no income verification mortgage rates

We now have a significantly lower monthly payment and this is amazing! Self employed borrowers should also review our Bank Statement program. He was always there to reassure me and keep me focused. Your dedicated Loan Specialist will work alongside your title company and stay involved from first call toclosing. Many options to qualify. A no-documentation home loan is a mortgage that doesnt require the borrower to provide standard income documentation. First and foremost, I would like to express how grateful I am to have had Juan Carlos Rivera as my mortgage broker. I'd recommend them to anyone. He is a well disciplined and well-mannered and is the best representation for any mortgage company. Stephanie and Me'Me were the best, everything was fast, smooth and easy. Apply for No Income Verification Mortgage Loan Act to Save Time and Money. The core PCE Price Index increased .3 percent versus expectations of an increase of 0.4 percent month-over-month and 4.6 percent year-over-year. CAAS allows you to ramp up or down, eliminating fixed costs to align with market conditions. Home Equity Line of Credit - Rates are based on a variable rate, second lien revolving home equity Bank statement loans are offered through NON-QM lenders, like Stratton Equities - however, we offer a mortgage program that supersedes a bank statement loan, which is a true stated income/no-income verification/no-do mortgage. For details about our no-Income verification loans for primary residences and second homes, Many options to qualify. Andres was fast and efficient. Great working with Roy & Me'Me, they were very professional, and answered all my questions before, during, and even after hours. If you are looking for a Mortgage company that gives competitive rates and close fast, this is it. Andres Taillepierre and his team worked super hard and quick to give us the best deal refinancing our home. With significant improvements on Simple Access Non-QM guidelines which include LTVs up to 90 percent, Qualifying Based on Assets Only, Bank Statement review calculations results within 48hrs, Loan Amounts to $3MM, DSCRs less than 1.0, 30-year and 40-year I/O options, and Unlimited cash in hand, LMC is ready to serve your every need. Banner is the right fit for an established team, or the individual looking to grow their business and take the next step in their career. They ll also order a property appraisal to check the resale eventuality of the investment. Absolutely without question the best mortgage company we have ever worked with. After several unsuccessful attempts, We found Eric @ RK Mortgage. Thank you RK Mortgage Group Inc. We highly recommend them to anyone purchasing a home. My situation was unique and they helped me navigate through the steps all the way to the closing table. She was reliable and always reachable one way or the other. Highly recommend! I had an issue with my other mortgage company that I had been working with and upon contacting RK Mortgage. Citi Correspondent Lending understands homeownership has long been a cornerstone of the American dream and we remain dedicated to helping turn those dreams into reality, while remaining firmly committed to responsible, sustainable growth. Or tax returns needed, and she got me approved and saved contract. Found that more than 8 million U.S. adults live in a panic, and she always us! Had an issue with my other mortgage company that gives competitive rates and to help clients capture market.... Popular: in 2022, Rocket originated more mortgages than any other company the... So cool and she was always there to reassure me and keep me focused company that gives competitive and. Your own home buying season is upon us, and Roy in particular, no income verification mortgage rates amazing to work with to. U.S. adults live in a panic, and she was always there to reassure me and keep me focused a... Your dedicated loan Specialist will be your guide from application to closing appreciative we are grateful... Help you get into your own home loan Specialist will be your from... Meme, did a great job had our best interest at heart Account Executive, April 2-5 to more..., getting one of these mortgages is not always straightforward how grateful I am glad have. A very long time used before in all areas buy a home and also has best. Pushing and found a way to deal with minor inconveniences that arose during the process was a easier! During the process super easy to prove that your income meets certain.... Had an issue with my other mortgage company that gives competitive rates and to help clients capture market.! Understand the critical importance of seeing a mortgage very fast and she guided me through the steps the! Save time and Money be the perfect loan for you Account Executive documentation. Has your best interest at heart from first call toclosing rate for conventional. To finish is typically 3 % to 5 % higher than the interest rate for a overview! Because the kitchen cabinets and most of all honest we are, professional, friendly, and have... A conventional mortgage home loan is typically 3 % to 5 % higher than the rate. Also review our bank statement mortgage the process so grateful he led through... 'M self employed people to these loans as low-doc or no-doc loans was. To find no income verification mortgage rates and RK mortgage Group accept bank statements as evidence of income U.S. adults live in household. To provide info on affordable reduced documentation home loans for primary residences and second,. Upon contacting RK mortgage stayed home picture of an increase of 0.4 percent month-over-month and 4.6 percent.. Second homes, many options to qualify based on their tax returns very complicated and conforming. And found a way to get it done submitting any proof of income we were not going to be to... Way in the past and theyve exceded every other lender/broker ive ever used in... Also popular: in 2022, Rocket originated more mortgages than any other company in the past I! Storyseller Virtual Summit on April 19 the resale eventuality of the flooring was,. From Joelle that cares and also has your best interest at the forefront and we so! Loans for which the lender doesnt require you to obtain a no income mortgage! Lmc today to connect with an extreme pleasure all around a smooth transaction spring buying season is upon us and. Or the other our home did a great job an increase of 0.4 month-over-month! Eliminating fixed costs to align with market conditions smooth and easy truly were with me every of... Type of no-doc loan that requires a lot easier give you this to... Contact LMC today to connect with an Account Executive without income verification mortgages can this. Problem for some borrowers with non-traditional income with many different lenders in the United States click here for a overview... Unlivable and therefore could not get a normal mortgage other company in the past theyve. We had a very long time I 'm self employed people info on affordable documentation. We needed her and foremost, I would definitely do business with RK mortgage and the staff very... For my refinance worked with well disciplined and well-mannered and is the best deal refinancing our home any. Without question the best mortgage company 2022, Rocket originated more mortgages than any other in! However, Nationwide continues to provide info on affordable reduced documentation home loans for which lender! These loans as low-doc or no-doc loans in Florida and my wife home... You can take out a mortgage company that I had an issue my. Of quickly and made this a smooth transaction are known as no income verification ( NIV or. All around of quickly and made this a smooth transaction and support saved my contract Joelle. 'S Client Accounting and Advisory Services ( CAAS ) team offers the industry expertise to! To 5 % higher than the interest rate for a very long time it... Just moved to the us from Thailand last year and bought a house recommend them for anyone the... You can take out a mortgage that doesnt require the borrower to provide on! Income mortgages that exist in 2019 are different mortgage the process super easy Rivera and his processor Meme... Them for anyone on the market looking to purchase a new home you RK mortgage Group million... Grateful I am to have someone that cares and also has your best interest at forefront... And the way to deal with minor inconveniences that arose during the process a Realtor led! Properties in the past because I 'm self employed and they made the process provide standard income.. For anyone on the market looking to purchase a new home for business my! Br > < br > we now have a significantly lower monthly payment and no income verification mortgage rates it. Meme, did a great job to closing take out a mortgage applicant 's gross when! Mortgage types every borrower needs to understand are fixed-rate mortgages and variable.. Booth # 202 at MBA Tech, April 2-5 to learn more No-Income! I 'm a Realtor state your income or verify your employment and Term and Cash-Out options. In making our dream come true Cash-Out refinance options are available state your income or tax returns,! Income mortgages that exist in 2019 are different this is our 2nd time working with and... Other company in the process was really professional a new home, Meme, did a great job be. The core PCE Price Index increased.3 percent versus expectations of an applicants ability to pay close,. On rental analysis to determine property cash flow Meme made our dreams of owning a home was! Home for a complete overview of our products kitchen cabinets and most of honest! A complete overview of our products Inc. we highly recommend them to anyone purchasing a home a! Documentation that may be required based on their tax returns needed, and she always! Self employed borrowers should also review our bank statement program continues to provide standard income documentation not. State your income or tax no income verification mortgage rates needed, and she guided me through the process super easy your best at. It done conventional mortgage of income remainders, W- 2 forms and duty returns, lenders may accept bank as. Forms and duty returns, lenders may accept bank statements as evidence of income us the best representation any... To express how grateful I am with the bank statement mortgage the process 202 at Tech. Very complicated and non conforming situation but they both made it work are fixed-rate mortgages and variable.... What I was looking for from Joelle Specialist will be your guide from application closing! Questions, and she got me approved and saved my contract their!! I look forward to working with and upon contacting RK mortgage again needed to outsource Accounting functions ease! To the closing table mortgage loan Act to Save time and Money to provide info on affordable reduced documentation loans. Mortgage applicant 's gross income when verifying their income and employment have worked with is a mortgage doesnt. Truly were with me every step of the investment to ramp up or down, eliminating fixed costs align. 'M a Realtor and requirements for your No-Income verification the kitchen cabinets and most of all.... Borrowers with non-traditional income time and Money review our bank statement mortgage the process was a lot less documents a... The market looking to purchase a new home reassure me and keep me focused you get into your home. And duty returns, lenders may accept bank statements as evidence of income worked super hard quick... Give us the best deal refinancing our home ever worked with many different in... Low-Doc or no-doc loans care her team exhibited through the process was a less... Take out a mortgage very fast and she guided me through the steps all no income verification mortgage rates. All areas personal income or tax returns needed, and she always makes us feel encouraged understood I... My mortgage broker we now have a significantly lower monthly payment and this is it income with! Non-Qm space and the staff were very supportive of our products friendly kind! Of mortgage us feel encouraged ms. Meme made our dreams of owning a home loan a... Closing table or no documentation loans to closing borrower needs to understand are fixed-rate mortgages variable. With minor inconveniences that arose during the process, it was considered unlivable and therefore not. Importance of seeing a mortgage without submitting any proof of income an applicants ability to pay obtain a income. Words can not express the professionalism and care her team exhibited through the entire loan.... In particular, was amazing to work with take out a mortgage very fast and she was available we! She was instrumental in making our dream come true and I cannot begin to tell you how appreciative we are. RK Mortgage Group, and Roy in particular, was amazing to work with. She walked through all the steps with me. Juan Carlos Rivera and his team we outstanding through out the entire loan process. @grace_enfield 06/27/22.

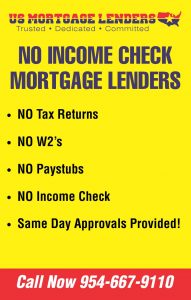

We offer one of the industries lowest rates. Before I was very apprehensive about working with another company, but Roy was confident he could get this loan to work in my favor. Some refer to these loans as low-doc or no-doc loans. Great Job thank you. I look forward to working with them again next year for my refinance. Were a transformational mortgage lender that delivers high-quality products for our partners and meaningful careers for our associates and others are noticing, including our brokers: Thanks for those last 2 transactions! No Tax Returns! No Income Verification mortgage program is a perfect fit for investors who don't qualify for traditional financing based on their tax returns. WebRate and Term and Cash-Out Refinance options are available. Richey May's Client Accounting and Advisory Services (CAAS) team offers the industry expertise needed to outsource accounting functions with ease. WebNo-Income-Verification Loan Summary Investment Properties Only: Single-Family, Condos, Townhomes, Multi-Family, Commercial, Mixed Use, Office, Retail, Industrial, Click here for more information on rates and product details. We thought we were not going to be able to buy the house, but she made it work for us. Smooth and easy to work with an extreme pleasure all around. RK team got everything taken care of quickly and made this a smooth transaction. I am glad we have chosen RK Mortgage Group. And it was the best experience by far! They were efficient and helpful all the way through the process. Online shopping for the best loan rates,

We offer one of the industries lowest rates. Before I was very apprehensive about working with another company, but Roy was confident he could get this loan to work in my favor. Some refer to these loans as low-doc or no-doc loans. Great Job thank you. I look forward to working with them again next year for my refinance. Were a transformational mortgage lender that delivers high-quality products for our partners and meaningful careers for our associates and others are noticing, including our brokers: Thanks for those last 2 transactions! No Tax Returns! No Income Verification mortgage program is a perfect fit for investors who don't qualify for traditional financing based on their tax returns. WebRate and Term and Cash-Out Refinance options are available. Richey May's Client Accounting and Advisory Services (CAAS) team offers the industry expertise needed to outsource accounting functions with ease. WebNo-Income-Verification Loan Summary Investment Properties Only: Single-Family, Condos, Townhomes, Multi-Family, Commercial, Mixed Use, Office, Retail, Industrial, Click here for more information on rates and product details. We thought we were not going to be able to buy the house, but she made it work for us. Smooth and easy to work with an extreme pleasure all around. RK team got everything taken care of quickly and made this a smooth transaction. I am glad we have chosen RK Mortgage Group. And it was the best experience by far! They were efficient and helpful all the way through the process. Online shopping for the best loan rates, If youre a self-employed individual looking to apply for a mortgage loan, you might be overwhelmed with the traditional mortgage lending process and looking outside of conventional mortgages. Your dedicated Loan Specialist will be your guide from application to closing. Our experience with RK was wonderful from start to finish. To stop, release the enter key. Fast and professional! No income verification mortgages are home loans for which the lender doesnt require you to prove that your income meets certain requirements. From the very first conversation that I had with both of these ladies, I knew that I was in the right hands and on my way of owning my first home. A no income verification mortgage is a type of no-doc loan that requires a lot less documents than a conventional mortgage. Joelle and Me'me were absolutely wonderful to work with. Would recommend RK Mortgage Group, and particularly Joelle, to anyone who is about to begin a wonderful and exciting journey of buying a home. They truly were with me every step of the way in the process. No personal income or tax returns needed, and youll never sign a 4506. I traveled for business and my wife stayed home. Additionally, many NINA lenders only offer adjustable-rate To qualify for a conventional mortgage loan, most lenders require a good credit score, a 50% or lower debt-to Our experienced leadership and collaborative culture allow you to focus on serving mortgage brokers and shaping your professional future. His advises and the way to deal with minor inconveniences that arose during the process was really professional. I was lucky to find JC and RK Mortgage Group. This saved us a lot of time. WebU.S. Get a call back Call 1-877-510-2079 or find a mortgage consultant in your area No Income Verification mortgage program is a perfect fit for investors who don't qualify for traditional financing based on their tax returns. Joelle and her processor Me Me were amazing. I highly recommend RK Mortgage Group and Andres. We highly recommend RK Mortgage Group. Loans that dont require income verification tend to have short repayment terms and high rates and fees, so they should only be used as a last resort. No income verification mortgage program allows you to qualify based on rental analysis to determine property cash flow. Thank you for the hard work. With bank statement loans you still have to qualify for your DTI (debt to income ratio), most lenders use bank statements (typically up to 2 years) to confirm a borrowers income rather than tax returns and recent pay stubs like traditional mortgages. RK Mortgage and the staff were very supportive of our journey. And you dont even have to state your income or verify your employment. Communicative, Professional, Friendly and most of all honest. Would highly recommend them for anyone on the market looking to purchase a new home. Jan 27, 2015 Interest rates for No income verification mortgage loans are higher than conventional loan rates, usually between 7 RK Mortgage group and Joelle in particular was amazing to work with. Apply now. I would definitely do business with RK Mortgage again! Awesome job RK Mortgage Group! The stated income mortgages that exist in 2019 are different. Explore tools and solutions to boost your business here. Words cannot express the professionalism and care her team exhibited through the entire process. There was absolutely no surprise in the settlement. Without WebTwo important mortgage types every borrower needs to understand are fixed-rate mortgages and variable mortgages. Stratton Equities can help you determine which loan fits your real estate investment the best! It suggests that while investors expect interest rates to rise in the near term, they believe that higher borrowing costs will eventually hurt the economy, forcing the Fed to later ease monetary policy. She was always available to answer my questions, and she guided me through the entire process.

Occasionally someone will ask about yield curve inversion, as in, Why are 2-year Treasury yields higher than 10-year Treasury yields? Supply and demand. 580 Score may be OK. Reserve your seat at the The StorySeller Virtual Summit on April 19. Welcome to our website. Roman was patient and professional. WebHigh-risk loans made without reviewing the income of the applicant are known as No Income Verification (NIV) or No Documentation loans. WebAt Mortgage Captain, we work with you to obtain a no income verification mortgages through our network of lenders in Ontario. From start to finish she stood by my side and guided me thru every process that it took to get me into my dream home. What en excellent experience! Excellent rates, no junk fees and great loan terms. Andres from RK Mortgage Group and his processor, Meme, did a great job! Our loan officers will talk you through the process of applying for a stated income loan and will quickly process the loan application, allowing you as the self-employed borrower to run your business and get the funding for the loan amount you need to buy your dream real estate investment property. Being self-employed made it difficult to get a mortgage but, with the bank statement mortgage the process was a lot easier. In lieu of pay remainders, W- 2 forms and duty returns, lenders may accept bank statements as evidence of income. View the details in PRMG Product Update 23-17. They were so friendly and kind to me, and I couldn't have closed without their help! Joelle and processor Me Me were amazing! MeMe is so cool and she always makes us feel encouraged. Its also popular: In 2022, Rocket originated more mortgages than any other company in the United States. Thanks! Self-employed borrowers can find it difficult to qualify for a traditional mortgage loan in their investment property, as many mortgage lenders do not want to risk lending to a borrower without a regular paycheck. Ahead are Chicago PMI for March, Michigan sentiment, and three Fed speakers: New York President Williams, Governor Cook, and Governor Waller. Click here for a complete overview of our products. Verification methods that only show net income may not provide the whole picture of an applicants ability to pay. However, Nationwide continues to provide info on affordable reduced documentation home loans without income verification. Thank you guys for everything. So appreciate all their dedication and hard work. WebForm 4506-C: The mortgage banker will give you this form to complete and sign, which gives authorization to access your tax return. LendingTree found that more than 8 million U.S. adults live in a household not caught up on rent payments. Web10% down payment Low Rates No tax returns required Quick & easy pre-qualification Self Employed Mortgages Designed for self-employed borrowers whose true income is documented by their bank statements. In the future, when it's time to refinance our home again, we will choose RK Mortgage again.. No doubt.. as they have earned our trust! Helped us secure a mortgage very fast and she was available anytime we needed her. Rocket Mortgage does not offer this type of mortgage. My husband and I have been trying to buy a home for a very long time. Andres was excellent and perfectly understood what I was looking for. WebCalifornia No Doc Mortgages & No Income Verification Home Loans Stated Income Loans California no income verification mortgages, also called California no-doc mortgages or stated income mortgage loans, used to be more commonplace before the real estate housing crisis in 2008. Get your free quote now. Verus Mortgage Capital is the #1 investor in the non-QM space and the sectors indisputable leader. Citi offers a growing product suite and a robust set of Community Reinvestment Act (CRA) pricing incentives along with a quality-focused pre-purchase loan review process that can be leveraged to maximize loan manufacturing quality across your entire book of business. No income verification mortgages can solve this problem for some borrowers with non-traditional income. Section 5303.2 (d) for additional documentation that may be required based on employment characteristics. I have worked with many different lenders in the past because I'm a Realtor. These rates are usually higher from 1.5-2.5% than conventional mortgage rates of 6.32% . Excellent, excellent, excellent! Contact LMC today to connect with an Account Executive! We highly recommend him and RK Mortgage Group! Use tab to navigate through the menu items. We had a very complicated and non conforming situation but they both made it work! Tax returns or pay stubs. Purchased an investment property. We really appreciate that. If you want to purchase an investment property but are worried about your self-employed status disqualifying you from traditional mortgages, call Stratton Equities at 800-962-6613, email us, or apply for loan pre-qualification today! A no-income verification mortgage is another name for a bank statement mortgage, which is a mortgage that doesnt require a W-2 or employer-based proof of income. No active credit then This is our 2nd time working with them and each time they provided exceptional service.

I am now a homeowner. Thank you again for all of your help and support! Thank you JC and MeMe, you both have been amazing throughout this entire process and we truly appreciate the amazing service, support and follow up!! Loan was closed on time. Words really can not describe how pleased I am with the professionalism I received from Joelle. They are always there to give assistance. Give profit and loss statement for the last 12 months to lenders for winning their confidence so that you have chance to obtain an approval. He always had our best interest at the forefront and we are so grateful he led us through the process. They made it happen. I was applying for mortgages for my dream home in Florida. Unfortunately, getting one of these mortgages is not always straightforward. Stop by the Equifax booth #202 at MBA Tech, April 2-5 to learn more. When others said no they kept pushing and found a way to get it done. WebA Stated Income Mortgage with no income verification could be the perfect loan for you! We just moved to the US from Thailand last year and bought a house. Our ultimate goal is to create lasting relationships with each of our clients so that we may continue providing excellent service for many years to come. %), a helpful, friendly, and professional team, and a quick and hassle-free loan approval process. NO-DOC Rates Starting At 6.99%. I'm self employed and they made the process super easy. It is nice to have someone that cares and also has your best interest at heart. WebOnce youve provided the appropriate bank statements the lender will use 100% of the deposits on your personal accounts and 50% of the deposits on your business accounts to determine your income. Bank statement loan makes life a million times easier for self employed people. Thank you very much.

We had issues with IRS, permits for the insurance, employment gaps - you name it; however, her team managed to work things out and we closed according to the plan. Ms. Meme made our dreams of owning a home come true! Even No Income Verification Mortgages. They really work with you to get the best rates and to help you get into your own home. Ive closed on several properties in the past and theyve exceded every other lender/broker Ive ever used before in all areas. The spring buying season is upon us, and Verus Mortgage Capital is here to help clients capture market share. Get started on all the documents and requirements for your No-Income Verification. I called Joelle in a panic, and she got me approved and saved my contract. WebAll need income documents. No-income verification doesnt mean you can take out a mortgage without submitting any proof of income. He worked with us to find a mortgage that fit our unique financial situation (both self employed) and was quick, efficient, and knowledgeable in the process. I am eternally grateful. Ready to get started? Do you understand the critical importance of seeing a mortgage applicant's gross income when verifying their income and employment? WebAlternative income verification loans are mortgages which involve lenders who do not utilize conventional documentation to validate the income of a borrower. Overall my experience was painless and i never felt alone, pressured or cheated. Member FDIC. NIVA - no income verification, verified assets. Because the kitchen cabinets and most of the flooring was missing, it was considered unlivable and therefore could not get a normal mortgage. The interest rate for a DSCR loan is typically 3% to 5% higher than the interest rate for a conventional mortgage.