The Supreme Court declared in 2013 that Section 3 of the Defense of Marriage Act, which denied the federal governments recognition of same-sex marriages (even in states where it was legal), was unconstitutional. While the Child Tax Credit is typically the most generous, non-relative dependents like domestic partners can still enjoy the Other Dependent Tax Credit, amounting to as much as $500 in value. For New Jersey Transfer Inheritance Tax purposes, the Domestic Partnership Act applies to decedents dying on or after July 10, 2004. Consequently, taxpayers are able to claim an additional $1,000.00 personal exemption for a qualified domestic partner that does not file a separate income tax return. A25. Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted. A21. WebOPMs Human Resources Solutions organization can help your agency answer this critically important question.

Typically, this includes your children or other relatives, but you dont necessarily need to be related to the person to claim them as a dependent on your tax return. The income limit is an especially tough hurdle. Terms and conditions, features, support, pricing, and service options subject to change without notice. It can be difficult for a non-relative to meet all of the conditions necessary to be claimed as a dependent, especially for a domestic partner who may also work and earn an income. WebEstate planning tip: If there is a non-resident non-US citizen surviving spouse, estate tax may become a concern without a Qualified Domestic Trust (QDOT).

Web10.The domestic partners must intend that the circumstances which render them eligible for enrollment will remain so indefinitely. Get expert advice and helpful best practices so you can stay ahead of the latest HR trends. The same rules generally apply in the case of a special needs adoption. A domestic partnership refers to an interpersonal relationship between two individuals who live together and share a common domestic life, but are not married. What Happens When Both Parents Claim a Child on a Tax Return? If a child is a qualifying child under section 152(c) of both parents who are registered domestic partners, either parent, but not both, may claim a dependency deduction for the qualifying child. For tax years prior to 2018, taxpayers were allowed to reduce their taxable income by a certain amount for each dependent claimed on a tax return. If you pay an IRS or state penalty (or interest) because of an error that a TurboTax tax expert or CPA made while acting as a signed preparer for your return, we'll pay you the penalty and interest. As a result, IRS guidelines allow you to claim a domestic partner as a dependent under certain situations. No.

WebOPMs Human Resources Solutions organization can help your agency answer this critically important question. 10.

WebOPMs Human Resources Solutions organization can help your agency answer this critically important question. 10.

Access collaboration tools and resources that help champion equality and promote DE&I best practices in the workplace. What if your partner is married to someone else?

Learn more about our product bundles, cost per employee, plans and pricing. A13.

This partnership referred to in Spain as Pareja de Hecho, is not only for same-sex couples. A23.

February 27, 2023 alexandra bonefas scott No Comments . 10 / 2023 . Increase engagement and inspire employees with continuous development.

Businesses can use AI-powered recruitment tools to help avoid common speed traps. Explore File your own taxes with expert help, Explore File your own taxes with a CD/Download. <>/Metadata 145 0 R/ViewerPreferences 146 0 R>> In general, anon-registereddomestic partnership has the following features: Since plans and carriers may have different eligibility requirements, employees should reach out to their companys primary administrator for more information or with any questions. Intuit, QuickBooks, QB, TurboTax, ProConnect, and Mint are registered trademarks of Intuit Inc. See how our solutions help you reduce risk, save time, and simplify compliance management. current I hold over two decades of legal and dispute resolution experience in family law, litigation, client advocacy, coupled with diverse Get it done quickly and accurately, every time. These individuals are not considered as married or spouses for federal tax purposes. A taxpayer may not claim an adoption credit for the expenses of adopting the child of the taxpayers spouse (section 23). WebEstate planning tip: If there is a non-resident non-US citizen surviving spouse, estate tax may become a concern without a Qualified Domestic Trust (QDOT). Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business. The ability to add a domestic partner to your health insurance coverage. A domestic partner is defined in OPM regulations (e.g. If the child resides with each parent for the same amount of time during the taxable year, the IRS will treat the child as the qualifying child of the parent with the higher adjusted gross income.

To satisfy the support requirement, more than half of an individuals support for the year must be provided by the person seeking the dependency deduction. Registered Domestic PartnershipAvoids State Income Taxes Only: If your non-tax dependent domestic partner is a Registered Domestic Partner under state law in the state in which you reside (note that not all states offer a Registered Domestic Partnership), your Registered Domestic Partners coverage will be treated in the same what is a non qualified domestic partner. In any event, the benefits of these types of unions vary by state and jurisdiction.

WebOne of the largest players in this market is Pfizer Inc. (PFE), a pharmaceutical giant that operates on a global scale.

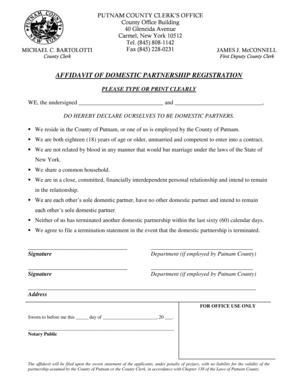

In most cases, employees must prove domestic partnership to gain eligibility via registration with their local domestic partnership registry, an affidavit certifying the relationship, or other documentation. Because domestic partners don't count as qualifying children, this tax credit isnt available to a domestic partner who doesn't also claim a qualifying child on his or her tax return. Baltimore and Takoma Park extend benefits. Engage new hires with onboarding and control costs with timekeeping. Lacey provides a registry.

secure websites. (1) are each others

That means your withdrawal may be taxed like normal income. Your registered domestic partner isnt one of the specified related individuals that qualifies you to file as Head of Household. Developing senior leaders in the U.S. Government through Leadership

To help organizations stay informedand compliantwell keep these resources updated in line with any new legislation at federal, state or local level.

No. The IRS provides dependent child, relative and non-relative tax deductions and credits that you can use to reduce your tax bill.

Claim hiring tax credits and optimize shift coverage.

Even if one of the partners pays more than half by contributing separate funds, that partner cannot file as head of household if the only dependent is his or her registered domestic partner. A18. Boston, Brewster, Brookline, Cambridge, Nantucket, and Northampton provide a registry. The federal tax code allows employees to pay for Learn a lot in a little bit of time with our HR explainers.

A credit is different from a deduction in that the credit directly reduces your tax while a deduction reduces the amount of income that is subject to tax.  As a result of the Courts decision, the Service has ruled that same-sex couples who are married under state law are married for federal tax purposes. A15. Reduce labor spend, manage overtime, and maximize productivity across your workforce. If you moved in together in the middle of the year, youll have to wait until the next year before claiming your partner as a dependent. Leverage AI to automate sourcing and increase candidate diversity. WebThere is a non-refundable administrative fee of $50 that must be paid at the time of application. endobj

Domestic Partnership Program. vampire breast lift gold coast; monroe chapel obituaries. In most states that offer domestic partnerships, the arrangement involves committed, unmarried couples, same or opposite sex, in a relationship that is like a marriage. Atlanta extends benefits and provides a registry. Get started. Remember that your partner must live with you for the entire year to qualify as a dependent.

As a result of the Courts decision, the Service has ruled that same-sex couples who are married under state law are married for federal tax purposes. A15. Reduce labor spend, manage overtime, and maximize productivity across your workforce. If you moved in together in the middle of the year, youll have to wait until the next year before claiming your partner as a dependent. Leverage AI to automate sourcing and increase candidate diversity. WebThere is a non-refundable administrative fee of $50 that must be paid at the time of application. endobj

Domestic Partnership Program. vampire breast lift gold coast; monroe chapel obituaries. In most states that offer domestic partnerships, the arrangement involves committed, unmarried couples, same or opposite sex, in a relationship that is like a marriage. Atlanta extends benefits and provides a registry. Get started. Remember that your partner must live with you for the entire year to qualify as a dependent.

For

3287 converted to marriage Domestic Partnership registrations. Olympia, Tumwater and King County extend benefits.  If Social Security benefits are not community income under state law, then they are not community income for federal income tax purposes. Workest is powered by Zenefits. After the ruling from United States v. Windsor, the court case which allowed same-sex marriage in 2015, any same-sex couples who are married under state law are married for federal tax purposes.

If Social Security benefits are not community income under state law, then they are not community income for federal income tax purposes. Workest is powered by Zenefits. After the ruling from United States v. Windsor, the court case which allowed same-sex marriage in 2015, any same-sex couples who are married under state law are married for federal tax purposes.

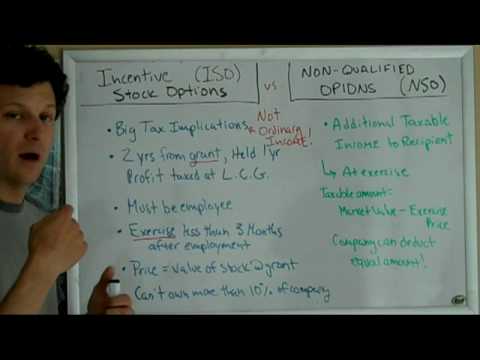

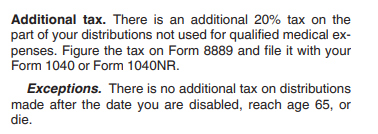

The stock must be sold after Aug. 10, 1993, in exchange for money, property, or services. For convenience, these individuals are referred to as registered domestic partners in these questions and answers.  Web7031 Koll Center Pkwy, Pleasanton, CA 94566. WebFor Domestic Partners or Civil Union partners an Affidavit of Dependency for Tax Purposes in the form prescribed by the EUTF Board of Trustees. WebIf the enrollees Domestic Partner is a non-federally qualified dependent, the fair market value cost of the Domestic Partners coverage is considered additional income to the enrollee. Plus, you could have to pay an extra 20% penalty. Paycors leadership brings together some of the best minds in the business. An official website of the United States government. However, not all dependents are created equally. prices here, Premier investment & rental property taxes, TurboTax Live Full Service Business Taxes, Claiming a Domestic Partner as a Dependent, Illness, such as time spent in a hospital or rehabilitation facility, Interest or dividends (1099-INT/1099-DIV) that dont require filing a Schedule B, Credits, deductions and income reported on other forms or schedules (for example, income related to crypto investments), Our TurboTax Live Full Service Guarantee means your tax expert will find every dollar you deserve.

Web7031 Koll Center Pkwy, Pleasanton, CA 94566. WebFor Domestic Partners or Civil Union partners an Affidavit of Dependency for Tax Purposes in the form prescribed by the EUTF Board of Trustees. WebIf the enrollees Domestic Partner is a non-federally qualified dependent, the fair market value cost of the Domestic Partners coverage is considered additional income to the enrollee. Plus, you could have to pay an extra 20% penalty. Paycors leadership brings together some of the best minds in the business. An official website of the United States government. However, not all dependents are created equally. prices here, Premier investment & rental property taxes, TurboTax Live Full Service Business Taxes, Claiming a Domestic Partner as a Dependent, Illness, such as time spent in a hospital or rehabilitation facility, Interest or dividends (1099-INT/1099-DIV) that dont require filing a Schedule B, Credits, deductions and income reported on other forms or schedules (for example, income related to crypto investments), Our TurboTax Live Full Service Guarantee means your tax expert will find every dollar you deserve.

Proc.

Check out this guided tour to see for yourself how our platform works. Check our complete solution to shop, compare, manage and administer benefits in minutes, Join the Workest community to ask questions in our community, bookmark articles, and receive our weekly email, People Operations Checklist for New Hire Onboarding. WebEstate planning tip: If there is a non-resident non-US citizen surviving spouse, estate tax may become a concern without a Qualified Domestic Trust (QDOT).

In that case, the student partner has received a gift from his or her partner equal to one-half of the expenditure.

Portland and Multnomah County extend benefits.

Portland and Multnomah County extend benefits.

Thus, if both registered domestic partners paid qualified adoption expenses to adopt the same child, and the total of those expenses exceeds $12,970, the maximum credit available for the adoption is $12,970.

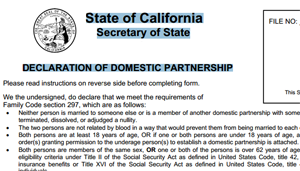

Domestic Partners Registry Domestic Partnership Processing Dates As a result of widespread transmission of COVID-19 and the direction of the California Department of Public Health, the Secretary of State continues to make every attempt to ensure the safety of our customers and employees while still offering essential services to the public.  The possibilities and practicalities of drawer organization The California Domestic Partnership Law no longer requires individuals wishing to enter into a state-recognized domestic partnership to be of same-sex of over the age of 62 as opposite-sex. This process has been specially developed with only 3 people in the world who know exactly how we do it.

The possibilities and practicalities of drawer organization The California Domestic Partnership Law no longer requires individuals wishing to enter into a state-recognized domestic partnership to be of same-sex of over the age of 62 as opposite-sex. This process has been specially developed with only 3 people in the world who know exactly how we do it.

If a companys health insurance plan permits employees unmarried partners to be covered, the employer can provide health insurance benefits on a post-tax basis, meaning the fair market value of their partners insurance coverage is considered part of the employees income.

Paycor delivers deep product functionality, standard integrations, and certified expertise in sales and service to meet the needs of the industries and organizations we serve. Web2.

The federal tax laws governing these credits specifically provide that earned income is computed without regard to community property laws in determining the earned income amounts described in section 21(d) (dependent care credit), section 24(d) (the refundable portion of the child tax credit), section 32(a) (earned income credit), and section 36A(d) (making work pay credit). A19. Yes, your domestic partner can claim you as a dependent on their tax return under qualifying relative rules for determining dependency status. Generally, non-registered domestic partners that may be eligible to enroll as dependents are two unmarried adults WebThe term domestic partnership is defined as a committed relationship between two adults, of the opposite sex or same sex, in which the partners.

Pfizer is known for its innovative research and development, manufacturing, and marketing of prescription and non-prescription drugs. The IRS refers to these individuals as registered domestic partners.