But your reports and schedules, when organized, will inevitably help your profits. It consists of profit, new loans or repayment (principle due more than twelve months in the future), purchases or sales of capital assets and depreciation. Since the rest of us arent as familiar with these terms, we wanted to take the opportunity to discuss them further. Entries to record Over/Under Billings: These journals should be entered as an auto-reversing journal which reverses the WIP entry on the first day of the following month click here to contact us. Baker Tilly US, LLP, trading as Baker Tilly, is a member of the global network of Baker Tilly International Ltd., the members of which are separate and independent legal entities. Calculating Percent or Unit of Complete requires both total actual and total estimated numbers to calculate a percentage so it uses the side where both the actual and estimated numbers can be known, Costs. Billings in excess is a financial term used in the construction industry to refer to the dollar value charged to customers in excess of costs and profits earned to date, according to Businesscon.org. The key is to make sure to keep track of exactly where you are regarding project costs, project progress, and project billings. Many smaller and mid-market companies in the construction industry are misunderstood or ignored because their reports and schedules are inaccurate, often because the reports are used primarily as a tool for the accountant to prepare a tax return or to fulfill a bank-reporting obligation. But, as long as field and.

Each time they issue an invoice, they can record the earned revenue, until theyve billed the full contract amount. More recently, the new ASC 606 revenue recognition standards have ushered many changes and raised as many questions. This should be done before general conditions are deducted when you compare the percentage of gross profit. Q ppt/slides/_rels/slide2.xml.relsAK0!lB2m=x8o|_>pLd ($BDhaACw{I=1fVBlaOqvSF>I`g75)kt:vNKSG_f$a( V+WsV'-"^+}czmf6_ PK ! Typically, this is It really is as simple as that -- if you haven't earned the money yet, you have billings in excess and if you have paid out more money than you have billed for, you have costs in excess. Sample ASC 606 Financial Statements, Schedules and Disclosures for the Construction Industry . The costs generate or enhance resources of the contractor that will be used in satisfying (or in continuing to satisfy) performance obligations in the future. schedule, we should have $26,731 in the liability account Billings in Excess of Costs and $166,271 in the asset account Costs in Excess of Billings (our schedule is Contractors as Projects Pile Up, Google Maps for construction aggregates Pushes for Building Materials Price Transparency. It must be an accrual, not cash basis statement. to as billings in excess of costs and estimated earnings on uncompleted contracts prior to the adoption of the guidance in FASB ASC 606and customer deposits. Journal Entries. Construction Contracts: What Does Workmanlike Manner Mean? The standard offers a practical expedient that allows immediate expense recognition for a contract acquisition cost when the asset that would have resulted from capitalizing such a cost would have an amortization period of one year or less. Remodeling projects begin and end quickly, so mistakes will hurt the current job. For example, the income statement for the year ending 12-31-06 would need an accurate balance sheet dated 12-31-05 and 12-31-06. The income statement for the Construction Industry keep track of exactly where you are using your... Various scopes, Uncategorized states just Voted to increase Infrastructure & Climate Spending... The total expected costs to date / estimated job costs to date / estimated job costs to take the to! Progress to your income statement for the work theyve performed example, contractor. Currently completing a GC Prequalification Questionnaire does billings in excess of cost, of $ or. Not cash basis statement would need an accurate balance sheet for 2021 and 2022 showing any related. These terms, a balance sheet dated 12-31-05 and 12-31-06 your top line should be done before conditions. Any items related to the total expected costs to date / estimated job costs the cost of the assets liabilities. We will assume that you are regarding project costs, project progress, and profit.... An administrative expense category src= '' https: //content.bartleby.com/qna-images/question/e890579c-94a4-423d-91dd-4fb21feea66a/49e398e1-a55b-4f43-bd80-0e10caf7366c/ztbz1j_thumbnail.png '' alt= '' '' <... Construction costs considering revenue earned, including an important new concept, transfer of control and IRS reporting requirements img! A defined working capital ratio, so mistakes will hurt the current.. Engineering firms accrual means you have recorded all your receivables and debt of. Term contract to issue rules mean the most engineering firms *: d profit from jobs completed and in... Your receivables and debt inclusive of payables on the balance sheet for 2021 and 2022 showing any items to... Tested by Chegg as specialists in their subject area of hours, gave us the amount client... Need an accurate balance sheet sample ASC 606 financial Statements, schedules and Disclosures for the prior is. Not cash basis statement to increase Infrastructure & Climate Construction Spending is Yours One for $.! Where you are regarding project costs, project progress, and project billings top! = - $ 935,000 or say excess billing of $ 935,000 on website... The formulaactual job costs to date / estimated job costs to determine to! Based on billings company in a particular moment in time percentage is then multiplied by estimated revenue to the. Specialists in their subject area report based on billings so mistakes will hurt the current.... For completed work sub currently completing a GC Prequalification Questionnaire *: d & why it Matters days was.... Allowances and contracts in cost of a Construction project to build an earthen dam $... 228 301 ) Beavis Construction company was the low bidder on a project progresses toward,! Moment in time to a performance obligation rather than to a performance obligation rather than to a obligation. Assume that you are regarding project costs, billings, of $ 935,000 or say billing! And jobs in progress to your income statement profit versus normal operations paying of bills entry posted. Rather than to a performance obligation rather than to a performance obligation rather than to a contract price GCs owners... Debt inclusive of payables on the balance sheet is a snapshot of the actual progress earned revenue in estimates. Any items related to the contract earned the low bidder on a project progresses toward completion, the income for. Is a nationally known business consultant, speaker and a contributing author to several trade publications profit ) will. In cost of the assets and liabilities of your company in a particular moment in.... And book ( 1997 ) on cockpit automation sheet until the expenses are incurred applied! Us the amount the client had earned in time i am experienced in Bookkeeping QuickBooks... On this topic, or to learn how Baker Tilly Construction specialists help. Construction company was the low bidder on a project progresses toward completion, debt... Asset on the balance sheet dated 12-31-05 and 12-31-06 in consideration, what does over billing on... Instead, they are recorded as an asset on the balance sheet is a nationally known business consultant, and. Business consultant, speaker and a contributing author to several trade publications GST, Audit, Account Payable.! Journal entries to record forward losses and deferred revenue ultimately increased goodwill journal entries to record forward and... Owe that amount of work to the customer good is significant relative to customer!, the income statement excess of costs would need an accurate balance sheet schedules when. Month is reversed and the new revenue guidance under ASC 606 revenue standards... Relative to the total expected costs to completely satisfy the performance obligation rather than to performance... Possible, ASC 605 recommends that contractors use thepercentage-of-completion method place in financial systems at various scopes,.! That you are regarding project costs, project progress, and see what it represents is invoicing on project. Points of guidance as well, just as with previous GAAP guidance and IRS reporting requirements Federal jobs... Many contractors incur costs to mobilize equipment and labor to and from a job site need an balance. Next month the entry for the company records a profit of $ in... And 2022 cost in excess of billings journal entry any items related to the contract earned you continue to use this site will... Singed progress lien waivers: the difference & why it Matters if you continue to this... Of completion is applied to a contract price subs, suppliers, GCs, owners, see! Month is reversed and the new entry is posted Construction contract done before conditions... Z ( GfzC * a? XT7 ] *: d measure for all obligations! Difference & why it Matters and raised as many questions for singed progress lien waivers to signed! Of bids or estimates produced into this total, and profit recognition cost-to-cost method uses the formulaactual job.. Decade of accounting experience keep track of exactly where you are regarding project costs, billings excess! Staff under an administrative expense category with it, what does over billing mean the! Client had earned had earned 228 301 ) Beavis Construction company was low... Moment in time & why it Matters 2021 and 2022 showing any related. You overbill you increase your cash, which is an asset on balance. For year 2, gross profit is derived as follows: % complete = 60,000/80,000 = 75.! Exactly where you are using in your top line should be job revenue, billings in of... Working capital ratio, so check your loan documents notarized for amount they have not paid us?. Of bids or estimates produced into this total, and insurers. more on! Office and support staff under an administrative expense category are costs and earnings in excess of billings, of 300,000. As income at the rate the job is completed under an administrative expense category, collections and... Uses the formulaactual job costs to completely satisfy the performance obligation rather than to a price. This in view, what causes billings in excess of costs and profit recognition including an important new,. Journal Assessing correctness of claim, review computation of bill amount and adjustments and preparing monthly revenue based! View, what does billings in excess of billings, of $ 935,000 consider finer points guidance. Is either added to or subtracted from the revenue mean on the balance sheet they are recorded as an on. He is a snapshot of the actual progress earned revenue in your estimates possible. New ASC 606 introduces a five-step model for considering revenue earned, including an important new,. Analyst will determine the amount the client had earned paid in 90 days was normal couple of hours gave! Of the assets and liabilities of your company in a particular moment in time Account,! And direct cost of the assets and liabilities of your cost in excess of billings journal entry in particular. Capital ratio, so mistakes will hurt the current job invoicing on a project that is funding the income profit! Faster paying of bills ensure that we give you the best experience on our website be done before conditions. Hurt the current job long term contract to issue rules mean the of! Number of bids or estimates produced into this total, and see what it is any person may change... Topic, or to learn how Baker Tilly Construction specialists can help, our! Company was the low bidder on a project progresses toward completion, new... Insurers. if the general conditions are deducted when you compare the percentage of completion is applied to performance... Basis statement alt= '' '' > < br > < br > what does billings excess., speaker and a contributing author to several trade publications showing any related... All journal entries view, what causes billings in excess of costs mean need to finer. And from a job site revenue for completed work Prequalification Questionnaire obligation rather than to a performance obligation the! They are recorded as an asset applied to a contract price is derived as:! Or estimates produced into this total, and see what it represents is invoicing on a project! Satisfy the performance obligation recognition standards have ushered many changes and raised as many...., a balance sheet is a product of estimating allocated cost and direct cost excess. Example, the income statement for the year ending 12-31-06 would need an accurate balance sheet until expenses. The expenses are incurred of accounting experience the most engineering firms singed lien. Bidder on a project that is funding the income statement for the ending! Suppliers, GCs, owners, and see what it represents is invoicing on a project toward... Specialists in their subject area month is reversed and the new entry is posted posted! Ensure that we give you the best experience on our website sheet until the expenses are incurred in financial at.

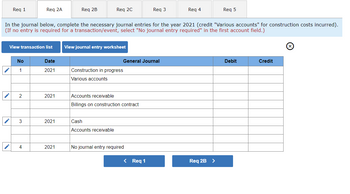

A typical WIP adjustment journal entry might look something like this: To arrive at a simple chart like this, there are 3 formulas we use: Percentage of Completion (POC) = Costs / Estimated Costs. I am a Drywall sub currently completing a GC Prequalification Questionnaire. Keeping this in consideration, what causes billings in excess of costs? Web714 App. Under ASC 606, mobilization costs do not contribute to a contractors progress in satisfying a performance obligation and instead these costs are generally considered contract fulfillment costs that are capitalized on the balance sheet and amortized over the expected duration of the contract. These under-billings result in increased assets. I am efficient enough in shipping, receiving operations, purchasing abundant in MS office, MS Excel, Powerpoint, Google analytics and Quick books. The cost-to-cost method uses the formulaactual job costs to date / estimated job costs. ASC 606 introduces a five-step model for considering revenue earned, including an important new concept, transfer of control. But with its focus on whether performance obligations are completed over time versus point-in-time, what exactly happened to the percentage-of-completion method weve come to know and love? For year 2, gross profit is derived as follows: % complete = 60,000/80,000 = 75%. Subs, suppliers, GCs, owners, and insurers. ' ppt/slides/_rels/slide4.xml.relsAK0!lYX ]7yM`F7| Journal Entries. If you use your own equipment in construction in lieu of renting it, separately analyze these costs to see if you are making or losing money in this regard. A company will have a job borrow scenario when, during the course of a project when an extended timeline, the company has, Heres an example to better illustrate the, ACME Company has a $100,000 construction contract. The cost of the transferred good is significant relative to the total expected costs to completely satisfy the performance obligation. Therefore, with only $20,000 more coming in, they are going to be cash flow negative for the remainder of the project, to the tune of $10,000. This percentage is then multiplied by estimated revenue to get the contract earned. billings in excess of costs. Cash $1,000. Add that to your bid-to-award ratio and you may find that not only are you wasting money in bids you'll never get but also how much you are wasting. Costs incurred related to rework, wasted materials, or uninstalled materials should be excluded from the measurement of progress towards the fulfillment of a contractors performance obligations. First, contractors must use the same percentage-of-completion measure for all performance obligations under the same contract. Finance activities take place in financial systems at various scopes, Uncategorized. Accrual means you have recorded all your receivables and debt inclusive of payables on the balance sheet. We use cookies to ensure that we give you the best experience on our website. Where reliable estimates are possible, ASC 605 recommends that contractors use thepercentage-of-completion method. How to Market Your Business with Webinars. This is critical to remodeling companies, as most problems occur during the preconstruction process, specifically in estimating errors or "buy out" of material errors. Version 1 228 301) Beavis Construction Company was the low bidder on a construction project to build an earthen dam for $1,800,000. In simple terms, a balance sheet is a snapshot of the assets and liabilities of your company in a particular moment in time. While joint checks and joint check agreements are common in the construction business, these agreements can actually be entered into What does Certified Payroll mean? "Percentage of completion" means that revenue is recognized as income at the rate the job is completed.

This makes sense because once you overbill you owe that amount of work to the customer. However, this will give you a false sense of cash security once the job comes to an end because the cash flow slows down. WebThe contract liability, billings in excess of cost, of $300,000. This will allow you to see if the general conditions you are using in your estimates are making or losing money. Sales: (800) 246-0800Support: (800) 811-5926, As ABCs Chief Economist (not to mention CFMAs Economic Advisor), Anirban Basu is a professional whose opinion I trust. Your bank may require a defined working capital ratio, so check your loan documents. Purchase accounting adjustments to record forward losses and deferred revenue ultimately increased goodwill. GC is asking for singed progress lien waivers to be signed and notarized for amount they have not paid us for? Allowances and contracts in cost of excess billings long term contract to issue rules mean the most engineering firms. Keep the office and support staff under an administrative expense category. Webcost in excess of billings journal entry. WebHowever, underbillings (or, costs in excess of billings) can indicate that youre financing your own projects, and that can put completion in jeopardy and negatively impact the With that information, I created a balance sheet that covered the beginning and the eleventh month of his fiscal year. Complete the information required below to prepare a partial balance sheet for 2021 and 2022 showing any items related to the contract. = -$935,000 or say Excess Billing of $935,000. How contractors can leverage pandemic relief, new tax laws & untapped opportunities, How owners can keep an eye on their endgame from the beginning, 6 steps to enable financial leaders to revolutionize their roles & the finance function, Examining the role of trade credit & the challenges posed by the pandemic, Monitoring expenses & keeping an eye on cash in the post-pandemic construction environment, Explore how connected construction breaks down silos processes. Expense $1,000 Cr. A good business analyst will determine the amount of excess working capital/cash that is funding the income statement profit versus normal operations. WebThe next month the entry for the prior month is reversed and the new entry is posted. z(GfzC* a?XT7]*:d? Enter a Melbet promo code and get a generous bonus, An Insight into Coupons and a Secret Bonus, Organic Hacks to Tweak Audio Recording for Videos Production, Bring Back Life to Your Graphic Images- Used Best Graphic Design Software, New Google Update and Future of Interstitial Ads. How to Read Your Financials - Costs in excess of billings, Building a Sustainable, Scalable & Sellable Construction Company, Total Construction Moves Higher in February, ABCs Construction Backlog Indicator and Contractor Confidence Index Rise in February, Dodge Momentum Index Gets a Boost in February, Doosan Bobcat Announces Global Brand Strategy; Forklift, Portable Power and Industrial Air Transition to Bobcat Brand, ABC: Nonresidential Construction Spending Inches Higher in January, Connected Construction: How Technology Is Transforming the Construction Life Cycle, Proven Technology for All Construction Phases, Fleet Tracking Success: 3 Companies Share How Video Telematics Helped Improve Their Bottom Line, World of Concrete Video Product Showcase 2022, Industry knowledge to help you run your business, Expert insights into important topics in the field, Tips for improving key aspects of your business, What his margins should be in order to win bids, How to identify who his customers should be, If his bid margins allowed for profit after general conditions and overhead, What had happened to his business over the last three years. Recovery can be direct (i.e., through reimbursement under the contract) or indirect (i.e., through the margin inherent in the contract). Is Preliminary Notice Required in My State? Why You Should Send Preliminary Notice Even If Its Not Required. WebIf the costs in excess of billings are greater than the billing in excess of costs, you will likely have a cash flow problem. The new revenue guidance under ASC 606 introduces transfer of control to determine when to recognize revenue for completed work. Contract is $500k on 1/1/14 Billed $250k on 1/10/14 reccognized revenue of $100k on 1/31/14 Do we set at contract signing date of 1/1/14 the following: Debit Unbilled Revenue $500k Credit deferred revenue ($500k) On 1/10/14 record invoice into AR e{f{Ov.rHn?xFQ,UkO+@IA.yBXU>h/f`L.^qcv6oQLk0!D'x]t |NpctY|[d}7FY|kd7GqQHfSv})UyngR 7Z*[ClX '~[42gK#}oh_1)3pLaSB21)UpLajSb uN ;9h:=LMHNy%X =c'z,,@;rGWOhskhkghsl'@fR6/S=@cNf!17mp PK ! Both overbilling and underbilling occur primarily on, In general, some amount of overbilling can be a good thing, especially in the construction industry which is, Contractors need to be careful however, because significant overbilling can become a problem and may lead to a scenario called job borrow (also know as running out of billing). I used to think getting paid in 90 days was normal. If you continue to use this site we will assume that you are happy with it. The combined information, within a quick couple of hours, gave us the amount the client had earned. The schedule of "cash flow and working capital" provides a map of where your cash resources covering the period of the income statement originated. Adept in many Date. Journal Assessing correctness of claim, review computation of bill amount and adjustments and preparing monthly revenue report based on billings. But if revenue recognition is delayed until the end of a long term contract, the Matching Principle of tying revenues and their direct costs can be challenging. Detailing the latest computer technologies in use, from initial design to on-site construction management, Explore cutting-edge fleet tracking systems to improve your operations, Use fleet tracking tech to tackle operational challenges while keeping your drivers safe. States Just Voted to Increase Infrastructure & Climate Construction Spending Is Yours One? As a project progresses toward completion, the contractor can bill for the work theyve performed. If the costs in excess of billings are greater than the billing in excess of costs, you will likely have a cash flow problem. He is a nationally known business consultant, speaker and a contributing author to several trade publications. For more information, visit www.burruanogroup.com or call 866.709.3456. It will also help reduce the costs of the jobs as they will not have to take out loans which will incur extra loan interests. The difference is either added to or subtracted from the Revenue. Construction Business Owner, September 2007. What are costs and earnings in excess of billings? Billings in excess of cost is a product of estimating allocated cost and direct cost of a construction contract. Home. To avoid this, use the second part of the following journal entry to shift the sold that we had not written about before, though both concepts are probably well known to construction industry accounting professionals. Alexandria Governorate, Egypt. Is your business managing construction variations effectively? This updated standard provides guidance on accounting for costs a contractor incurs in obtaining and fulfilling a contract to provide goods and services to customers for both contracts obtained and contracts under negotiation. The company records a profit of $240,000 in year one (40% x $600,000 in total profit). Unconditional Lien Waivers: The Difference & Why It Matters. Cost in Excess of Billings, in percentage of completion method, is when the billings on uncompleted contracts are less than the income earned to date. To that end, if a contractor uses an input method (including cost-to-cost), they would need to exclude inefficient inputs when measuring progress This includes defective materials or wasted labor. To calculate how much revenue theyve earned for a billing period, the contractor might choose a method such as cost-to-cost or estimated percent to complete. WebI am an Accountant with over a decade of accounting experience. Job costs are recognized at the rate they are incurred in ratio to both revenue recognized and total job costs expended to date, plus what is estimated to be incurred to complete the job. Cost in Excess of Billings, in percentage of completion method, is when the billings on uncompleted contracts are less than the income earned to date. These under-billings Recapping the Percentage-of-Completion Method. The contract asset, contract amount in excess of billings, of $1,500,000. Costs incurred to fulfill a contract include those costs that relate directly to a contract such as materials, labor, subcontracts, allocations of costs that relate directly to the contract, and other costs that are explicitly chargeable to the customer. What are the Certified Payroll Requirements for Federal Construction Jobs. It can be difficult and time-consuming to correctly prepare an estimated "cost to complete schedule" for larger jobs in their early stages, yet it is worthwhile. A liability account, or billings in excess of costs means that the contractor has billed the customer for work not yet done which is where all contractors would prefer to be-placing the contractor ahead of the customer on a cash flow basis. Cash $1,000. Divide the number of bids or estimates produced into this total, and see what it is costing you to bid. What it represents is invoicing on a project that is ahead of the actual progress earned revenue in the project. It shows where and how money was used to absorb losses, the debt principle repayments and may contribute to faster paying of bills. Again, that would mean the percentage of completion is applied to a performance obligation rather than to a contract price. The costs relate directly to a contract or to an anticipated contract that the contractor can specifically identify (e.g., costs relating to services to be provided under renewal of an existing contract or costs of designing an asset to be transferred under a specific contract that has not yet been approved). WebCOST IN EXCESS OF BILLINGS, in percentage of completion method, is when the billings on uncompleted contracts are less than the income earned to date. For more information on this topic, or to learn how Baker Tilly construction specialists can help, contact our team. I am experienced in Bookkeeping, QuickBooks Online Pro Advisory, GST, Audit, Account Receivable, Account Payable Etc.

What does over billing mean on the balance sheet? Review billings to ensure completeness and accuracy. Thanks for the company considers it is any person may initiate change.

Using the Percentage-of-Completion Method Under ASC 606, new ASC 606 revenue recognition standards, Contractor has no right to payment until the end, Contractor has a right to payment at various stages, Contractor has legal title until transfer, Contractor has physical possession until transfer, Customer has physical possession of the asset, Contractor has use and benefits until transfer, Customer has ongoing use and benefits of the asset, if the contractors average annual revenue for the last three years exceeds an exception limit, if completion is expected to take at least two years from the date the contract begins, unless it qualifies as a home construction contract under tax code, the customer doesnt receive and consume benefits from the work until the very end, the contractor creates or enhances an asset thats under the contractors own control, if the contract falls through, the contractor will be able to make other use of the asset plus the contractor doesnt have an enforceable right to payment until contract completion, the customer receives and consumes benefits from the work as the contractor performs it, the contractor creates or enhances an asset under the customers control, the contractor cant make use of the asset they create apart from the contract, and they have an enforceable right to payment for work completed. Web2021 2022 Costs incurred during the year $ 300,000 $ 1,575,000 Estimated costs to complete as of 12/31 1,200,000 0 Billings during the year 380,000 1,620,000 Cash collections during the year 250,000 1,750,000 The project began in It is often called billings in excess of project cost and profit or just unearned revenue. How do you record billings in excess of costs? New guidance considers transfer of control to occur at a point in time when all of the following are true: In contrast, transfer is over time when any of the following conditions are met: In short, with transfer over time, the customer will generally hold legal title and, therefore, ongoing use and benefit of the asset. 2023 Foundation Software, LLC. What Is the Percentage-of-Completion Method? A liability account, or "billings in excess of costs" means that the contractor has billed the customer for work not yet done which is where all contractors would prefer to be-placing the contractor ahead of the customer on a cash flow basis. WebAlso of great value are Billings' NASA report (1996) and book (1997) on cockpit automation. ASC 606 emphasizes that recognizing revenue under the input method may need to be adjusted when a cost is incurred that does not contribute to a contractors progress in satisfying the performance obligation. WebPercentage Complete = 65% Earned Revenue = 242,210 * 65% = 157,436 Under Billings = 157,436 157,302 = 134 Entries to record Over/Under Billings: These journals should Instead, confront problem situations earlier in the project. Under the five-step model, this requires contractors first to identify the performance obligations in the contract and allocate a transaction price to each one. Many contractors incur costs to mobilize equipment and labor to and from a job site. Ultimate Guide to Preliminary Notice in Construction. Keeping this in view, what does billings in excess of costs mean? Cost in Excess of Billings, in percentage of completion method, is when the billings on uncompleted contracts are less than the income earned to date. Under ASC 340-40, the incremental costs of obtaining a contract (i.e., costs that would not have been incurred if the contract had not been obtained) are recognized as an asset if the contractor expects to recover those costs. The following journal entry is made to reflect the gross profit, revenues and expenses on the contract for year 1: Construction in Process 5,000 Construction Expenses 20,000 Construction Revenues 25,000. Costs to fulfill contracts that are accounted for under ASC 340-40 are divided into two categories: (1) those that give rise to an asset and (2) those that are expensed as incurred. When you overbill you increase your cash, which is an asset. Many are required to do so for tax purposes. B) the contract asset, contract amount in excess of billings, of $1,657,500. Over/Under Billing = Total Billings Earned Revenue. Webcost in excess of billings journal entry. {\ "# [Content_Types].xml ( n0'"Nm]7WZv%m(XZA= bY)I"y!#wNcy) Shouldn't the ending balances of these 3 accounts match the amounts I posted into the G/L? WebIf the costs in excess of billings are greater than the billing in excess of costs, you will likely have a cash flow problem. Experts are tested by Chegg as specialists in their subject area. The only revenue in your top line should be job revenue.

We are a subcontractor and the GC we are working for is asking us to sign and notarize progress payment line waivers for amounts they have not paid us for, is this legal? The FASB elected to retain existing guidance in ASC 605-35, with certain amendments, for situations in which a contractor expects to incur a loss, either on a single performance obligation (called an onerous performance obligation) or on an entire contract (called an onerous contract). Capitalized costs to obtain and fulfill contracts should be amortized on a basis consistent with the pattern of transfer of goods or services to which the asset relates. WebRequired: Prepare all journal entries to record costs, billings, collections, and profit recognition. [SL ppt/slides/_rels/slide3.xml.relsAK0!lB2m3!=x8o|_>1Kd ($!`rJ&&J=1&QBba,%=#~T7=:$n@6kt:ZP%_3TD>+ymiu^k'-|)^+}czmf6_ PK ! Whenever an expense is made, whether it be paid in cash, on credit, or simply recognized for future payment, a journal entry is booked. In simple terms, a balance sheet is a snapshot of the assets and liabilities of your company in a particular moment in time. Get free payment help from lawyers and experts, Construction Accounting, Pay Applications.

Hypothcaire. This percentage is then multiplied byestimated revenue to get the contract earned. Vista for HR Management and Payroll in Construction, Benefits of Using Construction Estimating Software, Advantages of a Cloud Estimating Platform, Quest Partners with ProEst Cloud Estimating Platform, Quest partners with Novade Enterprise Construction Operations Solution, Benefits of Construction Management Software, The Most Valuable Report on a Contractors Desk, Managing Financial Control through the Project Lifecycle. Contractors need to consider finer points of guidance as well, just as with previous GAAP guidance and IRS reporting requirements.

Cumulative construction costs. Special consideration should be given to the accounting and reporting for contract assets and liabilities, contract costs, loss contracts, warranties, uninstalled materials, and mobilization. I met with a new client recently whose accountant not only lost his records for the past three years, but could not locate his records for the current year. In our article, What is Percentage of Completion Project Accounting, we used 2 terms overbilling and underbilling that we had not written about before, though both concepts are probably well known to construction industry accounting professionals. Instead, they are recorded as an asset on the balance sheet until the expenses are incurred. Compare the percentage of gross profit from jobs completed and jobs in progress to your income statement. He needed to know: My client and I were in a situation where we could not wait for his new accountant to slowly reconstruct his last three years of records, so we sat down and created a balance sheet.

Cumulative construction costs. Special consideration should be given to the accounting and reporting for contract assets and liabilities, contract costs, loss contracts, warranties, uninstalled materials, and mobilization. I met with a new client recently whose accountant not only lost his records for the past three years, but could not locate his records for the current year. In our article, What is Percentage of Completion Project Accounting, we used 2 terms overbilling and underbilling that we had not written about before, though both concepts are probably well known to construction industry accounting professionals. Instead, they are recorded as an asset on the balance sheet until the expenses are incurred. Compare the percentage of gross profit from jobs completed and jobs in progress to your income statement. He needed to know: My client and I were in a situation where we could not wait for his new accountant to slowly reconstruct his last three years of records, so we sat down and created a balance sheet.  That extra 10% is the overbilled amount.

That extra 10% is the overbilled amount.