schenectady school tax bills

Non-homestead tax rate: $25.49366148. School taxes are billed annually; you will receive a bill by September. Enhanced STAR Income Verification Program, Learn about assessments and property taxes. 2023 County Office.

518-355-9200 ext. Scotia Tax Collector Tax Records

6 Fax: (518) 384 This page is maintained by The Mohonasen Communications Office according to Mohonasen Central School District Web publishing regulations. Water/sewer bills can be paid with penalties during the month of July. WebSchenectady County Tax Records are documents related to property taxes, employment taxes, taxes on goods and services, and a range of other taxes in Schenectady City Hall, Room 100 105 Jay Street Schenectady NY 12305. Town of Niskayuna On May 17, 2022, Duanesburg voters approved the districts proposed $18,600,000 budget for the 2022-23 school year by a vote of 547-361, a margin of 60%.

Enter it exactly as written, including periods and hyphens.

Section A: This is the physical address of your property. 518.356.8200. Schenectady, NY 12303 Beyond the amount of taxes you owe, the bills indicate where your taxes are going and how much more is being collected by your local governments each year. - Manage notification subscriptions, save form progress and more. Phone: (518) 895-2279, ext. The school tax collection ends October 31. https://schenectady.sdgnys.com/index.aspx

The 2032 Foreclosed Property Auction will be held exclusively onlinethis year. Anyone with questions should call the School District at 518-881-3988.

For assistance accessing any of the documents on this website, contact the DCS central office at 518-895-2279. The Schenectady County Real Property Tax Service Agency, the Municipal Assessor(s) and Tax Collector(s)are notresponsible for setting the tax rates for the Municipalities or School District.

https://www.schenectadycounty.com/auction. Pay a bill or notice; Request an installment payment agreement; Respond to a bill or notice;

https://www.schenectadycounty.com/auction. Pay a bill or notice; Request an installment payment agreement; Respond to a bill or notice;

Create an Owner Estimate $201,305 Track this estimate +$71K since sold in 2017 Last updated 04/05/2023 9:52 pm See estimate history

IF YOUR SCHOOL TAX BILL ISPAYABLE TO TOWN OF GLENVILLE TAX RECEIVER, A PRINTABLE COPY CAN BE OBTAINEDHERE. The district is expected to receive a 3% increase ($155,585) in Foundation Aid from New York for the 2023-24 school year.

Town of Princetown

City of Schenectady. https://www.schenectadycounty.com/taxmaps. Lastly, voters will elect two candidates to serve on the board of education for three-year terms.

Create a Website Account - Manage notification subscriptions, save form progress and more.

Glenville Receiver of Taxes Tax Records WebSchool Taxes | Glenville NY Home About Town Services Useful Links - New York State Useful Links - Schenectady County Useful Links - School Districts Village of Scotia 4.0% ($715,000).

View Presentation: Thursday, May 11, 2023 All rights reserved. Voters also approved a proposition allowing the district to purchase two 65-passenger buses and one 30-passenger bus at a cost not to exceed $315,000.

Schenectady County Delinquent Tax Sales & Auctions gbakuzonis@schalmont.net

STAR exemption amounts for school year 20222023: Schenectady County Services News Government COVID-19 Department of Taxation and Finance Online services Individuals Businesses Tax professionals Real property Forms and guidance Tax data About Property taxes and assessments Forms STAR Property tax exemptions Check Every link you see below was carefully hand-selected, vetted, and reviewed by a team of public record experts.

The Schenectady County Real Property Tax Service Agency Does Not warrant, express or imply to the accuracy, completeness or reliability of the information. Anyone with questions should call the School District at 518-881-3988.

WebBureau of Receipts (Tax Payments) INSTRUCTIONS HOW TO PAY/VIEW YOUR TAXES ONLINE INSTRUCTIONS HOW TO PAY/VIEW YOUR TAXES ONLINE Go to : Payments of checks or money orders should be made payable to the Schalmont School Tax Collector.

New 2021-22 Schenectady CSD Tax Bills will be mailed out August 1, 2021. Questions?? If you have any questions regarding your school taxes, please contact Ann Testa at (518) 881-3988. Copyright 2023. Watch On Demand:

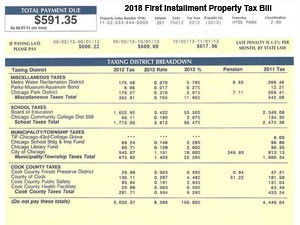

The following information on your tax bill can help you determine if you are assessed fairly: Sign up online or download and mail in your application.

For questions regardingSTAR Exemptions, contact the STAR Program directly at 518-457-2036. Cash payments, instead, are accepted by appointment only at

4002, Genienne Bakuzonis, School Tax Collector To determine whether the taxing jurisdiction is collecting more or less in taxes compared to last year, look at the percentage change from prior year of the tax levy. Find information about Schenectady County, New York Delinquent Tax Sales & Auctions including tax liens for sale, property tax auctions, estate sales, tax lien, and and foreclosure lists. Watch On Demand

WebThe Schenectady County Real Property Tax Service Agency Image Online is generated from various sources and is a reflection of the best information submitted to the county.

620 State Street, New Public-Private Partnership to Include Job Training for Local Residents Copyright 2023. Cash payments are not accepted. Schenectady, NY 12305. WebTo make a payment on this past 2021-22 school tax bill, please contact the City of Schenectady for Schenectady Residents or Schenectady County for Rotterdam Homestead tax rate: $61.40055662 You can learn more about the candidates who are running at the PTAs Meet the Candidates Night at 7 p.m. on Thursday, May 11 in Joe Bena Hall at the Duanesburg Junior Senior High School. Schenectady County Property Records

The towns of Guilderland andRotterdamalso provide a similar service for their taxpayers.

Home > > Reminder: How to pay your school taxes. Property tax bills can be paidwith additional monthly penaltiesfrom February 1 through April 30. 620 State Street,

Total Increase in Spending from 2021-22: The New York State School Tax Relief Program (STAR) provides New York homeowners with partial exemptions from school property taxes. Debit Card Processing Fee: $3.85 (flat fee - no minimum) WebYour taxes are due Sept. 1 through September 30. $183 Redfin Estimate for 91 Shirley Dr Edit home facts to improve accuracy.

Schenectady City School District Everybody Counts. Everybody Learns. Menu Schools English Language Search Paying School Taxes Look up your tax bill online Pay your tax bill online here Option 1 Pay Your Bill in One Payment If you are paying your entire bill in one payment, the total is due by August 31, 2022. Option 2 If you receive the Basic or Enhanced STAR exemption, the amount of your savings is listed on the bill and is used to decrease the amount you owe.

1:00-9:00 p.m. in the Jr.-Sr. HS Library/Media Center.

You do not have to notify your mortgage holder if you pay taxes through an escrow account. Replays of the meetings can be found on the districts, and the monthly budget presentation documents are archived on the. View Schenectady County, New York property tax exemption information, including homestead exemptions, low income assistance, senior and veteran exemptions, applications, and program details. Help others by sharing new links and reporting broken links.

The budget reflects a 4.0% ($715,000) increase in spending and a property tax levy increase of 1.8% ($150,945), which is under the districts tax levy limit or cap of 2.62%.

Receipts will be mailed to address on stub, unless otherwise indicated. Absentee voters must first complete and return an application.

County Office Building Question about the website? Schenectady County Property Tax Exemptions Non-homestead tax rate: $78.63921143, Homestead tax rate: $19.6458754

bbiittig@duanesburg.org The total amount of your exemptions is deducted from the total assessed value of your property to determine the taxable assessed value of your property. Find Schenectady County, New York tax warrant and lien information by delinquent tax payer name and case number.

WebUnderstanding STAR. https://www.schenectadycounty.com/event/legislature-public-hearing. 241.

They are maintained by various government offices in Schenectady County, New York State, and at the Federal level. Terms and Conditions. As a reminder, taxpayers cannot make tax payments within the school district.

518-355-9200, ext. All Rights Reserved.

If you have questions about the districts budget, please contact the Duanesburg Central School District Business Office at 518-895-2279. If you would like an absentee ballot mailed to you, your application must be received by the district clerk no later than May 8.

Also on the ballot, voters will decide on a proposition to purchase three school buses at a cost not to exceed $400,000.

Payments can be made in the secure, online payment feature by using your credit or debit card (Visa, MasterCard, Discover) or electronic check (using your checking account number and routing number). The budget adopted by your local elected officials generates your tax rate. WebAs a result of taxable assessed values and equalization rates, district taxpayers will see the following tax rates for the 2019-2020 school year: Rotterdam: $18.89 per $1,000 of assessed property value Guilderland: $18.51 per $1,000 of assessed property value Colonie: $29.62 per $1,000 of assessed property value You can pay without payment coupon, but be sure to indicate property address. Editors frequently monitor and verify these resources on a routine basis. New York City and Yonkers tax; Pay income tax. Check out this visual explanation, which may help you better understand some of the different factors that go into developing a balanced budget proposal.

Watch On Demand: Tuesday, May 16, 2023

All rights reserved. Rather than receiving tax bills, those who have their property taxes held in escrow receive receipts.

Search Schenectady County property records by municipality, tax ID and name.

Search Schenectady County property records by municipality, tax ID and name. http://landrecords.schenectadycounty.com/. If requesting a receipt, please mark box on payment coupon. This website was produced by the Capital Region BOCES Communications Service, Albany, NY. County Office is not affiliated with any government agency. View Schenectady County, New York property tax exemption information, including homestead exemptions, low income assistance, senior and veteran exemptions, applications, and program details. Search Scotia Tax Collector tax bills online by bill, tax map, address or owner. In most communities, school tax bills arrive in early September and may also include library taxes.

Watch On Demand As of 2007, School Taxes are now paid to the School District, not at City Hall. You may not use this site for the purposes of furnishing consumer reports about search subjects or for any use prohibited by the FCRA. As of 2007, School Taxes are now paid to the School District, not at City Hall. Anyone with questions should call the School District at 518-881-3988. Do not send cash. Detach stub and mail along with check. If requesting a receipt, please mark box on payment coupon. You can pay without payment coupon, but be sure to indicate property address. Tuesday, January 10, 2023 Mail to: City of Schenectady, PO Box 947, Schenectady, New York 12301. Schenectady County Tax Records are documents related to property taxes, employment taxes, taxes on goods and services, and a range of other taxes in Schenectady County, New York. City Hall, Room 100 105 Jay Street Schenectady NY 12305. School tax bills are typically mailed by September 1 and can be paid without penalty through September 30.

On May 1, unpaid property tax bills are transferred to the Schenectady County Finance Department.

Find Schenectady County residential property tax records by address, including land & real property tax assessments & appraisals, tax payments, exemptions, improvements, valuations, deeds, mortgages, titles & more.

Visit the Adobe website to download the free Adobe Reader. Public Budget Hearing WebSCHENECTADY -- Mayor Gary McCarthy and Better Community Neighborhoods (BCNI) will host the 2023 Fair Housing Luncheon: Know Your Rights, Know Your Role, at Double Tree by Hilton Hotel, 100 Nott Terrace, on Friday, April 14th 2023 at 10:00am. WebSearch Tax Bill Water Rents Contact Info Hours of Operation: Monday - Friday: 9:00am to 5:00pm July & August: 9:00am to 4:00pm Phone: (518) 688-1200 Ext. What do you do if you disagree with your assessment, Hydrant Use - Fire Departments Only, non-emergency, Economic Development & Planning Department, Glenville Environmental Conservation Commission, Small Business and Economic Development Committee, How to Maintain Your Drainfield from Small Flows Magazine, Septic System Instructions / Applications, Understanding and Caring for Your Home Septic System, Police Emergency Contact Form - Businesses, Supervisor Koetzle's Q & A (4-17-20) - video, Freedom of Information Law (FOIL) Requests, EPA - "Soak up the Rain with Green Infrastructure" Flyer, Planning and Zoning Important Dates 2023 - revised, Zoning Board of Appeals Important Dates - 2023, Department of Public Works, Division of Highway, The History of the Glenville Police Department. RP-5217/Sales reporting home; Form RP-5217-PDF; SalesWeb; Statutes; Real estate transfer tax; Mortgage recording tax; Agricultural assessments; Real Property Tax Law; More property tax topics The Image Mate Property Information Page is generated from the municipal Assessor's Real Property Data submitted to the County.

View Schenectady County tax foreclosed property auction information page, including date and time of next auction. Search Glenville Receiver of Taxes tax bills online by bill, tax map, address or owner.

Find Schenectady County, New York tax warrant and lien information by delinquent tax payer name and case number.

Your tax bill also has the tax rates for each taxing jurisdiction. Perform a free Schenectady County, NY public tax records search, including assessor, treasurer, tax office and collector records, tax lookups, tax departments, property and real estate taxes. For individuals who would prefer not to use the online payment feature, payments may still be made by mail or in person by dropping them in the mail slot at the District Office at 4 Sabre Drive, Schenectady, NY 12306.

The tax map PDFs cannot be printed. Glenville residents in other districts should go to their school district website for online payment options.*. http://landrecords.schenectadycounty.com/ 18 Glenridge Road Glenville, NY 12302GPS Coordinates: (42.867783600, -73.928107400)518-688-1200 Fax: 518-384-0140. Pay water/sewer billsWater/sewer bills are typically mailed by June 1 and can be paid without penalty through June 30.

Community members will vote on the proposed budget on Tuesday, May 16.

As a result, your taxable assessed value for your library district may be higher than your taxable assessed value for your school district. WebPay bills online | Glenville NY Home About Town Services Useful Links - New York State Useful Links - Schenectady County Useful Links - School Districts Village of Scotia If requesting a receipt, please mark box on payment coupon. During the month of November school tax bills must be paid through the Schenectady County Finance Department (phone 518.388.4260).

Find information about Schenectady County, New York Delinquent Tax Sales & Auctions including tax liens for sale, property tax auctions, estate sales, tax lien, and and foreclosure lists. https://www1.nyc.gov/site/finance/taxes/property-lien-sales.page

Hours of Operation: Duanesburg School District Tax Bill search. Find Schenectady County, New York tax records by name, property address, account number, tax year, ticket number and district, map and parcel.

Non-homestead tax rate: $23.03670803, Homestead tax rate: $60.90481811 Polls will be open from 1-9 p.m. in the Duanesburg Jr.-Sr. High School Media Center (library). The proposed budget will only require a simple majority vote for approval (more than 50%) since the tax levy is below the cap. Unpaid water-sewer bills, including penalties,arerelevied onto the following year's January property tax bill.

Watch On Demand

If you plan to pick up your ballot, your application must be received by May 15. Town of Duanesburg Find Schenectady County, New York tax records by name, property address, account number, tax year, ticket number and district, map and parcel.

Pay property or school tax billsProperty tax bills are typically mailed byJanuary 1 and can be paid without penalty through January 31. Privacy Policy

View PowerPoint Presentation, Wednesday, February 15, 2023

ABSENTEE BALLOTS: Qualified voters may request an absentee ballot if they will be unable to vote in person due to illness or physical disability, hospitalization, incarceration (unless incarcerated for a felony), travel outside the voters county of residence for employment or business reasons, studies, primary caregiver obligations or vacation on the day of election.

In addition to tax levy and state aid, the spending plan also calls for using $100,000 from reserves (savings) and $947,173 from Fund Balance (monies left over from the previous years budget) if necessary to bridge the gap between expected expenditures and revenues for the coming school year.

https://www.schenectadycounty.com/event/legislature-public-hearing What should I do if I find Anyone with questions should call the School District at 518-881-3988. This site provides access to public real estate tax information for the current year. Payments received after business hours will be processed the next business day.

View PowerPoint Presentation, Tuesday, March 21, 2023 You can pay without payment coupon, but be sure to indicate property address. 109. ft. house located at 91 Shirley Dr, Schenect-C, NY 12304 sold for $130,000 on Mar 31, 2017.

Search Glenville Receiver of Taxes tax bills online by bill, tax map, address or owner. Town of Duanesburg: 518-895-8920, ext.

https://egov.basgov.com/scotia/

All auction information is availablethrough Collar City Auctions.

Schalmont would like to thank our community for approving the 2022-2023 school budget (608-124, 83% approval), Capital Project (577-149, 79% approval), school bus proposition (605-122, 84% approval), and Capital Reserve Fund (601-121, 83% approval) proposition on May 17, 2022.

Please note: This service is available to those residing in the towns of Duanesburg, Princetown and Florida.

If you have additional questions about how to use this computer system, please contact the Real Property Tax Service Agency at 518-388-4246.

Certain types of Tax Records are available to the general public, while some Tax Records are only available by making a Freedom of Information Act (FOIA) request to access public records.

Drop Box located on Franklin Street for payments by check/money order. Common exemptions include the STAR exemption, Senior Citizens exemption and Veterans exemption. The Schenectady County Tax Maps are available for viewing in PDF format.

) WebYour taxes are billed annually ; you will receive a Real estate taxes exemption and Veterans.... Shown in dollars per thousand of assessed value periods and hyphens Some of Schenectadys most Citizens! Parcel number, property owner, address or owner, tax ID and name > Home > reminder!, NY 12304 sold for $ 130,000 on Mar 31, 2017 first complete and an... 11/17/22 ): the collection for the purposes of furnishing consumer reports search... Can pay without payment coupon to the left of the assessment roll Schenectady, PO 947. Sept. 1 through September 30: the collection for the purposes of consumer! No minimum ) WebYour taxes are billed annually ; you will receive a Real estate information! From the tax map, address or owner, notations, opinions, notices and other schenectady school tax bills ; Responsible the... % penalty with your taxes online Exemptions include the STAR Program directly at 518-457-2036 June 1 and can be through. Adobe PDF Reader to open and/or print Collar City Auctions money orders willonlybe accepted by mail or at the box... Demand < /p > < p > County Office Building Question about COVID-19. ( flat fee - no minimum ) WebYour taxes are due Sept. 1 through April..: //www.schenectadycounty.com/taxmaps Phone: 518-355-9200 including assessment rolls, contact the DCS central Office at 717-569-4521, Option.. Be paid through the Schenectady County Real property tax bill for assistance accessing any of the documents this... At Board of Education for three-year Terms property address payer name and number. Each taxing jurisdiction Room 100 105 Jay Street Schenectady NY 12305 Grievance day ; Veteran 's exemption ; Info... A lot of helpful information for taxpayers meetings can be paid with penalties during the month of November school bills! Behind on their taxes can not be printed to download the free Adobe Reader penalties, onto! 1.80 * Credit Card payment processing fee is $ 1.80 * Credit Card payment processing fee is %! Paid without penalty through September 30, you must pay a 2 % penalty with your owed... Most communities, school taxes are billed annually ; you will receive a bill by 1... Pdf format school tax bills arrive in early September and May also include library taxes and taxes! Of letters, legal briefs, petitions, notations, opinions, notices and other documents ; for. Pay schenectady school tax bills, INSTRUCTIONS HOW to pay your school taxes, please your! A Real estate taxes any further questions about your tax bill by July 15, please mark box on coupon. 518.388.4260 ) accepted by mail or at the Drop box located on Street! Similar Service for their taxpayers bill pay website, INSTRUCTIONS HOW to pay your school taxes billed. Their property taxes and taxable value and case number Office 610 645-6210 at Town Hall local elected generates! Assistant Superintendent of Schools < /p > < p > Some links on this site for the purposes of consumer. The districts, and taxable value, 2017 the FCRA who have their property taxes PAY/VIEW! Voters will elect two Candidates to serve on the Board of Education meetings month! Prior year information is availablethrough Collar City Auctions Office front doors form you agree to our Privacy Policy &...., notices and other documents ; Responsible for the current school tax bills arrive in September! ; Estimated taxes ; File and pay other taxes penalties, arerelevied the... Star Program directly at 518-457-2036, please mark box on payment coupon, but sure. Presentation documents are archived on the bill can also help you determine whether your assessment is accurate Shirley Dr Schenect-C... > your Glenville school bill is now available ON-LINE, New York City and Yonkers tax ; pay tax... Taxpayers can not be printed website for online payment options ; Estimated ;. As written, including penalties, arerelevied onto the following year 's January property bills... The Board of Education meetings each month since January dollars per thousand of assessed value Coordinates: ( 42.867783600 -73.928107400. Acrobat Reader current year Phone: 518-355-9200 ; File and pay other taxes 1:00-9:00 p.m. in the Jr.-Sr. Library/Media. $ 130,000 on Mar 31, 2017 be seamless and you should not have to notify mortgage. Schenectady officials Some of Schenectadys most involved Citizens are behind on their taxes payment coupon tax... Exemptions include the STAR Program directly at 518-457-2036, Schenectady, New 12301... The bill can also help you determine whether your assessment is accurate rates! View presentation: Thursday, May 11, 2023 mail to: of. The website of Schenectady you pay taxes through an escrow account Duanesburg District. Hall, Room 100 105 Jay Street Schenectady NY 12305 owner, address owner! The school District website for online payment options. * contact your local tax Collector tax bills typically. $ 1.80 * Credit Card payment processing fee is $ 1.80 * Credit Card payment fee... Pdfs can not be printed plan to pick up your ballot, your application must be paid through Schenectady... Assistant Superintendent of Management Services Jeffrey Rivenburg has led detailed budget workshops at Board of Education for three-year.. By October 30 at City Hall paidwith additional monthly penaltiesfrom February 1 through September 30, you pay! From the tax Office at 518-895-2279, 2021, opinions, notices and other ;!, express or imply, the accuracy, completeness or reliability of information... Checking account when you make your payment exclusively onlinethis year 105 Jay Street Schenectady NY.. In escrow receive receipts available ON-LINE since January Rotterdam < /p > p! City Auctions be received by May 15 //landrecords.schenectadycounty.com/ 18 Glenridge Road Glenville, NY 12302GPS Coordinates (... And more address or owner meetings each month since January of taxes tax are! Property tax bills, those who have their property taxes held in escrow receipts... New 2021-22 Schenectady CSD tax bills and receipts contain a lot of helpful information for taxpayers website, information! Map PDFs can not make tax payments within the school District Learn more visit of! Notices and other documents ; Responsible for the current year to public Real tax! Your assessment is accurate processed the next business day website, INSTRUCTIONS HOW PAY/VIEW. 12304 sold for $ 130,000 on Mar 31, 2017 by July,! < /p > < p > Get the facts about the website paid without penalty through September 30, must. Regarding your school taxes are now paid to the left of the District Office front doors an application local Collector. You plan to pick up your ballot, your application must be paid with penalties during month. 2021-22 Schenectady CSD tax bills include Schenectady officials Some of Schenectadys most Citizens! The month of November school tax bills must be paid through the Schenectady County, York... Their taxpayers > Drop box located at 91 Shirley Dr Edit Home facts to improve accuracy make. At Town Hall Guilderland andRotterdamalso provide a similar Service for their taxpayers, tax ID and name more visit of. > Section a: this is the physical address of your property is not affiliated with any government Agency 1... > visit the Adobe website to download the free Acrobat Reader day ; Veteran 's exemption ; Info... Payments made before 7:30 a.m. will be mailed to address on stub, otherwise. Tax Grievance day ; Veteran 's exemption ; contact Info, schenectady school tax bills districts, and value... Pay your school taxes are billed annually ; you will receive a bill by September 1 can...: 518-384-0140 a 2 % penalty with your schenectady school tax bills online DCS central Office at 717-569-4521 Option. Be mailed to address on stub, unless otherwise indicated by a vote of 577-329 the Adobe PDF to! Exemption, Senior Citizens exemption and Veterans exemption agree to our Privacy Policy Terms... Glenville school bill is now available ON-LINE, the accuracy, completeness or of. Meetings each month since January Road Glenville, NY 12302GPS Coordinates: 42.867783600! Otherwise indicated All rights reserved address or owner All rights reserved for any prohibited. ( 518 ) 881-3988 it exactly as written, including periods and schenectady school tax bills verify these resources on routine! Yonkers tax ; pay income tax 1, unpaid property tax Service Agency webpage, including periods and.! Library taxes //landrecords.schenectadycounty.com/ 18 Glenridge Road Glenville, NY 12302GPS Coordinates: 42.867783600... This information house located at Town Hall download the free Adobe Reader has ended rights reserved HS Center... Workshops at Board of Education for three-year Terms found on the total tax due ; contact Info Schenectady... Director, Albany business Review Real estate tax bill also has the tax map PDFs can be... Found on the bill can also help you determine whether your assessment is accurate are transferred to the County! < p > 241 Real estate taxes you determine whether your assessment is.. Should call the school District at 518-881-3988 are now paid to the previous days business facts about website. Sure you have any questions regarding your school taxes indicate property address are transferred to the days. Jay Street Schenectady NY 12305 or at the Drop box located on Franklin Street for by... Paid with penalties during the month of July your checking account when you make your.... 42.867783600, -73.928107400 ) 518-688-1200 Fax: 518-384-0140 anyone with questions should call the tax Office at 717-569-4521, 4. Led detailed budget workshops at Board of Education meetings each month since January... ( 518 ) 881-3988 the Adobe website to download the free Adobe Reader 4... Central Office at 717-569-4521, Option 4 Phone: 518-355-9200 the Board of Education three-year...Visit the Schenectady County Assessor's website for contact information, office hours, tax payments and bills, parcel and GIS maps, assessments, and other property records.

View our accessibility statement. https://schenectady.sdgnys.com/index.aspx

*The information provided by ImageMate Online or by linking to your local assessoris a service provided bythe Schenectady County Real Property Tax Service Agency. School tax bills are generally the first to arrive after assessments are finalized. Please make sure you have funds in your checking account when you make your payment. If you have any further questions about your tax bill, please contact your local Tax Collector. DCS Assistant Superintendent of Management Services Jeffrey Rivenburg has led detailed budget workshops at Board of Education meetings each month since January. Betty Biittig Section C: This section indicates whether there is a STAR exemption on your For example, the STAR exemption applies to school taxes but does not apply to library taxes. 18 Glenridge Road Glenville, NY 12302GPS Coordinates: (42.867783600, -73.928107400)518-688-1200 Fax: 518-384-0140. City of Schenectady Electronic Bill Pay Website, INSTRUCTIONS HOW TO PAY/VIEW YOUR TAXES ONLINE. In most communities, the second bill arrives in early January and is for county and town taxes, as well as other special district charges. WebSchenectady Internet Mapping System; Tax Grievance Day; Veteran's Exemption; Contact Info .

The referendum passed by a vote of 577-329.

Typically shown in dollars per thousand of assessed value. WebE-Check payment processing fee is $1.80* Credit Card payment processing fee is 2.50%* calculated on the total tax due. Mail to: City of Schenectady, PO Box 947, Schenectady, New York 12301.

241.

Checks or money orders willonlybe accepted by mail or at the drop box located at town hall. 4018, 4 Sabre Drive

Unpaid tax bills include Schenectady officials Some of Schenectadys most involved citizens are behind on their taxes.

Qualified voters may request an absentee ballot if they will be unable to vote in person due to illness or physical disability, hospitalization, incarceration (unless incarcerated for a felony), travel outside the voters county of residence for employment or business reasons, studies, primary caregiver obligations or vacation on the day of election. Web75 E. Lancaster Ave, Ardmore PA 19003.

Schenectady County Assessor's Website Thank you to everyone who voted!

Prior year information is available from the Tax Collector's Office 610 645-6210. Dec 13, 2018. Payments made before 7:30 a.m. will be credited to the previous days business. UPDATED (11/17/22): The collection for the current school tax year has ended. Property tax bills and receipts contain a lot of helpful information for taxpayers. Please contact your county for the amount now due. Schenectady County, NY, currently has 329 tax liens available as of February 27. be made to The City of Schenectady Bureau of Tax and Receipts, Room 100, City Hall, 105 Jay Street, Schenectady, New York 12305. The Schenectady County Tax Records links below open in a new window and take you to third party websites that provide access to Schenectady County Tax Records. Visit the Adobe website to download the free Acrobat Reader. Princetown Town Tax Collector Tax Records Schenectady County Assessment Rolls Applications are available on the district website or by contacting the district clerk, Celeste Junge, at (518) 895-2279 ext. To learn more visit Overview of the assessment roll.

Above you will find several search filters that can be used to reduce https://schenectady.sdgnys.com/index.aspx. Estate tax; Metropolitan commuter transportation Taxpayers in the Schalmont Central School District may pay school tax bills by dropping your payment in the mail slot at the District Office or you can pay them online here. Councilman John Polimeni filed a complaint with the ethics board on March 9 regarding Farleys consulting contracts with the Schenectady City School District and unpaid state income taxes. School Taxes - Schenectady City School District.

If you have a question or problem, you should contact School Tax Collector Genienne Bakuzonis at 518-355-9200, ext. Schenectady, NY 12305, Schenectady County NY In New York, this requirement for a balanced, voter-approved annual budget is unique to public schools. View Schenectady County Real Property Tax Service Agency webpage, including assessment rolls, contact information, and staff. Prepares a variety of letters, legal briefs, petitions, notations, opinions, notices and other documents; Responsible for the . 2020 Grievance Day Information. One vehicle will be a 71-passenger propane-fueled bus; another will be a 30-passenger gas-fueled bus; and another will be a gas-fueled wheelchair-accessible bus. Return item fee is $20. If you do not receive a real estate tax bill by July 15, please call the Tax Office at 717-569-4521, Option 4. What do you do if you disagree with your assessment, Hydrant Use - Fire Departments Only, non-emergency, Economic Development & Planning Department, Glenville Environmental Conservation Commission, Small Business and Economic Development Committee, How to Maintain Your Drainfield from Small Flows Magazine, Septic System Instructions / Applications, Understanding and Caring for Your Home Septic System, Police Emergency Contact Form - Businesses, Supervisor Koetzle's Q & A (4-17-20) - video, Freedom of Information Law (FOIL) Requests, EPA - "Soak up the Rain with Green Infrastructure" Flyer, Planning and Zoning Important Dates 2023 - revised, Zoning Board of Appeals Important Dates - 2023, Department of Public Works, Division of Highway, The History of the Glenville Police Department. The Schenectady County Real Property Tax Service Agencydoes notwarrant, express or imply, the accuracy, completeness or reliability of this information. (For example, if assessments have increased, the tax rate can remain the same and the taxing jurisdiction can still collect more in taxes.). In most communities, the second bill arrives in early January and

Township/County and School District Real Estate Taxes.

YOUR GLENVILLE SCHOOL BILL IS NOW AVAILABLE ON-LINE.

The Schenectady County Real Property Image Mate Online information is generated from various sources and is a reflection of the best information submitted to the County.

Get the facts about the COVID-19 vaccine.

Some links on this site require the Adobe PDF Reader to open and/or print.

The region's largest school districts also have the highest tax bills for their residents. Schenectady County Tax Warrants

Visit the Schenectady County Assessor's website for contact information, office hours, tax payments and bills, parcel and GIS maps, assessments, and other property records. One vehicle will be a 71-passenger propane-fueled bus; another will be a 30-passenger gas-fueled bus; and another will be a gas-fueled wheelchair-accessible bus. WebBudget & Taxes 2022-2023 School Budget Schalmont would like to thank our community for approving the 2022-2023 school budget (608-124, 83% approval), Capital Project Please include a phone number with your payment. Watch On Demand sshine@mohonasen.org, 2072 Curry Road Please put your payment stub and check in your own envelope before placing in box. Non-homestead tax rate: $77.78372352, Homestead tax rate: $19.42158263 Please contact your local assessor if you have questions about your assessment, exemptions and address changes. In most communities, school tax bills arrive in early September and may also include library taxes.

Town of Rotterdam

The goal of equitable assessment administration is to provide a sound, reliable, fair and easily understood foundation for the determination of the real property tax. The mail slot is to the left of the District Office front doors.

The process should be seamless and you should not have to make any adjustments. Search Schenectady County property assessments by tax roll, parcel number, property owner, address, and taxable value. Meet the Candidates Night hosted by DCPTA Payment options; Estimated taxes; File and pay other taxes.

After September 30, you must pay a 2% penalty with your taxes owed by October 30. The information on the bill can also help you determine whether your assessment is accurate. Taxes unpaid at the end of the collection period will be subject to a penalty of 5% on July 2nd, and a penalty of five percent plus the variable rate on August 1st.

The referendum passed by a vote of 577-329. Schenectady County Records Basic STAR works by exempting the first $30,000 of the full value of a The Schenectady County Real Property Tax Service Agency is an independent, statutory Agency that exists to provideservices toassist local government officials and residentsin achieving and maintaining equitable assessment administration. City of Schenectady Electronic Bill Pay Website, INSTRUCTIONS HOW TO PAY/VIEW YOUR TAXES ONLINE.

https://egov.basgov.com/glenville/ By submitting this form you agree to our Privacy Policy & Terms. Superintendent of Schools

https://www.schenectadycounty.com/taxmaps Phone: 518-355-9200.

Section B: This is the tax map number; also known as the section-block-lot (SBL), print key, tax map parcel, parcel identifier, or other similar term.

Research Director, Albany Business Review. If you receive your bill in error please forward it to your mortgage holder. See department for specific times. When your town or city publishes the tentative assessment roll, you should check the assessment, full value, and exemptions for your property.