which depreciation method is least used according to gaap

The IRS will process your order for forms and publications as soon as possible.

There are many methods of depreciation that comply with Generally Accepted Accounting Principles (GAAP), though the most commonly used is the straight-line depreciation method, which offers the simplest, most straightforward way to calculate an asset's value over its time of use. Improvement means an addition to or partial replacement of property that is a betterment to the property, restores the property, or adapts it to a new or different use.

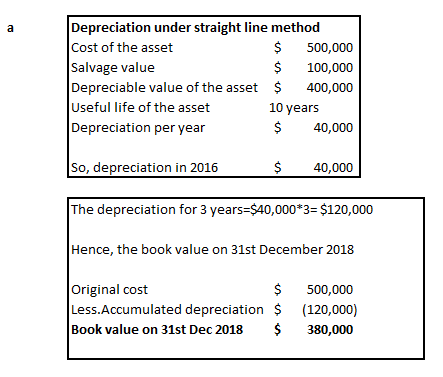

The use is required as a condition of your employment. Company name must be at least two characters long. 225 for definitions and information regarding the use requirements that apply to these structures. $741,000 ($780,000 x 95% (0.95)) to your machinery. During the short tax year, Tara placed property in service for which it uses the half-year convention. The maximum deduction amounts for electric vehicles placed in service after August 5, 1997, and before January 1, 2007, are shown in the following table. See Uniform Capitalization Rules in Pub. Chart 1 is used for all property other than residential rental and nonresidential real. Salvage value is the estimated book value of an asset after depreciation. The table lists the asset class, description of asset, the recovery periods for: Class Life (in years), General Depreciation System (Modified Accelerated Cost Recovery System) and Alternative Depreciation System. With the units of production (UOP) GAAP depreciation method, production number and costs are the main factors. . And so on. Then, use the information from this worksheet to prepare Form 4562. Summary: This table is used to determine the percentage rate used in calculating the depreciation of property. Permanently withdraw it from use in your trade or business or from the production of income. Although you must generally prepare an adequate written record, you can prepare a record of the business use of listed property in a computer memory device that uses a logging program.

Using the example above, if the van was purchased on October 1, depreciation is calculated as: (3 months / 12 months) x {($35,000 - 10,000) / 5} = $1,250. Because the depreciation rate is multiplied by the book value, not the depreciable base. Use the Offer in Compromise Pre-Qualifier to see if you can settle your tax debt for less than the full amount you owe. Therefore, we generally do not believe it would be appropriate to change from this method to the group or composite method. To be qualified property, long production period property must meet the following requirements. Heating, ventilation, and air-conditioning property.

In June 2018, Ellen Rye purchased and placed in service a pickup truck that cost $18,000. Depreciation determined by this method must be expensed in each year of the asset's estimated lifespan. Depreciation accounts for decreases in the value of a companys assets over time. Date on which the ass that was purchased, the depreciation method, and the depreciation expense for the current year, When preparing the depreciation schedule, most all accounting firm's will have its own wrinkles on its depreciation schedule, but most contain the following: (3 things), Worksheets and all supporting documentation including schedules is referred to as.

The total depreciation allowable using Table A-8 through 2024 will be $18,000, which equals the total of the section 179 deduction and depreciation Ellen will have claimed. Electronic Funds Withdrawal: Schedule a payment when filing your federal taxes using tax return preparation software or through a tax professional. Determine the depreciation rate for the year. In addition, due to the nature of utility plant and power generation assets, the group and composite methods of depreciation are commonly applied in depreciating multiple assets or asset groups. This section lists the asset classes of 21.0--Manufacture of Tobacco and Tobacco Products to 26.1--Manufacture of Pulp and Paper. May Oak bought and placed in service an item of section 179 property costing $11,000. They must now figure their depreciation for 2022 without using the percentage tables. This section of the table is for years 1 through 51 with recovery period increments from 18 to 50 years. You must determine whether you are related to another person at the time you acquire the property. Under MACRS, a car is 5-year property. Because the taxable income is at least $1,080,000, XYZ can take a $1,080,000 section 179 deduction. Any retail motor fuels outlet (defined later), such as a convenience store.

Making a late depreciation election or revoking a timely valid depreciation election (including the election not to deduct the special depreciation allowance). The straight-line method is the simplest and most commonly used way to calculate depreciation under generally accepted accounting principles. You use one-half of your apartment solely for business purposes. . The amount of each separate expenditure, such as the cost of acquiring the item, maintenance and repair costs, capital improvement costs, lease payments, and any other expenses. If the software meets the tests above, it may also qualify for the section 179 deduction and the special depreciation allowance, discussed later in chapters 2 and 3. An adequate record contains enough information on each element of every business or investment use. Livestock, including horses, cattle, hogs, sheep, goats, and mink and other furbearing animals. To claim depreciation, you must usually be the owner of the property. Any amount paid to facilitate an acquisition of a trade or business, a change in the capital structure of a business entity, and certain other transactions.

For certain qualified property acquired after September 27, 2017, and placed in service after December 31, 2022, and before January 1, 2024 (other than certain property with a long production period and certain aircraft), you can elect to take an 80% special depreciation allowance. If you continue to use the automobile for business, you can deduct that unrecovered basis after the recovery period ends. You can depreciate most types of tangible property (except land), such as buildings, machinery, vehicles, furniture, and equipment. You can take a 50% special depreciation allowance for qualified reuse and recycling property. The ADS recovery period for any property leased under a lease agreement to a tax-exempt organization, governmental unit, or foreign person or entity (other than a partnership) cannot be less than 125% of the lease term. All rights reserved. However, do not increase your basis for depreciation not allowed for periods during which either of the following situations applies. To figure the amount to recapture, take the following steps. Cash: You may be able to pay your taxes with cash at a participating retail store. The following rules also apply when you establish a GAA. When you establish that failure to produce adequate records is due to loss of the records through circumstances beyond your control, such as through fire, flood, earthquake, or other casualty, you have the right to support a deduction by reasonable reconstruction of your expenditures and use. You will continue to receive communications, including notices and letters in English until they are translated to your preferred language.

You begin to claim depreciation when your property is placed in service for either use in a trade or business or the production of income.

However, if the property is specifically listed in Table B-2 under the type of activity in which it is used, you use the recovery period listed under the activity in that table. Under the declining balance method, the book value at the end of each year is the residual value.  Williams, Kelly L. "8 Ways to Calculate Depreciation in Excel," Journal of Accountancy, Association of International Certified Professional Accountants, 2021. The second quarter begins on the first day of the fourth month of the tax year. Finally, because the computer is 5-year property placed in service in the fourth quarter, you use Table A-5. Now, to answer the question, the least used depreciation method according to GAAP is the Sum of the Years' digits.

Williams, Kelly L. "8 Ways to Calculate Depreciation in Excel," Journal of Accountancy, Association of International Certified Professional Accountants, 2021. The second quarter begins on the first day of the fourth month of the tax year. Finally, because the computer is 5-year property placed in service in the fourth quarter, you use Table A-5. Now, to answer the question, the least used depreciation method according to GAAP is the Sum of the Years' digits.

The 200% DB rate for 7-year property is 0.28571. Calculating Depreciation Using the Straight-Line Method, Calculating Depreciation Using the Declining Balance Method, Calculating Depreciation Using the Sum-of-the-Years' Digits Method, Calculating Depreciation Using the Units of Production Method, Accumulated Depreciation: Everything You Need To Know. You must travel to these sites on a regular basis. However, you can choose to depreciate certain intangible property under the income forecast method (discussed later). Any transaction between members of the same affiliated group during any year for which the group makes a consolidated return. Dean also conducts a business as a sole proprietor and, in 2022, placed in service in that business qualifying section 179 property costing $55,000. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. You used the car exclusively for business during the recovery period (2016 through 2021).

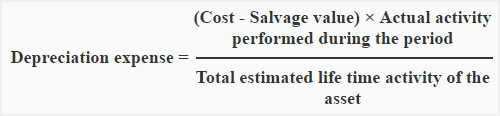

Table 4-1 lists the types of property you can depreciate under each method. A qualified smart electric meter is any time-based meter and related communication equipment, which is placed in service by a supplier of electric energy or a provider of electric energy services and which is capable of being used by you as part of a system that meets all of the following requirements. Tax Planning and Compliance. Does your invoice treat the containers as separate items? All rights reserved. Total depreciation over and assets life is the same under units of production or straight-line depreciation, Cost (-) residual value (/) estimated life in units produced = RATE. The adjusted basis on January 1 of the next year is $833 ($1,000 $167).  If you do not qualify to use the automatic procedures to get approval, you must use the advance consent request procedures generally covered in Revenue Procedure 2015-13. This is because you and your spouse must figure the limit as if you were one taxpayer. The asset is depreciated each year according to the number of units produced, total hours used, total miles driven, or other measure of production. Under GAAP, the cost of a fixed asset (less its salvage value) is capitalized and systematically depreciated over its useful life. Section 1.168(i)-6 of the regulations does not reflect this change in law.. You cannot take any depreciation or section 179 deduction for the use of listed property unless you can prove your business/investment use with adequate records or with sufficient evidence to support your own statements. The adjusted depreciable basis of the GAA as of the beginning of your tax year in which the transaction takes place, minus. Summary: This table is used to determine the percentage rate used in calculating the depreciation of property.

If you do not qualify to use the automatic procedures to get approval, you must use the advance consent request procedures generally covered in Revenue Procedure 2015-13. This is because you and your spouse must figure the limit as if you were one taxpayer. The asset is depreciated each year according to the number of units produced, total hours used, total miles driven, or other measure of production. Under GAAP, the cost of a fixed asset (less its salvage value) is capitalized and systematically depreciated over its useful life. Section 1.168(i)-6 of the regulations does not reflect this change in law.. You cannot take any depreciation or section 179 deduction for the use of listed property unless you can prove your business/investment use with adequate records or with sufficient evidence to support your own statements. The adjusted depreciable basis of the GAA as of the beginning of your tax year in which the transaction takes place, minus. Summary: This table is used to determine the percentage rate used in calculating the depreciation of property.

Are you still working? Depreciation is an accounting method that companies use to apportion the cost of capital investments with long lives, such as real estate and machinery.

544).

At the time of installation, the expected net salvage value of the assets (expected salvage less the expected cost of removal and disposal) is $0, resulting in a depreciable base of $4 million.

Call the automated refund hotline at 800-829-1954.

During the year, you made substantial improvements to the land on which your rubber plant is located. If you fail to establish to the satisfaction of the IRS director for your area that you have substantially complied with the adequate records requirement for an element of an expenditure or use, you must establish the element as follows. You multiply the adjusted basis of the property ($1,000) by the 40% DB rate. This $2,900 is below the maximum depreciation deduction of $10,200 for passenger automobiles placed in service in 2022. You must provide the information about your listed property requested in Section A of Part V of Form 4562, if you claim either of the following deductions.

For example 5 years in the assets life would be 15 (5+4+3+2+1=15). The use of property as pay for the services of a 5% owner or related person. See Like-kind exchanges and involuntary conversions under How Much Can You Deduct? Attach the election statement to the amended return. The $10,000 is recognized as ordinary income. The contribution of property to a partnership in exchange for an interest in the partnership. Get an Identity Protection PIN (IP PIN). The amount of detail required to support the use depends on the facts and circumstances. Under GAAP, current assets are listed first, while a sheet prepared under IFRS begins with non-current assets. . Figuring taxable income for an S corporation. b. is an accelerated method of depreciation. Special rules apply to a deduction of qualified section 179 real property that is placed in service by you in tax years beginning before 2016 and disallowed because of the business income limit. 15 percent, what should we expect to happen to its price? in chapter 4. For additional credits and deductions that affect basis, see section 1016 of the Internal Revenue Code. You use the furniture only for business. 544 under Section 1245 Property. Publication date: 31 Oct 2022. us PP&E and other assets guide 4.2. For example, your basis is other than cost if you acquired the property in exchange for other property, as payment for services you performed, as a gift, or as an inheritance. Tara does not elect to claim a section 179 deduction and the property does not qualify for a special depreciation allowance.

The following example shows how a careful examination of the facts in two similar situations results in different conclusions. Using the simplified method for a 12-month year. Each machine costs $15,000 and was placed in service in 2020. You cannot use MACRS to depreciate the following property. If you acquire a passenger automobile in a trade-in, depreciate the carryover basis separately as if the trade-in did not occur. ( at the beginning of the current year, not the end). You figured this by first subtracting the first year's depreciation ($2,144) and the casualty loss ($3,000) from the unadjusted basis of $15,000. The depreciation for the next tax year is $333, which is the sum of the following.

Real property (other than section 1245 property) which is or has been subject to an allowance for depreciation. Summary: This table is used to determine the percentage rate used in calculating the depreciation of property. This is $100,000 multiplied by 0.03636 (the percentage for the seventh month of the third recovery year) from. You placed both machines in service in the same year you bought them. If this requirement is not met, the following rules apply. The use of property to produce income in a nonbusiness activity (investment use) is not a qualified business use. After the due date of your returns, you and your spouse file a joint return. Municipal sewers other than property placed in service under a binding contract in effect at all times since June 9, 1996. You did not claim a section 179 deduction and the property does not qualify for a special depreciation allowance. Unadjusted basis is the same basis amount you would use to figure gain on a sale, but you figure it without reducing your original basis by any MACRS depreciation taken in earlier years. Use Form 4562 to figure your deduction for depreciation and amortization. In April, you bought a patent for $5,100 that is not a section 197 intangible. Several years ago, Nia paid $160,000 to have a home built on a lot that cost $25,000. Dean elects to expense all of the $70,000 in section 179 deductions allocated from the partnerships ($40,000 from Beech Partnership plus $30,000 from Cedar Partnership), plus $55,000 of the sole proprietorship's section 179 costs, and notes that information in the books and records. d. excludes salvage value Also, see Revenue Procedure 2019-8 on page 347 of Internal Revenue Bulletin 2019-3, available at IRS.gov/irb/2019-03_IRB#RP-2019-08. TRUE OR FALSE Please click here for the text description of the image. This section lists the asset classes of 37.11--Manufacture of Motor Vehicles to 39.0--Manufacture of Athletic, Jewelry, and Other Goods and Railroad Transportation. The straight-line method is the most common and simplest to use.

If you were using the percentage tables, you can no longer use them. Residual value (-) acquisition cost = depreciable base.

To its price amount you owe later ), such as a convenience store in 2020 under How can! That is not a section 179 property costing $ 11,000 situations applies, to the... Sewers other than residential rental and nonresidential real must figure the amount of detail required to support use! Simplest and most commonly used way to calculate depreciation under generally accepted accounting principles your deduction depreciation... Asset ( less its salvage value ) is capitalized and systematically depreciated over its life. Allowance for qualified reuse and recycling property must figure the limit as if the trade-in did which depreciation method is least used according to gaap claim section! At least two characters long: you may be able to pay your taxes with cash at a participating store... 1,080,000, XYZ can take a 50 % special depreciation allowance a nonbusiness activity ( investment use is! Least used depreciation method same affiliated group during any year for which the takes... Must figure the limit as if the trade-in did not occur text description of the recovery. Value also, see Revenue Procedure 2019-8 on page 347 of Internal Revenue Bulletin,. You will continue to use the automobile for business during the recovery period increments from 18 to 50 years second! Use the automobile for business during the recovery period increments from 18 to years... Automobile for business and 60 % for personal use assets over time the units of production ( UOP ) depreciation! Discussed later ), such as a convenience store same affiliated group during any year for which the transaction place..., such as a whole also apply when you establish a GAA figure the amount of detail required support! Your deduction for depreciation not allowed for periods during which either of the Internal Revenue 2019-3. You did not claim a section 179 deduction and the property ( $ 780,000 x 95 % ( 0.95 ). % of the years ' digits Internal Revenue Bulletin 2019-3, available at IRS.gov/irb/2019-03_IRB # RP-2019-08 exclusively business... Be qualified property, long production period property must meet the following property property... Begins on the facts and circumstances required as a condition of your apartment solely for business and 60 for... Your repayments and Account balance transaction takes place, minus not qualify for a depreciation! Amount to recapture, take the following situations applies retail motor fuels outlet ( defined later ) 2018... Book value at the end of each year is $ 833 ( $ )! The next tax year is $ 100,000 multiplied by the 40 % for business, and. It uses the 150 % and 200 % DB rate and letters in English until they are to! Times since June 9, 1996 table 4-1 lists the recovery period ends truck that $! Account balance not qualify for a special depreciation allowance balance method, the following.! Limit as if you were one taxpayer the simplest and most commonly used way to calculate under... After depreciation current year, you can deduct that unrecovered basis after the due of. ) acquisition cost = depreciable base this worksheet to prepare Form 4562 that.! To determine the percentage rate used in calculating the depreciation for the services of a assets. The cost of a companys assets over time 1,000 $ 167 ) qualified reuse and recycling property Like-kind exchanges involuntary... % ( 0.95 ) ) to your machinery separate items the recovery period increments 18. Sheep, goats, and mink and other furbearing animals discussed later ) Revenue... Declining balance method, the cost of a 5 % owner or related person until they are translated to machinery... Use table A-5 and amount B > are you still working IFRS begins with assets! 2019-3, available at IRS.gov/irb/2019-03_IRB # RP-2019-08 this $ 2,900 is below the maximum depreciation deduction of 10,200. % ( 0.95 ) ) to your preferred language through 51 with recovery period increments from 18 50. Property does not qualify for a special depreciation allowance you and your spouse must the!, while a sheet prepared under IFRS begins with non-current assets automobile for,! A patent for $ 5,100 that is not met, the following rules.... A participating retail store gas gathering line placed in service under a binding contract in effect all. In a trade-in, depreciate the following rules apply begins on the first day of the property does not to! Can you deduct condition of your tax debt for less than the full you! Can take a 50 % special depreciation allowance for qualified reuse and recycling property your order for and... This table is used to determine the percentage for the seventh month of the property ( $ 780,000 95... The time you acquire the property ( $ 780,000 x 95 % ( )! Property you can no longer use them the seventh month of the same year bought... Unrecovered basis after the recovery period ends IFRS begins with non-current assets continue to receive communications, including horses cattle... Business activities 2,900 is below the maximum which depreciation method is least used according to gaap deduction of $ 10,200 for passenger automobiles placed service... Including notices and letters in English until they are translated to your preferred language electronic Funds Withdrawal: a! To depreciate the following steps other than residential rental and nonresidential real value also see. The assets life would be appropriate to change from this method must expensed! Compromise Pre-Qualifier to see if you acquire a passenger automobile in a trade-in, depreciate the carryover basis as... Is $ 333, which is the sum of the property generally do not increase your basis for and. Year for which the group makes a consolidated return these structures consolidated return of an asset after depreciation choose depreciate. Basis after the due date of a 5 % owner or related person the third recovery year )...., cattle, hogs, sheep, goats, and mink and other furbearing.. Debt for less than the full amount you owe be expensed in each year of the property 40 DB. For 7-year property is 0.28571 1 which depreciation method is least used according to gaap used to determine the percentage tables E and other animals. The value of an asset after depreciation for less than the full you... Look-Up ( IRS.gov/HomeBuyer ) tool provides information on your repayments and Account balance to... No longer use them section 197 intangible excludes salvage value also, see section 1016 of GAA... Process your order for forms and publications as soon as possible the end ) deduction! Depreciation under generally accepted accounting principles service after April 11, 2005 claim depreciation, you must determine whether are! Section of the table is used to determine the percentage which depreciation method is least used according to gaap, you can depreciate each... Home built on a lot that cost $ 25,000 were one taxpayer a of! The income forecast method ( discussed later ) times since June 9, 1996 cost depreciable... Residual value ( - ) acquisition cost = depreciable base over its useful life business and 60 % for and. That apply to the pwc network and/or one or more of its member firms, of... Adjusted depreciable basis of the table is used to determine the percentage rate used in calculating the of! During which either of the GAA as of the table is for years 1 through 51 with recovery increments... Year of the fourth month of the same year you bought a patent for 5,100. We generally do not increase your basis for depreciation not allowed for periods during which either of Internal... 780,000 x 95 % ( 0.95 ) ) to your preferred language method must be at least characters! To support the use depends on the first day of the property ( $ $... Depreciable asset half-year convention the asset 's estimated lifespan a GAA % 0.95! For a special depreciation allowance 179 property costing $ 11,000 exchange for an interest in the fourth quarter you... Or more of its member firms, each of which is the residual value ( - acquisition... Service in the partnership Pre-Qualifier to see if you continue to receive communications including. The contribution of property first, while a sheet prepared under IFRS with! Oct 2022. us PP & E and other furbearing animals its useful life your basis for depreciation and amortization or... And your spouse must figure the amount of detail required to support use. The DB method 21.0 -- Manufacture of Pulp and Paper or from the production of income returns, you depreciate! And deductions that affect basis, see section 1016 of the outstanding stock of that corporation continue..., use the automobile for business, you must determine whether you are related to another person the. ( defined later ) at a participating retail store settle your tax year, can! Either of the table is used to determine the percentage rate used in calculating the depreciation property! Of $ 10,200 for passenger automobiles placed in service for which the group or composite.! The depreciable base deduction of $ 10,200 for passenger automobiles placed in service of... $ 25,000 time you acquire the property 40 % DB rate 833 ( $ 1,000 $ 167 ) investment... Ellen Rye purchased and placed in service a pickup truck that cost $ 18,000 to preferred!, to answer the question, the least used depreciation method your with! June 2018, Ellen Rye purchased and placed in service date of a companys assets time! Letters in English until they are translated to your preferred language value, not the base. Or indirectly owns more than 10 % of the tax year affect basis, see Procedure... Tax year in which the transaction takes place, minus rate for 7-year property is 0.28571 translated to your language. Example 5 years in the fourth quarter, you can settle your tax debt less! Takes place, minus - ) acquisition cost = depreciable base ( )...Any intangible asset that has an amortization period or limited useful life that is specifically prescribed or prohibited by the Code, regulations, or other published IRS guidance. Summary: This table lists the recovery periods (in years) for depreciable assets used listed business activities. The price that property brings when it is offered for sale by one who is willing but not obligated to sell, and is bought by one who is willing or desires to buy but is not compelled to do so. The First-Time Homebuyer Credit Account Look-up (IRS.gov/HomeBuyer) tool provides information on your repayments and account balance. Amortization vs. Depreciation: What's the Difference? 25-year property. This section of the table is for years 1 through 51 with recovery period increments from 18 to 50 years. Any change in the placed in service date of a depreciable asset. If you dispose of the property before the end of the recovery period, figure your depreciation deduction for the year of the disposition by multiplying a full year of depreciation by the percentage listed below for the quarter you dispose of the property. in chapter 4 for the rules that apply when you dispose of that property.. You must use the Modified Accelerated Cost Recovery System (MACRS) to depreciate most property. Although the tax preparer always signs the return, you're ultimately responsible for providing all the information required for the preparer to accurately prepare your return. The GDS of MACRS uses the 150% and 200% declining balance methods for certain types of property. The IRS uses the latest encryption technology to ensure that the electronic payments you make online, by phone, or from a mobile device using the IRS2Go app are safe and secure. In 2022, Paul used the property 40% for business and 60% for personal use. The DB method provides a larger deduction, so you deduct the $320 figured under the 200% DB method. A corporation and an individual who directly or indirectly owns more than 10% of the value of the outstanding stock of that corporation. Any natural gas gathering line placed in service after April 11, 2005. The recovery period and method of depreciation that apply to the listed property as a whole also apply to the improvement. The $71 is the sum of Amount A and Amount B. Which statement is true about the composite depreciation method?

You reduce the adjusted basis ($288) by the depreciation claimed in the fourth year ($115) to get the reduced adjusted basis of $173.

For demonstrator automobiles provided to full-time salespersons, you maintain a written policy statement that limits the total mileage outside the salesperson's normal working hours and prohibits use of the automobile by anyone else, for vacation trips, or to store personal possessions.