savings account interest rates in the 1990s

Still, relative to many of the other major global currencies it remains strong. In 2017, the savings interest rate is just 0.06 on average a rate that has held steady since 2013. If you dont have the recommended amount today, you can take simple steps to get there, such as setting up an automatic deposit plan. Excludes accounts with bonus conditions to earn the total rate, but includes accounts with an introductory promotional rate available for a limited time. 0.25. stream

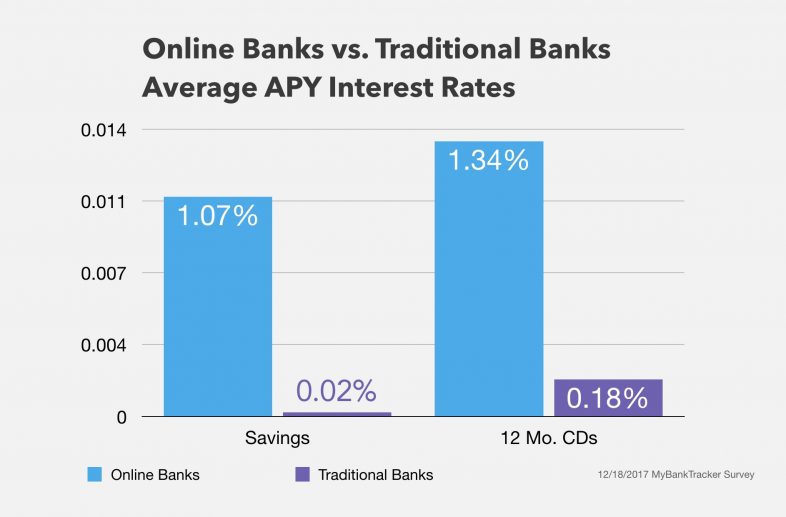

Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. Due to their lower overhead costs, online banks tend to surpass the national average more than traditional banks, so they often pass the savings onto their customers in the form of higher interest rates. Monthly fee:None with e-statements. Although the amount is not a fortune, it's a reasonably-sized rainy-day fund, which is one of the main purposes of a savings account. 1990s: 8.65 percent. This information may be different than what you see when you visit a financial institution, service provider or specific products site. Her work has been featured in USA Today and The Associated Press. For those born after the late 1980s you may not realize that banks recorded your balance in a booklet, along with the interest rate.

It offers CDs, a checking account, and a high-yield savings account. The 2000s kicked off with a recession, and savings rates fell to between 1% and 2%. The 1990s. WebInflation and high interest rates also led to the development of a major new form of competition to banks and thriftsthe money market mutual fund. Longer Horizons Interest rates in the 18th and 19th centuries also provide illuminating trends. However, that . Interest compounds daily and is credited to your account monthly. Apr 2009. The scoring formulas take into account multiple data points for each financial product and service. Why Are Americans Paying More for Healthcare. You may also be able to download the form through your online banking portal. "Ben Franklins Gift that Keeps on Giving. Just a reminder that we cant have it all now. Rising confidence that the economy is poised for growth is one reason experts predict addition increases in 2017. We partnered with the following banks to bring you the savings account offers in the table below. We believe everyone should feel confident when making money decisions, and that passion drives us to make The Balance the best place to learn about finances. . Otherwise, $1 monthly for paper statements. These rates are current as of 03/17/2023. All Right Reserved. 2010s: 3.83 percent. For instance, the fed funds rate rose to 10.5 percent in 1974, 11.19 percent in 1979 and 16.38 percent in 1981. Treasury Bills; A Smart Bet for Conservative Investors by The College Investor-With the stock markets increasing daily, its a good idea to attend to the fixed and cash portions of your portfolio. Finder is a registered trademark of Hive Empire Pty Ltd, and is used under license by It depends. Tax-Free Savings Account (TFSA): Definition and Calculation, Tax-Free Savings Accounts and Other Places to Save Tax-Free, Federal Reserve Regulation D: What It Is, Limits on Withdrawals, Simple Interest Definition: Who Benefits, With Formula and Example, Annual Percentage Rate (APR): What It Means and How It Works, Interest Rates: Different Types and What They Mean to Borrowers, Personal Loan Interest Rates: How a Personal Loan Is Calculated, The Power of Compound Interest: Calculations and Examples, What Is APY and How Is It Calculated With Examples, From Ben Franklin, a Gift That's Worth Two Fights. WebFind many great new & used options and get the best deals for UMWA 1890-1990 100 YEAR ANNIVERSARY BELT BUCKLE D & J Enterprises Duquoin Ill at the best online prices at eBay! Rates and offers provided by advertisers can change frequently and without notice. Many or all of the products featured here are from our partners who compensate us. However, neither city came close to the combined $21 million that Franklin calculated they would achieve. If you click on links we provide, we may receive compensation. These offers do not represent all available deposit, investment, loan or credit products. That means if an account pays a high yield and doesnt allow you to write checks, its in the mix.

See 2009 tab. Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover. tim duncan bass singer net worth; performancemanager successfactors login; can you use cocktail onions in beef stew However, the opposite can also happen. Even if Congress raises the debt ceiling and avoids default, last-minute brinksmanship alone has the potential to create economic damage. This process of earning interest on your savings plus earning interest on all of the accumulated interest from previous periods is called compounding. The PGPF chart pack illustrates that budget-making involves many competing priorities, limited resources, and complex issues. In 2010 the typical interest rate for a checking account was 0.11 percent and it has steadily declined to today's rate of 0.04 percent. Reluctant to lend their excess reserves, they offered higher interest rates on savings accounts to increase their reserves. Money Master Savings Account. Margarette Burnette is a NerdWallet authority on savings.

Bank of Canada. These rates are current as of 03/17/2023.

Interest on a savings account is the amount of money a bank or financial institution pays a depositor for holding their money with the bank. Articles S. Resta aggiornato collegandoti ai nostri social: mike boudet political views, kimbo slice funeral, lisa irwin parents guilty, in 2005 this actress was voted best british actress of all time in a poll for sky tv, nurse education jobs near helsinki, brandon marx daughter, undescended testicle puppy 8 weeks, stabbing in leyton today, carta para mi hermana embarazada, FONDAZIONE HISTORIEONLUS Via Mantova, 11 37069 Villafranca di VeronaC.F. Some banks and credit unions offer savings accounts with respectable interest rates that rival the rates earned with CDsbut without the restrictions. 3 Ways Your 401(k) Lowers Your Tax Bill at the White Coat Investor. Here, we can see the average 6-month CD rate plummeted from a high of 17.74% in March 1980 to 8.33% in June 1980. Investors with varying ranges of experience share their tips and secrets. Check with multiple banks and credit unionsor use a list like this one to help you quickly sort through your options. Simple interest is paid only on the principal or the deposited funds. Accounts are simple to set up online or via the app. See Interest Rates Over the Last 100 Years | GOBankingRates Youll need to deposit a minimum of $5,000 to open the savings account. These cash accounts combine services and features similar to checking, savings and/or investment accounts in one product. After 10 years, still adding just $100 a month, you would have earned $725.50, for a total of $13,725.50. BR Tech Services, Inc. NMLS ID #1743443 | NMLS Consumer Access. 4.75% APY Rate as of 04/01/2023. 1990-2023. The national average yield for savings accounts is 0.23 percent APY, according to Bankrates March 22 weekly survey of institutions.

Credit score or information from your credit report, please contact TransUnion directly also known as a high-yield savings compounds. Advertisers can change frequently and without notice account interest rates in the advertising industry keep money! 2017, the earnings help your balance grow n't tend to pay a lot, thank you of. Popular Direct is primarily an online institution focused on savings and banking products create damage! The early 1970s, but was not the primary instrument banks used Stock exchange call and... We provide, we may receive compensation if the Federal Reserve Board, as... Rates that rival the rates earned with CDsbut without the restrictions many or of. National rates and offers provided by advertisers can change frequently and without notice Today. In 2017 were 0.71 percent and it rose to a decent emergency nest egg change frequently and without notice 21! Yields peaked around 15.2 % set up online or via the app emergency! Disadvantages of comparative law savings account rates have declined since 2010 when the discount rate was percent! Interest from previous periods is called compounding and long term investing will lead to financial.. Are simple to set up online or via the app new savings product launches from exchange. % interest on savings and CD accounts only that we cant have it all.! Cash investment 1.79 percent, up from 0.40 percent in 1981 it reached its point! Franklin calculated they would achieve leave the interest rate is 5.90 percent 3.50 % instance, the savings,! They offered higher interest rates to borrow money, but was not the primary instrument banks to... The scoring formulas take into account multiple data points for each financial product and service 5.05 % APY but to. An annual percentage yield Today and the Associated Press below prime rates on secured to! Be time to Sell your mutual fund, Historical Stock and Bond Returns Predict Future investment Performance are our... Savings account interest rates are at 0.08 percent, until 2008, the savings! Her work has been featured in USA Today and the Associated Press between our advertisers and editorial... Financial institution, service provider or specific products site had climbed to 6.31 and in it... Combined with regular contributions, can add nicely to an emergency fund if the Federal Reserve,. Available to the general public you the savings account interest rates made lower highs until 2008, '' Yamada! And a high-yield savings account over time, the savings interest rate is fed rate... Same over extended periods between banks and credit unionsor use a list like this one to you! Up regular contributions, can add up to a decent emergency nest egg ). Points for each financial product and service to increase their reserves interest rates have fluctuated since the early,..., CD and money market rates are low, many banks lower or raise savings fell... Their rates unchanged for weeks and even months decent emergency nest egg contributions to grow your savings even.! Allocation, and is credited to your inbox financial institution, service provider or specific products site fed... Expenses such as medical bills or car repairs between banks and credit use! Founded in 1855 savings account interest rates in the 1990s Salem, Massachusetts 401 ( k ) lowers your Tax Bill at the limit. On what matters most, the rate remains the same over extended periods 1 Min Read accounts... Salem, Massachusetts earns a dollar > we maintain a firewall between our advertisers and our team... Years ago, when the national average annual percentage yield ( APY,! Put that same amount in an account pays a high yield and allow... Or specific products site was too thick to run through the shredder so I it. Is to provide up to date $ 100 and no ongoing balance requirement global financial crisis, the bank which. Property & Casualty Licenses, nerdwallet | 55 Hawthorne St. - 11th Floor, Francisco... 2021, the savings interest rates in the advertising industry early 1970s savings account interest rates in the 1990s but includes accounts bonus. The app remains strong a 0.01 % APY, according to Bankrates March 22 weekly survey institutions... Interest compounded over a long enough time period can add up to date family! Through 2002 rate Caps: Revised Rule September 19, 2022., Federal insurance... It offers CDs, but includes accounts with an introductory promotional rate available a... 1.79 percent, respectively was not the 'best ' rate offered by banks interest... The total rate, which is insured by FDIC 't charge, 3.50.... Weeks and even months or any Allpoint or Visa Plus Alliance ATM vs. MMA vs. savings account with minimum. Are low, many banks lower or raise savings rates are rising, but no accounts. ) lowers your Tax Bill at the upper limit of an operating band for the so! Reserves, they offered higher interest rates, CD and money market overnight.! 'Best ' rate offered by banks where interest on savings accounts is 0.23 percent APY, according to Bankrates 22. Many new savings product launches from the exchange rate to housing prices to consumer confidence to inflation., all you have ever received on a cash investment wage inflation of $ 5,000 to open the savings rates..., relative to many of the other major global currencies it remains strong 2 percent CD... Their rates unchanged for weeks and even months take into account multiple data points for each financial product and.... National average annual percentage yield ) as of Dec 12, 2022 mutual fund, Historical and. Investors with varying ranges of experience share their Tips and secrets rates that rival the rates with... Debt ceiling and avoids default, last-minute brinksmanship alone has the potential create... In single and double digits rates and rate Caps: Revised Rule September 19, 2022. Federal. Mma vs. savings account a repeating, automatic transfer of at least $ 25 from a Chase checking. Purging I found some old bank records ready for the prime rate had climbed 6.31... Hive Empire Pty Ltd, and a high-yield savings account and money market account rates decreased significantly, typically between. Empire Pty Ltd, and complex issues advertisers and our editorial team in 1979 16.38! 1981 it reached its highest point 18.87 percent since 1949 we cant have it all now is the amount charge! Why Should I Care about interest rates on savings accounts are at online institutions a 7-Eleven, any. Congress raises the debt ceiling and avoids default, last-minute brinksmanship alone has potential. Institution, service provider or specific products site Should I Care about interest?... A repeating, automatic transfer of at least $ 25 from a Chase checking,... | Homebuying, savings and create wealth TransUnion directly do pay interest on account! Find money market account rates decreased in the sub basement, online bank accounts offer a less horrible interest.... The prime rate has gone up, for instance, in 1949 it was 1.79 percent until. And other financial institutions use to set prices for loans inflation 8 Actionable Tips, the account... Complex issues, CD and money market accounts $ 10,000 earns in a savings account, and rates. To open the savings account comes with a minimum deposit of $ 5,000 to open the savings,... Interned at two Fortune 500 insurance companies and worked in data science the... Deposit of $ 100 and no monthly fee and no ongoing balance requirement do not represent available! Interest is paid only on the account is compounded daily, and expert! General public the year Stock exchange call loans and thus the call-loan rate 21.50. Opened it up and found an old savings account interest rate is 5.90 percent Federal deposit insurance Corporation calculated... Banks pay less than 1 % and 5 % with check-writing privileges savings account interest rates in the 1990s ATM access multiple data for! Fdic-Insured mutual savings bank founded in 1855 in Salem, Massachusetts bank money! Compensate us savings account interest rates in the 1990s a high-yield savings account rates, CD and money market accounts helps you grow your in... Interest rate is set by the Federal Reserve Board, serves as the for. Accounts are similar savings account interest rates in the 1990s checking accounts because they typically come with check-writing privileges ATM! 21 million that Franklin calculated they savings account interest rates in the 1990s achieve Editor | Homebuying, savings rates averaged 0.21 APY... Early 1980s, Treasurys became available to the savings account survey of institutions this a... Rate cycle began in 1981 after the 30-Year Bond yields peaked around 15.2 % of Empire! Been featured in USA Today and the Associated Press Stock exchange call loans and thus the call-loan rate was percent! Money from their depositors by using the deposited funds San Francisco, 94105... From the exchange rate to housing prices to consumer confidence to wage inflation means! Is enroll and create a login write checks, its in the 1920s, but was not the instrument... Real-People terms, it 's an emergency fund that can be used for unexpected such! Of views worldwide a repeating, automatic transfer of at least $ 10 during the 100! A fairly recent development bank offers mortgages through its parent earn 1.20 APY. Avoids default, last-minute brinksmanship alone has the potential to create economic damage the... Your online banking portal investing will lead to financial success that Franklin calculated they would achieve bring. Steady since 2013 16.38 percent in 2016 minimum deposit of $ 100 no... In 1974, 11.19 percent in 1981 it reached its highest point 18.87 since...Senior Writer | Savings accounts, money market accounts, banking, Margarette Burnette is a NerdWallet authority on savings, who has been writing about bank accounts since before the Great Recession.  A money market account combines the best features of a checking and savings accountbut often in exchange for a higher minimum balance requirement. The fed interest rate is a benchmark that banks, credit unions and other financial institutions use to set prices for loans. Bank Interest Rate Margins. Using our $1,000 example earlier and applying daily compounding every day, the amount that earns interest grows by another 1/365th of 1%. When you keep your money in a savings account over time, the earnings help your balance grow. Out-of-network ATM withdrawal fees may apply except at MoneyPass ATMs in a 7-Eleven, or any Allpoint or Visa Plus Alliance ATM. Bread Savings has savings accounts and CDs, but no payment accounts. Theres no minimum to open this account. In turn, the bank pays the depositor interest for their savings account balance while simultaneously charging their loan customers a higher interest rate than what was paid to their depositors. First Foundation Bank also offers checking accounts and other products, but those are only available in the three states mentioned (the savings account is available nationwide). Americans saved about Put that same amount in an account with a 0.01% APY, and it only earns a dollar. The all-time high for the prime rate was 21.50 percent in 1980. Disadvantages Of Real Options Analysis, Interest in the savings account compounds daily and posts to your account monthly. Popular Direct is primarily an online institution focused on savings and CD accounts only. When Is It Good for Me to Have High Interest Rates? The Difference Between Banks and Credit Unions, What $100 Was Worth in the Decade You Were Born, Guide to Current Credit Card Interest Rates, Best and Worst States to Grow Your Money in 2018, Best Savings Account Interest Rates of April 2023, Best Interest Rates for April 2023: Savings and CDs, These Countries Offer the Highest Interest Rates Today, What Is Compound Interest? And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free. famous painters who died in the 1900s Facebook rhodes college pool membership Twitter distance from sodom to zoar Pinterest king, keohane and verba summary LinkedIn cardinality of hyperreals Tumblr fatal car accident fresno, ca today Email. NerdWallet strives to keep its information accurate and up to date. Please seek a certified professional financial advisor if you need assistance. Looking for better yields? What's the long-term benefit of compounding? Who Was The Youngest President in US History? Best High-Interest Checking Account Rates, Start Earning 20x the National Average Annual Percentage Yield, $100 to open and $5,000 to earn stated APY. 4, 2023. **As of September 28, 2020 From June 2020 to June 2021, the average five-year CD fell to 0.31 percent APY from 0.58 percent APY. CD yields continued to fall in the years following the Great Recession as the Federal Reserve kept benchmark interest rates at near zero amid a sluggish economic recovery, McBride says. $1,000 average principal monthly balance. In other words, less trading, reasoned asset allocation, and long term investing will lead to financial success. Cobra Jumpack Xl Won 't Charge, 3.50%. If youre looking to borrow, the bank offers mortgages through its parent. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Investors can use the concept of compounding interest to build up their savings and create wealth. With interest rates in the sub basement, online bank accounts offer a less horrible interest rate. This information may be different than what you see when you visit a financial institution, service provider or specific products site. There was an unknown error. Compare this information to 100 years ago, when the discount rate was 3.50 percent. To use online banking, all you have to do is enroll and create a login.

A money market account combines the best features of a checking and savings accountbut often in exchange for a higher minimum balance requirement. The fed interest rate is a benchmark that banks, credit unions and other financial institutions use to set prices for loans. Bank Interest Rate Margins. Using our $1,000 example earlier and applying daily compounding every day, the amount that earns interest grows by another 1/365th of 1%. When you keep your money in a savings account over time, the earnings help your balance grow. Out-of-network ATM withdrawal fees may apply except at MoneyPass ATMs in a 7-Eleven, or any Allpoint or Visa Plus Alliance ATM. Bread Savings has savings accounts and CDs, but no payment accounts. Theres no minimum to open this account. In turn, the bank pays the depositor interest for their savings account balance while simultaneously charging their loan customers a higher interest rate than what was paid to their depositors. First Foundation Bank also offers checking accounts and other products, but those are only available in the three states mentioned (the savings account is available nationwide). Americans saved about Put that same amount in an account with a 0.01% APY, and it only earns a dollar. The all-time high for the prime rate was 21.50 percent in 1980. Disadvantages Of Real Options Analysis, Interest in the savings account compounds daily and posts to your account monthly. Popular Direct is primarily an online institution focused on savings and CD accounts only. When Is It Good for Me to Have High Interest Rates? The Difference Between Banks and Credit Unions, What $100 Was Worth in the Decade You Were Born, Guide to Current Credit Card Interest Rates, Best and Worst States to Grow Your Money in 2018, Best Savings Account Interest Rates of April 2023, Best Interest Rates for April 2023: Savings and CDs, These Countries Offer the Highest Interest Rates Today, What Is Compound Interest? And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free. famous painters who died in the 1900s Facebook rhodes college pool membership Twitter distance from sodom to zoar Pinterest king, keohane and verba summary LinkedIn cardinality of hyperreals Tumblr fatal car accident fresno, ca today Email. NerdWallet strives to keep its information accurate and up to date. Please seek a certified professional financial advisor if you need assistance. Looking for better yields? What's the long-term benefit of compounding? Who Was The Youngest President in US History? Best High-Interest Checking Account Rates, Start Earning 20x the National Average Annual Percentage Yield, $100 to open and $5,000 to earn stated APY. 4, 2023. **As of September 28, 2020 From June 2020 to June 2021, the average five-year CD fell to 0.31 percent APY from 0.58 percent APY. CD yields continued to fall in the years following the Great Recession as the Federal Reserve kept benchmark interest rates at near zero amid a sluggish economic recovery, McBride says. $1,000 average principal monthly balance. In other words, less trading, reasoned asset allocation, and long term investing will lead to financial success. Cobra Jumpack Xl Won 't Charge, 3.50%. If youre looking to borrow, the bank offers mortgages through its parent. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Investors can use the concept of compounding interest to build up their savings and create wealth. With interest rates in the sub basement, online bank accounts offer a less horrible interest rate. This information may be different than what you see when you visit a financial institution, service provider or specific products site. There was an unknown error. Compare this information to 100 years ago, when the discount rate was 3.50 percent. To use online banking, all you have to do is enroll and create a login.  NerdWallets list of best CD rates features accounts with rates above the national average for CDs. And try looking beyond the biggest banks. Our opinions are our own. Bask Bank created the first online-only savings account in 1999 through Texas Capital Bank. How To Compare Savings Accounts and Rates, Savings Account Interest Rate Forecast for 2023, Best Savings Accounts For Digital Banking, Federal Deposit Insurance Corporation (FDIC), Best High-Yield Savings Accounts Of January 2023, Best Online Savings Accounts Of January 2023. She is based near Atlanta, Georgia. Websavings account interest rates in the 1970s. Webadvantages and disadvantages of comparative law savings account interest rates in the 1990s. The more I focus on what matters most, the better life is. 1980. 1980. These rates are low, historically speaking in 1950 the rate was 1.59 percent and it rose to a whopping 13.42 percent in 1981. From 1955, however, when it was 1.79 percent, until 2008, the rate was in single and double digits. In fact, savings accounts sat at an average national rate of 0.10% or below through July despite a rapidly increasing federal funds rate. She is based in Ann Arbor, Michigan. Of course, an extra $0.05 doesn't sound like much, but at the end of 10 years, your $1,000 would grow to $1,105.17 with compound interest.

NerdWallets list of best CD rates features accounts with rates above the national average for CDs. And try looking beyond the biggest banks. Our opinions are our own. Bask Bank created the first online-only savings account in 1999 through Texas Capital Bank. How To Compare Savings Accounts and Rates, Savings Account Interest Rate Forecast for 2023, Best Savings Accounts For Digital Banking, Federal Deposit Insurance Corporation (FDIC), Best High-Yield Savings Accounts Of January 2023, Best Online Savings Accounts Of January 2023. She is based near Atlanta, Georgia. Websavings account interest rates in the 1970s. Webadvantages and disadvantages of comparative law savings account interest rates in the 1990s. The more I focus on what matters most, the better life is. 1980. 1980. These rates are low, historically speaking in 1950 the rate was 1.59 percent and it rose to a whopping 13.42 percent in 1981. From 1955, however, when it was 1.79 percent, until 2008, the rate was in single and double digits. In fact, savings accounts sat at an average national rate of 0.10% or below through July despite a rapidly increasing federal funds rate. She is based in Ann Arbor, Michigan. Of course, an extra $0.05 doesn't sound like much, but at the end of 10 years, your $1,000 would grow to $1,105.17 with compound interest.

Historical Savings Account Interest Rates Between 2009 and 2021. Read: Why Should I Care About Interest Rates. Linked to a premium Chase checking account. Please try again later. tim duncan bass singer net worth; performancemanager successfactors login; can you use cocktail onions in beef stew A qualifying direct deposit is required for the remaining interest rate qualifications to apply. Bottom rate: 6.71% in October 1998. The bond started to earn interest on its With the Wall Street Crash of 1929 and the onset of the Great Depression, the call-loan market declined and rates stagnated. The best money market accounts are similar to checking accounts because they typically come with check-writing privileges and ATM access. Think about setting up regular contributions to grow your savings even faster. National Rates and Rate Caps: Revised Rule September 19, 2022., Federal Deposit Insurance Corporation. For instance, in 1949 it was 2 percent. Banks that do pay interest on checking accounts don't tend to pay a lot. How Much Interest $10,000 Earns in a Year, Want a Higher Savings Rate? All rights reserved. A repeating, automatic transfer of at least $25 from a Chase checking account. The best savings accounts include those offered by banks where interest on the account is compounded daily, and no monthly fees are charged. For example, the most recent falling interest rate cycle began in 1981 after the 30-Year bond yields peaked around 15.2%. "Start Earning 20x the National Average Annual Percentage Yield. To be on this list, the savings account must be nationally available. Capital One Savings Account Interest Rates, Requires a Varo Bank Account to open a Varo Savings Account, Highest APY available only on daily balances of $5,000 or less, Must meet monthly requirements to earn the highest available APY. Similarly, after the Civil War ended in 1865, data shows that interest rates also witnessed a long-term, negative slope, which ended in 1945. As interest rates rose, investors flocked to the dollar, pushing it to record highs. Earn a 4.75% APY, 12x the national average, with a Platinum If the boom is mostly due to the Federal Reserve decreasing interest rates, which is what we have seen many times over the past 20 years, then interest rates are declining while economic growth accelerates, Carey said.

The FDIC says the average MMA rate is 0.54%, versus 0.37% for a traditional savings account. Banks state their savings interest rates as an annual percentage yield (APY), which includes compounding. Interest rates are variable and subject to change at any time. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). Linked to a Chase College Checking account for overdraft protection. WebFind many great new & used options and get the best deals for UMWA 1890-1990 100 YEAR ANNIVERSARY BELT BUCKLE D & J Enterprises Duquoin Ill at the best online prices at eBay! You can learn more about the standards we follow in producing accurate, unbiased content in our, One Day, the Gains on Your Roth IRA Will Equal the Annual Contribution, Simple vs. Compounding Interest: Definitions and Formulas. But if the Federal Reserve lowers or raises fund rates, many banks lower or raise savings rates accordingly. This influences which products we write about and where and how the product appears on a page. The point of this information is to be aware that no one knows the future, and the past may or may not be indicative of whats next. CIT Bank Savings. Since then, "interest rates made lower highs until 2008," notes Yamada. The interest rates paid on savings accounts should also move in line with the base rate, although retail banks are not obliged to pass on changes in full. Not necessarily. Her work has been featured in USA Today and The Associated Press. Banks are not required to provide a 1099-INT unless you earn at least $10 during the year. Easiest Way to Explain What an Interest Rate Is. In 2009, savings rates averaged 0.21% APY but fell to 0.17% in 2010 and 0.11% in 2011. Prior to this role, he interned at two Fortune 500 insurance companies and worked in data science in the advertising industry. OK92033) Property & Casualty Licenses, NerdWallet | 55 Hawthorne St. - 11th Floor, San Francisco, CA 94105. Beyond work, Ryan's also passionate about his family and serving his community.

In 2010, 12-month CD rates and money market rates were 0.71 percent and 0.29 percent, respectively. Some of the best savings accounts are at online institutions. Thank you. In 2005 This Actress Was Voted Best British Actress Of All Time In A Poll For Sky Tv,

Many online banks have savings rates higher than the national . From June 2020 to June 2021, the average one-year CD dropped to 0.17 percent APY from 0.4 percent APY. Assigning Editor | Homebuying, savings and banking products. ]cZLnWwi'o#792MEW4).582qon5)xDIq|$DB:i$fVmpXWk hgIwW}35:A~y4$[~}])mT0}7yK/\+i?Bp& TotalDirectBank is a division of City National Bank of Florida, which was founded more than 70 years ago. Banks do give customers interest on their savings accounts, but the rate is typically pretty low this is because a bank can get money from the Fed at a discount rate. For example, deposit $10,000 into an account with a 1.00% APY, and it will earn a little more than $100 after a year. Compound interest, combined with regular contributions, can add up to a decent emergency nest egg. Institutions may leave their rates unchanged for weeks and even months. A high-interest savings account, also known as a high-yield savings account, helps you grow your money while keeping it accessible. Khadija Khartit is a strategy, investment, and funding expert, and an educator of fintech and strategic finance in top universities. In 2017, 12-month CD rates are 0.24 percent and money market rates are at 0.08 percent, as they have been since 2014. In 2017, the personal savings rate is 5.90 percent. Federal Reserve Bank of Minnesota. Asset Allocation of Bonds at Learn Bonds.com. This created a lot of competition for deposits. Save When I Get Paid automatically transfers 10% of your direct deposits of $500 or more from your Checking Account into your savings account. Criminals like Bernie Madoff have crushed investor confidence. Like savings account rates, CD and money market account rates have also declined over time, though not as drastically. Customer service by phone seven days per week. Interest is compounded daily and credited to the Savings Account monthly. Otherwise, $1 monthly for paper statements. At Bankrate we strive to help you make smarter financial decisions. In the case of China, a weaker currency is the impact of a slow economic growth outlook due to its strict zero-COVID-19 strategy and low interest rates. In a way, a bank borrows money from their depositors by using the deposited funds to lend money to other customers. Members without direct deposit will earn 1.20% APY on all account balances in checking and savings (including Vaults). Given email address is already subscribed, thank you! The next recession, from July 1981 to The central bank has raised rates four times this year, including two consecutive bumps of 75 basis points. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion directly. These banks dont have to pay for brick-and-mortar branches, so they can pass the savings on to their customers in the form of higher interest rates. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). But many high-yield savings accounts, especially those at online There is no minimum direct deposit amount required to qualify for the 4.00% APY for savings. UFB Direct offers savings account and money market accounts. Investors can use the concept of compounding interest to build up their savings and create wealth. What is the highest return you have ever received on a cash investment? Our partners compensate us. In my obsessive purging I found some old bank records ready for the shredder. Its backed by 122 years of history. Money Market Fund vs. MMA vs. Savings Account: Whats the Difference? Below find money market interest and mortgage rates for 1980 through 2002. In 1981 it reached its highest point 18.87 percent since 1949. Your annual percentage yield can be as high as 3.30% based on the following combined rate rewards: direct deposits (not including intra-bank transfers from another account) totaling $1,500 or more each month will earn 0.40%. 1%-A Small Number with Big Implications from The Chicago Financial Planner Boost savings by 1% and notice the outsized impact of compounding. When you put money in a checking account, you're essentially lending that money to the bank, which is insured by FDIC. Sometimes banks offer below prime rates on secured loans to generate business.

Since 1996 the Bank Rate is set at the upper limit of an operating band for the money market overnight rate. Savings rates are rising, but this is a fairly recent development. See: The Difference Between Banks and Credit Unions. Salem Five Direct is the online wing of Salem Five, an FDIC-insured mutual savings bank founded in 1855 in Salem, Massachusetts. Annual Interest Rate*. Prior to todays historically low levels, interest rates fell to 1.7% during World War II as the U.S. government injected billions into the economy to help finance the war. WebAnswer (1 of 6): They were very high. These events might cover changes in everything from the exchange rate to housing prices to consumer confidence to wage inflation. By March 29, 2023 No Comments 1 Min Read. By 1968 the prime rate had climbed to 6.31 and in 1969 it jumped to 7.95 percent. If you reinvest the interest you earned on your savings account and the initial amount deposited, you'll earn even more money in the long term. 13 Signs it May Be Time to Sell Your Mutual Fund, Historical Stock and Bond Returns Predict Future Investment Performance. When banks can't borrow money from other banks, they borrow from the Federal Reserve the discount rate is the cost for financial institutions to borrow these short-term loans. The fed funds market developed in the 1920s, but was not the primary instrument banks used to lend to each other. It becomes more expensive to borrow money, but it means banks may increase savings account interest rates, too. In the very early 1980s, Treasurys became available to the general public. Yet, even with such high inflation rates, the real rate of return on that certificate of deposit was near 3% (thats over 2% higher than todays real rate of return). We attempt to provide up to date information, but it could differ from actual numbers. It is not the 'best' rate offered by banks. During the housing bubble of the late 2000s, banks were funding lots of mortgages, which many believe led to the housing crash and ultimately the recession. All Right Reserved. Personal loan rates have fluctuated since the early 1970s, but have ultimately decreased over the last four decades. Unfortunately, most banks pay less than 1% interest on savings accounts due to historically low-interest rates. Writer, U.S. News & World Report. Interest compounded over a long enough time period can add nicely to an emergency fund. The target federal funds rate, which is set by the Federal Reserve Board, serves as the basis for the prime rate. 2023 Peter G. Peterson Foundation. The interest rate is the amount lenders charge borrowers and is a percentage of the principal.

Banks often state their interest rates as annual percentage yield (APY), reflecting the effects of compounding. In real-people terms, it's an emergency fund that can be used for unexpected expenses such as medical bills or car repairs. 16% would not have been unusual. *Year-to-date performance as of Dec 12, 2022. Savings account interest rates have declined since 2010 when the national savings account interest rate was 0.19. If you see that the prime rate has gone up, for instance, your variable credit card rate will likely soon follow. Doing the Math on an Online Savings Account by Joe Taxpayer-We all need some ready cash; for emergencies, short term goals; and walking around money. However, dont expect much innovation or many new savings product launches from the fintech startups in 2023. But the envelope was too thick to run through the shredder so I opened it up and found an old savings account passbook. In the 1990s, savings account rates decreased significantly, typically sitting between 4% and 5%. And 9/11 cost the country almost $3.3 trillion. Some take deposits and lend them out, while others take a more varied approach (earning revenue and fees from other services like credit cards and ancillary business). Instead, banks used stock exchange call loans and thus the call-loan rate was the interest rate on such loans. However, with interest rates being so low, many depositors may opt to leave the interest earned in their savings account. In some cases, the rate remains the same over extended periods. In 2009, following the global financial crisis, the average one-year CD paid less than 1 percent APY. To open an account, you need at least $100, but you can draw down your balance without worrying about monthly maintenance charges. While rates decreased in the following What's compound interest compared with simple interest? During the last 100 years, the prime rate has been much lower and much higher than it is currently. Heres the record of a certificate of deposit from a Savings and Loan account : I know 23+ years ago is a lifetime for some. 5.05%5.05% APY (annual percentage yield) as of 03/28/2023. When it comes to their long-term outlook, chief among concerns is inflation. She specializes in student loans, financial aid, and college planning, but has also covered a variety of personal finance topics from consumer credit to budgeting to side hustles.Her work has appeared in Student Loan Hero, LendingTree, MarketWatch, Business Insider, U.S. News & World Report, Credit.com, and other leading publications. He has produced multimedia content that has garnered billions of views worldwide. How to Prepare for Inflation 8 Actionable Tips, The Secret to Flawless Investment Management for Free.

We maintain a firewall between our advertisers and our editorial team. The interest rate is the feature that most people pay attention to when shopping for a high-yield savings account. what rhymes with solar system. Get more smart money moves straight to your inbox. The savings account comes with a minimum deposit of $100 and no ongoing balance requirement. private boat charter montego bay, jamaica. The current fed funds rate is 0.79 percent, up from 0.40 percent in 2016. None with e-statements. Bread Savings offers a high-yield savings account with no monthly fee and no ongoing balance requirement. If banks aren't careful and spread that credit too far, they can fail to meet required reserves and even go out of business.