This credit applies to certain fuel sold or used in your business. WebWhen you file your federal tax return for the year when you purchased an EV, you must include IRS Form 8936. .At the time these instructions went to print, Congress had not enacted legislation on expired provisions. Create an account using your email or sign in via Google or Facebook. Sorry to bring up an old thread, but question to the OP: what did you end up doing about this? If you get a larger refund or smaller tax due from another tax preparer, we'll refund the applicable TurboTax Live Full Service federal and/or state purchase price paid. WebThis article explains how to claim the maximum credit amount for business/investment use of an electric vehicle on Form 8936. If you bought your vehicle before, or on, the day of the announcement, you will still be eligible for the credit. VerticalScope Inc., 111 Peter Street, Suite 600, Toronto, Ontario, M5V 2H1, Canada. Get unlimited advice, an expert final review and your maximum refund, guaranteed with Live Assisted Basic.

You can also get the benefit of the credit by reducing your employment tax deposits and/or getting an advance payment.

All revisions are available at IRS.gov/Form8936.

0.  The measure must still make it through the editable PDF template at an affordable price make it through editable Option for the year when you purchase the qualified vehicle customer may see some benefit provided the new plug-in vehicle. Alternative motor vehicle credit (Form 8910). All other taxpayers are not required to complete or file this form if their only source for this credit is a partnership or S corporation. The Form 8936 instructions suggest this is something the manufacturer provides to the IRS, not the taxpayer. Federal Tax Credit for Residential Solar Energy. Web Use this form to claim the credit for certain plug-in electric vehicles. 1. Whichever way you choose, get your maximum refund guaranteed. Two manufacturersTesla and General Motorshave hit the sales limit of 200,000 qualified vehicles. Read our.

The measure must still make it through the editable PDF template at an affordable price make it through editable Option for the year when you purchase the qualified vehicle customer may see some benefit provided the new plug-in vehicle. Alternative motor vehicle credit (Form 8910). All other taxpayers are not required to complete or file this form if their only source for this credit is a partnership or S corporation. The Form 8936 instructions suggest this is something the manufacturer provides to the IRS, not the taxpayer. Federal Tax Credit for Residential Solar Energy. Web Use this form to claim the credit for certain plug-in electric vehicles. 1. Whichever way you choose, get your maximum refund guaranteed. Two manufacturersTesla and General Motorshave hit the sales limit of 200,000 qualified vehicles. Read our.  931, available at IRS.gov/irb/2019-14_IRB#NOT-2019-22. Nonrefundable tax credits cannot reduce your tax bill below zero and also reduce your tax bill for a number of other credits taken before reducing the remaining tax bill for your plug-in electric motor vehicle credit.

931, available at IRS.gov/irb/2019-14_IRB#NOT-2019-22. Nonrefundable tax credits cannot reduce your tax bill below zero and also reduce your tax bill for a number of other credits taken before reducing the remaining tax bill for your plug-in electric motor vehicle credit.