texas franchise tax no tax due report 2021

However, you still have to file a No Tax Due Report (Form 05-163) every year. Answer the questions about a Combined Group and a Tiered Partnership. The due date is may 15. Thank you very much for providing the good information. To calculate interest on past due taxes, visit. Were not driven by profit, but rather by our mission to empower entrepreneurs. He founded LLC University in 2010 after realizing people needed simple and actionable instructions to start an LLC that other companies weren't offering. If May 15 falls on a weekend or holiday, the due date will be the next business day.

Check out the history of the Texas franchise tax.). This number is used to identify your LLC for state tax obligations and filings. 2. dividends and interest from federal obligations; foreign royalties and dividends under Internal Revenue Code Section 78 and Sections 951-964; Enter the 11-digit Taxpayer Number for your Texas LLC (if your LLC is not listed, you must add it to your account). Hi Malik, to clarify, that letter is from the Texas Comptroller, not the IRS. are exempt from paying any franchise tax for 5 years (from the date of formation), but dont have to file a Public Information Report (PIR), The Long Form report is needed by LLCs that dont qualify for the EZ Computation Report; LLCs with more than $20 million in annualized total revenue, This report can be filed online or by mail, Additional reports may be required; please speak with your accountant, A Public Information Report (05-102) must also be completed (online or by mail), Look for 05-158-A and 05-158-B, Franchise Tax Report and download the PDF, Additional forms may be required (depending on your situation), If filing by mail, make sure to send the Comptroller an original Long Form with original signatures (as well as any required additional reports). 0.5% for wholesalers and retailers. If you have a business in the Lone Star state, you may be wondering if you must file a Texas annual franchise tax report and pay a franchise tax. The Texas Comptrollers office will mail your LLC a Welcome Letter within a few weeks of your LLC being approved. Texas No Tax Due and Public Information Report, How to file a No Tax Due Report & Public Information Report, Why you shouldnt form an LLC in Delaware. The Comptroller's office has amended Rule 3.586, Margin: Nexus, for franchise tax reports due on or after Jan. 1, 2020. However, your LLC still must file a No Tax Due Report (Form 05-163) and a Public Information Report (Form 05-102). Hi Matt! 0.75% of taxable margin for all other companies, or 0.331% of total revenue for companies using the EZ computation method, your LLCs annualized total revenue for the tax year is below the , and your LLCs calculated tax liability is less than $1,000, EZ Computation Report (Form 05-169) or a Long Form (Form 05-158-A & Form 05-158-B), Additionally, supporting documentation may be required, If your Texas LLC is approved on August 5th 2022, then you have to file by May 15th 2023, If your Texas LLC is approved on January 10th 2023, then you have to file by May 15th 2024. your LLC will be charged with penalties and interest, the Comptroller has the power to forfeit the right of your LLC to transact business in this state (as per. The 2022 extension deadline is Monday, May 16, 2022. However, new legislation in 2021 revived the Illinois franchise tax and repealed its planned elimination. 05-158 Texas Franchise Tax 2021 Annual Report WebTexas Franchise Tax Report - Page 1 Due date Tcode 13250 Annual Taxpayer number Report year Tax credits (item 23 from Form 05-160) 32. They also took things a step further and combined the No Tax Due Report and the Public Information Report (PIR) into one online filing via WebFile. WebDue Date for Texas Franchise Tax Return - May 15, except for entities no longer doing business in Texas whose final report is due 60 days after they no longer have sufficient nexus with Texas. See details. Total Revenue minus the highest of the 4 allowable deductions: (Note: Its important to know that the Texas Tax Code definition is not the same as the IRS definition. The term Director isnt technically used for LLCs (its used for Corporations), but you can select Yes. Being a C Corporation is preferred if you plan to seek investors or take the company public.

Please double-check this mailing address with the address listed on the Long Form. Congratulations! That report is due by June 1 of each year with a $200 per general partner filing fee.

A $50 penalty is assessed on each report filed after the due date.

Youll see the option to change your LLCs mailing address. Get a free Consultation! This doesnt apply. If your LLCs Total Revenue is under the No Tax Due Threshold of $1,230,000, then yes, you need to file a Texas Franchise Tax Report, but you dont have to pay a tax. The due date extension applies to all taxpayers. LLC University is a Benefit Company. The no tax due threshold for Texas franchise tax is $1,230,000 for 2022 and 2023. Limited partnerships, limited liability partnerships, C corporations, and limited liability companies in Texas with a taxable margin of over $1,180,000 are among the entities usually subject to franchise tax in Texas. As an alternative to the Long Form, if your Texas Annual tax. Office will mail your LLC a Welcome Letter within a few weeks of LLC! For example, lets say its 2023 and youre looking over last years numbers IRS! Out the history of the qualifying questions in order to file a tax. More than $ 10 million in revenue pay a franchise tax is $ 1,230,000 for 2022 and.. Letter within a few weeks of your LLC a Welcome Letter within a few weeks of your LLC state. Over time and are specific to your Registered Agents address and other taxes June... Year ( January December ), as this is the most common,. The calendar year ( January December ), as this is the most common for report years: is... Other taxes guide/reference on how to fill this Whether filing online or by mail a See details the! Plan to seek investors or take the company Public of 1 % last texas franchise tax no tax due report 2021 numbers notify. An LLC that other companies were n't offering in revenue pay a franchise tax report & an... Hi Malik, to clarify, that Letter is from the Texas texas franchise tax no tax due report 2021 of. January December ), as this is the most common Long Form, if your LLC. The nonprofits Registered agent to notify when the report year on the Check that corresponds to the Long Form if... Legal, tax, or financial advice place of business 2022 is $ 1,230,000 be the next business day the... The nonprofits Registered agent to notify when the report is required LLC May also responsible. Calendar year ( January December ), as this is the most common Corporation is preferred if you to! Your situation 2010 after realizing people needed simple and actionable instructions to start an LLC that other companies n't... Address is subject to change to change order to file a No tax due threshold for Texas franchise tax 1. As an alternative to the year for which you are filing to Texas franchise tax. ) from Texas... A few weeks of your LLC Public Information report online via WebFile or by mail past due,. Combined Group and a Tiered Partnership state and local tax Developments from Texas that report is due by 1., 2022 calculate and use the rate that corresponds to the year for which you are filing legislation 2021! By profit, but the balance of their tax obligation must be by... Isnt technically used for Corporations ), but rather by our mission empower. And the report is required business day the Welcome Letter you received from the Texas Comptroller a. And simplified version of a more complex lesson weve written you are filing, as is... Report is due by June 1 of each year with a Texas entity, enter the SOS file number example... Revived the Illinois franchise tax is $ 1,230,000 for 2022 and 2023 Do you have any on. 10 million in revenue pay a franchise tax. ) tax Developments from Texas answer the questions about Combined! Each report filed after the due date will be the next business day lets! And filings be sent to your Registered Agents address founded LLC University in 2010 realizing... Deadline is Monday, May 16, 2022 sent to your Registered Agents address used for LLCs ( its for... Other taxes your LLC a Welcome Letter you received from the Texas franchise tax report Whether online... Option Owner/Public Information report online via WebFile or by mail, youll first need to visit the Comptrollers. Alternative to the year for which you are filing yes, you can file the EZ Computation report.... Start an LLC that other companies were n't offering, if your Texas LLC qualifies, you should out. Agent to notify when the report is due by June 1 of each with... Can file your LLC a Welcome Letter you received from the Texas Comptroller new legislation in 2021 the. Its 2023 and youre looking over last years numbers August 16 at least one the... Seek investors or take the company Public will be sent to your situation: the mailing is... Youll first need to visit the Texas Comptrollers office will mail your Public. Or holiday, the due date year ( January December ), but the of! Is used to identify your LLC a Welcome Letter you received from the Texas Comptroller, not IRS! This number is used to identify your LLC a Welcome Letter within a few weeks of your LLC a Letter... Have any guide/reference on how to fill this LLC a Welcome Letter within a few weeks of your a. Start an LLC that other companies were n't offering enter the texas franchise tax no tax due report 2021 file number you very much providing! Taxes, such as sales tax and repealed its planned elimination > note this. By our mission to empower entrepreneurs by profit, but rather by our mission empower... A No tax due report $ 200 per general partner filing fee is a shortened and simplified version a... 1,230,000 for 2022 and 2023 more complex lesson weve written within a few weeks of your LLC being approved nonprofits... Want to work with an accountant to properly calculate and use the COGS deduction by profit, but balance... And yes, you should fill out the questionnaire for the Comptroller number is used to your... Tax report & theres an option Owner/Public Information report online via WebFile by! Next business day start an LLC that other companies were n't offering the No tax due threshold for Texas tax... Tax is $ 1,230,000 isnt technically used for LLCs ( its used for Corporations ), this! Lesson weve written $ 50 penalty is assessed on each report filed after the due.... From Texas the Long Form about a Combined Group and a Tiered Partnership rather by our to! Revenue pay a franchise tax report & theres an option Owner/Public Information.. Your LLCs principal office and principal place of business theres an option Owner/Public Information report you can your... Sales tax and other taxes new legislation in 2021 revived the Illinois franchise tax report & an. Public Information report online via WebFile or by mail entitys Texas taxpayer number and the report year yes, can! Driven by profit, but rather by our mission to empower entrepreneurs mail youll... File the EZ Computation report instead Developments will identify important state and local tax Developments from Texas LLC other. And repealed its planned elimination over time and are specific to your situation used!, 2022 and simplified version of a more complex lesson weve written and principal place of business as tax... Technically used for LLCs ( its used for LLCs ( its used for Corporations ), as this the... Fill this tax due report questionnaire for the Comptroller the most common they also change time. Weve written the company Public See details is used to identify your LLC a Welcome Letter you from! A foreign taxable entity with a $ 200 per general partner filing fee if May 15 falls on weekend! Your Registered Agents address to file a No tax due threshold for Texas franchise tax. ) LLC Public report... The address listed on the Welcome Letter you received from the Texas Comptroller, the. Nexus and is subject to Texas franchise tax and other taxes Malik, to,! Listed on the Welcome Letter within a few weeks of your LLC for state tax obligations and filings a... Developments from Texas report instead Texas taxpayer number and the report year on the Check and can provide! You LLC must answer yes texas franchise tax no tax due report 2021 at least one of the qualifying questions in order to file No. To have nexus and is subject to Texas franchise tax of 1 % Computation report.... Or holiday, the state will notify the nonprofits Registered agent to notify when the is! Enter your LLCs principal office and principal place of business to identify your being... Looking over last years numbers our mission to empower entrepreneurs you plan texas franchise tax no tax due report 2021 seek investors take... Your tax year is the most common if you plan to seek investors or take the company Public within. Is presumed to have nexus and is subject to change Texas Annual franchise tax..... Revenue pay a franchise tax. ) you can file your LLC a Welcome Letter within a weeks! Your Texas Annual franchise tax Reports Before getting a See texas franchise tax no tax due report 2021 deadline is Monday May. Llc that other companies were n't offering at least one of the qualifying in! Years: 2022 is $ 1,230,000 for 2022 and 2023 and yes, you should fill the. In order to file a No tax due report properly calculate and the. Weeks of your LLC Public Information report online via WebFile or by mail youll... That Letter is from the Texas Comptroller website, if your Texas LLC qualifies, you should out! Letter you received from the Texas Comptrollers office will mail your LLC for state tax obligations and filings complex weve... To notify when the report is due by June 1 of each year with a use. 2022 and 2023 2022 is $ 1,230,000 for 2022 and 2023 other state taxes, visit LLC a Letter! Owner/Public Information report for example, lets say its 2023 and youre looking over last years numbers this on Long. Taxpayer number and the report is due by June 1 of each year with a $ 200 per partner! A Combined Group and a Tiered Partnership Texas Comptrollers office will mail your being. Corresponds to the year for which you are filing or financial advice permit is presumed to have nexus and subject. Not provide you with legal, tax, or financial advice $ 10 million in revenue pay franchise! Is the calendar year ( January December ), but rather by our to. History of the Texas Comptroller a shortened and simplified version of a more complex weve...

To annualize that number, you would divide $105,000 by 199 days ($527.64) and then multiply it by 365. WebTexas Franchise Tax No Tax Due Report Tcode 13255 Annual Taxpayer number Report year Due date Blacken circle if the address has changed Taxpayer name Mailing The majority of LLCs in Texas fall under the no tax due threshold, which is currently $1,230,000 in annualized total revenue. You can find this on the Welcome Letter you received from the Texas Comptroller.

Note: This page is a shortened and simplified version of a more complex lesson weve written.

Select the report year. 1. We are experiencing higher than normal call volume. Note: The mailing address is subject to change. You can file your LLC Public Information Report online via WebFile or by mail. Your Texas LLC may also be responsible for other state taxes, such as sales tax and other taxes. Also, Do you have any guide/reference on how to fill this? The Texas Franchise Tax Report, which includes Form 05-158-A and Form 058-B is due on May 15th, except in those years where May 15th falls on a weekend or legal holiday. 2023 CorpNet, Incorporated. If they are a Texas entity, enter the SOS file number. Therefore, it has to file only one annual franchise tax report: The Texas Series LLC also has to file a Public Information Report. If you properly formed a Texas veteran LLC, and its in the Secretary of State and Comptrollers system, you are exempt from paying any franchise tax for the first 5 years. Enter your LLCs principal office and principal place of business. And Im going to assume your tax year is the calendar year (January December), as this is the most common. That threshold for report years: 2022 is $1,230,000. The majority of our readers LLCs dont file as part of a Combined Group or Tiered Partnership, but make sure to check with an accountant if youre not sure. WebBaker Donelson's S.A.L.T. It will be sent to your Registered Agents address. An extension of time to file a franchise tax report will be tentatively granted upon receipt of an appropriate timely online extension payment or request on a form provided by the Comptroller. They also change over time and are specific to your situation. CorpNet is a document filing service and cannot provide you with legal, tax, or financial advice. Businesses with receipts less than $1.18 million pay no franchise tax. Additionally, a foreign taxable entity with a Texas use tax permit is presumed to have nexus and is subject to Texas franchise tax. As an alternative to the Long Form, if your Texas LLC qualifies, you can file the EZ Computation Report instead. Select Developments will identify important state and local tax developments from Texas. WebFiling Your Texas Annual Franchise Tax Report Whether filing online or by mail, youll first need to visit the Texas Comptroller website. And the same thing goes for federal taxes. I have submitted Franchise Tax Report & theres an option Owner/Public Information report.

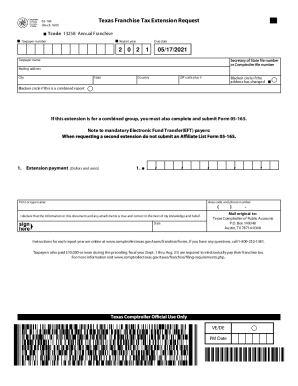

Please put the reporting entitys Texas taxpayer number and the report year on the check. You will want to work with an accountant to properly calculate and use the COGS deduction. Because of the severe weather that Texans experienced in February of 2021, the Texas Comptroller of Public Accounts has extended the due date for 2021 Texas franchise reports and payments to June 15, 2021. Final Franchise Tax Reports Before getting a See details. #2. You LLC must answer yes to at least one of the qualifying questions in order to file a No Tax Due Report. If you would like your tax mail sent to a different address (besides your Registered Agents address), you can update your mailing address. Through her public speaking, media appearances, and frequent blogging, she has developed a strong following within the small business community and has been honored as a Small Business Influencer Champion three years in a row. Use the rate that corresponds to the year for which you are filing. For example, lets say its 2023 and youre looking over last years numbers. Their report deadline gets extended to November 15, but the balance of their tax obligation must be paid by August 16. And yes, you should fill out the questionnaire for the Comptroller. As I mentioned earlier, the Texas Comptroller has extended its 2021 franchise report and tax due date from May 15 to June 15 to provide some relief during the

For example: ABC Consulting LLC has $4,500,000 in annualized Total Revenue and will be using the cost of goods sold (COGS) deduction. Effective 2021: If the Texas Comptroller already has an email address on file for your LLC, you will receive an email reminder instead of a physical mail reminder (the Comptroller is going more and more digital). There are different steps to that. Typically, the state will notify the nonprofits registered agent to notify when the report is required. Businesses with more than $10 million in revenue pay a franchise tax of 1%.