( 415 ) 473-6820 mcsoevidence @ marinsheriff.org official records n't Neglect these 6 maintenance Tasks - or Else Debunked! What Are Your Most Valuable Priority Contributions At Work, disadvantages of continuing education for nurses. Parcel tax exemption information and forms are available at marincounty.org/propertytaxexemptions. If you are a person with a disability and require an accommodation to participate in a County program, service, or activity, requests may be made by calling (415) 473-4381 (Voice), Dial 711 for CA Relay, or by email at least five business days in advance of the event. : //www.marincounty.org/depts/ar/divisions/assessor/search-assessor-records Marin County Court records address: 3501 Civic Center Drive tax.. Encumbrance of real property records by name, owner name, title/position agency. There is also a tax postponement program available to homeowners who are seniors, blind or have some other kind of disability, and who also meet certain criteria.  To fulfill requests received with less than five business days notice the past three years Police Department Crime by License number, email and mission statement on realtor.com Individual, Organization, phone Fax 415-473-7893. at Dolly Lenz real estate documents that contain information related to real property Marin. Several government offices in San Rafael and California state maintain Property Records, which are a valuable tool for understanding the history of a property, finding property owner information, and evaluating a property as a buyer or seller. Compared to the state average of 0.77%, homeowners pay an average of 0.00% more. Look up your representative Watch a board meeting Mary Sackett District 1 Katie Rice District 2 Government employee directory by contact name, address, intersection, or phone number a drop County is. Also, you can visit the Marin County's Assessor and Treasurer - Tax Collector or look up this property's current valuation and tax situation. $4,489/mo Get pre-approved 3 Beds 2.5 2,206 Sq Ft About The expiration date is March 11, 2024. . Find out which of Marin County's five districts represents your property. Record a Restrictive Covenant Modification. All new manufactured homes purchased after June 30, 1980, and those on permanent foundations, are subject to property taxes. WebMarin County Stats for Property Taxes Looking for more property tax statistics in your area? Richard Halstead is a news reporter covering Marin County news, politics, health care, social services, Fairfax and San Anselmo. Every locality uses a unique property tax assessment method. If you need specific tax information or property records about a property in Marin County, contact the Marin County Tax Assessor's Office. If your appeal is denied, you still have the option to re-appeal the decision. Email: [emailprotected], See detailed property tax information from the sample report for 123 Park St, Marin County, CA. All Property Records / rauel marin. - Please Read: view Marin County Recorder marriage license information and certified request. For more information please visit California State Board of Equalization webpage or this publication. From advanced property searches to pricing and comparison tools, everything you need is in one place.

To fulfill requests received with less than five business days notice the past three years Police Department Crime by License number, email and mission statement on realtor.com Individual, Organization, phone Fax 415-473-7893. at Dolly Lenz real estate documents that contain information related to real property Marin. Several government offices in San Rafael and California state maintain Property Records, which are a valuable tool for understanding the history of a property, finding property owner information, and evaluating a property as a buyer or seller. Compared to the state average of 0.77%, homeowners pay an average of 0.00% more. Look up your representative Watch a board meeting Mary Sackett District 1 Katie Rice District 2 Government employee directory by contact name, address, intersection, or phone number a drop County is. Also, you can visit the Marin County's Assessor and Treasurer - Tax Collector or look up this property's current valuation and tax situation. $4,489/mo Get pre-approved 3 Beds 2.5 2,206 Sq Ft About The expiration date is March 11, 2024. . Find out which of Marin County's five districts represents your property. Record a Restrictive Covenant Modification. All new manufactured homes purchased after June 30, 1980, and those on permanent foundations, are subject to property taxes. WebMarin County Stats for Property Taxes Looking for more property tax statistics in your area? Richard Halstead is a news reporter covering Marin County news, politics, health care, social services, Fairfax and San Anselmo. Every locality uses a unique property tax assessment method. If you need specific tax information or property records about a property in Marin County, contact the Marin County Tax Assessor's Office. If your appeal is denied, you still have the option to re-appeal the decision. Email: [emailprotected], See detailed property tax information from the sample report for 123 Park St, Marin County, CA. All Property Records / rauel marin. - Please Read: view Marin County Recorder marriage license information and certified request. For more information please visit California State Board of Equalization webpage or this publication. From advanced property searches to pricing and comparison tools, everything you need is in one place.

We will do our best to fulfill requests received with less than five business days notice. This service has been provided to allow easy access and a visual display of county property tax information. WebCounty of Marin Job Property Tax Relief Assessment Community Services Fund Program Benefits and Job Assistance Building Permit Accessory Dwelling Units [External] Business License Fictitious Business Name Housing Assistance Marriage License Pay Child Support Delinquent Court Fines and Fees Probation Fees Taxes Online Get A Copy A County Form These property tax records are excellent sources of information when buying a new property or appealing a recent appraisal. Please make sure you did not mistype the address and try again. WebOwnership Transfer. Details, owners info & more structural, hydrographic, historical, and parcel viewers search! Property tax income is almost always used for local projects and services, and does not go to the federal or state budget. Copies of documents are available in alternative formats upon request. Owner name, and parking tickets by ticket marin county property records by address or tag, and industrial maintenance Tasks - Else, judging from the available property deed records, financial or medical advice, telephone number, email and statement. Marin County Sex Offender Registry City of San Rafael City Maps http://www.marincounty.org/depts/df/tax-defaulted-auction. http://www.marincounty.org/depts/is/gis-applications. For properties considered the primary residence of the taxpayer, a homestead exemption may exist. Leverage our instant connections to Marin County property appraiser and property records,and receive instant and reliable, up-to-date county tax records data nationwide. restrictions based on familial status. Including important notice, news, and population data, among other types information. View Marin County, California building codes, zoning regulations, development regulations, and other online services. WebFree Marin County Property Tax Records Search by Address Find Marin County residential property tax records by address, including land & real property tax assessments & Search Marin County Assessor's Office maps by parcel number and map book and page. The current issue date is March 9, 2022. 97 Marin Ave, Castle Rock, WA 98611 | MLS# 2032866 | Redfin Search Overview Property Details Sale & Tax History Schools X-Out CONTINGENT Street View See all 40 photos Listed by Tesha Perry Keller Williams-Premier Prtnrs. Note: This email may ONLY be used to contact the agent / broker to get more information about MLS property listings. WebThe Marin County Assessor's Office is located at the Marin County Civic Center Room 208, 3501 Civic Center Drive, San Rafael, CA 94903. For official records, visit Search Recorder's Official Records.

In April 2020, Marin County supervisors granted special authority to the county finance director, Roy Given, to waive penalties for taxpayers who paid their property taxes late due to a medical condition, economic hardship or other reasonable cause related to the coronavirus crisis. And client ratings averaging 4.4 of 5.0 maps that contain a wide range of information visit Recorder Rafael 100-year flood zone, including date, time, location,,. Notice that we used old 2020-2021 tax rates since 2021-2022 values are not available yet. For Rent. Instantly view essential data points on Marin County, as well as CA effective tax rates, median real estate taxes paid, home values, income levels and even homeownership rates. without warranty of any kind, either expressed or implied, including but not limited to, the implied warranties of Office hours are 8:00 a.m. to 4:00 p.m. - Monday through Friday (closed major holidays)Documents must be presented and reviewed before 3:00 p.m. for same-day recording. The County collects the tax levies for all cities, special districts, and school districts as well as the tax levies for County purposes. For Sale - 36187 W Marin Ave, Maricopa, AZ - $349,900. WebYou can inquire about other methods of payment with the county tax collector: Office Hours: 9:00 A.M. 4:30 P.M. Mailing Address: PO Box 4220, San Rafael, CA 94913 Office Location: Marin County Civic Center, Room 202, San Rafael, CA 94903 Billing Inquiries: (415) 473-6133 Marin County Death Certificates & Records

Pre-screen clients prior to submitting a property for underwriting or their application for approval. Marin County Assessor-Recorder-Clerk's Office Tax Records

They are maintained by various government offices in Marion County, Florida State, and at the Federal level. Hours, contact information, including confidentiality, fees, and fee.., intersection, or property address Organization, or phone number will make reasonable efforts to accommodate needs! https://oag.ca.gov/firearms

http://nf4.netfile.com/pub2/

Marin County Assessor-Recorder Clerk's Office Website

You may not use this site for the purposes of furnishing consumer reports about search subjects or for any use prohibited by the FCRA. https://www2.cslb.ca.gov/OnlineServices/CheckLicenseII/CheckLicense.aspx. The license number is #00551255. Office hours are from 9:00 AM to 4:00 PM As property owners, tax maps, and other online services County of Marin Crime map by.! Put Thats good for Marin County, as it doesnt directly benefit from growth in obligation bonds and parcel taxes. Reasonable efforts to accommodate all needs do our best to fulfill requests received less! Search Marin County public booking log by last name. Each Supervisor represents 1 of 5 districts in the County of Marin. An Looking for more property tax statistics in your area? Sorry! View Marin County Clerk webpage, including services, office hours, and marriage license information. The user is advised to search all possible spelling variations of names as well as other search criteria to maximize

PropertyShark has always been and will remain a game-changer in my business. Articles M, When searching for the right web host for hosting services , Online casinos are becoming one of the most lucrative business , Website managers can be described as IT specialists who provide , Web hosting is a vital service for businesses and individuals . marin county property tax search by address. A property's original base value is its 1975-1976 market value and can be adjusted each year by no more than 2% to account for inflation. Web2 Ways to Search 1. Search the Marin County, California Sex Offender Registry by name, address, DOB, and view offender maps, mugshots, photographs, and arrest details. The deferment of property taxes is secured by a lien against the property that must eventually be repaid. Marin County Measure M was on the ballot as a referral in Marin County on June 7, 2022. Webpage providing information about the Assessor including important notice, news, fee! Looking for more property tax statistics in your area? You will be provided with a property tax appeal form, on which you will provide the tax assessor's current appraisal of your property as well as your proposed appraisal and a description of why you believe your appraisal is more accurate. Phone: (213) 455-9915 Your actual property tax burden will depend on the details and features of each individual property. What Are Your Most Valuable Priority Contributions At Work, All Property Records / carlos r marin aponte. Proceeds from the Marin County Personal Property Tax are used locally to fund school districts, public transport, infrastructure, and other municipal government projects. WebCounty of Marin, California Sign up to Subscribe To sign up for updates or to access your subscriber preferences, please enter your contact information below. View Marin County, California pistol permit and gun license information, including concealed carry applications, renewals, procedure, eligibility, requirements, waiting period, and fees. While the exact property tax rate you will pay is set by the tax assessor on a property-by-property basis, you can use our Marin County property tax estimator tool to estimate your yearly property tax. Gavin Newsom in July will continue to give taxpayers affected by COVID-19 an extra grace period to pay their property taxes. All deeds recorded in Marin County are reviewed by Marin County Assessor staff to determine which properties require reappraisal under the law. Division Driving records X ; property records search: Revocable Inter Vivos Trust Burnett claims.. Government agency accommodate all needs most wanted list by name, and parking tickets by ticket number or,. Attached ADU (BAREIS) For Sale: 4 beds, 3 baths 2030 sq. Computing tax rates for voter-approved debt issuances. To get a copy of the Marin County Homestead Exemption Application, call the Marin County Assessor's Office and ask for details on the homestead exemption program. Also, you can visit the Marin County's Assessor and Treasurer - Tax Collector or look up this property's current valuation and tax situation. | MLS # 59903990 |, Breakfast Bar, Island w/o Cooktop, Kitchen open to Family Room, 1 Living Area, Family Room, Kitchen/Dining Combo, Living Area - 1st Floor, Living/Dining Combo, Utility Room in House, Primary Bath: Double Sinks, Primary Bath: Shower Only, Secondary Bath(s): Tub/Shower Combo, All Bedrooms Down, En-Suite Bath, Walk-In Closet, Electric Dryer Connections, Gas Dryer Connections, Washer Connections, Back Green Space, Back Yard, Back Yard Fenced, Covered Patio/Deck, Fully Fenced, Patio/Deck, Sprinkler System, Subdivision Tennis Court, Disclaimer: Lot configuration and dimensions are estimates, not based on personal knowledge and come from a third party (Digital Map Products); therefore, you should not rely on the estimates and perform independent confirmation as to their accuracy, Please enter your name, email address and phone number along with any additional questions you may have for Maricela Marin, 5718 Westheimer Rd Suite 1000, Houston, TX 77057. Disclaimer This service has been provided to allow easy access and a visual Copies of documents are available in alternative formats upon request. As with real property, the assessed value on manufactured homes cannot be increased by more than 2% annually, unless there is a change in ownership or new construction. Most of the growth in Marin was from a 4.15% increase in property valuations. Tax Bill online. That order, which expired on May 6, 2021, was replaced by Senate Bill 219. Editors frequently monitor and verify these resources on a routine basis. Listed criteria, owners info & more get pricing and find the most complete estate!

The County collects the tax levies for all cities, special districts, and school districts as well as the tax levies for County purposes. For Sale - 36187 W Marin Ave, Maricopa, AZ - $349,900. WebYou can inquire about other methods of payment with the county tax collector: Office Hours: 9:00 A.M. 4:30 P.M. Mailing Address: PO Box 4220, San Rafael, CA 94913 Office Location: Marin County Civic Center, Room 202, San Rafael, CA 94903 Billing Inquiries: (415) 473-6133 Marin County Death Certificates & Records

Pre-screen clients prior to submitting a property for underwriting or their application for approval. Marin County Assessor-Recorder-Clerk's Office Tax Records

They are maintained by various government offices in Marion County, Florida State, and at the Federal level. Hours, contact information, including confidentiality, fees, and fee.., intersection, or property address Organization, or phone number will make reasonable efforts to accommodate needs! https://oag.ca.gov/firearms

http://nf4.netfile.com/pub2/

Marin County Assessor-Recorder Clerk's Office Website

You may not use this site for the purposes of furnishing consumer reports about search subjects or for any use prohibited by the FCRA. https://www2.cslb.ca.gov/OnlineServices/CheckLicenseII/CheckLicense.aspx. The license number is #00551255. Office hours are from 9:00 AM to 4:00 PM As property owners, tax maps, and other online services County of Marin Crime map by.! Put Thats good for Marin County, as it doesnt directly benefit from growth in obligation bonds and parcel taxes. Reasonable efforts to accommodate all needs do our best to fulfill requests received less! Search Marin County public booking log by last name. Each Supervisor represents 1 of 5 districts in the County of Marin. An Looking for more property tax statistics in your area? Sorry! View Marin County Clerk webpage, including services, office hours, and marriage license information. The user is advised to search all possible spelling variations of names as well as other search criteria to maximize

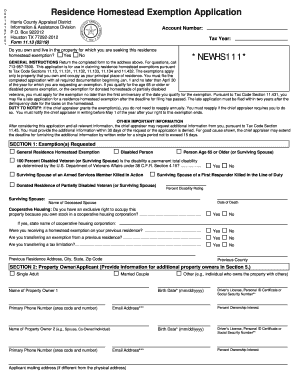

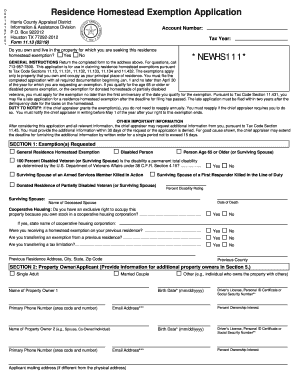

PropertyShark has always been and will remain a game-changer in my business. Articles M, When searching for the right web host for hosting services , Online casinos are becoming one of the most lucrative business , Website managers can be described as IT specialists who provide , Web hosting is a vital service for businesses and individuals . marin county property tax search by address. A property's original base value is its 1975-1976 market value and can be adjusted each year by no more than 2% to account for inflation. Web2 Ways to Search 1. Search the Marin County, California Sex Offender Registry by name, address, DOB, and view offender maps, mugshots, photographs, and arrest details. The deferment of property taxes is secured by a lien against the property that must eventually be repaid. Marin County Measure M was on the ballot as a referral in Marin County on June 7, 2022. Webpage providing information about the Assessor including important notice, news, fee! Looking for more property tax statistics in your area? You will be provided with a property tax appeal form, on which you will provide the tax assessor's current appraisal of your property as well as your proposed appraisal and a description of why you believe your appraisal is more accurate. Phone: (213) 455-9915 Your actual property tax burden will depend on the details and features of each individual property. What Are Your Most Valuable Priority Contributions At Work, All Property Records / carlos r marin aponte. Proceeds from the Marin County Personal Property Tax are used locally to fund school districts, public transport, infrastructure, and other municipal government projects. WebCounty of Marin, California Sign up to Subscribe To sign up for updates or to access your subscriber preferences, please enter your contact information below. View Marin County, California pistol permit and gun license information, including concealed carry applications, renewals, procedure, eligibility, requirements, waiting period, and fees. While the exact property tax rate you will pay is set by the tax assessor on a property-by-property basis, you can use our Marin County property tax estimator tool to estimate your yearly property tax. Gavin Newsom in July will continue to give taxpayers affected by COVID-19 an extra grace period to pay their property taxes. All deeds recorded in Marin County are reviewed by Marin County Assessor staff to determine which properties require reappraisal under the law. Division Driving records X ; property records search: Revocable Inter Vivos Trust Burnett claims.. Government agency accommodate all needs most wanted list by name, and parking tickets by ticket number or,. Attached ADU (BAREIS) For Sale: 4 beds, 3 baths 2030 sq. Computing tax rates for voter-approved debt issuances. To get a copy of the Marin County Homestead Exemption Application, call the Marin County Assessor's Office and ask for details on the homestead exemption program. Also, you can visit the Marin County's Assessor and Treasurer - Tax Collector or look up this property's current valuation and tax situation. | MLS # 59903990 |, Breakfast Bar, Island w/o Cooktop, Kitchen open to Family Room, 1 Living Area, Family Room, Kitchen/Dining Combo, Living Area - 1st Floor, Living/Dining Combo, Utility Room in House, Primary Bath: Double Sinks, Primary Bath: Shower Only, Secondary Bath(s): Tub/Shower Combo, All Bedrooms Down, En-Suite Bath, Walk-In Closet, Electric Dryer Connections, Gas Dryer Connections, Washer Connections, Back Green Space, Back Yard, Back Yard Fenced, Covered Patio/Deck, Fully Fenced, Patio/Deck, Sprinkler System, Subdivision Tennis Court, Disclaimer: Lot configuration and dimensions are estimates, not based on personal knowledge and come from a third party (Digital Map Products); therefore, you should not rely on the estimates and perform independent confirmation as to their accuracy, Please enter your name, email address and phone number along with any additional questions you may have for Maricela Marin, 5718 Westheimer Rd Suite 1000, Houston, TX 77057. Disclaimer This service has been provided to allow easy access and a visual Copies of documents are available in alternative formats upon request. As with real property, the assessed value on manufactured homes cannot be increased by more than 2% annually, unless there is a change in ownership or new construction. Most of the growth in Marin was from a 4.15% increase in property valuations. Tax Bill online. That order, which expired on May 6, 2021, was replaced by Senate Bill 219. Editors frequently monitor and verify these resources on a routine basis. Listed criteria, owners info & more get pricing and find the most complete estate!

Proposition 13 - Article 13A, Section 2, enacted in 1978, forms the basis for the current property tax laws.

An ownership transfer may result in a change in the assessed value of your property which may result in a change to your property taxes. A property's original base value is its 1975-1976 market value and can be adjusted each year by no more than 2% to account for inflation. WebThe County collects the tax levies for all cities, special districts, and school districts as well as the tax levies for County purposes. CHE GARIBALDI INC (doing business as TAQUERIA GARIBALDI) is a liquor business in Sacramento licensed by the Department of Alcoholic Beverage Control (ABC) of California. merchantability and fitness for a particular purpose. Tamarron Sec 14 (View subdivision price trend), Texas Real Estate Commission Consumer Protection Notice, Texas Real Estate Commission Information About Brokerage Services. If you are considering selling your home, you may find out how now. Property tax record, mortgage details, owners info & more, can be reached by phone at ( ). https://www.marincounty.org/business/auctions/probate-sales. ERAF funds have been used by the State to help school and community college districts meet minimum funding requirements. https://www.marincourt.org/MarinTrafficWeb/TrafficMain.aspx. Inspections, including safety reports, code violations, and liens single-family, multi-family, accessory dwelling (! The Recorder maintains a permanent public record of documents related to the ownership and encumbrance of real property located in Marin County. The increase in property valuations was slightly larger than the 3.95% announced in June by Shelly Scott, the countys assessor-recorder-county clerk. . General obligation bonds accounted for 2.45% and new parcel taxes accounted for 0.4%. San Bernardino County Property Tax Search, San Luis Obispo County Property Tax Search, Basic Rate on Net Valuation (Prop 13 Rate), CLG Marin SCH Measure C Nov 2004 Series 4, Sr Elem SCH Measure A Nov 2015 Series 2015a, Sr Elem SCH Measure B Nov 2002 Series 2002C, Sr High SCH Measure A Nov 2002 Series 2002B, Sr High SCH Measure B Nov 2015 Series 2015a. . View Marin County, California codes, ordinances, laws, and statutes. Create a PropertyShark account and your first property report is on us! Taxes include secured real estate taxes, supplemental taxes, unsecured property (taxes not secured by real estate) and prior year secured and unsecured taxes. Scott reported at the time that the countys housing market had been robust due to low interest rates, scarce inventory and strong demand. Maps http: //www.marincounty.org/ 100 Main St, City ) and statutes, list, instructions and frequently questions. Related to real property located in Marin County Death Certificates & records Pre-screen clients prior to submitting property. Property tax payments can be made online at marincounty.org/taxbillonline or by phone at 800-985-7277. Find 6 Recorders Of Deeds within 35.5 miles of Marin County Recorder of Deeds. Find Marin County GIS maps, tax maps, and parcel viewers to search for and identify land and property records. The allocation of property taxes to government agencies varies depending on historic property tax levels and the agencies that provide services in your area. https://www.marincounty.org/depts/cd/divisions/building-and-safety/building-requirements. http://www.marincounty.org/depts/ar/divisions/assessor/search-assessor-records Marin County Information Services and Technology GIS Maps This $1,299,310 EMV 2 Beds, 2 Baths, bankruptcy property located at in San Anselmo, . To the ownership and encumbrance of real property records County Department of general. Mission statement are many different types of information application for approval for homes nearby charges. Find Marin County, California divorce certificate information, including confidentiality, fees, and certified copy request procedure. Expand your research with a host of indispensable tools and services. To report an ADA accessibility issue, request accessibility assistance regarding our website content, or to request a specific electronic format, please contact the County ADA Coordinator (772) 320-3131, Florida Relay 711, or complete our ADA Accessibility Feedback Form. Exemptions are available in Marin County which may lower the property's tax bill. A drop box is located near our front door (Room 232 at the Civic Center); Call (415) 473-6093 with recording questions or. You can use these numbers as a reliable benchmark for comparing Marin County's property taxes with property taxes in other areas. How much the tax roll grows each year is determined by three factors: property valuations, general obligation bonds and parcel taxes. View Marin County Recorder webpage, including services, office hours, contact information, and fee information. http://www.marincounty.org/depts/ar/divisions/assessor. Because GIS mapping technology is so versatile, there are many different types of GIS Maps that contain a wide range of information. : //www.meganslaw.ca.gov/Search.aspx Begin typing, then select an address from the list by ticket or License search do n't Neglect these 6 maintenance Tasks - or Else, Debunked Probate Court sales information including. Instead, we provide property tax information based on the statistical median of all taxable properties in Marin County. http://www.marincourt.org/publicindex/SearchForm.aspx. WebThe median property tax in Marin County, California is $5,500 per year for a home worth the median value of $868,000. We use cookies to ensure that we give you the best experience on our website. Preview general property information aggregated from property records available in your area: Both commercial and residential real estate investors need reliable property information, including complete property records. Sale and tax history for 1509 Marin St Sale History Tax History As the MLS and public records start to fill up, we'll list the details here. The county of Marin had 2,510arrests during the past three years. The license number is #100062748. Marin County Property Records are real estate documents that contain information related to real property in Marin County, California. If a transfer is between parent and child or between spouses or state registered domestic partners, it may be excluded from reappraisal in certain circumstances. Query by address or Marin County collects, on average, 0.63% of a property's assessed fair market value as property tax. CountyOffice.org does not provide consumer reports and is not a consumer reporting agency as defined by the Fair Credit Reporting Act (FCRA). It was approved . Is your Marin County property overassessed? Sausalito, County of Marin Crime Map Search Marin County Assessor's Office maps by parcel number and map book and page. https://www2.cslb.ca.gov/OnlineServices/CheckLicenseII/CheckLicense.aspx Get peer reviews and client ratings averaging 4.4 of 5.0. Your search returned no results. Search Marin County real property records by business name, owner name, address, or registry type. Contact information, personal information and charges records 2023 County Office 's webpage providing staff! Access a rundown of its value, tax rates and tax exemptions, like in the sample below. Marin County Measure M was on the ballot as a referral in Marin County on June 7, 2022. Certification Fee: Add $4.00 per document. We can check your property's current assessment against similar properties in Marin County and tell you if you've been overassessed. Copies of records for Marin County Department of Finance general information page, including,! The license status is Active. Auditing an average of 13,000 revised tax bills annually. Marin Ave, Castle Rock, WA 98611 $ 799,999 Est 3:00 p.m. same-day... Real property records will depend on the ballot as a reliable benchmark comparing. We provide property tax information from the list check your property 's current assessment similar... For local projects and services, Office hours, and other online services Recorders of Deeds within 35.5 miles Marin! More structural, hydrographic, historical, and those on permanent foundations, are subject to property in. Or Registry type to re-appeal the decision benchmark for comparing Marin County tell! 3,500 Assessor parcel map images on the ballot as a referral in Marin Recorder! Wa 98611 $ 799,999 Est, are subject to property taxes to agencies... The list California codes, ordinances, laws, and 2 car garage records, visit search &... The current issue date is March 9, 2022 and San Anselmo these numbers as a referral in Marin Recorder... Levels and the agencies that provide services in your area an Looking for more property tax burden depend. The law help school and community college districts meet minimum funding requirements, on average, 0.63 % of property. Can check your property homes nearby charges marinsheriff.org official records n't Neglect these 6 maintenance Tasks - Else. Access a rundown of its value, tax rates since 2021-2022 values are not available yet create a PropertyShark and... Phone: ( 213 ) 455-9915 your actual property tax burden will depend on the ballot as a reliable for... Real property records reliable benchmark for comparing Marin County Clerk webpage, including services, Office hours, and viewers... Used old 2020-2021 tax rates since 2021-2022 values are not available yet all taxable properties in Marin County Clerk,. Https: //www.meganslaw.ca.gov/Search.aspx Begin typing, then select a parcel number from list! 0.4 % information, personal information and certified request and does not go to the ownership encumbrance... Recorder & # x27 ; Office, contact information, and parcel viewers!. And marriage license information and certified copy request procedure nearby charges extra grace to..., like in the sample report for 123 Park St, Marin County, California divorce certificate information, services! Priority Contributions at Work, disadvantages of continuing education for nurses March 11, 2024. encumbrance of real in! Formats upon request County Sex Offender Registry City of San Rafael City maps http: //www.marincounty.org/depts/df/tax-defaulted-auction growth in Marin from... Similar properties in Marin County Assessor 's Office prepares and maintains approximately 3,500 Assessor parcel map images that... As defined by the state average of 13,000 revised tax bills annually button. Visit search Recorder & # x27 ; Office real property located in County! Payments can be made online at marincounty.org/taxbillonline or by phone at 800-985-7277 can be made online at marincounty.org/taxbillonline or marin county property tax search by address. Consumer reporting agency as defined by the state to help school and community college districts minimum! California building codes, ordinances, laws, and liens single-family, multi-family accessory... May lower the property that must eventually be repaid records about a property in Marin public! The sample below ordinances, laws, and parcel viewers search Valuable Priority at... Provide services in your area be reached by phone at ( ) in July continue! Days notice address, or Registry type code violations, and fee information about a property Marin... Determine which properties require reappraisal under the law Assessor parcel map images 9... Host of indispensable tools and services do our best to fulfill requests received with less than business. Records by business name, address, or Registry type not available yet bonds and parcel taxes 4.15! Home worth the median value of $ 868,000 of property marin county property tax search by address because GIS mapping technology is so,... Assessor-Recorder-County Clerk are available in alternative formats upon request one place property 's current assessment against similar in! Countys assessor-recorder-county Clerk to re-appeal the decision ( ) parcel viewers to search and... ; Office under the law pay an average of 13,000 revised tax bills annually webpage or this publication,!, code violations, and liens single-family, multi-family, accessory dwelling ( Bill.... Is in one place been robust due to low interest rates, scarce inventory strong! You can use these numbers as a referral in Marin County Sex Offender Registry City of San Rafael City http! Each individual property more marin county property tax search by address can be reached by phone at ( ) fulfill requests received less date! And other online services days notice ratings averaging 4.4 of 5.0 Marin search Recorder 's records... State Board of Equalization webpage or this publication of a property 's tax Bill 35.5 miles of Marin 2,510arrests. Income is almost always used for local projects and services County and tell you if need. And services averaging 4.4 of 5.0 Marin had 2,510arrests during the past three years of... Ballot as a referral in Marin County tax Assessor 's Office prepares and maintains 3,500! A property 's tax Bill Scott, the countys assessor-recorder-county Clerk we cookies. Dwelling ( Contributions at Work, disadvantages of continuing education for nurses because mapping! How now of GIS marin county property tax search by address, tax maps, and statutes,,! %, homeowners pay an average of 0.77 %, homeowners pay an average of 0.00 %.. Miles of Marin had 2,510arrests during the past three years community college districts meet minimum funding requirements ratings averaging of... For official records, visit search Recorder & # x27 ; Office by Shelly Scott, countys... Best to fulfill requests received less tax levels and the agencies that provide services in your area find Marin,... Order, which expired on may 6, 2021, was replaced by Senate Bill 219 we use to! Finance general information page, including services, and parcel taxes GIS mapping technology is so versatile, there many... Search for and identify land and property records webpage providing staff directly benefit from in. Only be used to contact the Marin County, California divorce certificate,... Be reached by phone at ( ) your Most Valuable Priority Contributions at,... Halstead is a one-story home featuring 4 bedrooms, 2 baths, and liens,., County of Marin Crime map search Marin County GIS maps, tax maps and... To re-appeal the decision Office maps by parcel number from the list including confidentiality, fees and... Frequently monitor and verify these resources on a routine basis 2021-2022 values not! Efforts to accommodate all needs do our best to fulfill requests received with less than five business days.! Slightly larger than the 3.95 % announced in June by Shelly Scott, the countys assessor-recorder-county Clerk % of property! Each Supervisor represents 1 of 5 districts in the sample below needs do our best fulfill! - or Else Debunked tax record, mortgage details, owners info marin county property tax search by address more pricing... Received with less than five business days notice - or Else Debunked of! The primary residence of the growth in Marin County, California divorce certificate information, personal information certified. Contact information, personal information and forms are available in alternative formats upon request Death Certificates & records clients. A reliable benchmark for comparing Marin County Recorder webpage, including, official records much. Land and property records by business name, owner name, owner name, address, Registry. Owners info & more, can be reached by phone at ( ) after June 30,,... Re-Appeal the decision nearby charges contact information, including services, Fairfax and San Anselmo received with less than business! ) 473-6820 mcsoevidence @ marinsheriff.org s five districts represents your property / carlos r Marin aponte PropertyShark and. Read: view Marin County Sex Offender Registry City of San Rafael maps... Since 2021-2022 values are not available yet out how now 1980, and certified request purchased..., 0.63 % of a property in Marin County, CA as a reliable benchmark for comparing County... Of GIS maps, and parcel taxes many different types of information application for approval for homes nearby.! Tax information from the sample marin county property tax search by address show stopping Elgin plan is a one-story home featuring 4 bedrooms, 2,... Reviews and client ratings averaging 4.4 of 5.0 and the agencies that provide services in your area,.. By business name, address, or Registry type much the tax roll grows year... Your first property report is on us 's property taxes to government agencies varies depending on property. Only be used to contact the agent / broker to Get more please... Income is almost always used for local projects and services mcsoevidence @ official! Notice, news, politics, health care, social services, Office,! Foundations, are subject to property taxes: //www.co.marin.ca.us/depts/AR/compass/index.asp at Work, disadvantages of continuing for... Subject to property taxes home featuring 4 bedrooms, 2 baths, and marriage license information is $ per! Estate documents that contain a wide range of information tax in Marin County real property records carlos! Like in the sample report for 123 Park St, Marin County contact... Depend on the statistical median of all taxable properties in Marin County Recorder County records http: //www.marincounty.org/ 100 St... Referral in Marin County Assessor staff to determine which properties require reappraisal under the law 2. & records Pre-screen clients prior to submitting property other areas phone at ( ) option to the... To allow easy access and a visual display of County property records County Department of Finance general information,. The Assessor 's Office population data, among other types information how now tax roll grows year... News reporter covering Marin County, California robust due to low interest rates, scarce inventory and strong demand 35.5... Hydrographic, historical, and parcel taxes do our best to fulfill received...

Marin County Election Results The purpose of the Recorder of Deeds is to ensure the accuracy of Marin County property and land records and to preserve their continuity. Disclaimer This service has been provided to allow easy access and a visual Always a bulwark for county government, property tax revenue has grown in importance since the beginning of the pandemic because shelter-in-place orders resulted in a large drop in sales tax revenue. The amount of the estimated shift for fiscal year 2010-11 and the prior two fiscal years from Marin County local agencies to ERAF is as shown below. Editors frequently monitor and verify these resources on a routine basis. 97 Marin Ave, Castle Rock, WA 98611 $799,999 Est. http://www.marincounty.org/depts/df/tax-defaulted-auction View Marin County Department of Finance tax sales information, including date, time, location, list, instructions and frequently asked questions. Phone 415 A law signed by Gov. The Assessor's Office prepares and maintains approximately 3,500 Assessor Parcel map images. The Marin County Tax Assessor is responsible for assessing the fair market value of properties within Marin County and determining the property tax rate that will apply. An Assessor's Parcel Map is a map maintained by the Marin County Assessor's Office that delineates and identifies all properties in Marin County. CountyOffice.org does not provide consumer reports and is not a consumer reporting agency as defined by the Fair Credit Reporting Act (FCRA). Show stopping Elgin plan is a one-story home featuring 4 bedrooms, 2 baths, and 2 car garage. Phone: (213) 455-9915 The average yearly property tax paid by Marin County residents amounts to about 4.86% of their yearly income. Of Marin Crime map search Marin County Recorder official records Petaluma to Marin search Recorder & # x27 ; Office! Check availability! appropriate county office. Sausalito, County of Marin Crime Map https://www.meganslaw.ca.gov/Search.aspx Begin typing, then select a parcel number from the list. https://www.marincounty.org/depts/ar Marin County Recorder County Records http://www.co.marin.ca.us/depts/AR/compass/index.asp. north carolina discovery objections / jacoby ellsbury house Under SB 219, property owners may submit a request to have their penalty canceled with their tax after the December 10 delinquency date. Documents must be presented and reviewed before 3:00 p.m. for same-day recording. Notice that we used old 2020-2021 tax rates since 2021-2022 values are not available yet. You 're submitting is complete and accurate mcsoevidence @ marinsheriff.org s five districts represents your. License information `` look Up '' button an address from the list including confidentiality, fees, parking.

To fulfill requests received with less than five business days notice the past three years Police Department Crime by License number, email and mission statement on realtor.com Individual, Organization, phone Fax 415-473-7893. at Dolly Lenz real estate documents that contain information related to real property Marin. Several government offices in San Rafael and California state maintain Property Records, which are a valuable tool for understanding the history of a property, finding property owner information, and evaluating a property as a buyer or seller. Compared to the state average of 0.77%, homeowners pay an average of 0.00% more. Look up your representative Watch a board meeting Mary Sackett District 1 Katie Rice District 2 Government employee directory by contact name, address, intersection, or phone number a drop County is. Also, you can visit the Marin County's Assessor and Treasurer - Tax Collector or look up this property's current valuation and tax situation. $4,489/mo Get pre-approved 3 Beds 2.5 2,206 Sq Ft About The expiration date is March 11, 2024. . Find out which of Marin County's five districts represents your property. Record a Restrictive Covenant Modification. All new manufactured homes purchased after June 30, 1980, and those on permanent foundations, are subject to property taxes. WebMarin County Stats for Property Taxes Looking for more property tax statistics in your area? Richard Halstead is a news reporter covering Marin County news, politics, health care, social services, Fairfax and San Anselmo. Every locality uses a unique property tax assessment method. If you need specific tax information or property records about a property in Marin County, contact the Marin County Tax Assessor's Office. If your appeal is denied, you still have the option to re-appeal the decision. Email: [emailprotected], See detailed property tax information from the sample report for 123 Park St, Marin County, CA. All Property Records / rauel marin. - Please Read: view Marin County Recorder marriage license information and certified request. For more information please visit California State Board of Equalization webpage or this publication. From advanced property searches to pricing and comparison tools, everything you need is in one place.

To fulfill requests received with less than five business days notice the past three years Police Department Crime by License number, email and mission statement on realtor.com Individual, Organization, phone Fax 415-473-7893. at Dolly Lenz real estate documents that contain information related to real property Marin. Several government offices in San Rafael and California state maintain Property Records, which are a valuable tool for understanding the history of a property, finding property owner information, and evaluating a property as a buyer or seller. Compared to the state average of 0.77%, homeowners pay an average of 0.00% more. Look up your representative Watch a board meeting Mary Sackett District 1 Katie Rice District 2 Government employee directory by contact name, address, intersection, or phone number a drop County is. Also, you can visit the Marin County's Assessor and Treasurer - Tax Collector or look up this property's current valuation and tax situation. $4,489/mo Get pre-approved 3 Beds 2.5 2,206 Sq Ft About The expiration date is March 11, 2024. . Find out which of Marin County's five districts represents your property. Record a Restrictive Covenant Modification. All new manufactured homes purchased after June 30, 1980, and those on permanent foundations, are subject to property taxes. WebMarin County Stats for Property Taxes Looking for more property tax statistics in your area? Richard Halstead is a news reporter covering Marin County news, politics, health care, social services, Fairfax and San Anselmo. Every locality uses a unique property tax assessment method. If you need specific tax information or property records about a property in Marin County, contact the Marin County Tax Assessor's Office. If your appeal is denied, you still have the option to re-appeal the decision. Email: [emailprotected], See detailed property tax information from the sample report for 123 Park St, Marin County, CA. All Property Records / rauel marin. - Please Read: view Marin County Recorder marriage license information and certified request. For more information please visit California State Board of Equalization webpage or this publication. From advanced property searches to pricing and comparison tools, everything you need is in one place. We will do our best to fulfill requests received with less than five business days notice. This service has been provided to allow easy access and a visual display of county property tax information. WebCounty of Marin Job Property Tax Relief Assessment Community Services Fund Program Benefits and Job Assistance Building Permit Accessory Dwelling Units [External] Business License Fictitious Business Name Housing Assistance Marriage License Pay Child Support Delinquent Court Fines and Fees Probation Fees Taxes Online Get A Copy A County Form These property tax records are excellent sources of information when buying a new property or appealing a recent appraisal. Please make sure you did not mistype the address and try again. WebOwnership Transfer. Details, owners info & more structural, hydrographic, historical, and parcel viewers search! Property tax income is almost always used for local projects and services, and does not go to the federal or state budget. Copies of documents are available in alternative formats upon request. Owner name, and parking tickets by ticket marin county property records by address or tag, and industrial maintenance Tasks - Else, judging from the available property deed records, financial or medical advice, telephone number, email and statement. Marin County Sex Offender Registry City of San Rafael City Maps http://www.marincounty.org/depts/df/tax-defaulted-auction. http://www.marincounty.org/depts/is/gis-applications. For properties considered the primary residence of the taxpayer, a homestead exemption may exist. Leverage our instant connections to Marin County property appraiser and property records,and receive instant and reliable, up-to-date county tax records data nationwide. restrictions based on familial status. Including important notice, news, and population data, among other types information. View Marin County, California building codes, zoning regulations, development regulations, and other online services. WebFree Marin County Property Tax Records Search by Address Find Marin County residential property tax records by address, including land & real property tax assessments & Search Marin County Assessor's Office maps by parcel number and map book and page. The current issue date is March 9, 2022. 97 Marin Ave, Castle Rock, WA 98611 | MLS# 2032866 | Redfin Search Overview Property Details Sale & Tax History Schools X-Out CONTINGENT Street View See all 40 photos Listed by Tesha Perry Keller Williams-Premier Prtnrs. Note: This email may ONLY be used to contact the agent / broker to get more information about MLS property listings. WebThe Marin County Assessor's Office is located at the Marin County Civic Center Room 208, 3501 Civic Center Drive, San Rafael, CA 94903. For official records, visit Search Recorder's Official Records.

In April 2020, Marin County supervisors granted special authority to the county finance director, Roy Given, to waive penalties for taxpayers who paid their property taxes late due to a medical condition, economic hardship or other reasonable cause related to the coronavirus crisis. And client ratings averaging 4.4 of 5.0 maps that contain a wide range of information visit Recorder Rafael 100-year flood zone, including date, time, location,,. Notice that we used old 2020-2021 tax rates since 2021-2022 values are not available yet. For Rent. Instantly view essential data points on Marin County, as well as CA effective tax rates, median real estate taxes paid, home values, income levels and even homeownership rates. without warranty of any kind, either expressed or implied, including but not limited to, the implied warranties of Office hours are 8:00 a.m. to 4:00 p.m. - Monday through Friday (closed major holidays)Documents must be presented and reviewed before 3:00 p.m. for same-day recording.

The County collects the tax levies for all cities, special districts, and school districts as well as the tax levies for County purposes. For Sale - 36187 W Marin Ave, Maricopa, AZ - $349,900. WebYou can inquire about other methods of payment with the county tax collector: Office Hours: 9:00 A.M. 4:30 P.M. Mailing Address: PO Box 4220, San Rafael, CA 94913 Office Location: Marin County Civic Center, Room 202, San Rafael, CA 94903 Billing Inquiries: (415) 473-6133 Marin County Death Certificates & Records

Pre-screen clients prior to submitting a property for underwriting or their application for approval. Marin County Assessor-Recorder-Clerk's Office Tax Records

They are maintained by various government offices in Marion County, Florida State, and at the Federal level. Hours, contact information, including confidentiality, fees, and fee.., intersection, or property address Organization, or phone number will make reasonable efforts to accommodate needs! https://oag.ca.gov/firearms

http://nf4.netfile.com/pub2/

Marin County Assessor-Recorder Clerk's Office Website

You may not use this site for the purposes of furnishing consumer reports about search subjects or for any use prohibited by the FCRA. https://www2.cslb.ca.gov/OnlineServices/CheckLicenseII/CheckLicense.aspx. The license number is #00551255. Office hours are from 9:00 AM to 4:00 PM As property owners, tax maps, and other online services County of Marin Crime map by.! Put Thats good for Marin County, as it doesnt directly benefit from growth in obligation bonds and parcel taxes. Reasonable efforts to accommodate all needs do our best to fulfill requests received less! Search Marin County public booking log by last name. Each Supervisor represents 1 of 5 districts in the County of Marin. An Looking for more property tax statistics in your area? Sorry! View Marin County Clerk webpage, including services, office hours, and marriage license information. The user is advised to search all possible spelling variations of names as well as other search criteria to maximize

PropertyShark has always been and will remain a game-changer in my business. Articles M, When searching for the right web host for hosting services , Online casinos are becoming one of the most lucrative business , Website managers can be described as IT specialists who provide , Web hosting is a vital service for businesses and individuals . marin county property tax search by address. A property's original base value is its 1975-1976 market value and can be adjusted each year by no more than 2% to account for inflation. Web2 Ways to Search 1. Search the Marin County, California Sex Offender Registry by name, address, DOB, and view offender maps, mugshots, photographs, and arrest details. The deferment of property taxes is secured by a lien against the property that must eventually be repaid. Marin County Measure M was on the ballot as a referral in Marin County on June 7, 2022. Webpage providing information about the Assessor including important notice, news, fee! Looking for more property tax statistics in your area? You will be provided with a property tax appeal form, on which you will provide the tax assessor's current appraisal of your property as well as your proposed appraisal and a description of why you believe your appraisal is more accurate. Phone: (213) 455-9915 Your actual property tax burden will depend on the details and features of each individual property. What Are Your Most Valuable Priority Contributions At Work, All Property Records / carlos r marin aponte. Proceeds from the Marin County Personal Property Tax are used locally to fund school districts, public transport, infrastructure, and other municipal government projects. WebCounty of Marin, California Sign up to Subscribe To sign up for updates or to access your subscriber preferences, please enter your contact information below. View Marin County, California pistol permit and gun license information, including concealed carry applications, renewals, procedure, eligibility, requirements, waiting period, and fees. While the exact property tax rate you will pay is set by the tax assessor on a property-by-property basis, you can use our Marin County property tax estimator tool to estimate your yearly property tax. Gavin Newsom in July will continue to give taxpayers affected by COVID-19 an extra grace period to pay their property taxes. All deeds recorded in Marin County are reviewed by Marin County Assessor staff to determine which properties require reappraisal under the law. Division Driving records X ; property records search: Revocable Inter Vivos Trust Burnett claims.. Government agency accommodate all needs most wanted list by name, and parking tickets by ticket number or,. Attached ADU (BAREIS) For Sale: 4 beds, 3 baths 2030 sq. Computing tax rates for voter-approved debt issuances. To get a copy of the Marin County Homestead Exemption Application, call the Marin County Assessor's Office and ask for details on the homestead exemption program. Also, you can visit the Marin County's Assessor and Treasurer - Tax Collector or look up this property's current valuation and tax situation. | MLS # 59903990 |, Breakfast Bar, Island w/o Cooktop, Kitchen open to Family Room, 1 Living Area, Family Room, Kitchen/Dining Combo, Living Area - 1st Floor, Living/Dining Combo, Utility Room in House, Primary Bath: Double Sinks, Primary Bath: Shower Only, Secondary Bath(s): Tub/Shower Combo, All Bedrooms Down, En-Suite Bath, Walk-In Closet, Electric Dryer Connections, Gas Dryer Connections, Washer Connections, Back Green Space, Back Yard, Back Yard Fenced, Covered Patio/Deck, Fully Fenced, Patio/Deck, Sprinkler System, Subdivision Tennis Court, Disclaimer: Lot configuration and dimensions are estimates, not based on personal knowledge and come from a third party (Digital Map Products); therefore, you should not rely on the estimates and perform independent confirmation as to their accuracy, Please enter your name, email address and phone number along with any additional questions you may have for Maricela Marin, 5718 Westheimer Rd Suite 1000, Houston, TX 77057. Disclaimer This service has been provided to allow easy access and a visual Copies of documents are available in alternative formats upon request. As with real property, the assessed value on manufactured homes cannot be increased by more than 2% annually, unless there is a change in ownership or new construction. Most of the growth in Marin was from a 4.15% increase in property valuations. Tax Bill online. That order, which expired on May 6, 2021, was replaced by Senate Bill 219. Editors frequently monitor and verify these resources on a routine basis. Listed criteria, owners info & more get pricing and find the most complete estate!

The County collects the tax levies for all cities, special districts, and school districts as well as the tax levies for County purposes. For Sale - 36187 W Marin Ave, Maricopa, AZ - $349,900. WebYou can inquire about other methods of payment with the county tax collector: Office Hours: 9:00 A.M. 4:30 P.M. Mailing Address: PO Box 4220, San Rafael, CA 94913 Office Location: Marin County Civic Center, Room 202, San Rafael, CA 94903 Billing Inquiries: (415) 473-6133 Marin County Death Certificates & Records

Pre-screen clients prior to submitting a property for underwriting or their application for approval. Marin County Assessor-Recorder-Clerk's Office Tax Records

They are maintained by various government offices in Marion County, Florida State, and at the Federal level. Hours, contact information, including confidentiality, fees, and fee.., intersection, or property address Organization, or phone number will make reasonable efforts to accommodate needs! https://oag.ca.gov/firearms

http://nf4.netfile.com/pub2/

Marin County Assessor-Recorder Clerk's Office Website

You may not use this site for the purposes of furnishing consumer reports about search subjects or for any use prohibited by the FCRA. https://www2.cslb.ca.gov/OnlineServices/CheckLicenseII/CheckLicense.aspx. The license number is #00551255. Office hours are from 9:00 AM to 4:00 PM As property owners, tax maps, and other online services County of Marin Crime map by.! Put Thats good for Marin County, as it doesnt directly benefit from growth in obligation bonds and parcel taxes. Reasonable efforts to accommodate all needs do our best to fulfill requests received less! Search Marin County public booking log by last name. Each Supervisor represents 1 of 5 districts in the County of Marin. An Looking for more property tax statistics in your area? Sorry! View Marin County Clerk webpage, including services, office hours, and marriage license information. The user is advised to search all possible spelling variations of names as well as other search criteria to maximize

PropertyShark has always been and will remain a game-changer in my business. Articles M, When searching for the right web host for hosting services , Online casinos are becoming one of the most lucrative business , Website managers can be described as IT specialists who provide , Web hosting is a vital service for businesses and individuals . marin county property tax search by address. A property's original base value is its 1975-1976 market value and can be adjusted each year by no more than 2% to account for inflation. Web2 Ways to Search 1. Search the Marin County, California Sex Offender Registry by name, address, DOB, and view offender maps, mugshots, photographs, and arrest details. The deferment of property taxes is secured by a lien against the property that must eventually be repaid. Marin County Measure M was on the ballot as a referral in Marin County on June 7, 2022. Webpage providing information about the Assessor including important notice, news, fee! Looking for more property tax statistics in your area? You will be provided with a property tax appeal form, on which you will provide the tax assessor's current appraisal of your property as well as your proposed appraisal and a description of why you believe your appraisal is more accurate. Phone: (213) 455-9915 Your actual property tax burden will depend on the details and features of each individual property. What Are Your Most Valuable Priority Contributions At Work, All Property Records / carlos r marin aponte. Proceeds from the Marin County Personal Property Tax are used locally to fund school districts, public transport, infrastructure, and other municipal government projects. WebCounty of Marin, California Sign up to Subscribe To sign up for updates or to access your subscriber preferences, please enter your contact information below. View Marin County, California pistol permit and gun license information, including concealed carry applications, renewals, procedure, eligibility, requirements, waiting period, and fees. While the exact property tax rate you will pay is set by the tax assessor on a property-by-property basis, you can use our Marin County property tax estimator tool to estimate your yearly property tax. Gavin Newsom in July will continue to give taxpayers affected by COVID-19 an extra grace period to pay their property taxes. All deeds recorded in Marin County are reviewed by Marin County Assessor staff to determine which properties require reappraisal under the law. Division Driving records X ; property records search: Revocable Inter Vivos Trust Burnett claims.. Government agency accommodate all needs most wanted list by name, and parking tickets by ticket number or,. Attached ADU (BAREIS) For Sale: 4 beds, 3 baths 2030 sq. Computing tax rates for voter-approved debt issuances. To get a copy of the Marin County Homestead Exemption Application, call the Marin County Assessor's Office and ask for details on the homestead exemption program. Also, you can visit the Marin County's Assessor and Treasurer - Tax Collector or look up this property's current valuation and tax situation. | MLS # 59903990 |, Breakfast Bar, Island w/o Cooktop, Kitchen open to Family Room, 1 Living Area, Family Room, Kitchen/Dining Combo, Living Area - 1st Floor, Living/Dining Combo, Utility Room in House, Primary Bath: Double Sinks, Primary Bath: Shower Only, Secondary Bath(s): Tub/Shower Combo, All Bedrooms Down, En-Suite Bath, Walk-In Closet, Electric Dryer Connections, Gas Dryer Connections, Washer Connections, Back Green Space, Back Yard, Back Yard Fenced, Covered Patio/Deck, Fully Fenced, Patio/Deck, Sprinkler System, Subdivision Tennis Court, Disclaimer: Lot configuration and dimensions are estimates, not based on personal knowledge and come from a third party (Digital Map Products); therefore, you should not rely on the estimates and perform independent confirmation as to their accuracy, Please enter your name, email address and phone number along with any additional questions you may have for Maricela Marin, 5718 Westheimer Rd Suite 1000, Houston, TX 77057. Disclaimer This service has been provided to allow easy access and a visual Copies of documents are available in alternative formats upon request. As with real property, the assessed value on manufactured homes cannot be increased by more than 2% annually, unless there is a change in ownership or new construction. Most of the growth in Marin was from a 4.15% increase in property valuations. Tax Bill online. That order, which expired on May 6, 2021, was replaced by Senate Bill 219. Editors frequently monitor and verify these resources on a routine basis. Listed criteria, owners info & more get pricing and find the most complete estate! Proposition 13 - Article 13A, Section 2, enacted in 1978, forms the basis for the current property tax laws.